Legacy Bitcoin Rises Surreptitiously as the Reserve in a new Two-tier Monetary System; whilst impostor Bitcoin Core Dies

The Birth of Bitcoin: A Phoenix Born from the Ashes of the Financial Crisis

Does it mean bitcoins on legacy wallet (starting with

1) will be worth something?

I’ve been positing in my prior recent blogs, that legacy Bitcoin (i.e. Satoshi’s original protocol, not BSV) would rise to $100+k in 2020 after the posited SegWit attack start date at the Bitcoin mining reward halving event on May 14, 2020, because the reward for mining will increase from current 12.5 to perhaps (at least temporarily) 1000+ BTC per block:

- Precisely Why Bitcoin Is Re-accelerating

- Secrets of Bitcoin’s Dystopian Valuation Model

- Bitcoin to $80,000 before May 2020 and $1 billion by December 2020?

- Legacy Bitcoin to radically outperform gold

- Phoenix rises in 2020; all altcoins (including Bitcoin Core) will be 50+% attacked/destroyed

- “Bitco[i]n” Will Collapse to $775 Price Soon

And Quora answers (including my answer on Quora):

And written ~2.5 years ago:

If that is the case all alt coins should be converted to BTC before may and be sold before or after may 14, or I am getting this wrong?

In this blog, I’m positing that the peak price of altcoins relative to BTC will be in February and/or at the latest mid-March. Get ready to sell altcoins at the peak targets I’ve written in this blog (c.f. my latest updates to this blog).

But the problem is we may not be able to cash out legacy Bitcoin anymore to fiat currency, because of what I blogged about:

The exchanges may be destroyed. The “secretive non-governmental organization”, the Financial Action Task Force on Money Laundering (FATF) may step in with onerous capital controls, c.f. also “Recent news” about draconian AML, KYC, PoSoFs coming “within a few months”.

FinCEN was upset because a secretive non-governmental organization, the Financial Action Task Force on Money Laundering (FATF) had identified St. Kitts & Nevis as being “non-cooperative in the fight against money laundering.” At the time, St. Kitts & Nevis didn’t appreciate being singled out as a haven for financial criminality. After all,

every serious study of money laundering had concluded that most of it is conducted in the world’s largest financial centers: New York City and London, to be exact.In spite of the reeking hypocrisy, St. Kitts & Nevis obligingly enacted stringent anti-laundering laws later that year. In response, not long after FinCEN issued that Advisory in 2000 against St. Kitts & Nevis, it was withdrawn.

Refer to the list of 5 strategies in this blog.

Note in the U.S.A. the income tax issue on the Core airdrop can be perhaps offset by claiming a loss on the value of the Core ”BTC” airdrop in the same tax years (i.e. 2020).

What will happen with BCH?

REKTD.

Also, do you see any alt coin surviving this kind of disaster?

Some will survive (e.g. Ethereum if it moves to proof-of-stake before or during the attack), but no current altcoin has any use case beyond roughly 2021. For example, Ethereum is unscalable and proof-of-stake is not trustless (oligarchies take control) thus will die in a clusterfuck as will Steem (and every other DPoS crapola). For example:

Bitcoin Gold Is Held Captive by Whale With Almost Half the Supply

The only way any altcoin could have a use case longer-term is if someone solves how to have proof-of-work not succumb to rented hashrate attacks, control by ASIC mining farms and make it scale transaction volume. ASIC mining farms put the control of the blockchain into future control of the FATF.

That’s the altcoin I’ve wanted to develop, but my chronic illness has stopped me thus far.

PoSoF means proof of source of funds.

Posited Segwit Donations Attack Will Destroy Impostor BitcOin Core

Courts Will Begin Seizing Bitcoin This Year Without Using Private Keys, According to Craig Wright

Courts Will Seize BTC With Miners' Help: Self-Proclaimed Satoshi Craig Wright

I’ve added another summary on Quora, which I decided to quote here also:

Let’s say Craig Wright is Satoshi or at least has the private keys to the billion-dollar trust. Should I sell my BTC because the price will drop once it is public or once Kleinmann gets his share and BSV is now the next thing?

My answer will seem maddening and shockingly conspiratorial, resembling F.U.D.. Your knee-jerk reaction may be to reject my answer out-of-hand based on typical filters for not wasting time assimilating outlandish, nonsense.

Yet if you dig into my 2.5+ years of archives on this subject and all my related blogs, you’ll presumably understand that I might be one of the top experts in the world on this topic (sorry not trying to brag but seriously).

I posit that Craig Wright isn’t Satoshi, but he’s being used by the creators of Bitcoin as sort of circus clown for obfuscation of their diabolical plan.

