Mathematical Analysis on Bankera: ICO review (An ICO with Net Transaction revenue reward) Part 2/4

In the first part, we have reviewed the overall idea behind Bankera. In this 2nd part of the Bankera analysis, we will review the merits of the Bankera tokens from a mathematical perspective.

Merit #1: Bankera Net Transaction Revenue Share Program

Bankera's website states the following.

"Each holder of Banker (BNK) tokens will be entitled to a referral commission, paid weekly; this will be constituted of 20% of Bankera and SpectroCoin net transaction revenue. This will be implemented by taking 20% of Bankera's and SpectroCoin's net revenues and sending them to the smart contract."

On a weekly basis, Token holders will be receiving into their spectrocoin account ETH or NEM

Payments of Net transaction revenue are paid out to all token holders every Tuesday or Wednesday with a notification Email. Here is an example of Email notification.

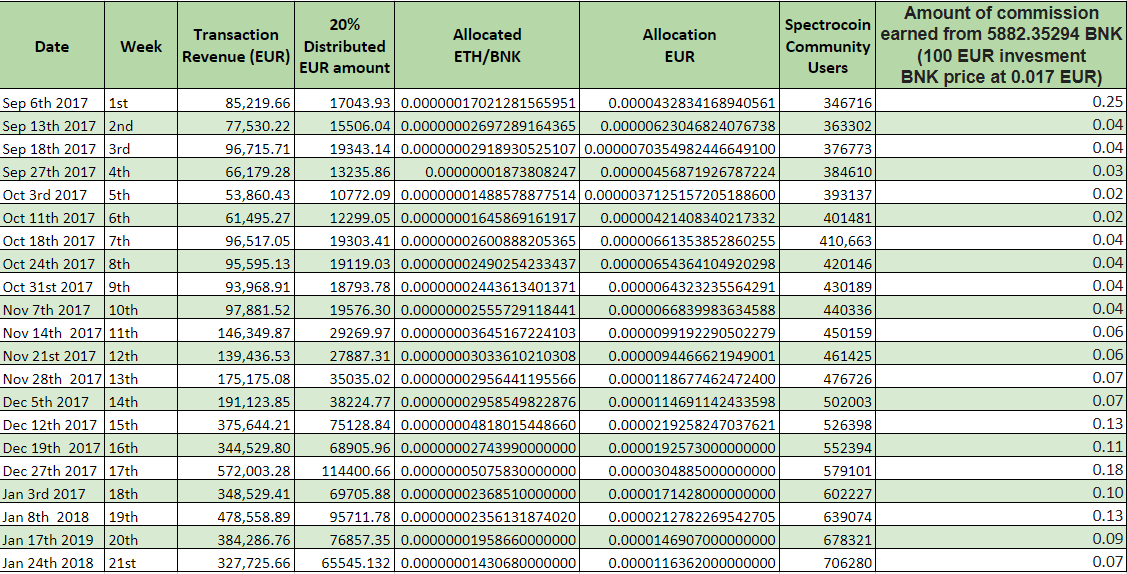

Here is a summary of all these data from 1st pay out until Jan 24th 2018.

Weekly Transactions:

Bankera has been committed on awarding BNK holders on a weekly basis without a fail.

Net Transaction Revenue:

Only amount is provided however no proof of verifying this. For the sake of analysis this value was used. From the table, we can see that as the number of users grow so does this value. The more people in the crypto-community uses Spectrocoin and Bankera services, the more transaction revenue can be expected.

20% contribution:

The amount of contribution back to BNK holders grows as net transaction revenue grows.

Users:

A healthy growth in the Spectrocoin community can be observed.

The return on 100 euro investment at BNK tokens at 0.017 EUR:

If an Individual invests 100 EUR and purchase BNK at the rate of 0.017 EUR, 5,882.3529411765 BNK can be acquired.

individual who has invested as such, for example will be receiving 0.07 EUR on week 21.

If an individual who has invested 10x more than roughly about 0.7 EUR.

If an Individual who has invested 100x more than roughly should be receiving 7 EUR.

Whether this deal may sound attractive or not, may depend on what kind of investor you are.

