Whither Bitcoin in a Global Liquidity Contagion?

Someone mentioned to me that this reminds them of the 2008/9 stock markets and gold crash. Both markets quickly recovered to new all time highs.

Did BTC Miners Crash Bitcoin Price With 51 Days Before the Halving?

However, there’s one major distinction now. This time there was massive private sector selling of sovereign bonds. They needed cash liquidity. The yields may have gone down but that’s only central bank buying. This seems to indicate that the system is extremely over-leveraged, that a spiraling liquidity contagion can be ignited by an economic shock such as these lockdowns shutting down the global economy. Also there wasn’t a global economic lockdown in 2009.

However, please see the chart I added yesterday to the top of my recent blog Bitcoin’s Whiplash Spike Low is Even More Bullish which shows a pattern repeating now that matches the 2008/9 crash.

I presume Bitcoin and to some extent also gold are assets held by strong hands with long time preferences. And I presume that they will be sought after assets as the public confidence in governments wanes. And I presume that much of the high leverage (e.g. 100-to-1 long positions on Bitmex) were already liquidated with the crash to ~$3.9k.

Nevertheless there’s still a risk that a contagion could still drag Bitcoin down to between $2.4k to $3.1k.

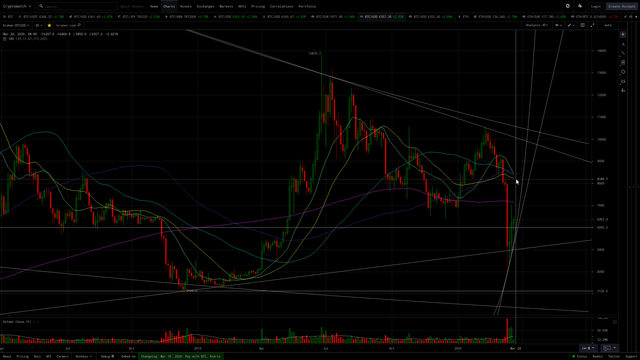

However, as I illustrated in the following charts, the bullish triangle is still projecting to up to ~$8.1k perhaps within the next day or two, although might not complete 100% of the projected rise. I suppose up to ~$8.9k is plausible. We should expect a very strong bounce (to perhaps fill the gap) after such an egregious, rapid drop in the price.

Yet after this current, ongoing reaction bounce peaks (and it may have already at the 100 WMA shown), a decline is nearly assured. I am annotating on my charts a decline to ~$5k by approximately the 2nd or 3rd week of April, which would match the pattern and timing of the bounce and second bottoming in Q1 2019 which you can view on one of my charts below.

My opinion is that the general markets can’t fully recover until there’s indication that governments will be lifting some of the lockdowns. There could be another 10% losses before a bottom in U.S. stock markets.

Glassman said sending $1,000 to workers at restaurants and gyms won’t help the workers or the business. “Sending money in the mail is a random blast,” Glassman said.

Glassman said that, in his travels across the country over the last few weeks, he has discovered that “no one is confident that anyone is going to help them.”

“This is a self-inflicted wound. We’re shutting down the system [for a good reason] and we should just put companies on a holding pattern,” he said.

Glassman estimated the government would end up essentially paying the salaries of 70 million hourly workers at a cost of $5 billion per day. The program, though, would not cover gig-economy workers.

He said the bill for his proposal would be much lower than the trillions needed if Congress permits all those workers to be laid off.

I note that Mexico is heavily dependent on their Easter (April 12) Spring Break vacationers and they’re not doing these insane lockdowns nor blocking international tourists despite the wailing of the corrupt/inept health agencies (although Pompeo and Trump blocked access via the land border for Americans until at least April 21, presumably by pressuring Mexico). Air travel to Mexico apparently remains unrestricted for Americans, c.f. also, also and also.

And my new opinion and analysis is that Mexico is likely correct and if they can hold the line they may end up being a counterexample for the entire world to see that these ridiculous martial law lockdowns are insane. I will explain more about that in a subsequent blog, but until then read the Updates section at the bottom of my prior blog Coronavirus Panic Became Necessary Because Testing Was [Intentionally] Too Late. I added numerous updates just moments before writing this blog.

