Bitcoin is destined to fail

Every time there is more talk about cryptocurrencies, and especially the most famous and used of all: the bitcoin. These types of currencies, created from the private sector, are essentially characterized by being digital and by being governed by a complex computer software that connects all its users in such a way that a distributed accounting model is originated for each transaction. The way to issue new currency is carried out through the resolution of a computer algorithm that is increasingly becoming more complex and in which any user can participate. In the case of bitcoin, the issuance of the currency is limited to a maximum of 21 million units.

Bitcoin was created in 2009, in the midst of the global economic crisis, and since then its use has been increasing. Used at first in very few regions and only in certain economic sectors, it has been expanding more and more to reach new countries and new economic branches. And, although today it is still a currency with a marginal use worldwide, it draws a lot of attention the importance that has reached a currency created by the private sector, since it has registered a success that has no comparison in history.

The advantages of using bitcoin for the user are several, but without doubt highlight 1) the use of a payment system outside the banking system and 2) the exemption in the payment of taxes. When transactions are carried out through a system that is out of sight of the tax authorities, it is impossible for them to claim the payment of taxes. This opacity is being used not only to evade taxes but to carry out illegal activities knowing that hardly any authority will find out what is happening. It is the perfect currency for economic liberalism: the public sector does not intervene either in its creation or in its regulation, so that any person can carry out their transactions without the need to render accounts to the Treasury or the Justice.

However, there are many reasons that lead to think that this experiment will not have a long journey. After all, and as Hyman Minsky explained, everyone can create money, the problem is that it is accepted. And the degree of acceptability of the currency in question depends on the ability of the issuer to achieve (violently or peacefully) its use. That is, the more power the issuer has to get its currency used, the more robust it will be. That is why the most solid and used currency is the one that emits the most powerful State on the planet (in military, economic, technological and cultural terms) that is able to impose even by force its use: the dollar1. And that is also why the Venezuelan bolivar is left aside for a good part of the country: because the State of Venezuela is not capable of imposing its widespread use.

And what ability do bitcoin issuers have to make their currency widely used? Very little, considering that there is not even a single emitter, but that any user can (after a complicated and prolonged process) create new bitcoins. None of them-not even the company responsible for software-has the capacity to forcefully force people to use the currency. Today people use bitcoin because at the moment it seems to have utility and robustness, but that belief can be broken at any time because there is no powerful agent supporting the issuance of this cryptocurrency.

All you have to do is look around: how many experiences of currencies issued and regulated solely by the private sector have triumphed? Very easy: none. The case of the social currencies supposes a crystalline example: the only ones that have been successful have been those that have been endorsed by some type of public administration. As in Bristol, where the City Council supports the issue of social currency and gives confidence. People tend to distrust the "little papers" that a private company or association creates. On the other hand, when those same pieces of paper include the logo of a town hall or of a State, their degree of trust skyrockets. People know that public administrations are not an invention of a day and that they enjoy much greater solidity and stability than any private company. States rarely break, and even if they do, they do not cease to exist. The same does not happen with private companies.

The loss of confidence in the cryptocurrency can occur for many reasons, but there is a threat that stands out in front of all: the possibility of being persecuted by the authorities. For the time being Bitcoin does little damage to state farms, but as its use continues to spread, States will sooner or later begin to strongly regulate its use, even going so far as to prohibit it, as is the case in China. Needless to say that if this happened, the bitcoin boom would stop and it would only have to go back until it could even disappear.

To this we must add another non-negligible limitation: only 21 million bitcoins can be created. This is simply the result of a design devoid of economic sense, since an economy needs as much money as activities occur within it. If transactions in bitcoins continue to increase but the amount of currency stops doing so because it has a maximum limit, it will tend to suffer deflationary tensions. That is, each bitcoin will be revalued too much and the prices of the products nominated in that currency will fall, which is not at all positive for economic activity.

This is not all: the production of bitcoins consumes an exorbitant amount of energy. The methods of creation and operation of cryptocurrencies are purely electronic and require the use of countless computers around the world, which means a very high energy consumption. According to the studies of Power Compare, the international production of bitcoins consumes 29 terawatt-hours, equivalent to 0.13% of the energy needs of the entire planet (the consumption of 159 countries). And this trend does not stop increasing. A waste of energy in every rule, taking into account that conventional methods of creating money hardly require energy consumption.

And there is more: the development of quantum computers endangers the security of the storage and use of bitcoins. The cryptocurrencies have important security features that prevent them from being stolen or copied thanks to a series of cryptographic protocols that are difficult to decipher with current computer technology. However, it is estimated that the enormous computational power that quantum computers will acquire by 2027 will allow us to easily solve these security crossroads. And the first computers of this type are already in development.

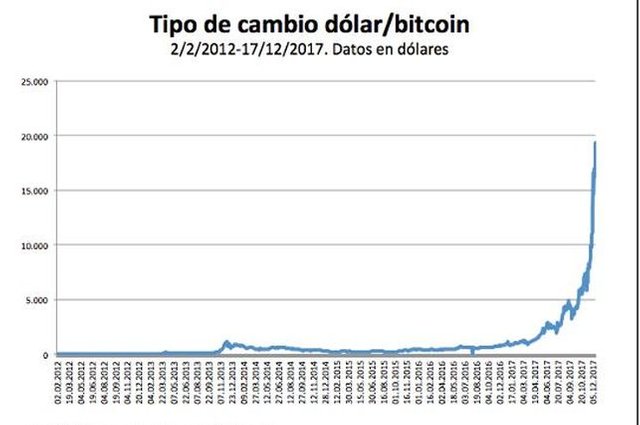

Finally, as if it were not enough with weaknesses and threats of a structural nature, another one of a conjunctural nature has recently been added: the generation of a speculative bubble. Today, a lot of people buy bitcoins to sell at a more expensive price, making a quick profit on the road. The inflationary spiral is notorious: while in 2010 a bitcoin could be exchanged for 0.05 dollars, currently it can be done for more than 16,000. And we already know perfectly well what happens with the bubbles: that at some point they explode and all the artifice goes to hell.