How Small Blocks Are Hurting My Bitcoin Business

Background

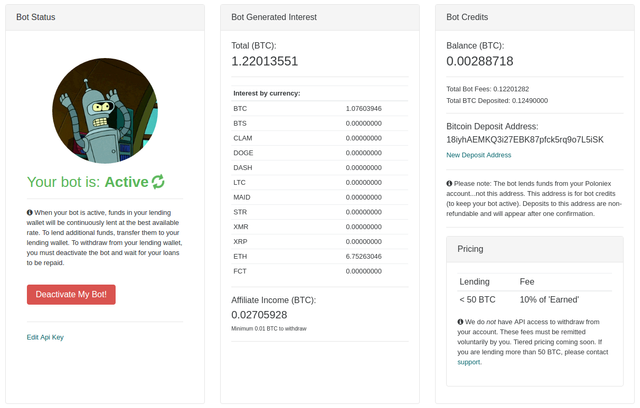

I’m Ben and I run Poloniexlendingbot.com, a service that automates margin lending on Poloniex.

As part of this service, I've created an accounting and payment system that lets users remit a percentage of their bot-generated-interest without granting ‘withdrawal’ permissions on their Poloniex API keys.

It works like this:

When users sign up, they have a ‘Bot Credit’ balance of 0.00000000 BTC. As their bot starts earning them loan interest, it subtracts its cut of the interest (a ‘Bot Fee’) from the ‘Bot Credit’ balance. Users can pause their bot when the ‘Bot Credit’ balance is negative, but they can’t restart the bot until they bring the ‘Bot Credit’ balance above zero.

I like this system because:

- Users don’t have to give the service withdrawal permissions on their Poloniex account

- Users can try the bot for free, and pay only if they want to keep using the service

- Users have a small line of credit, which keeps the bot earning funds for both of us even if they can’t pay immediately

This system also leads to lots of micro transactions. In the last three months, the median Bitcoin payment to the service was just 0.00165918 BTC.

Fees

According to 21inc’s Bitcoin Fee calculator:

The fastest and cheapest transaction fee is currently 60 satoshis/byte, shown in green at the top. For the median transaction size of 257 bytes, this results in a fee of 15,420 satoshis (0.08$).

Using the median payment from above (0.00165918 BTC) leads us to the conclustion that >= 50% of payments to my lending bot service are incurring a miners fee of 9% or more of their total value!

I’ve also received emails like these from users:

Hello,

Sending the required balance on my account would cost more in transfer

fee than earned interests.

What do you suggest I do ?

Thanks

Unfortunately, there’s nothing this user can do. I don’t accept that asking the user to ‘lend more funds’ is the answer to this problem. The lending bot service has active users in over 30 countries, and in many of these countries, the user's total balance is all they can afford to lose on an exchange like Poloniex.

Conclusion

Building a business in the cryptocurrency space is a very forward looking endeavour. I would be happy to continue using Bitcoin for accounting and payments if there were a suitable road-map for scaling, or any hope that such a road-map might be implemented.

As of today, I'm strongly considering moving Poloniexlendingbot's accounting and payment system to Ethereum. Ethereum transaction costs are significantly lower, there's a true commitment to scaling the network, and the added features of smart contracts and potential integrations with other Ethereum dapps could lead to new and interesting opportunities.

Sorry man. I think it's time to give up on Bitcoin. The people in charge do not think your kind of business is important enough to facilitate, while there already are working alternatives that do.

It is sad, but I think @demotruk is right.

The Bitcoin network is not going to get cheaper in the foreseeable future. The most advanced technology that might help you is probably Blockchain Thunder (https://www.blockchain.com/thunder/) but their FAQ says it will take at least 12 months to get out of "alpha stage", and that timeline depends on "upgrades to the Bitcoin protocol" that typically have fictional delivery dates.