I wrote:

The bureaucracy is moving crazy fast now that somebody (Pence?) is breathing down their neck. Stop spreading misinformation.

Moving so fast that the general public has been reassured and properly informed?

That’s good to hear about the approval of medicines.[no they weren’t approved] But the systemic/bureaucratic stonewalling and Kafkaesque healthcare failures can continue in other ways. We’ll observe.The scare mongering is real. The Walmart grocery store shelves are empty around here today. And HEB will only allow 50 people in at a time. Yet there’s no cases locally and only a handful within a couple of hundred miles radius.

Mexicans don’t seem to be concerned at all. They can obtain Chloroquine without the burden of hurdling some Kafkaesque healthcare maze.

Globally 1.5 million people die annually from Tuberculosis and tens of thousands die in the USA from the influenza flu. Yet we need a national emergency for 307 deaths. How do you square that?

Are you pinning the ‘misinformation’ label on the report about Italy saying that 99% of those who died from this virus were also suffering from other illnesses?

I want you to note that the green 50 DMA is about to bearish cross under the cyan 200 DMA and then the yellow 100 DMA. So this supports the idea of a bounce up to 100 DMA and then a renewed decline. But note the 100 DMA was still below the 200 DMA, so there will not be further bearish cross and there could soon be a bullish cross up over the 200 DMA by both 50 DMA and 100 DMA when Bitcoin prices rise back up to ~$10+k again perhaps by late April or early May.

Note I also suggest reviewing again the edits I made to my recent blogs Bitcoin Death Spiral Underway — or Something Else? and Bitcoin’s Pivotal, Religious Moment of Transformative Truth Has Likely Arrived (Tomorrow), because this flash crash actually matches the pattern of what happened in 2013 before the massive bull run.

Note Bitcoin has been rising off its bottom while the DJIA has continued to decline although the rise did correlate with a slight bounce in the DJIA and Bitcoin did decline on Friday along with the DJIA. But Bitcoin declined to bullish support. Whereas, the DJIA declined to a lower low. The DJIA futures are threatening to open lower on Monday, but narrowly and there was the $1 trillion stimulus program that was approved. And I think other nations will be announcing stimulus programs perhaps this week if they have not done so already. Germany finally capitulated on austerity and is agreeing to $1 trillion in Coronavirus Euro bonds.

You may of course click these charts to zoom:

There’s this bearish rising wedge though that is going to at least drop to ~$5.5k to $5.8k to hit the main support for the upward trendline, before moving higher:

Update 14 Hours Later

The decline I predicted has occurred and the DJIA futures have turned to no decline for Monday’s open. Looks like we’re good to go for a bullish phase.

I’ll want to set a stop-loss below the up trend-line I spoke of.

17 Hours Later

The volatility is going crazy because the Congress failed to pass the stimulus bill and now the DJIA futures are down -5%! Perhaps they can hammer out a deal overnight?

22 Hours Later

@FilbFilb published his thoughts which are similar to mine, although I’m leaning strongly to the “Save the halving” scenario except in my scenario there could be another decline in first half of April back to ~$5k after a rise to ~$7.3k to $8k:

(click to embiggen)

The upper line on the channel above can be drawn higher at ~$7.3k to $8k. The recent peak at ~$7k was to the 100 WMA, so does not necessary require the channel line drawn as low as on @FilbFilb’s chart above.

However, @FilbFilb’s “Save the halving” interpretation could be correct. Yet in that case I see the possibility of slingshot to between ~$9k to $10k (on $trillions of global stimulus approvals this week) before declining back to the top channel line which becomes support on his chart. I know this would be verticality extremism, but remember what I blogged in Bitcoin Death Spiral Underway — or Something Else?:

I’m expecting the superimposition of a tweening of a prior fractal similar visually to the following:

(click to embiggen)

Note above the spike down from 2013 before the egregious SLINGSHOT vertical moonshot. Bitcoin has demonstrated that the more volatile/steep the decline then the more steep the ascent!

