Upwards Bitcoin Price Acceleration Imminent

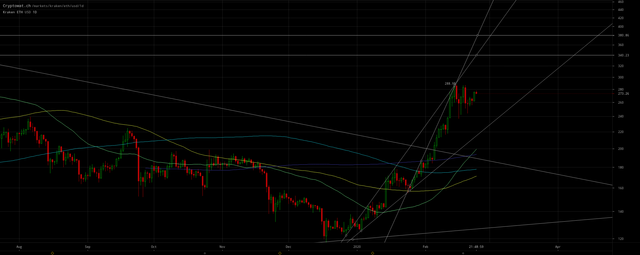

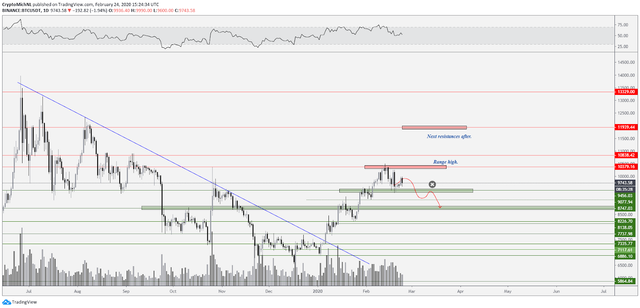

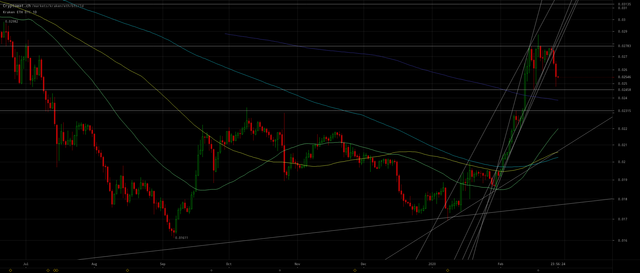

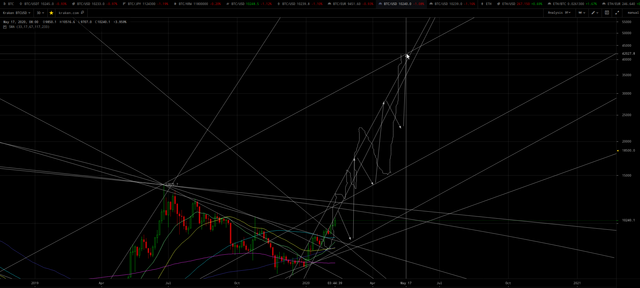

Bitcoin is moving up to at least ~$10,100 at the top of the declining channel charted in my prior February 21 update:

(click to zoom)

(click to zoom)

A spike dip to a higher low may be possible along the way to trigger stop-losses.

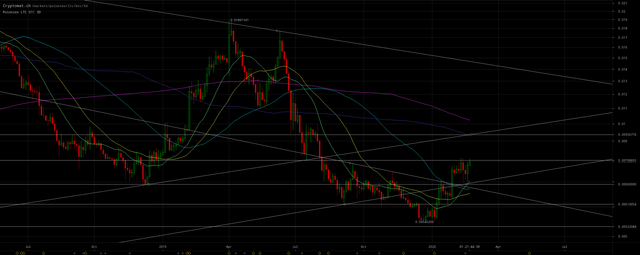

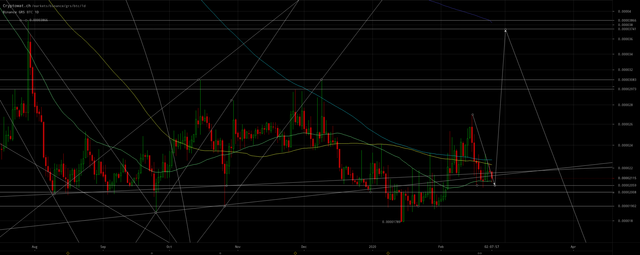

Thus what’s changed in interpretation from that update is the altcoins ostensibly already completed their corrections with the tops of their analogous channels ~$95 and $340 – $380 respectively for Litecoin and Ethereum:

(click to zoom)

(click to zoom)

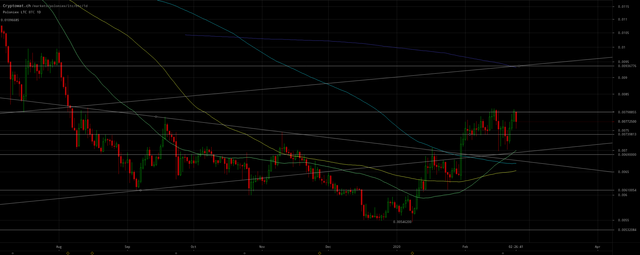

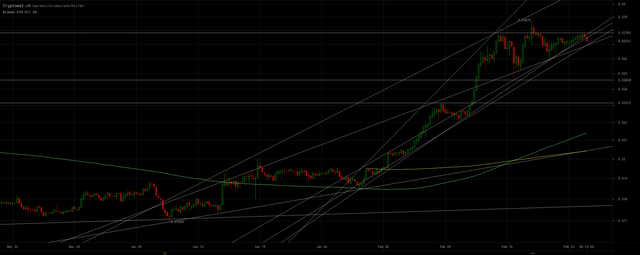

Thus the expected increases to up to ~0.0093 and 0.035 respectively for LTC/BTC and ETH/BTC (and ~0.000029 to 0.000037 for GRS/BTC) might be imminent. Both LTC/BTC and ETH/BTC have bullish patterns ostensibly poised for an imminent breakup through horizontal resistance lurching upwards analogous to an uncoiled spring:

(click to zoom)

(click to zoom)

Bitcoin may be rejected at the top of the channel and decline for the lower low I had been contemplating. Or it may blast through lurching up to the next higher highs mentioned in my February 21 update. Possibly by February 28 back up to ~$11.9k at the top of the wedge since the ATH in 2017, which with ETH/USD ~$420 would also be 0.035 for ETH/BTC.

BTC/USD has already completed a -11% correction duplicating the 11% correction that occurred in January. Ditto LTC/USD duplicated its -21% correction. ETH/USD corrected -17% compared to only -13% in January.

In any case, I doubt LTC/BTC will make it back up to ~0.014 at the top of the former long-term wedge annotated on my chart, because it already fell out of that wedge and ~0.0093 is the bottom of the wedge. So LTC/BTC is ostensibly just rebounding to test the overhead resistance it broke down out of in August 2019:

(click to zoom)

Whereas, as I alluded to in my February 18 update, ETH/BTC had not fallen out of its long-term wedge so may rise to ~0.047 at the top its wedge along with a lurch up of Bitcoin:

(click to zoom)

UPDATE: Looks like the bottoms of this bullish flag, stop-loss triggering dip will be ~$9400, $70 and $253 for BTC/USD, LTC/USD and ETH/USD respectively:

(click to zoom)

(click to zoom)

(click to zoom)

Thus bottoms ~0.0074, 0.027 and perhaps 0.00002 – 0.0000205 for LTC/BTC, ETH/BTC and GRS/BTC respectively:

(click to zoom)

(click to zoom)

(click to zoom)

(click to zoom)

Filb filb tweeted on February 19:

(click to zoom)

And tweeted:

The hardest thing in a bull market is having the resolve to get off the horse when the market is euphoric.

The second hardest thing in a bull market is having the resolve to get back on the horse.

Others:

Bitcoin ready for retest of $9,400 before move towards $11,000?

Bitcoin price holds $9.4K as a crucial support

The weekly closed above the crucial level of

$9,500and is currently stabilizing. Is this bearish? No, not in particular. The price of Bitcoin has moved about50%in six weeks thus a retracement and period of consolidation are natural and healthy for a market before it continues.The key areas to hold for Bitcoin are the

$9,500and$8,800areas on the weekly timeframe. If the price of Bitcoin can sustain support above these levels (preferably$9,500), a bullish continuation is still warranted.The critical resistance ahead is the

$11,600zone, which similarly, still has a CME gap around this area too.

