What most People misunderstand about the Halving.

If you are one of those who regularly proclaim the second coming of Bitcoin as a consequence of the halving, I really urge you to read through this. There are many aspects most people in this sub are clearly not aware of and if you haven't graduated in economy or something, I bet you too will read something you haven't thought about yet.

This is intended to be an educational post. I don't want to be a downer even if in the beginning I debunk the technical reason for Bitcoin going up. The last section will explain why the price will still go up even if it's for a completely different reason.

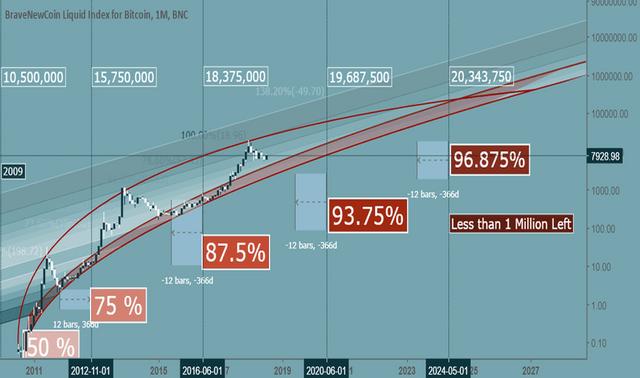

Let me clarify that there is a completely rational reasoning behind the price going up on the halving. The miner-made inflation decreases, halving the amount of new tokens being injected into the available supply. Knowing that any liquid market follows the law of supply and demand, it only makes sense that the price goes up.

Now keep in mind that any model of reality is an abstraction, abstracting from details and hence not able to cover the full depth of reality. So what did we forget?

- futures arbitrage

- miners

- liquidity

- market psychology

Futures Arbitrage

What happens when you know that the price of an asset will be higher in the future? Disregarding opportunity cost - the cost of missing other opportunities - you will simply buy that asset way before the price appreciates to sell it afterwards at a profit. That means that the halving will be priced in way before the actual event. And since any time in the market comes at an additional risk for the holder, the market is pricing it in gradually rather than immediately.

Therefore, it shouldn't come at a surprise that the market has already partially priced in the halving. Buying in now, you won't take full advantage of this event. Further assuming that the market is good at price discovery, the current price is already perfectly balancing between opportunity and risk. That means if you buy now, you are taking the risk and hope for the opportunity. Taking the risk should not be underestimated. There are several events that could quickly hurt the market such as a global recession, exchange hacks, majority or spam attacks, security flaws in the protocol, regulatory issues (Trump banning BTC) or simply Satoshi moving a coin.

If it was proven that the halving would result in X price in the future ... Don't worry, someone would already have bought and we would already trade at X. The profit you make is the risk you take.

Miners

You cannot overestimate the importance of miners for market cycles. Miners take full advantage of market cycles. As soon as they smell a bull cycle, they stop throwing their rewards onto the market. Who sells in the early stage of a bull market? Noobs. And if anyone here is not a noob, then it's miners who have been in this business since the early days.

Simply put, they stop selling. They decrease the amount of tokens they sell to the absolute minimum they need to keep operating. Now they have been getting rich of Bitcoin for many years. They ain't poor after holding Bitcoin for almost a decade. Trust me, they have more than enough safety funds to cover any expenses. That minimum is zero.

Further, let's look how much hash power a few Chinese mining pools own. Now what happens when a handful Chinese mining pool owners talk with each other? If you really think there is no mining pool cartel, I can only congratulate you on the faith you put into humanity. They collaboratively agree to stop selling to drive the market up. Bitcoin's volatility can only partially be explained with market psychology. Miners are a super important force in this process.

Coming back to the halving, miners had already stopped selling by April. Why do you think did we break through $6k without any resistance? Why do you think have we so suddenly gone up from $4,200 to $8,500 in just a few weeks without any reaction to the USDT or the Binance hack? The halving won't suddenly decrease the supply being injected because that supply is already being held back. Much more than a halving happened when miners stopped selling.

Liquidity

Let's just assume the halving would actually decrease the supply being sold to 50%. This is really the most optimistic perspective we could take. We would assume that only miners sell. This is obviously wrong. Bitcoin's inflation is 3.84% per year or 1800 BTC per day. That's $14.4M at the current price. With openmarketcap.com reporting $2,256M volume - an undervaluation since it only considers 15 exchanges - inflation could not even account for 0.7% of that volume even if miners dumped all their rewards onto the market.

And even if the price would go up, don't forget about all the people selling along the way to take profits. There is resistance that must be broken especially since the market hasn't fully laid down its bear mentality quite yet.

Market Psychology

Market psychology is the best explanation for why the halving actually increases the price. If I asked people on here why they think that the price will go up, many would respond with the halving. Look, it actually got a name. It's important less to the available supply but more to the people. It's people who give it the importance it has. The halving is BTC's best marketing. People buy because they expect the price to rise as a technical consequence, ignorant of the actual mechanism. In the end it becomes a self-fulfilling prophecy: people buying because they expect the halving to increase price and the halving increasing price because people buy.

Really, if it was purely technical, please explain to me why all those coins which do not increase in supply don't have a $1T market cap yet? They have countless halvings every day, halving from 0 to 0. In contrast to inflationary BTC, they are actually deflationary. The halving is much more of a psychological event that drives up the price than a technical reason.

Best Regards,

Andriano

Your level lowered and you are now a Red Fish!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @andr1an0! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @andr1an0! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!