Bitcoin Fractal Projects an Infinite Price

From the extensive updates to my prior blog, think of a Matryoshka doll:

(click to zoom)

Self-similarity - Wikipedia

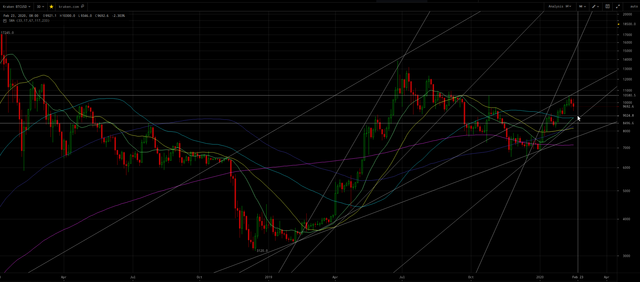

Keep the big picture of the repeating fractal pattern and incredible bullishness of Bitcoin in mind:

(click to zoom)

Here’s a copy of the above chart with selected price points displayed (if zoomed of course) for annotated lines to help you understand which annotated lines correspond to the analyses below:

(click to zoom)

(Tangentially on above chart note the golden cross of purple 50 up over the magenta 100 WMA, which instead was death cross under in 2019!)

Here’s the 3D (three day) version of above chart:

(click to zoom)

The annotated horizontal lines point out the fractal correspondence between the current cup & handle pattern with the one in 2019 which led to the $13.9k peak. Note how the cup comes up to the peak prior to the cup before forming the handle.

After the handle (correction), there’s a blow-off, parabolic move to another peak before a new decline and cup & handle ensues. Consecutive fractal patterns are become smaller and more accelerated, but these affine relationships also exist within larger scale self-similarity as can also be seen by zooming in/out on Mandelbrot sets.

So the difficult part which requires a high visual mathematical IQ, is that the current peak and correction — which forms the handle of the cup at the scale in which this current juncture corresponds to May 2019 — also corresponds to both peaks in February and April 2019 at other scales of the self-similar fractal pattern.

So fractal pattern correspondence of the current juncture to late June 2019 $13.9k top (which forms the ongoing handle correction for the larger fractal pattern correspondence) is 3X to 5X accelerated, i.e. 0.33 (⅓) to 0.2 (⅕) of duration. Thus we can expect this correction to be between 0.33 × 0.33 = 0.11 to 0.2 × 0.2 = 0.04 the duration of the ~7 months correction in 2019 from the $13.9k peak to the $6.5k bottom. Thus 1 to 4 weeks for this current handle correction, which began on February 17.

Since this current juncture handle correction also has correspondence to either February 2019 (per the LTC/BTC pattern correspondence mentioned in my prior blog Bitcoin Movements Ahead on the Way to the Moon) or April 2019 (per the bullish, golden crosses of green 50 to yellow 100 and cyan 200 DMA) on the larger (broader) scale fractal pattern, thus a decline to or slightly below the 50 DMA is likely.

Note for my annotated trend lines on the first chart above that the prior $13.9k peak occurred at the junction of the — long-term trend line from the kickoff of the bullish move to the $19.7k peak prior to the $13.9k peak — and the trend line from the kickoff of the bullish move to the said $13.9k peak. And the corresponding ~$40k junction April 30, 2020 of the — trend line from the kickoff of the bullish move to the $13.9k peak prior to the current juncture coming peak — and the trend line from the kickoff of the bullish move to the current juncture coming peak!

That ~$40+k peak just before the May 14, 2020 Bitcoin mining reward halving event, it strongly suggestive of my posited Segwit donations attack on the impostor Bitcoin Core.

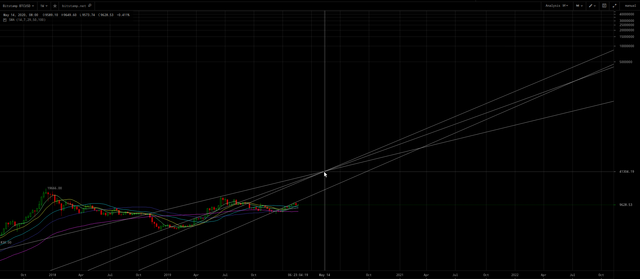

I added two trend lines to the following chart as compared to the first chart above, one which intersected at a confluence junction which predicted the $13.9k peak as shown (Bitstamp exchange):

(CLICK TO ZOOM)

The other added trend line is parallel to the trend line it would need to intersection to predict a peak price after $40k by April 30. This projects the next peak price after the May 14, 2020 halving event is infinite U.S. dollars! This seems to confirm the posited Segwit attack valuation model.

Here are the four pertinent trend lines for easier visualization (Kraken exchange):

(CLICK TO ZOOM)

Note if I draw one of the trend lines in another position, there’s seems to be a ~$100k confluence junction February 2021, which I interpret to apply perhaps to Craig Wright’s BSV or to recovery of the posited impostor Bitcoin Core after Core is forced to hardfork (aka hardfuck) it to lower the difficulty so blocks can be mined every 10 minutes instead of once a month or so (although I think the Core chain will be continually 50+% attacked after the Segwit donations attack siphons away all the miners to legacy):

(CLICK TO ZOOM)

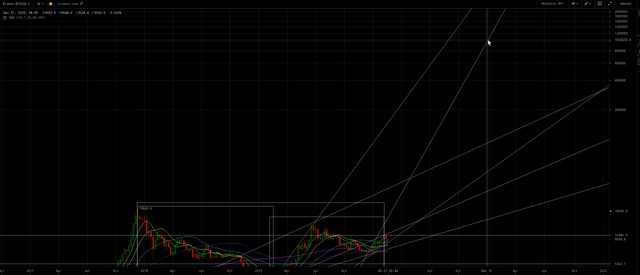

The self-similarity (two rightmost boxes and separately two leftmost boxes) fractal pattern depicted below also crudely (because non-linear, affine projection) linearly projects congruently 38 days × 24 months ÷ 14 months = 65 days + Feb. 17, 2020 =Apr. 22, 2020 and ($10.5k − 6.4k = $4.1k ÷ 6.4k = 0.64) ÷ ($4190 − 3330 = $860 ÷ 3330 = 0.26) = 2.5 × ($5.5k - 4.2k = $1.3k ÷ 4.2k = 0.31) × $10.5 = $8.1k + $10.5 =$18.6k:

(CLICK TO ZOOM)

As marked with the mouse on the above chart, I expect that $15+k price in March due to the acceleration of cumulative fractal patterns combined.

Legacy Bitcoin could plausibly attain a $1 million valuation in 2020, posited to be due to the stock-to-flows valuation model and the acceleration of feeding miners ~100+ Segwit donated BTC per mined block:

(click to zoom)

IOW, Bitcoin eventually becomes the new world reserve currency asset and U.S. dollar dies, as I have predicted in many of my blogs such as:

- Get Ready for a World Currency

- Bitcoin rises because land is becoming worthless

- Facebook’s Libra + Bitcoin + Trump + Israel = 666 Orwellian Dystopia

- Phoenix rises in 2020; all altcoins (including Bitcoin Core) will be 50+% attacked/destroyed

My answers on Quora:

Recent news related to the draconian FATF regulation of cryptocurrency coming:

Treasury Secretary Mnuchin Gives Testimony on Cryptocurrency, New Regulations Rolling Out Soon

As Treasury Signals New Rules For Crypto, Does Trump Seek A Ban?

The U.S. Is Very Worried About Bitcoin—And It’s Finally Doing Something About It

Video and Transcript of U.S. Treasury Secretary's Press Briefing on Cryptocurrencies

Mnuchin Warns Bitcoin Users of ‘Very, Very Strong’ Regulations

Mnuchin: FinCEN to Roll Out ‘Significant’ New Cryptocurrency Rules

US Treasury Secretary Promises ‘Significant New Requirements’ on Cryptocurrency

US Treasury secretary voices support for new FATF rules regarding crypto exchanges

AML/KYC Compliance Just Got Harder

The European Union’s Fifth Anti-Money Laundering Directive (5AMLD) went into force on Jan. 10, with new regulations for cryptocurrencies, wallets and exchanges

Top Fund Manager: Treasury’s New Crypto Rules Could Help Industry

Speaking with CNBC on Friday regarding Bitcoin and the broader cryptocurrency space, Mike Novogratz — incumbent CEO of Galaxy Digital and a former partner at Goldman Sachs — argued:

“We’re going to see something from Treasury

in the next few monthsthat kind of puts some guardrails around Bitcoin […]U.S. Treasury Secretary states stronger crypto rules coming to strengthen transparency…

“We are working with FinCEN, and we will be rolling out new regulations to be very clear on greater transparency so that law enforcement can see where the money is going and that this isn’t used for money laundering.”

[…]

In Chainalysis’ latest report, the blockchain analysis firm found that the value of cryptocurrency spent on dark web markets, where individuals can buy items like fake identification and drugs, surged 60 percent to a “new high” of $601 million in Q4 of 2019.

Chainalysis added that 1 percent of Bitcoin transactions are used for illicit activity — up from the approximately 0.5 percent seen in the year prior

Treasury and Congress Set to Pass Off New Regulatory Burden on Small Businesses

- Both proposals foist a new burdensome beneficial ownership reporting requirement on small businesses, while exempting those most able to abuse the financial system.

- For decades, the U.S. government has expanded the regulatory burden under the AML regime, requiring financial companies to file millions of reports.

- The existing AML framework now costs Americans billions of dollars per year—more than $7 million for every conviction obtained.

[…]

On May 11, 2018, a new FinCEN “Customer Due Diligence” rule took effect that substantially ramped up these requirements. If bankers are having trouble completing these tasks, perhaps the real problem is that Congress should never have treated them as if they were law enforcement officials. Of course, that’s the way that Washington works—this legislation is moving toward passage because large financial institutions are pushing for it.

[…]

Aside from shifting the reporting burden from banks to small businesses, the legislation would create a national corporate ownership database to “facilitate financial institutions’ customer due diligence efforts to confirm information currently obtained during the customer onboarding process.”

This feature raises all kinds of privacy concerns […]

Mnuchin: stricter crypto AML rules coming ‘very quickly’

Mnuchin’s comments come at a time when governments worldwide are changing the way they regulate crypto assets to comply with new guidance put forth by the Financial Action Task Force last year. The international body, which creates policies to combat money laundering and the financing of terrorism, is followed by about 200 countries, including the U.S..

Paul | Weiss’ Economic Sanctions and Anti-Money Laundering Developments - 2019 Year in Review:

Amendment of the Reporting, Procedures, and Penalties Regulations. On June 21, 2019, OFAC published an interim final rule amending the Reporting, Procedures, and Penalties Regulations (the “RPPR”).³⁷ Among other things,

the rule revised the RPPR to require all U.S. persons(not just U.S. financial institutions, as had previously been the case) to file rejection reports with OFAC. The rule also amends the RPPR to require rejection reports for all rejected transactions (not just fund transfers, as had previously been the case), including transactions relating to wire transfers, trade finance, securities, checks, foreign exchange, and goods or services. In addition to these new requirements, the interim final rule also expanded the scope of information that OFAC requires to be included on initial and annual reports of blocked property.³⁸Federal Register / Vol. 84, No. 120 / Friday, June 21, 2019 / Rules and Regulations

§501.603 Reports on blocked and

unblocked property.

(a) Who must report—(1) Holders of blocked property. Any U.S. person (or person subject to U.S. jurisdiction), including a financial institution, holding property blocked pursuant to this chapter or releasing property from blocked status (i.e., unblocking property) pursuant to this chapter shall submit the relevant reports described in this section to the Office of Foreign Assets Control (OFAC). This requirement applies to all U.S. persons (or persons subject to U.S. jurisdiction)who have or have hadin their possession or control any property blocked pursuant to this chapter, including financial institutions that receive and block payments or transfers.

Guidance on Applicability of FinCEN Regulations to Certain Business Models Involving Convertible Virtual Currencies. On May 9, 2019, FinCEN issued interpretive guidance stating that preexisting BSA regulations applied to several common business models involving Convertible Virtual Currencies (“CVCs”).⁸⁸ Covered business models include:

- Peer-to-Peer Exchangers: Natural persons who engage in transfers between different types of CVCs, as well as exchanges of CVC for other types of value;

[…]

Anonymity-Enhanced CVC Transactions: Transactions structured to conceal information otherwise generally available through the distributed public ledger;

[…]

Guidance on Red Flags and Typologies for Suspicious Convertible Virtual Currencies Activity. Also on May 9, 2019, FinCEN issued an advisory regarding the use of virtual currency to support illegal activity, money laundering, and other behavior endangering U.S. national security.⁹⁰ The advisory highlights the capability of virtual currency to be used as an alternative to traditional payment transmission systems, and tracks the rising exploitation of virtual currency in criminal enterprises. The advisory describes multiple virtual currency abuse typologies, including those involving darknet marketplaces,

unregistered peer-to-peer exchangers, unregistered foreign-located MSBs, and CVC kiosks, and provides case studies of each. In addition, the advisory discusses several red flags to assist financial institutions in identifying unregistered MSB activity and suspicious virtual currency purchases, transfers, and transactions. The red flags include any connections between a customer’s CVC addresses or IP addresses to darknet or Tor activity;receipt of multiple cash deposits or wires prior to purchasing virtual currency; transmission or receipt of funds or CVCs to or from foreign exchanges or jurisdictions with reputations for being tax havens; operation of CVC kiosks in locations with high incidences of criminal activity; andstructuring of transactions just below reporting thresholdsor CVC kiosk daily limit to the same wallet address.⁹¹[…]

On October 11, 2019, the CFTC, FinCEN, and SEC issued a joint statement on activities involving digital assets.¹⁴⁵ In this statement, the agencies discuss the AML/CFT obligations that apply to entities that the BSA defines as “financial institutions,” as well as the factors involved in determining whether and how a person or entity must register with one or more of the different agencies. Each agency also separately provided additional commentary regarding the application of BSA regulations to their specific agencies.

[…]

Considerations for Strengthening Sanctions/AML Compliance

In light of the developments described above, senior management, general counsel, and compliance officers

should consider the follow points in strengthening their institutions’ sanctions/AML compliance:[…]

Continued Caution Around U.S. Dollar Transactions. In its landmark 2017 settlement with CSE Global and CSE TransTel, two Singapore-based companies, OFAC found that they violated U.S. sanctions by sending U.S. dollar payments involving Iran, where the payments cleared through U.S. financial institutions and thereby “caused” them to violate sanctions by exporting financial services to a comprehensively sanctioned country.¹⁵² For some non-U.S. companies, conducting business involving sanctioned jurisdictions or parties in U.S. dollars—even without any other U.S. touchpoints—remains a major area of sanctions-related risk.

[…]

Enhance Compliance Procedures for Virtual Currency Businesses and Clients. In 2019, regulators continued to emphasize the potential risks posed by virtual currency transactions and businesses. Regulatory expectations of appropriate monitoring of virtual currency BSA/AML and sanctions risk are increasing as further guidance and advisories related to virtual currency are issued. Among other things, financial institutions should ensure that all procedures are updated to consider the unique risks of virtual currencies, including virtual currency exchangers. When evaluating potentially suspicious activity, FinCEN advises that red flags relevant to identifying efforts to circumvent AML and Sanctions controls include (1) if a customer transfers or receives funds to or from an unregistered foreign virtual currency exchange, or other MSB with no relation to where the customer lives or conducts business; (2) if a customer conducts transactions with virtual currency addresses that have been linked to extortion, ransomware, sanctioned addresses, or other illicit activity; and (3) if a customer’s transactions are initiated from non-trusted IP addresses, IP addresses from sanctioned jurisdictions, or IP addresses previously flagged as suspicious.

Consider BSA/AML Risk of Correspondent Banking Relationships with Higher-Risk Financial Institutions. As the expanding Danske Bank inquiry has demonstrated, financial institutions should consider the regulatory risk and compliance costs associated with maintaining correspondent banking relationships with financial institutions with high-risk customers or located in higher-risk jurisdictions. U.S. dollar clearing services pose unique risks as financial institutions have more limited information about underlying transaction activity. U.S. regulators expect that banks that provide services to higher risk financial institutions will appropriately monitor for and report suspicious activity flowing through correspondent banking channels.

Applicable laws (and insane, unconstitutional absence of rule-of-law):

Money Laundering Control Act – Wikipedia

Section 1956 prohibits individuals from engaging in a financial transaction with proceeds that were generated from certain specific crimes, known as "specified unlawful activities" (SUAs). Additionally, the law requires that an individual specifically intend in making the transaction to conceal the source, ownership or control of the funds. There is no minimum threshold of money, nor is there the requirement that the transaction succeed in actually disguising the money. Moreover, a "financial transaction" has been broadly defined, and need not involve a financial institution, or even a business. Merely passing money from one person to another, so long as it is done with the intent to disguise the source, ownership, location or control of the money, has been deemed a financial transaction under the law. Section 1957 prohibits spending in excess of $10,000 derived from an SUA, regardless of whether the individual wishes to disguise it. This carries a lesser penalty than money laundering, and unlike the money laundering statute, requires that the money pass through a financial institution.

Money Laundering: An Overview of 18 U.S.C. § 1956 and Related Federal Criminal Law

Forfeiture

[…]

Forfeiture is the confiscation of property to the government as a consequence of the property’s proximity to some form of criminal activity.¹²⁷ The government’s claim to the property can be secured by default […] ordinarily in rem (against the property itself).¹²⁸ The proceeds of a confiscation are generally shared among the law enforcement agencies that participate in the investigation and prosecution of the forfeiture.¹²⁹ […] First, the “proceeds” of any Section 1956 predicate offense (and any property traceable to such proceeds) are subject to confiscation without the necessity of any actual violation of Section 1956.¹³⁰ This permits the confiscation of property derived from crimes that might form the basis for a money laundering offense without having to prove that a money laundering offense occurred.¹³¹ Second, property “involved” in a Section 1956 money laundering offense (or property traceable to such involved property) may be confiscated.¹³² Involved property obviously includes more than the proceeds of the predicate offense, since the proceeds are separately forfeitable already. “Property eligible for forfeiture under 18 U.S.C. §982(a)(1) includes that money or property which was actually laundered ... , along with any commissions or fees paid to the launderer and any property used to facilitate the laundering offense.”¹³³Civil Asset Forfeiture is insane, read all of these below ↓- In Rem – Criminal Activity of Government

- Deodand – Civil Asset Forfeiture Violate Every Principle of Human Rights & Civilization

- Supreme Court Did Not Rule on Civil Asset Forfeiture

- Police Civil Asset Forfeitures Exceed All Burglaries in 2014

- Oklahoma – The State You Must ALWAYS Avoid Driving Through

- Gold – the Desirable Object – Can it Survive as the Alternative to Electronic Money?

- Why a Judge Ruled the Police Have NO DUTY to Protect Citizens

18 U.S.C. § 1957

[…]

Unless there is some element of promotion, concealment, or evasion, Section 1956 does not make simply spending or depositing tainted money a separate crime. Section 1957 does.¹⁴⁴ It outlaws otherwise innocent transactions contaminated by the origin of the property involved in the transaction.¹⁴⁵

[…]

At the heart of any Section 1957 offense lies a monetary transaction. A monetary transaction for purposes of Section 1957 is any deposit, withdrawal, or transfer of funds, in or affecting interstate or foreign commerce, and involving a financial institution.¹⁴⁸ Numbered among the qualifying financial institutions are banks and credit unions, but also car dealerships, jewelers, casinos, stockbrokers, travel agents, and pawnbrokers, to mention a few.¹⁴⁹

Section 1957 only applies to transactions involving $10,000 or more at the time of the transaction.¹⁵⁰[…]

The government must prove that the defendant knew the funds or other property in the transaction was “criminally derived property,” ¹⁵² that is, the proceeds, or funds derived from the proceeds, of criminal activity.¹⁵³ The government need not show that the defendant knew that proceeds were the product of a “specified unlawful activity,”¹⁵⁴ but the proceeds must in fact be derived from a specified unlawful activity (predicate offense).¹⁵⁵

[…]

31 U.S.C. § 5322: Reporting Requirements

Section 5322 penalizes willful violation of several monetary transaction reporting requirements found primarily in title 31 of the United States Code. The section’s coverage extends to violations of the following sections and their attendant regulations:

- 31 U.S.C. § 5313 – financial institution reports of cash transactions involving $10,000 or more;

[…]

- 31 U.S.C. § 5316 – reports by any person taking $10,000 in cash out of the U.S. or bringing it in;

[…]

- 31 U.S.C. § 5331 – reports of trades and businesses other than financial institutions of

cash transactions involving $10,000 or more;

-

U.S. citizens and residents with a financial interest in or authority over foreign bank accounts or "foreign financial accounts" with an aggregate value of $10,000 are required to file a Foreign Bank Account Report (FBAR) with the U.S. Treasury by October 15 every year.

Do You Need To Report On An FBAR & Form 8938 Your Offshore Gold, Cash & Notes?

On the other hand, where the owner maintains exclusive control over the vault and does not give the foreign financial institution (or person engaged in the business of banking) access, reporting currency cash notes stored in such a vault is not required regardless of value. In that case, the vault would not be deemed a financial account maintained with a foreign financial institution (or a person engaged in the business of banking).

[…]

Second, absolutely no co-mingling of assets occurs, as is the case with traditional banks. On the contrary, each client is the direct owner of his or her assets, fully identifiable – at all times – as being the exclusive property of the client.

[…]

First, can SafeStore, as the company that operates the vault, be classified as a financial institution or at least as a person engaged in the business of banking? As a preliminary matter, such companies are generally not foreign financial institutions.

[…]

Even though the vault-operating company might not be a financial institution per se, could it be treated as being engaged in the business of banking? Admittedly, this is a grey area. The government is likely to argue that the company is the functional equivalent of a “commercial bank.”

[…]

Based on fourth circuit precedent, a court is likely to agree with the government that SafeStore does, in fact, function as a bank. In a literal sense, it operates a vault – the very place where assets are stored. As such, it holds assets on behalf of their owner – here gold or cash notes. Not only is it authorized to hold these assets, but it is presumably authorized to disburse them at the customer’s direction.

To the extent that SafeStore is deemed a surrogate bank, is the relationship between the owner of the assets and SafeStore so analogous to a bank-customer relationship that the account should be considered maintained by a person engaged in the business of banking? This is another grey area that could go either way.

[…]

In support of the argument that the account should not be considered maintained by a person engaged in the business of banking is the following. First, unlike a typical run-of-the mill bank account, no interest is paid on the principal. Second, the cash notes are held together in a designated area of the vault. In addition, they are individually packaged and labeled so that they are readily identifiable as the taxpayer’s property. Indeed, if the taxpayer ever wants to personally view or take physical possession of the cash notes, all he has to do is show up. Third, the taxpayer never relinquishes control over his cash notes to the vault-operating company, nor does he ever direct the company to disburse them to a third party for any purpose whatsoever. Instead, he remains in full possession and control of these notes at all times.

Finally, to the extent that the U.S. government gives deference to Swiss law, a bank’s vault activities are not deemed a “banking activity” under Swiss law.

Therefore, a compelling argument can be made that the vault is not a financial account maintained with a financial institution or other person engaged in the business of banking. In that case, the taxpayer need not file an FBAR.