Also given that the U.S. Congress won’t likely vote on the $2 trillion “stimulus” bill until 1pm EST, Bitcoin could decline anew to actually touch that key support which is the slightly thicker white line on my chart above, before slingshot higher upon first peep out of the negotiations that the bill has been agreed on by all parties:

(click to embiggen)

Note the bottom price for 1pm EST at the said support line is ~5.7k exactly the same value as the lower range @FilbFilb annotated on his chart.

If there’s no stimulus deal then the whole world is staring into the abyss because the public is too scared to push for abrupt end to the insane lockdowns.

"Stay Defensive... For Now" - Goldman Lays Out The 6 Conditions For A Market Bottom:

The core insight is that while conditions are deteriorating rapidly, markets find it hard to be confident in the limits of the damage and so put heavy weight on deep negative tail risks. Inflection points are often, in the first instance, about the market being able to put limits on those tail risks even before true recovery is visible.

[…]

- A stabilization or flattening out of the infection rate curve in the US and Europe.

- Visibility on the depth and duration of disruptions on the economy.

- Sufficiently large global stimulus.

- A mitigation of funding and liquidity stresses.

- Deep undervaluation across major assets and position reduction.

- No intensification of other tail risks.

Note the subsequent decline by ~April 6, coincides with what is going to be a horrific jobs report in the USA, end date of some of the lockdowns (if they’re not renewed) and also Armstrong’s key week for the start of abatement of this crisis.

Is Anthony Fauci the Destroyer of Worlds?:

Some states are overreacting and many have started to shut down their economies ordering people to stay home into the week of April 6th.

[…]

The computer has been projecting the two target weeks of March 23rd and April 6th since the start of the year. I believe we then the dust settles, Anthony Fauci will go down in history as the Destroyer of Worlds. I have never in my long career ever witnessed such absurdity as this man has created.

Update Next Day

There she blows!

Why this Nobel laureate predicts a quicker coronavirus recovery: ‘We’re going to be fine’

Stocks Soar After Fed Announced Open-Ended QE

Trump received the message Armstrong, I and others have been trying to send him!

Trump Weighs Easing Stay-At-Home Restrictions To Curb Economic Chaos

The Fed is Acting Precisely on the Forecasts of Socrates

Trump Says Coronavirus Restructions Will Be Lifted “Soon”, The US “Was Not Built To Be Shut Down”:

In any case, the following soundbites indicate that Trump appears to have made up his mind:

- “This is a medical problem. We are not going to let it turn into a long-lasting financial problem.”

- “You look at automobile accidents. Which are far greater than any numbers we're talking about. That doesn't mean we're going to tell everybody no more driving of cars.”

- “If it were up to the doctors, they may say let’s keep it shut down — let's shut down the entire world.”

- “You can't do that with a country — especially the No. 1 economy anywhere in the world, by far. ... You can’t do that. It causes bigger problems than the original.”

- “I will be listening to ... experts. We have a lot of people who are very good at this. It’s a balancing act. You know the expression, we can do two things at one time.”

Trump also said that if the economy is forced into a deep enough recession by social distancing measures, there could be deaths from suicides and other causes in excess of those caused by the coronavirus, and that parts of the nation might be able to resume economic activity even as others fight outbreaks.

“You’re talking about massive depression, massive numbers of suicide,” he said. “They had a fantastic job and now they have no idea what’s going on.”

“We can start thinking about, as an example, parts of our country are very lightly affected,” he said.

Older people would rather die than let Covid-19 harm US economy – Texas official:

Lieutenant governor Dan Patrick tells Fox News: ‘Do we have to shut down the entire country for this? I think we can get back to work’

Trump "Would Love To Have Economy Open By Easter"

President Trump told Fox News that he hopes to re-open the U.S. economy by Easter, which is April 12, after shutting down activity due to the coronavirus.

“I would love to have it open by Easter,” Trump said in an interview Tuesday with Fox News.

“I would love to have it opened up and just raring to go by Easter.”

Trump has said he would re-evaluate whether to call for people to return to work after his 15-day strategy for limiting social contact elapses next week