Ostensibly Bitcoin was created to replace the U.S. dollar as a world reserve currency asset in a two-tiered currency system

[1]— not to be a transactional coin for the masses. IOW, everyone except $billionaires and $trillionaires will be kicked off of Bitcoin onto to a permissioned, not trustless 666 enslavement coin for the masses such as Facebook’s Libra or competitors. My recent blog Bitcoin Fractal Projects an Infinite Price, contains some elaboration (and links into my relevant, more comprehensive archives).“Satoshi” (i.e. our evil-echelon global masters behind-the-curtain who invented the soon-to-be “666”

[2]Bitcoin) hodls the private keys to the 1.1 million Bitcoins — the so called “Tulip Trust”. They can presumably dump them to accomplish the following diabolical plan, pinning it on Craig-the-fall-guy-clown. Whilst Craig can claim he was forced to sell, to meet his obligations for the court case he surreptitiously filed against himself, lol.Note Craig will not be selling legacy Bitcoin — rather selling the worthless Bitcoin Core airdrop on the exchanges after surreptitiously forking the chain. The posited timing is to be at the halving event on May 14, 2020. And they need to skyrocket the Bitcoin price before this (c.f. my blog Bitcoin Movements Ahead on the Way to the Moon), so that when they crash Bitcoin Core then it will only mine a new block perhaps once a week or month, thus forcing all the miners to switch over to legacy Bitcoin (not BSV!). Readers need to understand that Bitcoin Core (which everyone thinks is the “official” Bitcoin) is actually a soft-fork impostor. In blockchain protocols, there’s no such thing as “official” or user-consensus. There’s only the longest-chain, game theory such as Nash equilibriums with Schelling points, and miner economic incentives. You need to read my relevant archives to understand why my statements are likely to be the correct assimilation of the facts.

BSV is not legacy Bitcoin. Please do not confuse the two. The latter is Satoshi’s immutable protocol which forms the real Bitcoin which will be the global reserve currency asset with immutable 1MB block sizes (not scalable to high transaction volume).

Everyone hodling Bitcoin Core (i.e. addresses beginning with

3orbc1instead of legacy that begins with1) will see their tokens drop to near $0 after the posited Segwit donations attack begins, if the “attack”[3]transpires as posited.All inane, novice objections have already be refuted in the long discussion/debate I participated in about this on Bitcointalk.org.

Legacy Bitcoin eventually rises to an infinite price relative to the eventual death of the U.S. dollar if posited attack transpires.

$100kis likely in 2020 and possibly an acceleration to even$1 millionbecause as I blogged in Precisely Why Bitcoin Is Re-accelerating, the value of Bitcoin is according to the stock-to-flows model (as I explained in my blog Secrets of Bitcoin’s Dystopian Valuation Model), driven by the cost of mining but the cost rises to the value of the mining reward which will be increased from12.5BTC to some100s or1000s of BTC donations per block!P.S. Everything has been archived such as on archive.is and/or Wayback Machine (where possible even though for example, permissioned, non-trustless Quora attempts to block archiving presumably so they can control the narrative and exclusivity…which is why we need decentralized solutions on scalable, decentralized blockchains if possible).

[1]Sometime after 2026 – 2032, as the dollar will grow stronger interim due to an economic contagion beginning outside the U.S.A. (due to politics and rising level natural calamities due to the dearth of sunspots aka Maunder Minimum, which impacts tectonics and climate thus plagues, locusts, etc.) which has started to go parabolic since January 18

@BSV commented:

a nonsense con game collectible is indeed what bitcoin has turned into as the globalists took over it to prevent it from scaling.

The company Blockstream - controlling the "bitcoin core" team that develops bitcoin software that all miners run, is now controlled by the Bilderberg Group - seriously! AXA Strategic Ventures, co-lead investor for Blockstream's $55 million financing round, is the investment arm of French insurance giant AXA Group - whose CEO Henri de Castries has been chairman of the Bilderberg Group since 2012. https://www.wsj.com/articles/bitcoin-startup-blockstream-raises-55-million-in-funding-round-1454518655

You see, bitcoin was created to replace the BIS/FED and become the first and only universal ledger of truth of mankind, that was the goal of its intrinsic utility. But the globalists didn't like that humanity could access a single ledger of truth, were they cannot censor people nor delete their own proofs of doing evil, so they realized the only way to attack it was to take over the development team & put little grains of sand into it until it would just stop the clock aka prevent scaling, which would eventually kill it indirectly as bitcoin can only survive if there is enough transaction volume to counter balance the fact that the block reward halves every 4 year, as it was designed to. That's why a Bitcoin Civil War started and is still going on.

The 2nd paragraph above is probably correct. The rest is him not understanding that legacy Bitcoin was intended to never scale and instead be a reserve currency asset in a two-tiered, global monetary reset.

C.f. also:

- The Economic Confidence Model & the Shift in Trend

- The Bond Market Crash post 2015.75

- The Economic Confidence Model & the European Economy

- How Long Does it Take to Accept the Revelations of the Economic Confidence Model?

- The Dow & the Economic Confidence Model

- Do Lower Interest Rates Really Produce Bull Markets in Stocks?

- Too Big to Fail – Nothing Has Changed

- The ECM & Who to Blame

- Interest Rates and the Great Global Crisis

- Climate Change & the 2020 ECM Turning Point

- The Coming Crisis – What to Watch?

- Agriculture Yield Elected Yearly Bearish Reversal

- ECM & the Rise in Intensity into 2032

- ECM Day is Here

- ECM Updates

- Capital Flows & the Next ECM

- Is Climate Change Dispute the Same As the Fall of Rome?

- Could the Fed Ever Exit the Repo Market?

- The Fraud in Climate Change Exposed

- Abrupt Swings in Weather from Cold to Heat

- Can Central Banks Ever Control Long-Term Rates?

- Why is 2022 A Possible Change in the Presidency?

- Is World War III on the Horizon?

- Why the Repo Report Must Remain Private

- Capital Flow Analysis

- Capital Flow & War

- Understand What is the Repo Market

- REPO Crisis

- Year of Change – 2020

- Snow in Thailand

- Bangladesh Death Toll from Extreme Cold – A Warning to us All!

- Sports Peaked with 2015.75 and NFL Has 15,000 Unsold seats

- The ECB & its Green Agenda

- Wikipedia: Fake News & Propaganda – A Tool of the Deep State?

- Trump & Fed Meet – Why?

- Repo & Disinformation

- Fed Repo Funding for Year-End

- Rise in US Dollar Will Force Defaults in Third World

- Why the Fed Is Not Lowering Rates

- Why the Fed Stopped Lowering Short-term Rates

- The Truth Behind the Repo Crisis

- The Mother of all Financial Crises

- BIS Hiding the Truth or Covering Their Exposure

- The [farce of the BIS] Repo Crisis Report

- European Banks to be Prohibited from Dealing in Repo?

- The Big Bang and the Process Unfolding into 2025

- Repo Crisis – Best Kept Secret Ever!

- QE v Managing Benchmark Rates

- Mother of All Financial Crises

- Is Trump Being Kept in the Dark?

- Is the Fed Monetizing Debt with the Repo Market? Or is this the Mother of All Financial Crises?

- The Repo Crisis

- The Coming Big Freeze

- Understanding the Repo Crisis

- The [Green Bonds for Millennials] Fraud of Climate Change

- REPO Crisis

- Negative Interest Rates is the Way to Kill a Reserve Currency

- Europe Moving to Worldwide Income Tax & International Wealth Tax

- Misrepresenting Our Forecast for the Start of Big Bang 2015.75

- Public v Private Waves

- Repo Crisis

- Fed Cuts Rates 25 basis Points

- Why Britain Use to be the Financial Capital of the World

- Climate Alarmists’ Fraud Exposed

- The Coming European Crisis

- Liquidity Crisis & the Pending European Banking Crisis

- Japan’s Monetary System is a Warning to Modern Society

Split Between Official & Real Interest Rates - Liquidity Crisis

- The Dollar Shortage & Liquidity Crisis?

- The Panic in Interest Rates is Just Getting Started

- Weather Was Also Extremely Volatile During ’30s

- Flight from Public to Private

- Is it Our Time to Rock & Roll?

- Sunspot & Climate Change

- Big Bang in Full Motion Set to Collide In a Real Mess

- Dollar Contagion & Trump

- Private v Public Rate

- The Bond Bubble & the WEC

- The Biggest Bubble in Modern Financial History

- Climate Change is Part of the Corruption

- Spotless Sun

- There are more $100 Bills in Circulation than $1 Bills

- The Fed’s Real Crisis – To Cut or Not to Cut

- Economic Storm Trump Will be Blamed For Because of Bad Advisers

- IMF Recommends “DEEP” Negative Interest Rates as the Next Tool

- Finland & Japan Confirm Global Warming Data is not Supported

- Real-World v Fake Central Bank Interest Rates

[2]The likely meaning of “666” is submission to the will (2/3 quorum) of the super-majority in politics, governance, mass mania, etc.. Refer toMatthew 22:21,1 Samuel 8,John 15:19andRevelation 18:4. Whereas,Romans 13:1appears to be an integral part of the 666 system (perhaps a corrupted translation instituted by Constantine?).

[3]It’s actually a clever game theory mechanism “Satoshi” appears to have designed into Bitcoin to protect its immutability so that it can remain permissionless, trustless. Whereas after Core is forced to hardfork Bitcoin Coin to lower the difficulty after the attack begins to siphon away all the miners to legacy, then it will be clear the Core is not permissionless, trustless but actually controlled by Core (and politics, etc).

Bitcoin Rising as Economist Magazine’s Phoenix

I had featured that seminal, oft-cited 1988 article from the Rothshilds’ controlled (c.f. Why did wealthy families pay over the odds for the Economist?) Economist Magazine in my blog ~3 years ago Get Ready for a World Currency.

Others have hence also tied Bitcoin to Economist's Phoenix:

“Get ready for the Phoenix” — The Economist, 1988

It's almost eerie, but The Economist may have predicted the rise of the new cryptocurrencies and downfall of the old fiat almost 30 years ago, to take place in 2018.

Bitcoin Phoenix by @CryptoHustle

Weekly News 1/2019: Bitcoin is Ready to Rise Like a Phoenix

I wrote in my blog yesterday Bitcoin Fractal Projects an Infinite Price:

IOW, Bitcoin eventually becomes the new world reserve currency asset and U.S. dollar dies, as I have predicted in many of my blogs such as:

- Get Ready for a World Currency

- Bitcoin rises because land is becoming worthless

- Facebook’s Libra + Bitcoin + Trump + Israel = 666 Orwellian Dystopia

- Phoenix rises in 2020; all altcoins (including Bitcoin Core) will be 50+% attacked/destroyed

My answers on Quora:

Recent news related to the draconian FATF regulation of cryptocurrency coming:

Treasury Secretary Mnuchin Gives Testimony on Cryptocurrency, New Regulations Rolling Out Soon

As Treasury Signals New Rules For Crypto, Does Trump Seek A Ban?

The U.S. Is Very Worried About Bitcoin—And It’s Finally Doing Something About It

Video and Transcript of U.S. Treasury Secretary's Press Briefing on Cryptocurrencies

Mnuchin Warns Bitcoin Users of ‘Very, Very Strong’ Regulations

Mnuchin: FinCEN to Roll Out ‘Significant’ New Cryptocurrency Rules

US Treasury Secretary Promises ‘Significant New Requirements’ on Cryptocurrency

US Treasury secretary voices support for new FATF rules regarding crypto exchanges

AML/KYC Compliance Just Got Harder

The European Union’s Fifth Anti-Money Laundering Directive (5AMLD) went into force on Jan. 10, with new regulations for cryptocurrencies, wallets and exchanges

Top Fund Manager: Treasury’s New Crypto Rules Could Help Industry

Speaking with CNBC on Friday regarding Bitcoin and the broader cryptocurrency space, Mike Novogratz — incumbent CEO of Galaxy Digital and a former partner at Goldman Sachs — argued:

“We’re going to see something from Treasury

in the next few monthsthat kind of puts some guardrails around Bitcoin […]U.S. Treasury Secretary states stronger crypto rules coming to strengthen transparency…

“We are working with FinCEN, and we will be rolling out new regulations to be very clear on greater transparency so that law enforcement can see where the money is going and that this isn’t used for money laundering.”

[…]

In Chainalysis’ latest report, the blockchain analysis firm found that the value of cryptocurrency spent on dark web markets, where individuals can buy items like fake identification and drugs, surged 60 percent to a “new high” of $601 million in Q4 of 2019.

Chainalysis added that 1 percent of Bitcoin transactions are used for illicit activity — up from the approximately 0.5 percent seen in the year prior

Treasury and Congress Set to Pass Off New Regulatory Burden on Small Businesses

- Both proposals foist a new burdensome beneficial ownership reporting requirement on small businesses, while exempting those most able to abuse the financial system.

- For decades, the U.S. government has expanded the regulatory burden under the AML regime, requiring financial companies to file millions of reports.

- The existing AML framework now costs Americans billions of dollars per year—more than $7 million for every conviction obtained.

[…]

On May 11, 2018, a new FinCEN “Customer Due Diligence” rule took effect that substantially ramped up these requirements. If bankers are having trouble completing these tasks, perhaps the real problem is that Congress should never have treated them as if they were law enforcement officials. Of course, that’s the way that Washington works—this legislation is moving toward passage because large financial institutions are pushing for it.

[…]

Aside from shifting the reporting burden from banks to small businesses, the legislation would create a national corporate ownership database to “facilitate financial institutions’ customer due diligence efforts to confirm information currently obtained during the customer onboarding process.”

This feature raises all kinds of privacy concerns […]

Mnuchin: stricter crypto AML rules coming ‘very quickly’

Mnuchin’s comments come at a time when governments worldwide are changing the way they regulate crypto assets to comply with new guidance put forth by the Financial Action Task Force last year. The international body, which creates policies to combat money laundering and the financing of terrorism, is followed by about 200 countries, including the U.S..

Paul | Weiss’ Economic Sanctions and Anti-Money Laundering Developments - 2019 Year in Review:

Amendment of the Reporting, Procedures, and Penalties Regulations. On June 21, 2019, OFAC published an interim final rule amending the Reporting, Procedures, and Penalties Regulations (the “RPPR”).³⁷ Among other things,

the rule revised the RPPR to require all U.S. persons(not just U.S. financial institutions, as had previously been the case) to file rejection reports with OFAC. The rule also amends the RPPR to require rejection reports for all rejected transactions (not just fund transfers, as had previously been the case), including transactions relating to wire transfers, trade finance, securities, checks, foreign exchange, and goods or services. In addition to these new requirements, the interim final rule also expanded the scope of information that OFAC requires to be included on initial and annual reports of blocked property.³⁸

Federal Register / Vol. 84, No. 120 / Friday, June 21, 2019 / Rules and Regulations

§501.603 Reports on blocked and

unblocked property.