However I believe we can all agree 100 EUR investment with a 0.07 EUR return may not sound attractive to many investors. (And for whatever unrealistic reason an individual keeps receiving 0.07 EUR weekly, it will take nearly 28 years to recover the investment).

0.07 EUR x 52 Weeks (1 year) x 27.39 Year = 100 EUR

while an investor must consider bankera may lowers its margin to stay competitive in the market and the risk associated with(with lower margins, lower net transaction revenue can be expected), simultaneously must consider the opportunity of its growth. The more crypto community grows, ETH and or NEM price continues to increase, Spectrocoin and Bankera becomes more and more active and earn much more transaction revenue, the earnings earned from net transaction revenue share program will become more and more attractive.

The potential of receiving ETH and NEM as return

While we will still have to review the performance of Net transaction Revenue share program based on Spectrocoin and Bankera's perfromance, ETH and NEM, both currencies has shown a promising growth in the year 2017 and surely will be performing positively in the year 2018 as the crypto community grows. As the value of these currencies grows so does the value of ETH and NEM you receive.

Merit #2: Loans and Deposits and Intersts?

Bankera Site lists the following statement in their white paper.

"Loans and deposits will be a key competitive edge as well as core service of Bankera. Current deposits will receive interest just as savings do. All Bankera clients will be able to benefit from higher interest rates due to proprietary information about borrowers' cash flow, as most loans will be given to business clients who use the payment processing solution."

Let us recapture the vision of Bankera. Bankera vision is to achieve the advantages enjoyed by traditional bankingwhile incorporating blockchain technology. Whether you are a business owner or an Individual, the service of banks and banking products play a key role in diversifying an individual portfolios, minimize one's assets risk and increase overall asset growth performance.

"For businesses, Bankera will improve cash flow by extending finance for payment processing against future expected payments, based on historical cash flows and expected payments."

"For individuals, Bankera will address the age-old problem of client’s savings not keeping up with inflation by creating an investment product linked to a basket of goods that automatically adjusts with inflation."

While Bankera has not yet announced its details on the financial products to be offered, the fusion of traditional banking and leverage with the advantage of blockchain technology that allows individual to lend, manage their portfolio while benefiting the interests is quite attractive one, especially for those individuals who wants to invest their cryptocurrency.

Now that we have seen the merits that Bankera offers to the token holders, lets see the potential benefits from a perspective of ICO structure.

BNK ICO details

ICO structure

Bankera hosted an Pre-ICO, with the price of token as 0.01 EUR. During the pre-ICO tokens were issued to determine the hard cap for ICO smart contract, simultaneously the price of ICO as well.

In Pre-ICO, 2,500,000,000 tokens were successfully sold. This defined the starting ICO price as 0.017 EUR.

Bankera states that the hardcap of ICO is determined by dividing the number issued during the pre-ICO by 0.1.

Following this calculation, since 2,500,000,000 tokens were distributed during the pre-ICO, the hardcap of Bankera can be calculated as 25,000,000,000 (25bn)

The structure of Tokens allocations is stated as below.

According to this diagram provided, the allocation of these tokens follows as below.

2,500,000,000 BNK: 10% of tokens are allocated for Pre-ICO

7,500,000,000 BNK: 30% of tokens are allocated to be sold sale via ICO,

7,500,000,000 BNK: 30% of tokens are allocated SCO

6,250,000,000 BNK: 25% of tokens are allocated to Management

1,250,000,000 BNK 5% of tokens are allocated to Advisor

From this structure, we can define the Hardcap for Pre-ICO and ICO as 10,000,000,000 BNK.

Now that we have defined the Hardcap, let us define the monetary value, using the ICO price rate provided.

