Bitfinex Trading Guide

A lot of people interested in margin trading avoid diving in due to the learning curve. Its the simplest way to augment your trading opportunities after plain spot trading.

Currently, BitFinex runs 3 types of exchanges which facilitate the trading of 8 products.

Exchange Types:

Exchange: self-explanatory

Trading: margin trading (what we're going to be using)

Funding: loaning out your currency so other traders can leverage

We're going to focus almost exclusively on Trading since Exchange is basic and Funding is mostly automated. Tips on optimizing Funding for Trading are at the end.

What is P2P Spot Margin Trading?

On January 13th, PBOC started clamping down on margin trading in China. This means that BitFinex, fallen from grace since the notorious hack, is suddenly the only liquid exchange to offer spot margin trading.

Lets break this product down to basics.

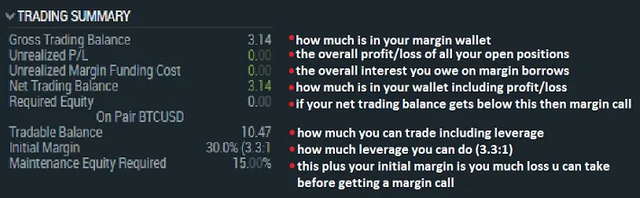

Margin is basically a way of multiplying your profits/losses by multiplying your position size. On BitFinex, you can trade up to 3.3x times your balance on leverage, meaning your profits/losses for each % change in price will be multiplied by 3.3x.

Spot margin is a type of margin trading where you borrow funds to temporarily take positions several times your actual balance on the same market as non-margin traders.

P2P spot margin is a type of spot margin unique to crypto where you pay interest to borrow margin funds from other users. Funding contracts have their own market where loaners can compete, making interest rate offerings more competitive.

Getting Started ASAP:

First things first. Make an account at BitFinex. Yes, that url includes a special code that gives you a 10% trading fee discount. You can enter it manually during the sign up page: vI9xewnNTj

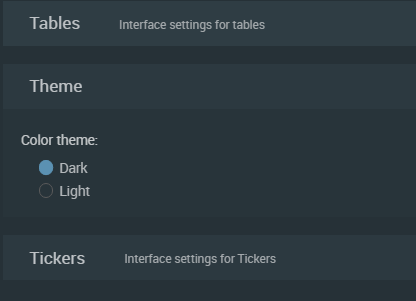

Bottom of the left sidebar, click Interface Settings, go to theme and set it to Dark.

The default theme is hideous and bad for your eyes.

Go to Account tab at the top right and make your settings look like this:

There is basically no advantage to choosing exchange or deposit account types other than to parental lock yourself from leverage.

You want USD fees by default if you want to do any accounting of your trades.

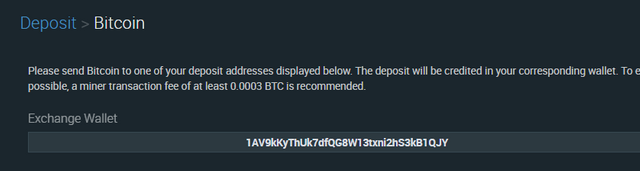

Obviously paying your fees at the end of term is preferable to paying daily interest on it.Go to the Transfers tab at the top right of the screen and choose Deposit. If you have Bitcoins, deposit to the Exchange Wallet address.

Don't use your margin wallet for your deposits, if you have a position open and its in the negative, your deposit is fair game since its in the margin wallet.

Now that you have actual funds to trade, go to the Transfers tab and choose Wallets. Transfer the funds you want to trade with to the Margin wallet.

If you are trading USD pairings its better to have your margin funds in USD. Use BTC if you're trading a BTC/altcoin market. You can move funds between exchange and margin to change your base currency.On the main trading page's left sidebar choose margin. Alright, you're all set up and can start margin trading immediately!

Opening Your First Position:

The order form at the top left is where you submit orders (surprise!)

Learn the order types and options:

Limit: Your order will only fill at your input price or better (almost always the best option), has the lowest trading fee.

Market: Buys whatever is available on the market to fill your order. Never use this ever -- even if you are chasing a big move just set a limit order past the market price.

Stop: If price moves past your stop order's price, you will either market buy or market sell (useful as an emergency brake to close your positions if bitcoin crashes while you're asleep). Its not just for closing positions, it also can also be used to open positions in case of a breakout.

Trailing Stop: Like a normal stop but relative to the peak of your position. For example, if you have a Trailing Stop of 5$ on a long and price moves up 10$ and falls 5$ you'll get stopped out at 5$ above your initial price. Useful for locking in profits on winning positions. Remember the number you are inputting is the size of the trailing amount, not the price of Bitcoin.

OCO: One-Cancels-Other. This lets you put up a pair of long and short orders. Whichever one price reaches first is executed and the other one is cancelled. Useful if you have a position and want both a take profit and stop loss on it.

Hidden: Hides your order from the books but raises the fee. Pretty useless since BitFinex is no longer a price leader.

Post Only: An addon for limit orders if you're ordering close to the market price and don't want to accidentally pay the market order fee.

Funding Opts: Covered later in the funding section if BitFinex ever gets popular enough again to be worth the bother.

Learn how to read the trading summary tab:

General Tips

Stick to limit orders as much as possible. BitFinex has a maker-taker trading fee model, which means that if you make an order and someone else takes it from you, the fees are lower. Dont click "close on your position just limit order you way out of it.

The "Claim" order as a closing method is generally a bad idea.

Remember in margin trading, longs and shorts cancel out. For example, if you are long 300 BTC at 3.3x and want to flip it into a short, you can margin sell 600 BTC.

99% of traders have nothing to gain from tinkering with the funding page. Leaving a loan bid open is ridiculous, you start paying interest on it immediately even if you're not using it.

When you open a margin position, BitFinex will automatically market buy the necessary funds at the cheapest available rate. Sometimes during high volatility your loans might be more expensive than the market price. You can close them manually, but remember you pay 1 hour minimum interest even if you only had the loan for a few seconds.

Use https://bfxdata.com to analyze the swap market and orderbook.

Go learn how to trade futures so you get better leverage, less slippage and cheaper fees. BitFinex's taker fee is 0.2% each time you open or close, whereas OkCoin's is 0.03% to open and 0 to close.

BTW, Bitbay from my experience is a great place when you can earn on arbitrage, because of permanent overpricing comparing to market :) For instance now:

-ETH on Bitbay (http://bit.ly/2wASwfK) is listed at $354 when on Bitfinex (http://bit.ly/2jeOM8V) at 327.7$ and accordingly;

-BTC on Bitbay: $4850, on Bitfinex: $4500

-Lisk on Bitbay: $7.5 on average market: $6.32

Thank you for providing valuable information https://9blz.com/bitfinex-review/