Ethereum ,The Beginning of The End!!!Why You Should Stop to Invest in Ethereum?!!

Hello guys, I want to talk with you about very interesting project that it’s called Tezos! I would like to share with you why I think Tezos is the beginning of the end for Ethereum.

As we already know, Tezos is a new decentralized blockchain that governs itself by establishing a true digital commonwealth. It facilitates formal verification, a technique which mathematically proves the correctness of the code governing transactions and boosts the security of the most sensitive or financially weighted smart contracts.

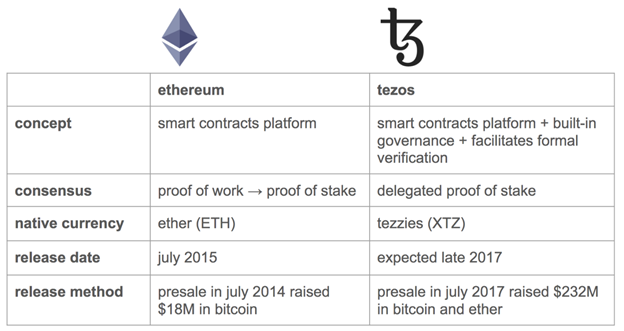

On this image we can see the some differences and similarities between these 2 projects. I want that you will pay attention on the consensus and validation part.

Proof of Stake (PoS) concept states that a person can mine or validate block transactions according to how many coins he or she holds. This means that the more Bitcoin or altcoin owned by a miner, the more mining power he or she has.

With PoS, validations are conducted through virtual mining rather than physical mining.

The one of the benefit that Tezos has over the Ethereum is that the team believes that hard forks, shouldn’t be the standard way to upgrade over time. Their view is that hard forks should only occur as a last resort, when the community needs to be split into two due to irreconcilable differences over how each group envisions the protocol evolving. Tezos takes a fundamentally different approach by creating governance rules for stakeholders to approve of protocol upgrades that are then automatically deployed on the network. When a developer proposes a protocol upgrade, they can attach an invoice to be paid out to their address upon approval and inclusion of their upgrade.

This approach provides a strong incentive for participation in the Tezos core development and further decentralizes the maintenance of the network. It compensates developers with tokens that have immediate value rather than forcing them to seek corporate sponsor-ships, foundation salaries, or work for Internet fame alone.

Maybe you heard that Ethereum plans to move from PoW (proof of work) to PoS (proof of stake), and all the people around think that this change will be very productive for Ethereum. But let’s take a look on essence of the problem.

You don’t need to spend money on electricity anymore to mine tokens .To participate on mining process you will need only to own tokens.

This is why Ethereum PoS is similar to Delegated PoS (Tezos). This means that Tezos and Ethereum token holders can delegate someone else to validate on their behalf if they do not wish to participate in staking directly. The difference is that in Ethereum, stakeholders will need an 1000 token amount to be delegated (not official info), but in Tezos anyone with small amount can participate.

An added benefit of PoS (proof of stake) is that it enables economic penalties, Stakeholders risk to lose theirs tokens then they are trying to do something malicious to the system-doesn’t matter for me, if their profits will be much higher than the loss. I think this will generate a high capitalization risk and high fraud percentage. In other words, if some party has a possibility to achieve monopoly, this opens a window for illegal activity.

Tezos also differs from Ethereum in that its smart contract programming language, named Michelson, is a functional language which facilitates formal verification. Formal verification essentially allows developers to mathematically prove the correctness of their smart contract code. Formal verification proves that some properties of the contract will be maintained, but does not necessarily mean that the code is 100% correct.

Michelson also differs from Solidity (Ethereum programming language) it that its was designed for PoS from the beginning, so if Ethereum try to change from PoW to PoS they might have a serious problems.

In conclusion, we know that hard fork occurred, but we did not notice a significant changes, this shows us that things can still go wrong .

Thank you guys enjoy the read & share.