Bitcoin’s bullish scenario

The bullish scenario is the same as the previous analysis and follows the described scenario. As long as the price of Bitcoin maintains above the

$9,400support area, the bullish momentum and trend are continuing.Holding the $9,400 support area can even grant continuation towards the next resistance at

$11,000and$11,600-11,900. However, such a move could take some time before it starts to happen, as the price is currently range-bound between two levels.

Altcoin market capitalization shows support at $91 billion

A similar outlook can be viewed on the altcoin market capitalization chart. Support is found at the $91 billion areas, through which consolidation started. Even a drop-down towards $82 billion wouldn’t be a bad outlook, as long as the total altcoin market capitalization doesn’t drop below that level […] If the $112 billion level [is breached to the upside], continuation towards $140-150 billion is on the tables for the altcoin market capitalization.

Bitcoin’s bearish scenario

The bearish scenario is pretty straight-forward. If the price of Bitcoin can’t hold the

$9,400level for support, a continuation downwards is likely.However, the price of Bitcoin could sustain inside this range for a while. If the price can’t make a new higher high (like rejection at

$9,900), a dropdown below$9,400is a serious possibility.Key signals to watch for would be a weak bounce from the

$8,750 level. If the price of Bitcoin bounces at$8,750and can’t break back above$9,400, a bearish rejection and confirmation are given. This rejection will grant continuation towards$8,000and perhaps lower.

Bitcoin Price Flag Pattern Breakout Could Rocket Bitcoin To $11,000

The rejection at

$10,500followed by a lower high and lower low patter has resulted in the formation of a bull flag pattern. Bulls appear to be losing control of the price in the near term. However, flag patterns have been known to culminate in the continuation of the prior pattern. In this case, BTC/USD’s uptrend to$10,500. A breakout above the flag’s resistance coupled with a higher volume, fundamentals and positive change in sentiments could send Bitcoin price not only above$10,000but also catapult it towards$11,000.

Price Analysis Feb 24: BTC/USD

Bitcoin (BTC) is currently trading inside the descending channel. If the bears sink the price below

$9,600, a drop to the support line of the channel, which is close to the 50-day SMA at$9,176, is possible.

[…]

The 20-day EMA has flattened out and the RSI has dropped close to the midpoint, which suggests a range-bound action for the next few days.

If the price breaks out of the channel, the bulls can carry the price to

$10,500. If this level is scaled, the uptrend is likely to resume. Above this level, a move to the long-term downtrend line at$11,350is possible.We anticipate the bears to mount a stiff resistance at the downtrend line once again. However, if the bulls can push the price above it, the BTC/USD pair is likely to pick up momentum.

Conversely, if the bears sink the price below the channel, the trend will turn in favor of the bears.

Price Analysis Feb 24: ETH/USD

Ether (ETH) has been largely stuck between

$235.70and$288.59. We spot a symmetrical triangle, which usually acts as a continuation pattern. With both moving averages sloping up and the RSI in the positive zone, the advantage is with the bulls.

[…]

If the bulls can push the price above the triangle and the overhead resistance at

$288.59, the uptrend will resume. The triangle setup has a target objective of$330. If this level is crossed, the up move can extend to$366.Contrary to our assumption, if the bears sink the ETH/USD pair below the triangle, a drop to

$235and below it to the 50-day SMA at$200is possible. Therefore, we suggest traders retain the stop loss on their remaining long positions at$230.

Price Analysis Feb 24: LTC/USD

Litecoin (LTC) is struggling to climb above the overhead resistance at

$80.27. This shows that the bears are still active at higher levels. If the price dips below the 20-day EMA at$73.60, it can again decline to the support at$66.15. This will keep the altcoin range-bound for a few more days.

[…]

The LTC/USD pair will turn negative on a break below the support at

$66.15. If this support cracks, the next level to watch out for is$50.Conversely, if the bulls can propel the price above the overhead resistance zone of

$80.27-$84.34, the pair is likely to pick up momentum. The target levels to watch on the upside are$100and above it$125.Therefore, the traders can buy on a breakout and close (UTC time) above

$85. We shall suggest a close stop loss after the trade triggers.

