How would a global stock market crash impact bitcoin

In every single market regardless if it's equity market traded or New York Stock Exchange or if it's a vegetable market traded on the local forum as long as humans are involved the nature of the market will not change market is ruled by fear and greed and therefore consistent cycles will continue to exist the bigger the rally the bigger the downside we already know that fat are pretty much done with these artificial stimulants the current interest rate increased recently up to 2% quantitative tightening on short QT continuous means fats will sell bonds in order to decrease monetary supply in this circulation in short everything goes downhill the stock market crash is inevitable it's just a matter of time when these ten years of inflated bubble will pop

Now the question is how we stock market will affect Bitcoin and other cryptocurrencies even though cryptocurrency market is highly correlated Bitcoin is by far safest investment in terms of risk adjusted returns in cryptocurrency market right now

since there is no historical data available on Bitcoin tunity previous stock market declines I believe it is reasonable enough to assume that Bitcoin may behave as the precious metals such as gold but we will see further in this article if this is correct

Let's look at the truly linked indices such as don't Jones and S&P 500 those of you who do not know what don't Jones is you should probably find an easy game to play than investing the Dow Jones Industrial Average often refers as Dow Jones or simply as the Dow is the price weighted average of the stocks of 30 largest American publicly traded companies it is the most well known US stock index and is used to indicate the market's performance from day to day in nutshell a price weighted index means the higher priced stocks have more influence over the industry formance than lower price wants some the well-known companies in don't Jones are Apple coca-cola American Express Goldman Sachs of course who would wonder Microsoft JP Morgan food stocks such as McDonald's and so on

The S&P 500 index another hand is a basket of 500 largest tax in the United States weighted by market capitalization this index is widely considered to be the best indicator of how large US stocks are performing on day to day basis so if you want to know how the economy is doing you can keep on eye on don't Jones or S&P 500

Let's see how don't Jones and S&P 500 perform in the previous crashes such as dot-com bubble in early 2008 housing bubble in 2008-2009

S&P 500 was at the peak in mm it was training from $1,500 per share and it dropped all the way to $800 two years later they met the bear market was entire two years it must be painful from 1,500 to 800 that's 47 percent decrease almost 50 percent this is insane but this is not a Bitcoin the entire economy declined basically by 50% moving forward to a housing bubble in 2008 in late 2007 S&P 500 was trading for $1,500 once again one year in six months later each up to 7500 that's another stunning 50% drop in the market and in the economy as well

Let's look at don't Jones Industrial Average it reached all-time high at that time was $11,200 in mm two years later it was training for $7,500 that's not bad comparing to S&P 500 it decreased by only 33% moving forward to 2008 in late 2007 don't Jones was trading around for $1400 with the same time frame it dropped to lo $7,000 that's also 50% decline

Now let's take a look at gold in 2001 ounce of gold was trading for $280 and after the stock market crash gold was not affected it continues to trade at approximately the same price so the good thing is the gold can be hedge against the stock market crash hold your horses right there let's see how gold behaved in the housing bubble crash at the peak before the housing bubble you could help purchase one ounce of gold for $900 at the lowest level of this housing bubble Gold decreased to 7500 that's a 16 percent drop even though Gold Souk slight hit in estill remains probably the best hedge against stock market crash well unless you want to be a time market machine and short the market when you believe the crash is coming I would not recommend this approach being a market timer and predicting the next market crash is like throwing dots blindfold

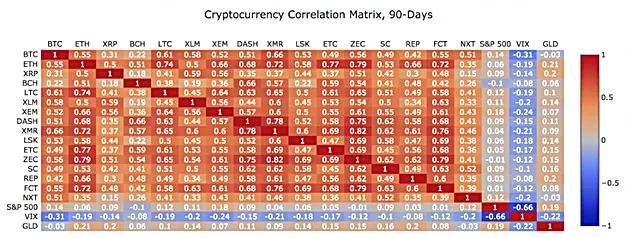

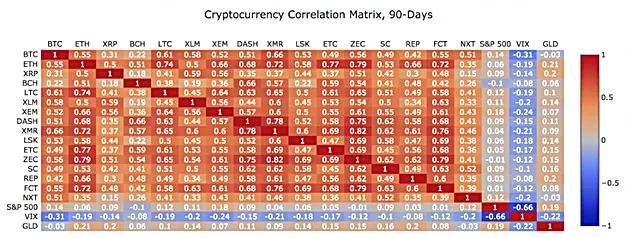

To answer the question if beaten will decline in the next stock market crash will go up or will behave as gold so answer those question will help to figure it out the correlation between Bitcoin S&P 500 and gold while many many attempts have been made to qualitative correlate cryptocurrency market even imply causation a big no-no in quantitative analysis relatively few attempts have been made to quantify the relationship asides from few outdated articles I have found something interesting the best resource I have been able to find the subject was silvered data a free cryptocurrency data visualization tool among other visualizations they have cryptocurrency correlation matrix which shows the z-score and peace core of correlations between the visual assets

For those of you who skips that is the classes in college well I didn't the numbers in the first chart are called a z-score they represent a direction and strength of the relationship between two asset classes a higher absolute z-score means greater correlation while a lower absolute z-score means less of the correlation whether the number is positive or negative indicates whether the relation is direct or inverse

The results can be interpreted as follows

0.5 to 1 strong positive relationship

0.3 to 0.5 modern positive relationship

0.1 to 0.3 weak positive relationship

minus 0.1 to 0.1 nonlinear a relationship

minus 0.1 to minus 0.3 weak negative relationship

minus 0.3 to minus 0.5 modern negative relationship

minus 0.5 to minus 1 Strunk negative relationship

The matrices above show how correlation and p-value are compounded from block returns of value weighted average daily price over 90 180 and 365 days visualization those correlations can be facilitated with trip the greenstick correlation graph rolling correlation shows how those values change over time the S&P 500 because of its z-score has a weak positive relationship to Bitcoin this is hardly interesting and according to this matrix it's not statistically significant gold also has a weak positive relationship with Bitcoin according to this matrix now let's take a look at Vix's z-score it is 0.31 making it modern negative relationship

For those of you who do not know what VIX is VIX is the index of volatility in the stock market and is also referred to as fear gorge this means that there is defined inverse correlation between VIX and Bitcoin this was demonstrated quite well in article earlier this year which contains few following graphs this is extremely interesting to find if this is true it means that fear in the markets decrease bitcoins price increase conversely as fear increases Bitcoin prices decreases this makes Bitcoin risk on investment as opposed to more conservative investments like gold which are considered risk investments it also tells us the long-term the best stock market and cryptocurrency will likely fear even more Perley than stock counterparts conversely in the bullish market they will likely feel better

I like one quote Warren Buffett used to say to a man with a hammer everything looks like a nail in other language it means if you have engineered every tool and if you have access to any data available in the world we tend to believe that somehow it gives us competitive advantage or some inside information that is not available to everybody else which means analysis paralysis just wasting your time if the math is not simple enough to compute in your head just forget it

That being said I do not believe this correlation matrix can tells a lot one reason being because data was analyzed from 90 days to 360 days which isn't enough they basically analyzed the correlation between bear market encrypted currency and bull market in stock market I believe builtin will behave as gold maybe it might drop even lower than the gold in the bear market percentage-wise

im sure the crypto will back to huge rally i think this year wasnt time of crypto

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by aboel3z from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

This post has received a 8.27 % upvote from @boomerang.

Congratulations @aboel3z! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: