DISCOVER, Why? the price of bitcoin has not touched bottom

According to analyst Murad Mahmudov, "the worst is yet to come".

Both Willy Woo and Murad Mahmudov point out that bitcoin could reach around $ 4,400 in 2019.

Bitcoin market analysts Willy Woo and Murad Mahmudov shared on Twitter predictions in which they claimed that bitcoin's price will continue to fall for some time. According to them, BTC will lower the support of $ 5,000 before experiencing an increase in its price, which they estimate will occur beyond the third quarter of 2019.

In the last 24 hours, the analyst Murad Mahmudov shared a series of graphs and analysis of the price of bitcoin, where he pointed out that "rest is far from over" and that "the worst is yet to come". These graphs can be seen in the tweet thread presented below.

The blue arrows indicate the figures to which, possibly, the price of bitcoin would fall and from which it would begin to experience an increase. According to Mahmudov's graphs, bitcoin will continue to fall next year and will begin to rise in price from approximately $ 4,334. According to this, the downward trend of the market would remain for several months, at least until the second quarter of 2019.

Mahmudov's estimates also indicate that bitcoin prices below $ 3,000 are possible, if the Triangle Model Descendant is fully developed. As we can see in the graph, it could reach the 2,880 dollars.

If the Descending Triangle theory is fully met, bitcoin could reach $ 2,880, according to Mahmoduv. Source: Murad Mahmoduv

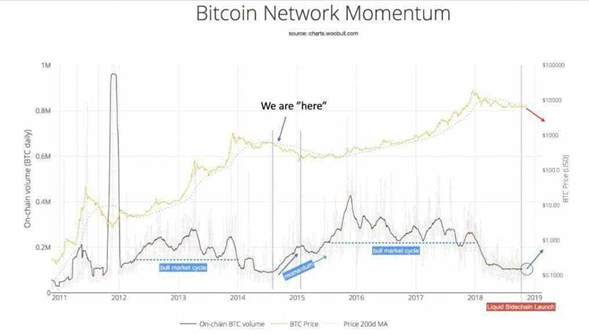

On the other hand, Mahmudov said that the market is currently repeating the pattern of the end of 2014 and the beginning of 2015. This is according to a new bitcoin price indicator during its main market cycles, called Momentun of the Bitcoin Network. This indicator raises "the relationship between the price of bitcoin and the BTC value of the daily transactions that flow through the chain of blocks". According to this analysis, the price of bitcoin would be starting a phase of free fall that precedes a cycle of bull market (bull market in which there is a high demand for an asset)

On the other hand, Willy Woo said through Twitter to be 100% in accordance with the long-term analysis of Mahmudov, in terms of time and price for support. This week, when the cryptocurrency market fell sharply and bitcoin was around $ 5,700, Woo said nothing had changed for him. The analyst took advantage of bringing to mind a publication made by him in September, where he pointed out that these indicators were still in play.

In its 9 September publication, Woo explained that it was very likely that the price of bitcoin would fall below $ 5,800, as well as predicting a free fall. On that occasion, Woo predicted that the next bitcoin support would be $ 4,900, but that a "third cat" would be completed (in reference to the pattern that is formed in the chart) with a support of $ 4,400.

Woo added that he suspected the bitcoin price would bottom out around the second quarter of 2019 and then the price rise would come, as Mahmouddo's analysis also points out. "I suspect that the time to get to the fund may be around the second quarter of 2019. After that we will start the real accumulation band, only after that, we will start a long routine up," Woo explained in a tweet.

It should be noted that Willy Woo and Murad Mahmudov are two leading analysts of the cryptoactive market. Last year, Woo presented the Bitcoin NVT Ratio indicator (NVT for Network Value to Transactions) that represents the relationship between the value of the network and the value of transactions in Bitcoin.

For its part, Mahmudov, together with David Puell, presented a new indicator for the Bitcoin market in October, called Bitcoin Market-Value-to-Realized-Value (MVRV) Ratio "(Value of Market to Value of Bitcoin). Bitcoin account). This indicator allows inferring the proximity between speculation times and Bitcoin accumulation or saving times; which, in turn, links the market capitalization with a new concept: the account value, introduced by Nic Carter.

The estimates of both analysts are also consistent with that of another figure in the ecosystem, the economist Tuur Demeester, who pointed out last August that he did not expect new Bitcoin peaks in 2018, but rather lower prices. "Despite a six-month recovery period, by 2018 we see more lateral and bearish potential in the price of bitcoin due to the slow retail demand, the doubts of the institutions and a current market capitalization that seems too high in relation to chain activity, "said Demeester