Majority Still Bearish (in denial of posited, imminent massive bullish move)?

Seems the majority is still complacent as they were during the rise from $3.1 to $6k in first quarter of 2019.

I responded in comments below this blog:

@luegenbaron wrote:

I'm waiting for a big dump ^^

Remember I cited in my recent blog Bitcoin Movements Ahead on the Way to the Moon:

Analysts Say Crypto Market Yet to Believe in Bull Run, Expect Further Gains:

Notable cryptocurrency observers claim that the Bitcoin market is still in disbelief at the current price rally. This, for them, is a sign that prices of crypto assets will head a lot higher during this market cycle.

So if that’s true then you’re with a majority sentiment of those who have’t yet accepted that Bitcoin is going much higher and not lower. The majority is [greater fool pigs must be] always slaughtered, so the minority can take profits. Is the majority now bullish? (find some reliable sentiment indicator for the majority, not your personal experience)

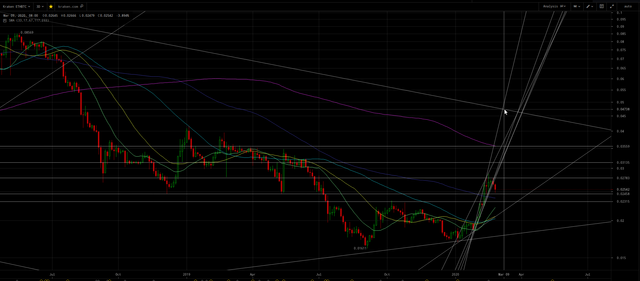

Crypto Fear & Greed Index – Multifactorial Crypto Market Sentiment AnalysisDon’t forgot what happened from February 2019 when everyone was waiting for Bitcoin to correct (because they hadn’t shifted their mindset to raging bull market) but it just kept on rising from

$3.1kto$13.9kwith only intra-day spike “crashes” on the way up.@luegenbaron wrote:

but halving is upcoming. and I kinda have it in my pee, that this halving will be different

I have posited in my recent blogs (listed below) that his halving will be different in an explosively bullish manner that will shock the hell out of everyone. I expect most will be behind the curve and the price will move up too fast in March and April 2020 for them to comprehend and react. If my theory is correct, seems you will be one of those who are left behind as the rocket leaves the liftoff pad?

- Upwards Bitcoin Price Acceleration Imminent

- Precisely Why Bitcoin Is Re-accelerating

- Legacy Bitcoin Rises Surreptitiously as the Reserve in a new Two-tier Monetary System; whilst impostor Bitcoin Core Dies

- Bitcoin Preparing to Rocket Launch?

- Legacy Bitcoin to radically outperform gold

- Bitcoin Movements Ahead on the Way to the Moon

- Armstrong Confirms Bitcoin Bull Market; Warns Dacronian Capital Controls

- Bitcoin’s Whiplash Bear Trap

- Bitcoin Fractal Projects an Infinite Price

- McAfee’s Dick Math: illuminating Bitcoin’s ACCELERATING price

- Bitcoin to $80,000 before May 2020 and $1 billion by December 2020?

- Slinghots to da Moon then Into Abyss of HIV-flu — Revelation’s plague bowl poured out

- Phoenix rises in 2020; all altcoins (including Bitcoin Core) will be 50+% attacked/destroyed

The following isn’t even factoring in my posited even more explosive scenario of a Segwit donations attack starting at the May 14, 2020 halving event which demands that the Bitcoin price be pumped much higher than usual beforehand so that crashing the Bitcoin Core price by dumping the free worthless Core airdrop of the “Tulip Trust” on the exchanges will cause the Core imposter blockchain to slow down to crawl (due to very high mining difficulty as a result of the parabolic price rise then price crash), causing the miners to leave Core and mine Satoshi’s legacy protocol (not BSV!):

Binance CEO Makes Rare Price Prediction—Says This Is When To Buy Bitcoin:

Now, Changpeng Zhao, the […] chief executive of the world’s biggest bitcoin and cryptocurrency exchange Binance, has broken his rule against market forecasting to predict “the bitcoin price will likely increase.”