Pre-ICO: 2,500,000 EUR (2,500,000,000 BNK x 0.01 EUR)

Tier 1: 17,000,000 EUR (1,000,000,000 BNK x 0.017 EUR)

Tier 2: 18,000,000 EUR (1,000,000,000 BNK x 0.018 EUR)

Tier 3: 19,000,000 EUR (1,000,000,000 BNK x 0.019 EUR)

Tier 4: 20,000,000 EUR (1,000,000,000 BNK x 0.020 EUR)

Tier 5: 21,000,000 EUR (1,000,000,000 BNK x 0.021 EUR)

Tier 6: 22,000,000 EUR (1,000,000,000 BNK x 0.022 EUR)

Tier 7: 23,000,000 EUR (1,000,000,000 BNK x 0.023 EUR)

Tier 8: 12,000,000 EUR (500,000,000 BNK x 0.024 EUR)

Total Token: 10,000,000,000 BNK = 177,000,000 EUR

In monetary value that makes it equivalent 177M EUR for ICO+Pre-ICO combined.

The top 10 ICO raised statistics of 2017 by coinscheduling are the following.

Top Ten ICOs of 2017

Position Project Total Raised

1 Filecoin: $257,000,000

2 Tezos: $232,319,985

3 EOS Stage 1: $185,000,000

4 Paragon: $183,157,275

5: Bancor: $153,000,000

6: Kin Kik: $97,041,936

7: Status: $90,000,000

8: TenX: $64,000,000

9: MobileGO: $53,069,235

10: KyberNetwork: $48,000,000

SCO in monetary value is 750M EUR (SCO price determined as 0.1 EUR/BNK). That being said the overall funds with pre-ICO + ICO + Management + Advisers + SCO brings the total funds goal to nearly 1 billion EUR, making Bankera ICO one of the largest ICO held.

If all BNK tokens (7.5bn) are not sold during the ICO, the remaining tokens will be distributed pro-rata to participants of the pre-ICO and ICO.

Funds accumulated from ICO will be utilized for Development of Bankera as a project, aquisition and securing of human resources, and to fill in the requirement as a capital as part of banking requirement.

ICO analysis: Scenario I- Pre-ICO

Now that we have an understanding about the ICO, let us look into the investment aspect.

For the sake of simplicity let’s take an example of an Individual who has purchased 100 EUR worth of Bankera Tokens at Pre-ICO at a Price of 0.01 EUR.

100 EUR @ BNK/0.01 EUR = 10,000 BNK.

At the begining of ICO, Price per Token converted to 0.017 EUR.

10,000 BNK at the price at ICO 0.017 EUR converts to 170 EUR.

The difference on your investment is +70 EUR on BNK token value per every 100 EUR investment at Pre-ICO.

ICO analysis: Scenario II - ICO

Say that an individual purchased 100 EUR worth of BNK at the start of ICO.

100 EUR investment at the rate of 0.017 EUR per token get an Individual 5,882.3529411765 BNK.

For every level that the price increase, the token holder benefits as below.

5,882.35294 BNK x 0.017 EUR = 100 EUR

5,882.35294 BNK x 0.018 EUR = 105.88 EUR

5,882.35294 BNK x 0.019 EUR = 111.77 EUR

5,882.35294 BNK x 0.020 EUR = 117.65 EUR

5,882.35294 BNK x 0.021 EUR = 123.53 EUR

5,882.35294 BNK x 0.022 EUR = 129.41 EUR

5,882.35294 BNK x 0.023 EUR = 135.29 EUR

5,882.35294 BNK x 0.024 EUR = 141.18 EUR

Approximately per every 100 Euro investment, investors benefit +5.88 Euro on BNK token value during the ICO per every 0.001 EUR increment.

ICO analysis: Scenario III - Average ICO price

ICO can be a very tricky. Some ICO sells out in a couple of hours, some ICO reaches a higher stage in the begging and slows down drastically at the end, Some ICO doesn't sell well in the beginning and starts selling out at the last couple days. Since there is no way of knowing how an ICO will perform, I've decided to look into this ICO with an average calculations.

Bankera's has started its ICO from Nov 27th 2017 and plans to hold until Feb 28th 2017. Below image is taken from Jan 11th on their official Bankera site, showing ICO sold reaching 2,000,000,000 BNK.