[…]

Even if there is no obligation to report gold or currency cash notes on an FBAR or Form 8938,

if the assets are owned by a corporation, partnership or trust, other information returns may be required.Because failing to file information returns related to foreign corporations, partnerships, and trusts carries its own penalties – many of which are equally or more severe than failing to disclose offshore assets on an FBAR or Form 8938Is My Dubai Gold Investment Reportable to IRS according to FATCA and FBAR rules?

[…] gold which you directly hold does not have a reportable requirement on the FBAR or Form 8938 of the IRS (The FBAR is the dreaded Report of Foreign Bank and Financial Accounts which the IRS requires of its poor subjects living abroad even when they are no longer U.S. based residents.)

Yet it is a qualified no because when you choose to sell the gold or other precious metals, you now have what amounts to an IRS reportable transaction. This means that in effect you are not required to report your gold holdings to the grasping IRS in the majority of overseas holding cases.

[…]

Selling Gold Overseas Is Also Complicated Tax Wise

Now to the other key part of the tricky question, what are you obligated to report when you finally sell your foreign-held gold and other precious metals, presumably overseas? This also depends on who you sell them to in the end. Should you sell off your tangible valuables such as gold holdings to a foreigner, then this represents a foreign sales contract, and it is a reportable asset according to the IRS. The Internal Revenue Service puts it this way on their website:

“The contract with the foreign person to sell assets held for investment is a specified foreign financial investment asset that you have to report on 8938, if the total value of all your specified foreign financial assets is greater than the reporting threshold that applies to you.”

What in the world does this mean? It simply states that should you sell off your gold holdings or other collectible assets to a foreign resident who is a United States’ person, then you will not incur a reportable transaction in the sale itself. However, should you sell the identical assets to a foreign resident who qualifies as a foreign person, matters are quite different.

Here is yet another opaque consideration for you. Assuming that the total value is a significant one, then you will have to report said foreign transaction to the IRS on their Form 8938.

Some of the possible increases in regulation were covered in a 2017 blog Why Government Will Never Take Down Cryptos:

requirement will be to initiate a “travel rule” for every transfer of value in virtual currencies. Exchanges and custodians will have to determine the beneficial owner of both the sender and recipient in any such transfer. They’ll also need to pass this information along to each other when transferring funds.

If that’s too much trouble and a country doesn’t want to deal with virtual currencies, the FATF guidance suggests it’s OK to ban them altogether

[…]

Still, I think there’s a high probability most countries will adopt the FATF standards, including the travel rule.

Treasury Secretary Mnuchin seems to agree. In a press conference July 19, he told reporters that both the G7 and the G20 (a larger group of wealthy countries than the G7) were on board with greater regulation of the crypto market.

Mnuchin went on to highlight the work of the Financial Stability Oversight Council Working Group on Digital Assets, which the Treasury Department created last year. If Uncle Sam plans a frontal assault on crypto, the working group will likely coordinate the attack.

One proposal that will likely be resurrected is a 2017 bill called the Combating Money Laundering, Terrorist Financing, and Counterfeiting Act. It would expand the current anti-money-laundering rules and require travelers who cross a US border to include “any prepaid access device” such as a prepaid debit card, gift card, phone cards, and of course, cryptos in their calculation of carried value. All travelers must report a combined value of $10,000 or more when they cross a US border. The new rules would change border crossing requirements for thousands of travelers.

If you’re arrested for failing to comply with the new rules, Uncle Sam could file a secret motion in federal court for a restraining order that would confiscate every asset you own under federal civil forfeiture laws. Even your safe deposit box could be cleaned out. You could lose all your property without being tried or convicted of any crime. The restraining order could be extended indefinitely.

Disclaimer: This is not investing advice. This is for your entertainment. Consult your own professional (perhaps licensed) investment adviser. I am not responsible for any decisions to make after reading my post.

Seems appropriate! ;)

http://trayan.info/3d-fractals/