[…]

“I personally believe the halving has not been priced in,” Changpeng Zhao, often known simply as CZ, told bitcoin, cryptocurrency and blockchain video news site BlockTV this week, adding he “doesn’t usually give market predictions” because he will be wrong “50% of the time.”

[…]

Whether the upcoming bitcoin halving has been “priced in” by the market has become a controversial issue among investors. Generally, in well-developed markets, equity, commodities and currencies are priced based on future expectations—suggesting that as bitcoin traders and investors are aware of the May halving, the price will have already made the gains related to it.

CZ disagrees, however, telling BlockTV: “The market is not efficient. Most people don’t get information quickly. People need a lot of time to let concepts sink in and adjust.”

Many are hoping the 2020 bitcoin halving will see a repeat of the last cut to supply. Bitcoin prices doubled in 2016 and soared 13-fold the following year.

However, CZ warned that “historic events do not predict future events, so don’t take that too literally,” but explained the bitcoin halving will mean “it costs miners almost double what it does now to produce one bitcoin. Psychologically, those miners won’t be willing to sell below that price.”

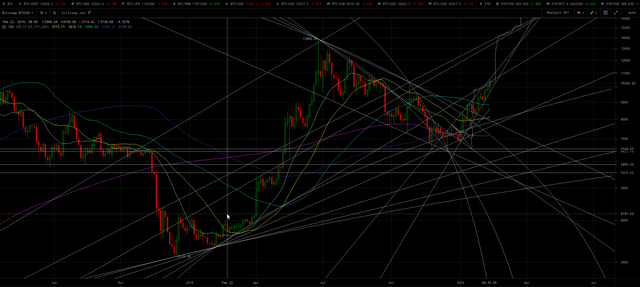

UPDATE Feb 25, 2020: Bitcoin is first headed down to the bottom of the declining channel charted in my prior February 21 update to the ~$9k price (between the 50 and 200 DMA as) I predicted in said update:

(click to zoom)

Hench a smaller time scale repeat of the fractal pattern from October 26 to December 18, 2019. Thus a bottom and initiation of a rocket shot upwards early in the first week of March.

The bullish thesis of this blog has not changed.

Altcoin bottom of correction targets are slightly higher than mentioned in said update, ~0.007, 0.026 and 0.000019–0.000020 for LTC/BTC, ETH/BTC and GRS/BTC.

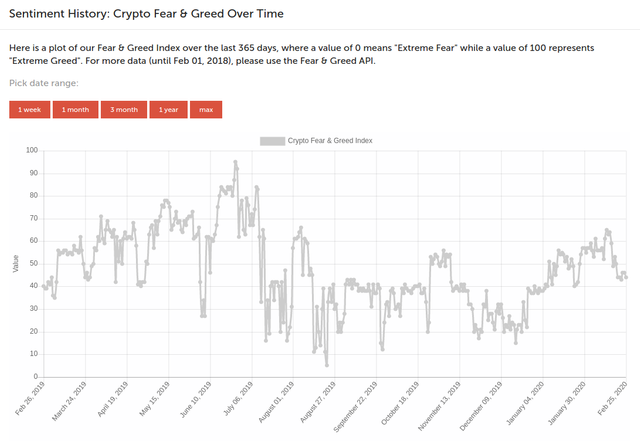

The fear index also needs to drop further to perhaps ~30 as it did in from October 26, 2019:

Sentiment History: Crypto Fear & Greed Over Time

UPDATE Feb 26, 2020, 3:30am GMT: Bitcoin looks to bottom ~$9k within this day. Then if repeating the aforementioned fractal pattern, it may bounce then decline again to final bottom ~$8.9k on March 1. Then fulfill the bullishness of this blog.

ETH/BTC should bottom ~0.0255 within this day. LTC/BTC likely to bottom 0.0070–0.0073 on March 1. GRS/BTC may lag a bit and bottom 0.000019–0.000020 after March 1.

