Bitcoin Whiplash Reaction High?

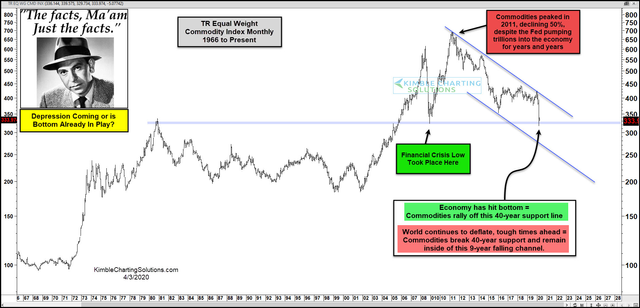

Looks like a spike high to between $8k and $10k may be incoming:

(click to engorge)

The lower ascending triangle with two hits on $6k before launching to $7k and now with two hits on $7k before launching higher. The smaller triangle if broken to the upside (which it did) projected to between ~$6.9k to $8.1k and the larger one to ~$8.3k to $10.1k but has not yet been broken to the upside.

I believe the gap has to be filled somewhere between $7.8k for the 50 DMA and $8.2k for the 100 and 200 DMA (bearish death cross is imminent). There’s also potential overhead resistance at ~$7.1k for the 100 WMA.

DJIA Futures are pointing up. Perhaps because of Dow Collapses but Hope Swells in COVID-19 Drug Breakthrough, c.f. also Chinese scientists seeking potential COVID-19 treatment find 'effective' antibodies.

If it happens, I would definitely take some profits but not even 50% of your Bitcoins. Just enough in case Bitcoin collapses to $0 in a SegWit attack that you will not hate yourself for the rest of your life. It appears to be a repeat of what happened before with a lower-low possibly to follow:

(click to engorge)

Alternatively the price rise may not make it back up to $7k and thus failed triangle and fall out to test the bottom. The spike high could come later in April perhaps. First make lower low, then spike high to $10k, then make much, much lower low in May. Ascending triangles can be bearish because it means strong overhead resistance and waning momentum to breakthrough it. Declining volume can be a sign. Yet volume has picked up again although only a lower high this far.

I currently have sell orders for just a hair below $7k and more $8k. If see Bitcoin weakening I might sell $6.5k. I will probably also place a few limits sell orders above $9k.

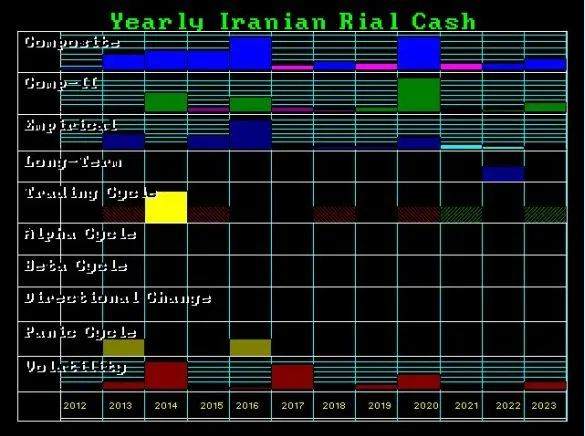

I have also begun to question my bullish analysis of the Forecast Array for Bitcoin in my prior blog Bitcoin the Phoenix Rises in a Wake of Dystopian Ashes — The Totalitarian Trojan Horses. Instead for Bitcoin it could be a slight bounce in April then the increasing volatility expected for May could either be bearish to lower lows or bullish. And June’s Directional Change could either be respectively to bullish instead of a posited bearish SegWit donations attack scenario.

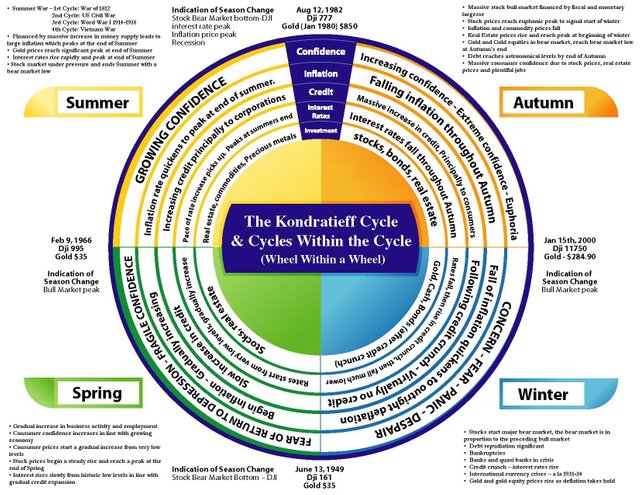

The DJIA Forecast Array has back-to-back Directional Changes for March and April, so that seems to indicate a bottom for the DJIA in April. If so it will probably be an extreme low so that future months don’t need to make a lower-low on continued GDP declines. IOW, the market may price in the total damage of the crisis early on. Perhaps that bottom could be retested again in June.

Whereas the DJIA Aggregate doesn’t make a new high until August, yet Bitcoin’s peaks in June. And Bitcoin has an extreme low on Aggregate in May with extreme insane high in Overnight Volatility, i.e. gaps up or down on open. A low Aggregate doesn’t mean a low in price. Highs and lows on Aggregate are notable for being possible reversals.

The simplest interpretation is that Bitcoin will have extreme price moves in May which culminate in June. However it makes no sense for Bitcoin to crash while the DJIA has already bottomed in April, unless a SegWit donations attack is underway. Also Bitcoin normally rises up to near to an ATH right before or after the halving event which is May 14 this year.

Thus my guess is that Bitcoin will make a spike high now, then decline to test the bottom along with the DJIA perhaps next week. Then after the DJIA has bottomed and starts to rise a little bit, that will be a signal to Bitcoin that it can run crazy bullish. Think about it like altcoins wherein Bitcoin is an altcoin compared to the dollar. Altcoins typically don’t start moving up until Bitcoin bottoms and pauses, e.g. February 2019. Because money flows out of the paused asset into the smaller asset market that can pop higher. A stampede into the small market ensues. Also because of the miners capitulation issue reversal that I mentioned in recent blogs. So as the DJIA bottoms perhaps next week and pauses until June, then Bitcoin will go bonkers bullish. So again I come back to the posited SegWit donations attack by June. Seems I always end up back at that interpretation.