From simple calculations, let us assume 2,000,000,000 tokens were sold since day 1. That makes on average 43,478,261 BNK are purchased daily. From a simple calculations, by Feb 28th that means 2,086,956,522 BNK additionally to be sold since this image was taken. In this scenario Total BNK sold will be reaching to 4th level where each price is equivalent to 0.020 EUR. (This scenario will be called scenario E)

If all BNK tokens (7.5bn) are not sold during the ICO, the remaining tokens will be distributed pro-rata to participants of the pre-ICO and ICO. The distribution rate can be seen from the following table:

According to the table 0.54 BNK are awarded for every BNK purchased in Scenrio E.

Scenario E: (with 100 EUR investment at 0.017 EUR/BNK): 3,176.471 BNK (3,176.4705882353 BNK will be given)

Recalculating the assets funds with distribution rate(Distributed BNK Tokens price is considered with the latest price upon the tokens) is as follows:

Scenario E: 106.2941176471 EUR (5,882.3529411765x0.01105+3,176.4705882353x0.01300 EUR)

In scenario E, for every 100 EUR investment at 0.017 EUR/BNK, an investors benefits, +6.2941176471 EUR on BNK token value.

Of course, above calculations is based on purely ICO price and not incorporating market factors.

ICO analysis: Scenario IV- SCO

Depending on the performance of ICO, Bankera may plan to operate a SCO (Second Coin Offering). SCO will be held only if Bankera determine that they need additional funds, but only if BNK price reaches at least 0.1 EUR per BNK)

If the price of ICO reaches the 0.1 EUR the profit is as it follows.

100 EUR 58,823.529411764 BNK @0.017 EUR x 0.1 = 588.235 EUR

1000 EUR Purchase: 58,823.529411764 BNK @0.017 EUR x 0.1 EUR = 5,882.35 EUR.

10,000 EUR Purchase: 588,235.29411764 BNK @0.017 EUR x 0.1 EUR = 58,823.53 EUR

in other words, for every 100 EUR investment, Investors benefits+488.235 EUR on BNK token value purchased at 0.017 EUR/BNK.

In addition, if you consider a scenario E and the effects of SCO, the investors can benefit as it the following calculations.

5,882.3529411765 BNK @0.017 EUR x 0.1 EUR = 588,24 EUR

3,176.4705882353 BNK @0.020 EUR x 0.1 EUR = 317.65 EUR

588.24 EUR + 317.65 EUR = aprox 905.89 EUR

In scenario E and the effect of SCO, for every 100 EUR investment at 0.017 EUR/BNK, an investors benefits, approximately +805.89 EUR on BNK token value.

One of the key notes to consider is, the SCO will not dilute the Pre-ICO and ICO since they will not be issued or circulated, until Bankera reaches its scalability limits. Bankera also states that, they will never supply more than 25bn Tokens.

The importance of Bankera's own exchange platform

There are comments that ICO is not worth participating and rather it is better to purchase currencies. In many cases I do understand this logic and agree in some levels. However in a sense purchasing BNK tokens seems to be purchasing ETH or NEM on a weekly basis, as it rewards the token holder on a weekly basis.

While there are several risks to considers, there are also several scenarios to consider as mentioned above. While assessing the benefits and returns, it is also important to consider the existence of emerging Bankera's own Exchange. Bankera's own exchange plat form has the potential to influence the amount of net transaction revenue share and the the price of token.

I hope via this 2nd article, I was able to give some thoughts to the readers, and aid on individuals to make a decision on whether to participate or not in this ICO.

I am not a professional financial adviser. If you find this article interesting and want to participate on the ICO, please participate on your own risk and decision. I am not promoting this ICO nor related or work for Bankera or SpectroCoin, and merely providing a review on the ICO. In case you decide to participate I will not be responsible for any loss or damage incurred. Make sure to participate in ICO in moderation and never invest on more than you can afford.

In this section we covered the overall analysis on Bankera ICO structure and the Merits.

In the following article, we will cover how to purchase these BNK tokens.

Hope you enjoyed this post and please feel free to comment.

Below you can find more information.

Bankera Site: https://bankera.com/

Bankera White Paper: https://bankera.com/Bankera_whitepaper.pdf

Bankera Blog: https://blog.bankera.com

Spectrocoin: https://spectrocoin.com