(a) Who must report—(1) Holders of blocked property. Any U.S. person (or person subject to U.S. jurisdiction), including a financial institution, holding property blocked pursuant to this chapter or releasing property from blocked status (i.e., unblocking property) pursuant to this chapter shall submit the relevant reports described in this section to the Office of Foreign Assets Control (OFAC). This requirement applies to all U.S. persons (or persons subject to U.S. jurisdiction)who have or have hadin their possession or control any property blocked pursuant to this chapter, including financial institutions that receive and block payments or transfers.Guidance on Applicability of FinCEN Regulations to Certain Business Models Involving Convertible Virtual Currencies. On May 9, 2019, FinCEN issued interpretive guidance stating that preexisting BSA regulations applied to several common business models involving Convertible Virtual Currencies (“CVCs”).⁸⁸ Covered business models include:

- Peer-to-Peer Exchangers: Natural persons who engage in transfers between different types of CVCs, as well as exchanges of CVC for other types of value;

[…]

Anonymity-Enhanced CVC Transactions: Transactions structured to conceal information otherwise generally available through the distributed public ledger;[…]

Guidance on Red Flags and Typologies for Suspicious Convertible Virtual Currencies Activity. Also on May 9, 2019, FinCEN issued an advisory regarding the use of virtual currency to support illegal activity, money laundering, and other behavior endangering U.S. national security.⁹⁰ The advisory highlights the capability of virtual currency to be used as an alternative to traditional payment transmission systems, and tracks the rising exploitation of virtual currency in criminal enterprises. The advisory describes multiple virtual currency abuse typologies, including those involving darknet marketplaces,

unregistered peer-to-peer exchangers, unregistered foreign-located MSBs, and CVC kiosks, and provides case studies of each. In addition, the advisory discusses several red flags to assist financial institutions in identifying unregistered MSB activity and suspicious virtual currency purchases, transfers, and transactions. The red flags include any connections between a customer’s CVC addresses or IP addresses to darknet or Tor activity;receipt of multiple cash deposits or wires prior to purchasing virtual currency; transmission or receipt of funds or CVCs to or from foreign exchanges or jurisdictions with reputations for being tax havens; operation of CVC kiosks in locations with high incidences of criminal activity; andstructuring of transactions just below reporting thresholdsor CVC kiosk daily limit to the same wallet address.⁹¹[…]

On October 11, 2019, the CFTC, FinCEN, and SEC issued a joint statement on activities involving digital assets.¹⁴⁵ In this statement, the agencies discuss the AML/CFT obligations that apply to entities that the BSA defines as “financial institutions,” as well as the factors involved in determining whether and how a person or entity must register with one or more of the different agencies. Each agency also separately provided additional commentary regarding the application of BSA regulations to their specific agencies.

[…]

Considerations for Strengthening Sanctions/AML Compliance

In light of the developments described above, senior management, general counsel, and compliance officers

should consider the follow points in strengthening their institutions’ sanctions/AML compliance:[…]

Continued Caution Around U.S. Dollar Transactions. In its landmark 2017 settlement with CSE Global and CSE TransTel, two Singapore-based companies, OFAC found that they violated U.S. sanctions by sending U.S. dollar payments involving Iran, where the payments cleared through U.S. financial institutions and thereby “caused” them to violate sanctions by exporting financial services to a comprehensively sanctioned country.¹⁵² For some non-U.S. companies, conducting business involving sanctioned jurisdictions or parties in U.S. dollars—even without any other U.S. touchpoints—remains a major area of sanctions-related risk.

[…]

Enhance Compliance Procedures for Virtual Currency Businesses and Clients. In 2019, regulators continued to emphasize the potential risks posed by virtual currency transactions and businesses. Regulatory expectations of appropriate monitoring of virtual currency BSA/AML and sanctions risk are increasing as further guidance and advisories related to virtual currency are issued. Among other things, financial institutions should ensure that all procedures are updated to consider the unique risks of virtual currencies, including virtual currency exchangers. When evaluating potentially suspicious activity, FinCEN advises that red flags relevant to identifying efforts to circumvent AML and Sanctions controls include (1) if a customer transfers or receives funds to or from an unregistered foreign virtual currency exchange, or other MSB with no relation to where the customer lives or conducts business; (2) if a customer conducts transactions with virtual currency addresses that have been linked to extortion, ransomware, sanctioned addresses, or other illicit activity; and (3) if a customer’s transactions are initiated from non-trusted IP addresses, IP addresses from sanctioned jurisdictions, or IP addresses previously flagged as suspicious.

Consider BSA/AML Risk of Correspondent Banking Relationships with Higher-Risk Financial Institutions. As the expanding Danske Bank inquiry has demonstrated, financial institutions should consider the regulatory risk and compliance costs associated with maintaining correspondent banking relationships with financial institutions with high-risk customers or located in higher-risk jurisdictions. U.S. dollar clearing services pose unique risks as financial institutions have more limited information about underlying transaction activity. U.S. regulators expect that banks that provide services to higher risk financial institutions will appropriately monitor for and report suspicious activity flowing through correspondent banking channels.

Applicable laws (and insane, unconstitutional absence of rule-of-law):

Money Laundering Control Act – Wikipedia

Section 1956 prohibits individuals from engaging in a financial transaction with proceeds that were generated from certain specific crimes, known as "specified unlawful activities" (SUAs). Additionally, the law requires that an individual specifically intend in making the transaction to conceal the source, ownership or control of the funds. There is no minimum threshold of money, nor is there the requirement that the transaction succeed in actually disguising the money. Moreover, a "financial transaction" has been broadly defined, and need not involve a financial institution, or even a business. Merely passing money from one person to another, so long as it is done with the intent to disguise the source, ownership, location or control of the money, has been deemed a financial transaction under the law. Section 1957 prohibits spending in excess of $10,000 derived from an SUA, regardless of whether the individual wishes to disguise it. This carries a lesser penalty than money laundering, and unlike the money laundering statute, requires that the money pass through a financial institution.

Money Laundering: An Overview of 18 U.S.C. § 1956 and Related Federal Criminal Law

Forfeiture

[…]

Forfeiture is the confiscation of property to the government as a consequence of the property’s proximity to some form of criminal activity.¹²⁷ The government’s claim to the property can be secured by default […] ordinarily in rem (against the property itself).¹²⁸ The proceeds of a confiscation are generally shared among the law enforcement agencies that participate in the investigation and prosecution of the forfeiture.¹²⁹ […] First, the “proceeds” of any Section 1956 predicate offense (and any property traceable to such proceeds) are subject to confiscation without the necessity of any actual violation of Section 1956.¹³⁰ This permits the confiscation of property derived from crimes that might form the basis for a money laundering offense without having to prove that a money laundering offense occurred.¹³¹ Second, property “involved” in a Section 1956 money laundering offense (or property traceable to such involved property) may be confiscated.¹³² Involved property obviously includes more than the proceeds of the predicate offense, since the proceeds are separately forfeitable already. “Property eligible for forfeiture under 18 U.S.C. §982(a)(1) includes that money or property which was actually laundered ... , along with any commissions or fees paid to the launderer and any property used to facilitate the laundering offense.”¹³³

Civil Asset Forfeiture is insane, read all of these below ↓

- In Rem – Criminal Activity of Government

- Deodand – Civil Asset Forfeiture Violate Every Principle of Human Rights & Civilization

- Supreme Court Did Not Rule on Civil Asset Forfeiture

- Police Civil Asset Forfeitures Exceed All Burglaries in 2014

- Oklahoma – The State You Must ALWAYS Avoid Driving Through

- Gold – the Desirable Object – Can it Survive as the Alternative to Electronic Money?

- Why a Judge Ruled the Police Have NO DUTY to Protect Citizens

18 U.S.C. § 1957

[…]

Unless there is some element of promotion, concealment, or evasion, Section 1956 does not make simply spending or depositing tainted money a separate crime. Section 1957 does.¹⁴⁴ It outlaws otherwise innocent transactions contaminated by the origin of the property involved in the transaction.¹⁴⁵

[…]

At the heart of any Section 1957 offense lies a monetary transaction. A monetary transaction for purposes of Section 1957 is any deposit, withdrawal, or transfer of funds, in or affecting interstate or foreign commerce, and involving a financial institution.¹⁴⁸ Numbered among the qualifying financial institutions are banks and credit unions, but also car dealerships, jewelers, casinos, stockbrokers, travel agents, and pawnbrokers, to mention a few.¹⁴⁹

Section 1957 only applies to transactions involving $10,000 or more at the time of the transaction.¹⁵⁰[…]

The government must prove that the defendant knew the funds or other property in the transaction was “criminally derived property,” ¹⁵² that is, the proceeds, or funds derived from the proceeds, of criminal activity.¹⁵³ The government need not show that the defendant knew that proceeds were the product of a “specified unlawful activity,”¹⁵⁴ but the proceeds must in fact be derived from a specified unlawful activity (predicate offense).¹⁵⁵

[…]

31 U.S.C. § 5322: Reporting Requirements

Section 5322 penalizes willful violation of several monetary transaction reporting requirements found primarily in title 31 of the United States Code. The section’s coverage extends to violations of the following sections and their attendant regulations:

- 31 U.S.C. § 5313 – financial institution reports of cash transactions involving $10,000 or more;

[…]

- 31 U.S.C. § 5316 – reports by any person taking $10,000 in cash out of the U.S. or bringing it in;

[…]

- 31 U.S.C. § 5331 – reports of trades and businesses other than financial institutions of

cash transactions involving $10,000 or more;U.S. citizens and residents with a financial interest in or authority over foreign bank accounts or "foreign financial accounts" with an aggregate value of $10,000 are required to file a Foreign Bank Account Report (FBAR) with the U.S. Treasury by October 15 every year.