Armstrong’s Coronavirus & Next Great Depression Report is quite sobering. He’s expecting negative GDP growth (i.e. decline) in the U.S.A. until a bottom near the end of the year. Unemployment could spike to 14% and then onwards to 25% by 2023. Trump’s extension of the lockdowns until April 30 will be catastrophic. If you have not already sold your (especially retail) business and real estate, then do so asap.

It’s a political coup accomplished with mass media propaganda induced hysteria and psychosis. The powers-that-be allowed Trump to build a following on Twitter because their aim to addict us all to Internet memes so they can bombard us with propaganda.

Note I added the section Sane Countries to my prior blog The Coronavirus Merry-Go-Round, Blackmail Scam.

UPDATE 19 Hours Later

The 100 WMA was penetrated just slightly to the upside but failed and crashed back thus far to bullish support. A huge spike in volume has turned this situation to definitively bullish on the 4H. The bullish trend (although not as definitive) remains up to the 1D chart. The bullishness is not yet seen in the volume for the 3D. Assuming bullish support doesn’t fail, looks like this spike up may complete within the next day or so.

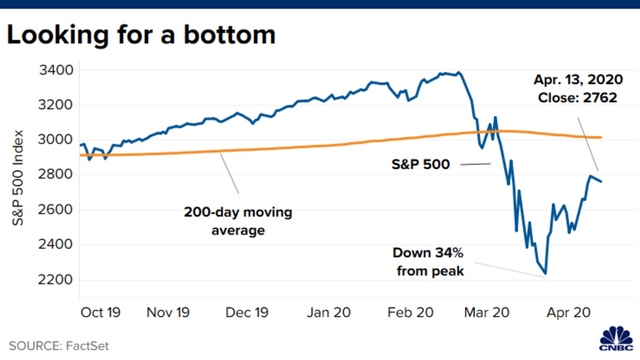

The SPX is threatened to double-top or push up to the original target of 2700 by Jeff Gundlach:

If so, then Bitcoin could hit $10k.

In any case, it seems likely Bitcoin will reload and make another attempt to break cleanly above the 100 WMA. Then the next target is $8k.

UPDATE Next Day

I’ve seen the April update for Armstrong’s Forecast Array and Premium Analysis text for Bitcoin. I urge those who can afford it to subscribe to Socrates and select the Premium Subscription and select Bitcoin as their Premium Market Subscription. It’s $155 monthly so you might need to have a friend join you, but strictly speaking Armstrong doesn’t allow sharing of the information but I doubt he can find out if you are only sharing with a trusted friend. Perhaps he is charging too much. There are many Bitcoin investors who would probably gladly pay $75 monthly. Because Bitcoin hodlers think that $155 will become $1550 (or perhaps even $15,500) if they just hodl it instead of spending it. So I suppose we are justified in taking the matter into our own hands given Martin may not fully understand our investment psychology.

The most salient change I notice from the March to April Bitcoin Forecast Array is that a Directional Change has been added for May. That change combined with the Premium Analysis text which stated a higher open (presumably for April?) above $6795 indicates a probable rally ahead and that no Monthly nor Quarterly Reversals were elected at the end of March, signifies confirmation of my hypothesis that we’d see a huge price rally in May and into June. I had been postulating that the March Directional Change was bullish and the June’s was bearish. Now this May Directional Change appears enabling the March to also be bearish, because the May Directional Change can be the shift to bullish. So I was sort of correct in understanding the March Directional Change to be about ending the decline from $13.8k (or $19.6k). So now that seems to be confirmed.

The huge Overnight Volatility has been removed from May, the Aggregate has been filled in to remove April as a turning point, and instead remains on June with June still having both a Directional Change and a peak turning point on the Aggregate. This probably portends a huge price spike high in June (possibly even an ATH) with a crash or significant correct thereafter.

There’s huge volatility again in August along with a low turning point on the Aggregate. That appears to be the capitulation of the correction from a posited peak high in June.

The rising volatility in September going to very high in October from the March version of the said Forecast Array, has been replaced with yoyo turning points from August until November. And then the huge Trading Cycle remains on November with November overtaking June as the most extreme turning point on the Aggregate.

I have a theory about these changes from March to April version of Bitcoin’s Forecast Array. Appears that before Socrates was picking up on the signals of Bitcoin Core’s demise. Which is why Armstrong was becoming so worried about cryptocurrencies collapsing into the abyss in April. He had warned about watching the bearish reversals carefully. When those were not elected, it appears Socrates is starting to pick up on some signals of legacy Bitcoin’s rise as the Phoenix. I see the possibility that the SegWit donations attack starts in June at the peak price. In July the attack is published but is initially not believed. By August there could be a stampede for the exits. Then from September to October there’s confusion with bankrupted exchanges so very yoyo price for legacy Bitcoin. By November it has become cleared and legacy Bitcoin is free to rise to $1 million. It’s just a theory. May not happen.

UPDATE Third Day

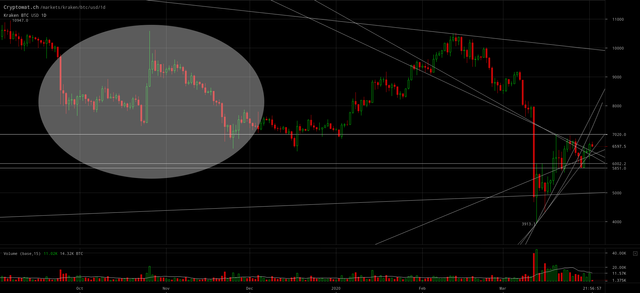

Market bottom or ‘very tough times ahead’? Here’s what one chart watcher is keeping his eye on:

Commodities index ‘will go miles and miles’ toward telling us if we are headed for tough times, says Kimble

The index has been headed south over the last nine years, reflecting general weakness in commodities, Kimble noted. In 2009, a then-29-year-old support level held, indicating that the worst of the financial crisis was priced in. It’s testing that level again now.