Bitcoin Plunges Towards $9,000: Where Top Traders Think the Price Will Bottom:

Filb Filb […] recently shared some insight into the drop in his Telegram channel, writing (slightly edited for clarity):

“Downside targets [of] the 200-day moving average, 20-week moving average, and 50-week moving average seem good for a bounce, but the 200-day moving average is never really lost in a bull run, so losing that could be more of a significant issue. Nevertheless, I’m looking for longs down there.”

For some context, the 200-day moving average is around $8,800 […]

Major Update February 27, 2020

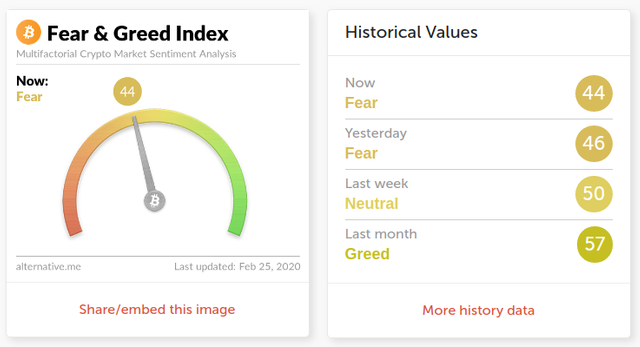

Now there’s clarity as the scenario from my blog 13 days ago Bitcoin Movements Ahead on the Way to the Moon has come to fruition:

That wedge bull flag is projecting a price rise to between

$28,444to$74,960!

[…]

So the top of the bearish wedge which may act initially as resistance could be reached between ~

$11,400to$11,900perhaps by February 17 to 20.Also there’s a rising, bearish wedge on the Bitcoin chart, which portends a peak and correction is near.

[…]

As of writing this, there’s a slight pullback to the $10,100 level, perhaps before lurching higher to the said targets, but…

Note @masterluc — who amazingly correctly predicted the December 2019 ~

$6klow a year or more before it occurred — has often failed with his shorter-term predictions. And his recent updates appears it will be another incorrect prediction because in my opinion/analysis he has drawn the bottom of the wedge too low (by not intersecting the December 2018$3klow, which is marked “a” on his chart):

(click to zoom and read)

[…]

And I can find evidence that @masterluc’s thesis for a correction may be correct — excepting as already stated in my opinion/analysis he drew the bottom of the wedge incorrectly and thus he exaggerates the severity of his posited correction and the duration for a potential move to the bottom of the wedge.

The LTC/BTC ratio chart is indicating that the current juncture is a potentially a repeating fractal pattern that corresponds to February 22, 2019:

(click to zoom)In that case, Bitcoin may be poised to decline back to the correctly drawn wedge bottom as it did in March 2019 perhaps before rising above

$11k. Note on the Bitstamp chart below there is also a repeating double-top pattern in 2019 and 2020:

(click to zoom)

[…]

After writing the above, I read that this posited double-top has been noted by another analyst in Top Analyst: BTC’s Current Resistance Could Spark a Move to $7,800 :

Yet in terms of overall timing of the cup and handle pattern, the current juncture also corresponds to April/May 2019, which is important for considering the duration of any dip back to the bottom of said bullish wedge. The current cup seems to be

~75%of the duration of the prior 2019 cup.Roughly looks like after peaking

$10.5kto$11.5kthen a decline into late February or start of March to between$8.4kto$8.8kat roughly the 100 or 200 DMA, although bear in mind the confluence$9,550zone mentioned below — which might serve as support on the downside.And the

~1.25Xvertical acceleration of this cup compared to the one in 2019, is portending a spike to between$13.8kand$15.3kprobably in early to mid-March.The repeating fractal pattern portends another spike to ~

$22klater in April. And then in the middle of May a blow-off peak of~$35kalthough the spikes could be progressively higher because acceleration is a non-linear projection.