Do You Need To Report On An FBAR & Form 8938 Your Offshore Gold, Cash & Notes?

On the other hand, where the owner maintains exclusive control over the vault and does not give the foreign financial institution (or person engaged in the business of banking) access, reporting currency cash notes stored in such a vault is not required regardless of value. In that case, the vault would not be deemed a financial account maintained with a foreign financial institution (or a person engaged in the business of banking).

[…]

Second, absolutely no co-mingling of assets occurs, as is the case with traditional banks. On the contrary, each client is the direct owner of his or her assets, fully identifiable – at all times – as being the exclusive property of the client.

[…]

First, can SafeStore, as the company that operates the vault, be classified as a financial institution or at least as a person engaged in the business of banking? As a preliminary matter, such companies are generally not foreign financial institutions.

[…]

Even though the vault-operating company might not be a financial institution per se, could it be treated as being engaged in the business of banking? Admittedly, this is a grey area. The government is likely to argue that the company is the functional equivalent of a “commercial bank.”

[…]

Based on fourth circuit precedent, a court is likely to agree with the government that SafeStore does, in fact, function as a bank. In a literal sense, it operates a vault – the very place where assets are stored. As such, it holds assets on behalf of their owner – here gold or cash notes. Not only is it authorized to hold these assets, but it is presumably authorized to disburse them at the customer’s direction.

To the extent that SafeStore is deemed a surrogate bank, is the relationship between the owner of the assets and SafeStore so analogous to a bank-customer relationship that the account should be considered maintained by a person engaged in the business of banking? This is another grey area that could go either way.

[…]

In support of the argument that the account should not be considered maintained by a person engaged in the business of banking is the following. First, unlike a typical run-of-the mill bank account, no interest is paid on the principal. Second, the cash notes are held together in a designated area of the vault. In addition, they are individually packaged and labeled so that they are readily identifiable as the taxpayer’s property. Indeed, if the taxpayer ever wants to personally view or take physical possession of the cash notes, all he has to do is show up. Third, the taxpayer never relinquishes control over his cash notes to the vault-operating company, nor does he ever direct the company to disburse them to a third party for any purpose whatsoever. Instead, he remains in full possession and control of these notes at all times.

Finally, to the extent that the U.S. government gives deference to Swiss law, a bank’s vault activities are not deemed a “banking activity” under Swiss law.

Therefore, a compelling argument can be made that the vault is not a financial account maintained with a financial institution or other person engaged in the business of banking. In that case, the taxpayer need not file an FBAR.

[…]

Even if there is no obligation to report gold or currency cash notes on an FBAR or Form 8938,

if the assets are owned by a corporation, partnership or trust, other information returns may be required.Because failing to file information returns related to foreign corporations, partnerships, and trusts carries its own penalties – many of which are equally or more severe than failing to disclose offshore assets on an FBAR or Form 8938Is My Dubai Gold Investment Reportable to IRS according to FATCA and FBAR rules?

[…] gold which you directly hold does not have a reportable requirement on the FBAR or Form 8938 of the IRS (The FBAR is the dreaded Report of Foreign Bank and Financial Accounts which the IRS requires of its poor subjects living abroad even when they are no longer U.S. based residents.)

Yet it is a qualified no because when you choose to sell the gold or other precious metals, you now have what amounts to an IRS reportable transaction. This means that in effect you are not required to report your gold holdings to the grasping IRS in the majority of overseas holding cases.

[…]

Selling Gold Overseas Is Also Complicated Tax Wise

Now to the other key part of the tricky question, what are you obligated to report when you finally sell your foreign-held gold and other precious metals, presumably overseas? This also depends on who you sell them to in the end. Should you sell off your tangible valuables such as gold holdings to a foreigner, then this represents a foreign sales contract, and it is a reportable asset according to the IRS. The Internal Revenue Service puts it this way on their website:

“The contract with the foreign person to sell assets held for investment is a specified foreign financial investment asset that you have to report on 8938, if the total value of all your specified foreign financial assets is greater than the reporting threshold that applies to you.”

What in the world does this mean? It simply states that should you sell off your gold holdings or other collectible assets to a foreign resident who is a United States’ person, then you will not incur a reportable transaction in the sale itself. However, should you sell the identical assets to a foreign resident who qualifies as a foreign person, matters are quite different.

Here is yet another opaque consideration for you. Assuming that the total value is a significant one, then you will have to report said foreign transaction to the IRS on their Form 8938.

Some of the possible increases in regulation were covered in a 2017 blog Why Government Will Never Take Down Cryptos:

requirement will be to initiate a “travel rule” for every transfer of value in virtual currencies. Exchanges and custodians will have to determine the beneficial owner of both the sender and recipient in any such transfer. They’ll also need to pass this information along to each other when transferring funds.

If that’s too much trouble and a country doesn’t want to deal with virtual currencies, the FATF guidance suggests it’s OK to ban them altogether

[…]

Still, I think there’s a high probability most countries will adopt the FATF standards, including the travel rule.

Treasury Secretary Mnuchin seems to agree. In a press conference July 19, he told reporters that both the G7 and the G20 (a larger group of wealthy countries than the G7) were on board with greater regulation of the crypto market.

Mnuchin went on to highlight the work of the Financial Stability Oversight Council Working Group on Digital Assets, which the Treasury Department created last year. If Uncle Sam plans a frontal assault on crypto, the working group will likely coordinate the attack.

One proposal that will likely be resurrected is a 2017 bill called the Combating Money Laundering, Terrorist Financing, and Counterfeiting Act. It would expand the current anti-money-laundering rules and require travelers who cross a US border to include “any prepaid access device” such as a prepaid debit card, gift card, phone cards, and of course, cryptos in their calculation of carried value. All travelers must report a combined value of $10,000 or more when they cross a US border. The new rules would change border crossing requirements for thousands of travelers.

If you’re arrested for failing to comply with the new rules, Uncle Sam could file a secret motion in federal court for a restraining order that would confiscate every asset you own under federal civil forfeiture laws. Even your safe deposit box could be cleaned out. You could lose all your property without being tried or convicted of any crime. The restraining order could be extended indefinitely.

Armstrong Confirms Bitcoin Bull Market; Warns Dacronian Capital Controls

The pitch that was coming from the IMF under Legarde was that countries should create their own cryptocurrency and then she implied that they would effectively outlaw private cryptocurrencies. I believe, based upon reliable sources, that governments have stood-by to observe if the public would embrace electronic currencies. Once they became acceptable, then

they would end paper money and private cryptocurrencies and force all money into their version where they could get 100% of the taxes they ever dreamed of. They will also use terrorism as a justification.

I commented in my February 21, 2020 update:

The perennial Bitcoin bear and doomsday-for-Bitcoin protagonist Martin Armstrong in his blog yesterday Gold in Currencies & Cryptocurrencies, has apparently finally capitulated and admits Bitcoin may test the major downtrend line from the 2017 ATH in March and given the directional change expected I presume he implies Bitcoin could break above that major resistance level:

The two key weeks ahead are those of 01/27 and 02/17. Therefore, failure to make a new high warns that we may see a retest of support ahead. We see February is a Double Directional Change

[…]

Even BitCoin was scheduled for a rally into February and it has yet to test the Downtrend Line. Here too, March remains as a Directional Change. As far as Blockchain is concerned, I do not think that is the issue […many excuses and his continued ignorance of the issues followed]

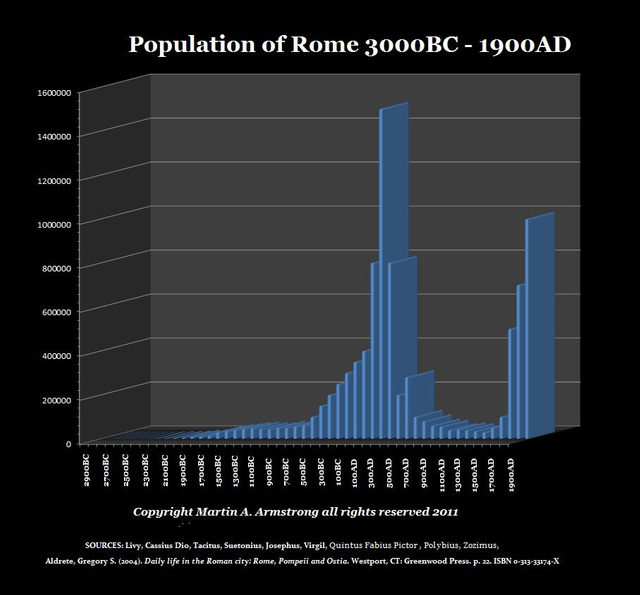

Armstrong should note the similarity of his Bitcoin chart to the his chart of the collapse of Rome, which of course subsequently soured to higher highs (not shown on his chart’s cutoff date):

…continued in Armstrong Confirms Bitcoin Bull Market; Warns Dacronian Capital Controls

I did more research on SegWit and I found that Bitcoins on the SegWit network are not actually Bitcoins. The signature is not part of the chain but according to Bitcoin whitepaper, by design the signature stays within the chain. If the signature is not part of the chain, it means it is not part of the hash. Whoever came up with this idea about SegWit has clear intend to destroy or control Bitcoin.

Congratulations @anonymint! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!