“If the index holds at 2009 support, it would suggest that lows are in play and the worst has already been priced into the markets,” he said. “If the index breaks this 40-year support/resistance line, it would suggest that some really tough times are ahead!”

That chart looks similar in structure (not chronology) to the situation with the Bitcoin chart threatening to make a lower low than the $3.1k bottom in 2019. That looks like it could be a bullish descending triangle.

The premise might be correct but because billions of Asians are rising economically. The only reason it would reflect well on the U.S. stock markets is because they’re still located the in the supreme military superpower, financial capitol and reserve currency in the world — where international capital will park when Europe goes into totalitarian cardiac arrest and the periphery nations’ economies catch the contagion flu.

If commodities are instead in a downward channel (as annotated in blue on the chart) that would imply global devastation destroying demand — 2020 is not about the end of China but rather the hand-off from the West of the reins of the global economy to Asia and the tumble over the cliff into the abyss for Europe with the USA to follow thereafter.

Armstrong blogged Iran & War:

It appears that 2020 is the low for oil and we should see tension rise sharply with Iran which will help oil into 2024.

So Bitcoin and maybe even the U.S. stock markets have bottomed. Remember Armstrong also blogged Can the United States Survive this Political Hatred?:

Everyone is ignoring the fact that Italy even topped-out on March 20th. We may still see a peak in the USA next week.

The peaking of nonsensical “confirmed cases” may cause another knee-jerk panic decline, but may not be enough to send it to lower lows.

UPDATE 5th Day, Tuesday April 7

Although there was some initial pause overnight DJIA futures because of worry about an oil truce between Russia and Saudi Arabi, this appears to be sorting itself out enough by early morning so the futures are up big.

So it appears that an assault up to at least $8k is in the cards perhaps today or within this week.

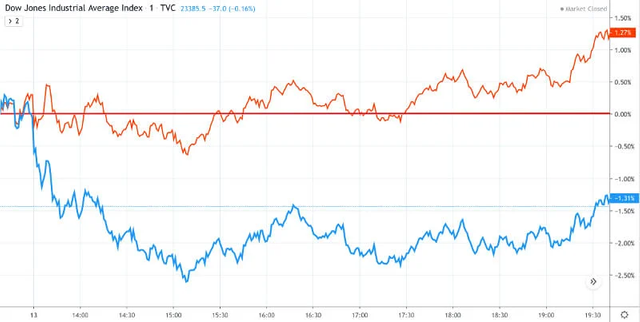

Armstrong is warning of a lower low for the DJIA to ensue after the peak high this week perhaps on Wednesday or Thursday. To crash to between 15,000 and 17,000 which will be assured if break below 19,000. Then there would be a bounce into the end of April. Upside for the DJIA this week is ~24,500 maximum on a closing basis for the week. Intraday spike could be as high as ~27,000 on busted shorts covering.

Bouncing to fill the gap before declining again

The Dow Is Surging – That’s Terrible News for Stock Market Bulls:

That might sound counterintuitive. But the truth is that meteoric stock market rallies often evaporate just as quickly, while Wall Street’s most “aggressive” bull runs look astonishingly boring on a day-to-day basis.

Also note that the Latin American currencies includian Mexican peso, Colombian peso and Chilean pesos all appear they need another ~-20% decline before this rout has completed.

I’m expecting Bitcoin to peak between $8k up to a busted short covering spike of $10k then decline to at least between $4.6k and $5.7k with a slight possibility of a lower-low perhaps has low as $2.5k. The following article bodes well for possibly a higher low for Bitcoin while the stock markets will likely make a lower low.

Yahoo’s ‘Top Crypto Bets’ Are Crushing the S&P 500 Amid Global Economic Uncertainty

Looks like the markets will bounce significantly from this low into June because presumably Trump is going to fight back against the virus hoax and reopen the economy in late April or May.

But after June it looks like civil unrest due to the awakening to the virus hoax corruption, the Schelling point for the start of the Civil War, and the reality of how bad the economy has devastated by this will hit. So appears a decline again to retest bottom (i.e. a worst case “L” shaped recover initially) until Q4 2020 when the reelection of Trump should start to drive international capital stampede into the U.S. markets (and Bitcoin and gold). Note I am positing the possibility (not assured) of the SegWit donations attack chaos after the peak bounce in June (possibly a new ATH) and not being resolved as the survivor legacy Bitcoin until November.

The current shock originated in the consumer sector, which accounts for 70% of GDP

[…]

However, Mislav Matejka, head of global equity strategy at J.P. Morgan warned investors in a Monday research note that there is a significant chance the global economy experiences “a vicious spiral, which is typical of recessions, between weak final demand, weaker labor markets, falling profits, weak credits markets and low oil prices.”

What’s particularly troubling to Matejka is that the current recession has been triggered by a shock to the consumer — which makes up 70% of GDP in Western economies — as workers around the globe are prevented from earning a living by the closures of nonessential business. This dynamic has led J.P. Morgan economists to predict “only a gradual bottoming out in activity, such as seen after the Great Financial Crisis, and not a V-shaped one that we see, for example, after natural disasters.” A so-called V-shaped economic recession is typically defined as one characterized by a sharp, but brief, slowdown in business activity that is followed by a powerful rebound.

Wall Street vet of a half-century’s standing warns of an ‘L-shaped’ economic recovery:

“The question is, will the public be eager to rush back? Even people like you and me, who love to go out and socialize, it might be difficult to get that back any time soon,” he said. “Will they come back? Yes. Will they come flooding back the day after they say you can relax social distancing? No. So the chances of a bounce-back are there, [but] the chances of a rapid bounce-back are low.”

Looks like an acceleration of U.S. stocks, Bitcoin and gold in Q2 2021 as the EU goes berserk with capital controls, confiscation of wealth, totalitarianism, etc.. Then a phase-transition peak by Q4 2022 which appears to be when they will assassinate (with a virus?) or overthrow Trump in the USA and the Civil War will turn into a hot shooting war.

Q4 2022 should also be the peak of the pandemic whether it’s just a pandemic of hallucination as now or if a real bioweapon virus is dropped on us (or spread via the coming vaccines) and/or the adverse health impacts of the impeding economic decline.

The current downturn is critically different from the US's last in how it's affected spending behavior, according to Heidi Shierholz, director of policy at the Economic Policy Institute. During the 2008 financial crisis and the following recession, for example, Americans weren't spending money because the $8 trillion housing market imploded.

The housing market is going to grind lower but not as precipitously as in 2008/9. And the stock markets will bounce, retest, then rise. So yes wealthy Americans will have some spending power. But the lower class is going to be disseminated. So expect a rise in civil disorder.

Additionally stagflation will hit us which we did not have in 2009. So the economic recovery may initially feel like a “V” in May and part of June but this optimism will quickly fade.

Those with investments that are rising in value in 2021 and 2022 will become the target of crime and resentment.

The recovery will look more “L” shaped except for the financial markets which will look “U” because of the international stampede into U.S. markets as the last safe market standing.

‘We need to see the other shoe drop’ before getting back into stocks: Minerd

[…]

‘When the markets start to see some of the data on unemployment rising and economic growth and corporate earnings contracting, there will be another level of panic in the market.’ — Scott Minerd

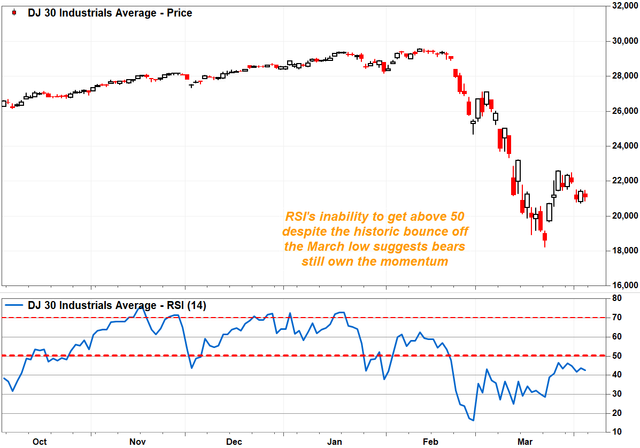

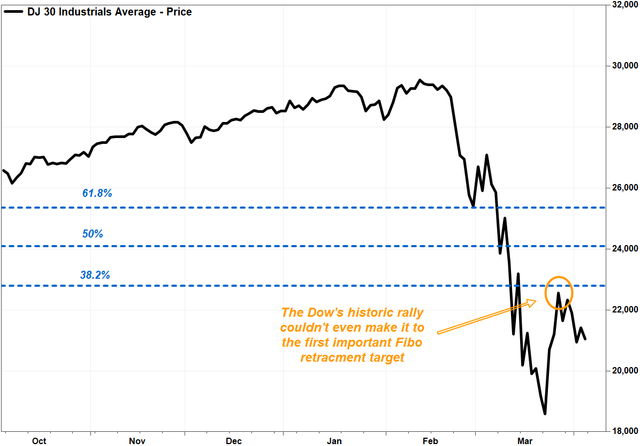

These Dow charts suggest there could still be many bears waiting to sell

RSI indicator, Fibonacci indicate the historic rally off the March low did very little to diminish the downtrend; where will the next selling wave come from?

(click to engorge)

(click to engorge)

UPDATE 9th Day, Saturday April 11

(click to engorge)

Bitcoin fell out of the bearish rising (narrowing) wedge to the projected 9% decline and appears to be headed back up to at least $7.9k by April 14 or before end of next week. A spike high to the 50 WMA at $8.7k is possible. Major resistance for DJIA next week is 24600 – 24900.

I think that decline was precipitated by Fauci et al saying the lockdowns would need to remain in place in the USA until widespread testing was instituted. Trump later fired back and say that would not be the case. Trump held a long news conference in which he sounded determined to at least partially reopen the economy in May. So it appears the markets will have one more “hope” bounce higher at start of next week due to this renewed optimism. Also there’s hope that OPEC has a deal to cut oil production in order to stabilize prices. DJIA futures were up on Good Friday.

But then the horrific economic data will come flowing out in remainder of April such as the bankruptcies of most small businesses who employ 58 million people in the U.S.A.. The U.S.A. is a 70% service economy. Small businesses (defined as businesses with fewer than 500 employees) account for 99.7% of all business in the U.S.. The progress on another stimulus[terminal end-of-life support] bill for small business will likely stall in the politicized Congress. Note the Fed’s lending program only applies to companies with a minimum of 5000 employees. The conspirators are attempting to destroy patriarchy and the ability of a man to have his own small business. And the OPEC deal may fall apart and/or the reality that the oil glut is so severe that the OPEC deal is insufficient.

If next week the DJIA does not close (at the end of the week) above the prior week’s high of 23719, then a decline to retest bottoms by end of April is very likely. It could be a bloodbath with lows as low as 15,000 for the DJIA and Bitcoin would at least test the $4.7k to $5k level — but a decline to $2.5k is also possible.

I strongly urge everyone to take some BTC profits this coming week on a small portion of your BTC hodlings so that you can buy back at lower prices if the bloodbath transpires. Also so you have cashed some BTC just in case the SegWit donations attack is in play and BTC never recovers ever again.

The bloodbath would be Armstrong’s long held SLINGSHOT prediction with the week of May 18 being a panic cycle to the upside. IOW, the end of April could be another panic but then by mid-May when Trump reopens some of the U.S. economy then there will be a surge to the upside. I do think we could see $13+k for Bitcoin in May and then a new ATH in June before everything collapses again with the aforementioned (in prior section) turning point in June.

This SLINGSHOT will not be unrelenting bullishness. No. The public will hate and doubt this bull market all the way to the peak by ~2022 to 2024. So the bull market will move up deceptively with surges and significant corrections.

Also the economic depression underway will not truly recover until 2022+. The decline in the GDP will max out by Q4 2020, but the recovery will be slow and arduous. And there will be severe supply limit induced STAGFLATION worsening until 2024. Massive unemployment and big government totalitarianism.

The reason the U.S. markets will eventually (2024?) hit a 40,000 peak is because CONFIDENCE in government has been destroyed. And the governments are going fiscally insane. Capital will have no choice but to park in private assets instead of government bonds. So gold, U.S. stocks, and Bitcoin will soar. U.S. stocks because it will be the strongest, largest economy and most reliable of all the nations on Earth.

When contemplating whether Bitcoin can truly drop to $2.5k I am reminded of the hypothesis I shared in recent blogs that the capitulation of less efficient ASIC miners (e.g. Bitcoin S9) drove a wave of selling which cascaded into a squeeze on highly leveraged longs. The exhaustion of that hypothesized miner selling combined with the likely double bottom already attained for the oil market prices, probably means the downside for Bitcoin is no lower than a double bottom at $3.1k. If Bitcoin declines below $3.1k and gold has not behaved similarly, then I would serious suspect that a SegWit donations attack is underway and that massive selling has been Craig Wright dumping forked Bitcoin Core on the exchanges. In that case I want to have sold what cash I needed at $7+k and then get my BTC off the exchanges pronto and into legacy (not Core!) addresses. Expect the unexpected.

For those who think they can just hodl legacy Bitcoin long-term, please reread my blog Our Bitcoins Will Be Taken/Frozen By the Miners; Involuntary INCOME Tax on Frozen Bitcoin!.

UPDATE 12th Day, Tuesday April 14

Bitcoin had formed what appeared to maybe be a smallish bearish head-and-shoulders top (H&S) pattern (which could be sort of seen on the daily chart I posted in prior update, yet more visible on the hourly charts) that was projecting as low as $6k but an average decline projected to $6.6k. The breakdown occurred and reached $6.5k and reversed above the neckline.

So it appears the bullish phase is reignited to push back up to at least the bottom of the wedge it broke drown out of from the prior update, which becomes overhead resistance. That’s currently at ~$7.6k but it rises to ~$7.9k – $8k by April 16 or 17. This next move up could perhaps push back over that resistance and up to the 50 WMA at ~$8.6k.

The DJIA is also set to move higher today presumably because:

- China is reporting less worse exports than were expected.

- Earnings season in the U.S. has kicked off with companies who benefit from the lockdown reporting increases in earnings, e.g. Amazon.com, Dominos Pizza, JP Morgan and Johnson & Johnson.

- Trumps press conference yesterday was emphatic about the “flattening the curve” achieved and Trump’s body language and comments portending at least a partial reopening of the economy by May 1 at the latest.

Armstrong is explaining that gold has been rocketing because of a fear in Europe of shutting off access and a total government shift into totalitarianism. His model expects a possible peak for gold Thursday April 17 or the following week of April 20. Gold has strong overhead resistance at ~1.8k and $1.9k.

It appears that gold might peak along with the bounce in U.S. stock market this week. Armstrong’s model expects gold to decline until the end of 2020 after peaking in Q2. So it appears gold will bottom along with the markets in May and then a high in all markets in June as a reaction to the reopening of the global economy this summer. The panic demand for gold presumably won’t reignite until the next flu season wrecks havoc again (blown out of proportion again with sensationalized propaganda). Flu season kicks off in earnest around January in the northern hemisphere. The governments will make some progress over the Summer and into the Fall in terms of partial reopening of the global economy so the fear mode that drives gold will abate somewhat until next flu season. This doesn’t mean that our freedoms and the violations of our Constitutional rights will ever come back to normal again:

Constitutional Advocate Thrown into Psychiatric Ward in Germany

Can’t even go outside for a walk in Spain

So after this enthusiasm about the positive news enumerated above the reality is going to kick in later this month about just how decimated the U.S. and global economy really is. Most the earnings reports for Large Cap companies come next week.

God-Awful Earnings Reports Are Coming From 12 Companies Soon

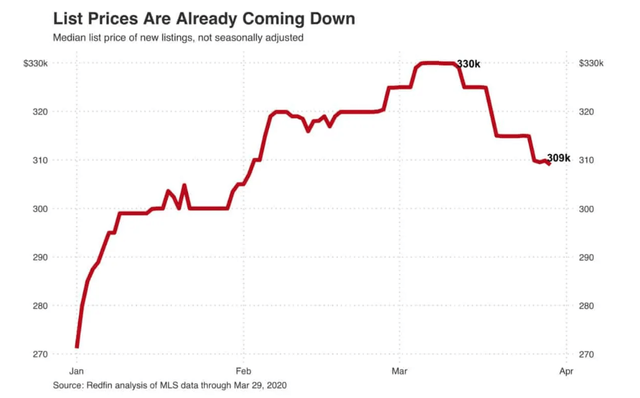

Coronavirus May Have Already Triggered a U.S. Housing Market Crash

Many small businesses that were finding it hard to compete with online businesses will not reopen

This Bubble Chart Predicts a Terrifying Crash

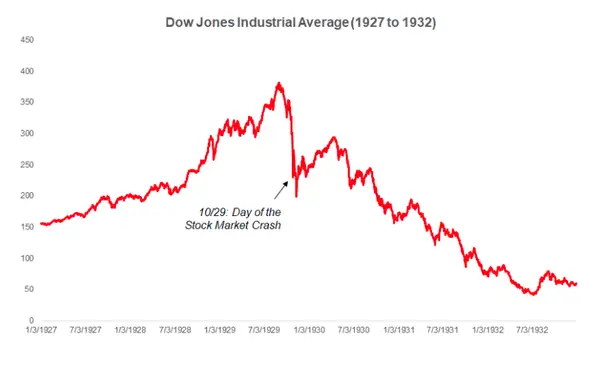

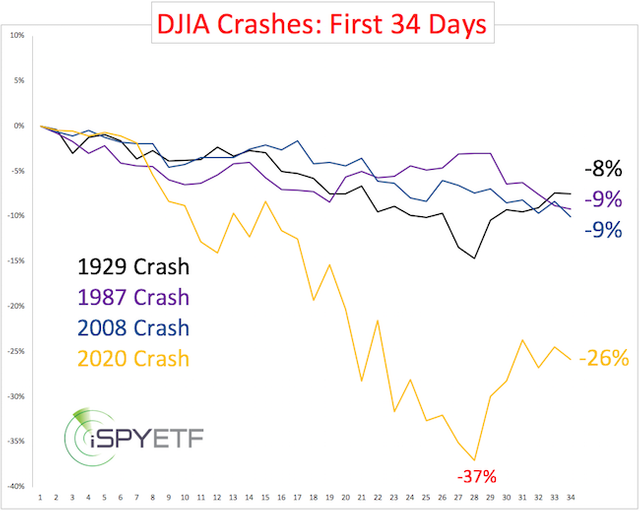

Is This 1929 All Over Again For The Dow?

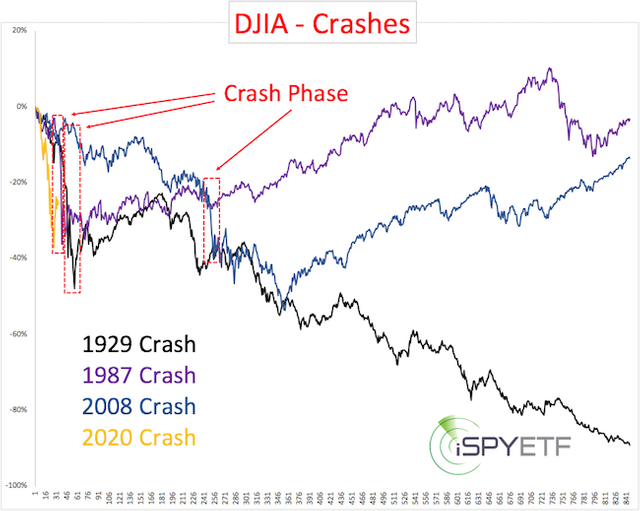

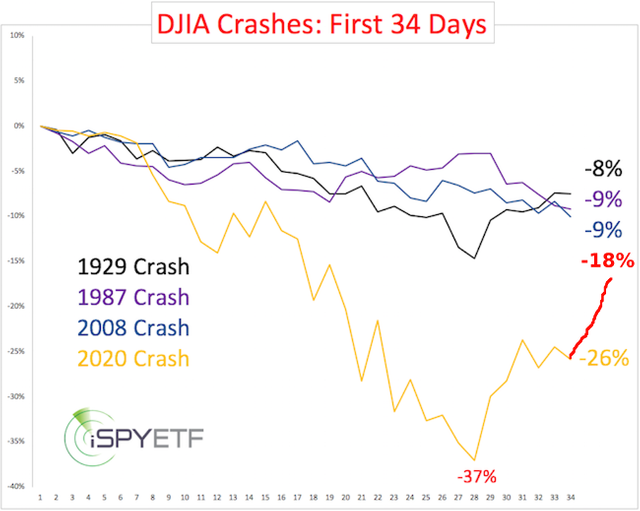

Today’s chart also shows disturbing similarities with the stock market in 1929, right before the stock market crash that led to the great depression. Then, just like now, stock prices returned to normal for a brief period only to capitulate into one of the worst Dow declines in history.

Stock prices briefly gained-ground only to capitulate into a multi-year long bear market for the Dow.

Note the DJIA is not likely to following that pattern of multiyear decline this time around because the U.S. dollar is not the reserve currency of the world and the international capital will have no place to stampede into other than the DJIA. The EU stock markets may resemble that 1929 pattern. So this coming spike low for the DJIA will be a SLINGSHOT to ~40,000 by 2022 to 2024. After that then the multiyear decline can ensue as the inertia of the stampede reverses.

Experts believe the economy could shrink by a staggering 33.5% in the first quarter as mass lockdowns slow economic activity to a trickle. A collapse in the travel and hospitality sector threatens to create a domino effect of corporate bankruptcies, and unemployment may soon hit 20%.

Meanwhile, the stock market is rising. And if that sounds strange to you, that’s because it is. The stock market now looks identical to the way it looked in the lead up to the great depression. And we may be on the verge of the biggest stock crash the world has ever seen.

[…]

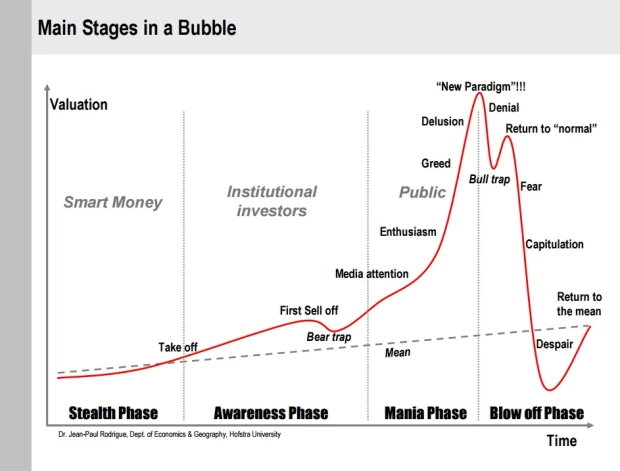

The Kindleberger-Minsky Bubble Chart

In 1979, economic historian Charles P. Kindleberger wrote a book titled “Manias, Panics, and Crashes,” where he outlined the five phases of a financial bubble. Later, Canadian scholar Jean-Paul Rodrigue built on Kindleberger’s findings to develop a more detailed chart of how bubbles tend to unfold.

[…]

We are currently at the “return to normal” part of this chart […] Terrifyingly, Rodrique found that after prices reach their all-time high, they collapse into a “bull trap” before “returning to normal” only to resume an even deeper capitulation.

A quick look at the S&P 500’s 12-month performance shows that this pattern is playing out in the U.S markets.

Dow futures jump more than 300 points as virus outlook improves

Note the performance of investment assets should be distinguished from the direction of the GDP which although Armstrong projected could bottom Q4 2020, he’s warned in an open letter to the U.S. President that lockdowns extending beyond May 1 could likely result in a Great Depression decline for 13 years into his epic ECM turning point year 2032.95 which ends the Private Wave and begins what is likely to be a very Marxist (younger Prophet and Artist generation) Public Wave — Millennials are Prophets and GenZ are Artists.

The Fourth Turning ~80 year cycle generational theory lines up the birth of the Prophets born after WW1 up to 1920s and the Artists born during the Great Depression crisis from 1930s to end of WW2 respectively with the Millennials combined with GenZ born up to 2015 and the Gen Alpha born hence in this enveloping crisis. As these younger generations takeover their idealism will likely be directed towards correcting the wrongs of crony capitalism and selfish political interest groups (e.g. Boomers) at the government level. However a possible difference from the post-WW2 awakening will be the advent or accelerating technological advance of decentralization as a solution towards achieving their goals. Yet that doesn’t mean they won’t vote for Universal Basic Income which they think is fair and humane.

Prophet (Idealist) generations enter childhood during a High, a time of rejuvenated community life and consensus around a new societal order. Prophets grow up as the increasingly indulged children of this post-Crisis era, come of age as self-absorbed young crusaders of an Awakening, focus on morals and principles in midlife, and emerge as elders guiding another Crisis.

[…]

Artist (Adaptive) generations enter childhood after an Unraveling, during a Crisis, a time when great dangers cut down social and political complexity in favor of public consensus, aggressive institutions, and an ethic of personal sacrifice. Artists grow up overprotected by adults preoccupied with the Crisis, come of age as the socialized and conformist young adults of a post-Crisis world, break out as process-oriented midlife leaders during an Awakening, and age into thoughtful post-Awakening elders.

AFTER THE MILLENNIALS

Read Armstrong’s aforelinked letter carefully. Let’s see what Trump says about the WHO later in this week. And whether he has tuned into the facet that not just the WHO is bought with private donations. If Trump continues to blame only China and singles out only the WHO and not also CDC and NIH, then he doesn’t think he can make the truth work politically.

Bitcoin is likely to replicate the pattern of the DJIA more than of gold, because it’s more of a speculative asset than gold. So Bitcoin is likely to head down again after peaking perhaps this week, and then bottom in May before rebounding to a high in June. The open questions are how low will be the May bottom and how high the June top.

Bearish outcome of previous ideas

Click here if you want to zoom my screen captures of the charts above.

Bitcoin can be argued to currently be at the “return to normal” part of the mania bubble chart. This is Armstrong’s thesis and it seems to apply to the FOMO greater fools who believe Bitcoin Core is Bitcoin and who think altcoins are not shitcoins. That mania is collapsing.

I’ve changed my speculative opinion about this. As I indicated with the mouse positions on the above charts, I still believe the highest level Bitcoin will decline to will be ~$5.1k and another support in the ~$4.3k to $4.5k range. And I still think the explanation that the marginal miner (e.g. Bitmain S9) dumping of mined BTC was a catalyst followed by liquidation of the highly leveraged longs (e.g. 100X leverage on Bitmex).

However, I have also learned from the Chinese market that some S9 owners are still unwilling to sell at firesale prices and thus are hoping for a significant rise in the price before and after the May 14 halving. Although I do think a rise will occur after a bottom in May, that rise may be insufficient to compensate for a halving of the block reward. And more saliently the drop towards a lower low in May (before any subsequent rise) will cause further capitulation by some S9 owners. Also presumably some leveraged bulls have reappeared. And the leveraged shorts can be capitulated with a spike high this week. Yet $4.3k might be equilibrium level and not a lower low.

Think about it also from the perspective of the powers-that-be who I posited are planning a SegWit donations attack for sometime this year. They would want to buy up all the S9 at firesale prices before initiating the massive rise in the price of legacy Bitcoin to $100+k (probably $1+ million). Bitcoin also needs an extreme spike low to initiate its SLINGSHOT.

Thus I’m now increasing the odds of Bitcoin declining to a May lower low between $2.1k and $3.1k. Seriously. Yet I also see the mid-$4000s level as fitting well as that would enable a rise into June and then a decline into the end of the year for Bitcoin Core matching the prediction in the chart above for a low below $2k around the end of 2020 for Bitcoin Core.

I think there’s near zero chance that BTC continues going up from $8k and never declines again to $5k or lower. So I don’t sense much risk to selling above $7.5k in terms of a BTC unit-of-account.

I think it’s quite likely that the SegWit donations attack on Bitcoin Core ensues after the posited June peak in price. The peak price can be exacerbated by Craig Wright et al borrowing Tether to buy BTC at the low (i.e. leveraged BTC long) and then dumping it to be short BTC at the peak. And to leverage short at the peak requires borrowing BTC which spikes the demand for BTC by constricting the supply.

I am no longer expecting some nosebleed high price in June before the SegWit donation attack begins. The minimum should be ~$10k. The price could spike to ~$14+k.

I expect legacy Bitcoin to outperform all assets in H2 2020 — Bitcoin’s revenge against gold outperforming since February. The tech heavy Nasdag stock exchange is starting to diverge to the upside from the industrial economy represented by the DJIA — which makes sense because tech companies can do remote “work from home.”

This is the End of the Dow Jones Industrial Average

Or is it just a sign that another decline is approaching?

Why the Dow is Different From S&P 500 & NASDAQ

The Dow is a reflection of the big money and international capital flows. The S&P 500 is more domestic oriented and used among institutions and fund managers, whereas the NASDAQ has more of a tendency to be retail. On the rally up from 2009, the Dow led. Note that at the peak here in 2020, the Dow peaked first, then the S&P 500, and the NASDAQ made new highs into February taking the lead from the Dow. That was the kiss of death and confirmation that a sharp correction was then possible.

Hopefully Treasury Secretary Mnuchin will be too busy with the stimulus and China trade negotiations during May and June to follow through on strict new AML and KYC for cryptocurrencies. Perhaps he will be even more motivated to focus on cryptocurrencies if an attack has begun thus heightening concerns about the miners being criminals. Given that China has most of the Bitcoin mining, this may be spun as a theft by China of Bitcoin. And that may set in motion the eventual FATF dictate to freeze BTC which has any lineage of this “theft”. If China doesn’t cooperate with such a freeze order the enforcement would only be on exchanges and the banking system of those countries which comply. If China cooperates, the freeze can be applied with a “50+% attack” on the permissionless attribute on the blockchain itself.