(click to zoom)

[…]

Maximum possible downside

sfor BTC is into the low-to-mid$8000s

The updated Bitcoin charts do indicate a bottom is coming somewhere between ~$7800 at the aforementioned “correctly drawn wedge bottom” and $8400 for the aforementioned moving averages:

(click to zoom to my annotated details

(click to zoom to my annotated details

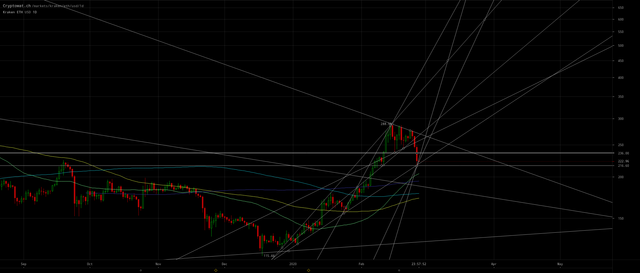

I have March 9 and 27 scenario targets annotated for a massive bullish reversal on the above as well as the following Ethereum charts which portend a rise of ETH/BTC to ~0.047 in March. ETH/USD and ETH/BTC may have bottomed or may decline between $195–$200 and 0.023–0.024 first:

(click to zoom to my annotated details

(click to zoom to my annotated details

(click to zoom to my annotated details

My February 21 update altcoin targets have been nearly achieved:

Altcoins update

Litecoin

Expecting to buy LTC/BTC between

0.0067and0.0069, then sell in early to mid March on a spike to between0.0088and0.0095for a gain of between+29%to+40%more Bitcoins. Note I will take profits0.0088and perhaps reenter on a correction before I bounce to the magenta 100 WMA and a key overhead resistance trendline at0.0095.Ethereum

Expecting to buy LTC/BTC between

0.024and0.025, then sell in early to mid March on a spike to between0.033and0.034for a gain of between+35%to+39%more Bitcoins.Groestlcoin

Expecting to buy LTC/BTC between

0.000019and0.0000195, then sell in early to mid March on a spike to between0.000035and0.000037for a gain of between+83%to+93%more Bitcoins.

Tangentially, nobody seems to know what indicator PlanB is citing for his $8200 bottom prediction, as the 200 WMA is down around $5k.

Update Feb 29, 2020

Within the next day or probably at most 3 days, Bitcoin should bottom ~$8k–$8.3k.

ETH/BTC, LTC/BTC and GRS/BTC should bottom ~0.0232–0.0246, 0.0061–0.0066 and 0.0000185–0.000019 respectively.

I posit that sometime in March, possibly not so many days after the bottom, there will be a massive, sudden spike in the prices of all cryptocurrencies analogous to that spike on April 2, 2019.

Bitcoin initially back up to top of the wedge it declined from. ETH/BTC, LTC/BTC and GRS/BTC should momentarily (set your limit sell orders in advance!) spike ~0.035–0.047, 0.0088–0.0094 and 0.000029–0.000037.

YOU MUST SELL ALTCOINS FOR BITCOIN NEAR THE TOP OF THAT SPIKE!

Altcoins will underperform Bitcoin after Bitcoin breaks above the ~$11.5k top of that massive, bullish wedge (that originates from the ATH in late 2017), because Bitcoin will have asserted its bull market in earnest and thereby reassert its dominance after bottoming in the ~50%–60% range.

I repeat:

YOU MUST SELL ALTCOINS FOR BITCOIN NEAR THE TOP OF THAT SPIKE!

Disclaimer: This is for your entertainment, not financial planning nor legal advice. Consult your own professional (perhaps licensed) adviser. I’m not responsible for any decisions you make after reading this post.

I'm waiting for a big dump ^^

@luegenbaron wrote:

Remember I cited in my recent blog Bitcoin Movements Ahead on the Way to the Moon:

So if that’s true then you’re with a majority sentiment of those who have’t yet accepted that Bitcoin is going much higher and not lower. The majority is [greater fool pigs must be] always slaughtered, so the minority can take profits. Is the majority now bullish? (find some reliable sentiment indicator for the majority, not your personal experience)

Crypto Fear & Greed Index – Multifactorial Crypto Market Sentiment Analysis

Don’t forgot what happened from February 2019 when everyone was waiting for Bitcoin to correct (because they hadn’t shifted their mindset to raging bull market) but it just kept on rising from

$3.1kto$13.9kwith only intra-day spike “crashes” on the way up.but halving is upcoming. and I kinda have it in my pee, that this halving will be different