Thus I’m expecting tainted (e.g. SegWit) lineage Bitcoin (which is what most all of us have unless the authorities become astute enough to differentiate tainted lineage that was not donated to miner from tainted lineage which was) to become frozen in world’s financial system (at least outside of China) by perhaps as early as late Q4 2020, although even that might take longer into 2021. I’m not expecting tainted lineage Bitcoin to be frozen on the blockchain before 2021. Also there’s a possibility that our non-donated legacy Bitcoin never becomes frozen on the blockchain.

Yet it will become increasingly difficult to cash out Bitcoin for fiat as the global economy implodes and capital controls increase. But as long as we can still transact it on the blockchain, then we could DEX it into an altcoin (e.g. Libra?) to extract out the gains without heading into fiat.

In summary, hodl some legacy Bitcoin beyond June. And expect an opportunity to arise. A little bird told me so. 😉

UPDATE 14 Days Later, Thursday April 16

Oil and commodity index have retested low and more or less held up ($19 and 327 respectively), so I want add some thoughts to what I wrote earlier in this blog:

Commodities index ‘will go miles and miles’ toward telling us if we are headed for tough times, says Kimble

The index has been headed south over the last nine years, reflecting general weakness in commodities, Kimble noted. In 2009, a then-29-year-old support level held, indicating that the worst of the financial crisis was priced in. It’s testing that level again now.

“If the index holds at 2009 support, it would suggest that lows are in play and the worst has already been priced into the markets,” he said. “If the index breaks this 40-year support/resistance line, it would suggest that some really tough times are ahead!”

Also an excerpt from Armstrong’s recent blog The Crisis in Agriculture:

Wheat has rallied to 5870 during March, just poking through the broad uptrend channel from the Great Depression. There is a major crisis unfolding, in part, because some workers needed for harvest are locked down as in Europe and cannot move from Poland to Spain. This is a serious problem. Those who advocate this lockdown like Gates and Fauci are

clueless[diabolical schemers] when it comes to the ripple effect through the rest of the economy.

[…]

The climate has turned bitterly cold and then there was excessive flooding in 2019. The trade war with China did not help. Farmers were already in a weak position before this concocted virus scare that has been used to justify shutting down the economy for something that is far less deadly than the annual flu. Many farmers were already in serious debt because of low profits and high taxes back in 2019 before this virus scare. This is merely pushing many into bankruptcy.

[…]

Now we have many restaurants, the entertainment industry, travel from airplane to cruise lines all shut down. The demand for produce has been declining. Prices are declining as a direct result of a drop in demand. We can see that the price of tomatoes has been falling in 2020 due to this virus shut down. Some farmers can’t make a profit and have started to just plow their crops under rather than harvesting them simply because it’s less of a loss than trying to bring the crops to market and migrant workers are unavailable. This is only setting up the crisis ahead for a rise in [the price of] agricultural products [due to a reduction in supply].

We can see that 2020 was a Directional Change and a turning point with high volatility which has indeed come to pass. If we see a sharp low here in 2020 and a collapse in our productive capability because some farmers cannot survive, the next high in prices should come in 2023.

The same is occurring with oil. Many oil producers will have to shutdown (except Mexico hedged at $49) and China will lock-in prices hedging at $20 which will constrict oil producers profits when the price rises again further cutting supply of the marginal producers. China is masterfully conquering the U.S.A. without any shot fired, now adding crippling our oil industry to the effects of their apparent complicity with the COVID-19 conspiracy.

So I don’t think commodity prices double-bottoming is a good sign for the economy. The DJIA can still follow-through with a lower low.

This may signify though that Bitcoin is also unlikely to make a lower low, assuming commodities don’t. Bitcoin is also under the analogous supply/demand dynamics as commodities in that a lower price removes marginal mining supply and thus reduces selling pressure.

Bitcoin has begun it’s ascent towards $7.5k – $7.9k (maybe as high as $8.6k) because of the presumed euphoria related to More big economies are easing coronavirus restrictions. Note a dip could occur if the jobless and construction data for the U.S. released this morning is significantly worse than expected, before moving up to those prices above (unless we rocket up there in the next 30 minutes). And the economic news will be horrible in the coming weeks, so the reality of the Great Depression deep shit the world is already in will set in. And the increased testing in the USA will find more and more (and some hot spots) of those bogus “confirmed cases” until flu season has genuinely subsided by late April or early May.

So we’re probably going to get another crash of the DJIA once the soberness kicks in that the reopening will be insufficient to prevent a Great Depression. And then from that lower low (at least for the U.S. stock markets, but maybe not a lower low for Bitcoin), the positive investment euphoria can return by mid-May when the reopenings are accelerating. By June this euphoric “greater fool” FOMO will peak out and then another crash as it becomes evident that the global economy is not recovering and STAGFLATION has begun with Minsky Moment debt implosion continuing as the balloon has been more than pin-pricked — a gaping hole has been blown through the hull of the Titanic.

A decline will ensue into some bottom in Q4 2020 — given the lower low expected near end of April, then 137 days historic average for the final bottom in September (for U.S. stocks, not a low for GDP). That decline could also take Bitcoin Core to near ~$0 if the posited SegWit donations attack was started in June at the peak. In that case legacy Bitcoin might attain $100+k before the end of 2020 and perhaps as high as $1 million because of Precisely Why Bitcoin Is Re-accelerating.

This is how big bear-market rallies have been in the past nine decades

Follows my update to the above chart:

(click to engorge)

UPDATE 17 Days Later, Saturday April 19

Bitcoin appears poised to make its pre-halving spike high, between ~$7.9k – $8.6k or perhaps even above $9+k.

https://cointelegraph.com/news/weekend-trap-bitcoin-price-hits-73k-in-attempt-to-finally-break-out

https://cointelegraph.com/news/price-analysis-april-17-btc-eth-xrp-bch-bsv-ltc-eos-bnb-xtz-link

A crash from current fear levels doesn’t seem likely, instead need to move higher and create some FOMO before retesting to see firm bottom along with an impending lower low bottom in U.S. markets by third week of May: