What you can not do when bitcoin becomes cheaper ?

If trading requires great discipline, then cryptotrading is inhumanly huge. To defeat the market, built on emotions, you need to get rid of the emotions yourself. Here are three simple rules that you need to remember every time you lose composure in a falling market, from co-founder Mesmr and LVLUPDojo Reza Jafari.

Crypto currency trading or investment is a psychological struggle with oneself. Stock market traders often say that investing in traditional markets requires a huge mental discipline - when the market behaves unstably, it is very important to maintain self-control, not to do stupid things and continue to stick to the chosen strategy.

In this sense, the market of crypto-currencies presents even higher demands to us, since it is more volatile than any other. If you decide to do cryptotrading, you must become a Jedi who meditates on the top of the mountain during a meteor shower.

Yes, around the apocalypse, but you are sitting on top of the mountain, and you are completely calm. I have been working in this market for several years already - I started with investments, now I work in an accelerator that helps to sell tokens, and recently plunged even deeper, joining the team of the project that I loved. So, it seems, I imagine the rules of the game.

What conclusions did I draw? I understand that the state of this market is almost entirely determined by the emotions of the participants, which means that it does not always reflect any reality. In the crypto currency, the percentage of retail investors is higher than in any other market.

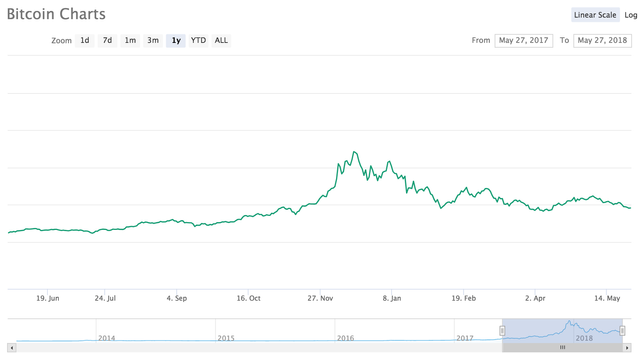

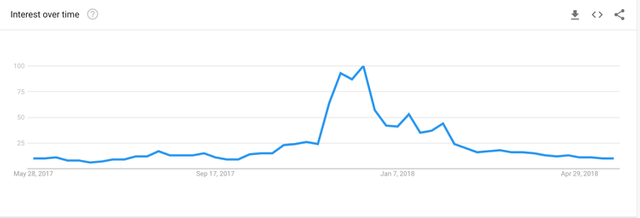

This is easily seen by comparing the bitcoin price graph with the search frequency in Google with the word "bitcoin" - you will see that they are very similar. Unless the search query graph looks smoother, because it uses fewer points to build it.

Moreover, the number of search requests increases just before the price increases. So, to defeat the market, built on emotions, you need to get rid of the emotions yourself. The point is that understanding does not always have to lead to action - sometimes inaction is more important, and it is for this that the psychological stability, about which we spoke above, is needed.

When the price of bitcoin decreases and you see how your assets lose value, it is very difficult to remain calm, as it is impossible not to think that they can never rise in price again.

1. Do not try to catch the bottom of a dip If the market starts to fall, and at that moment a part of your capital is in a fiat currency or in bitcoin, perhaps this is a good time to form a portfolio - it is useful to imagine market correction as a sale of a crypto currency.

I almost always keep free money in fiat or bitcoins in case of a deep recession, but the natural desire to find the bottom has cost me more than once dearly to me. Here you are looking at the price chart of the coin at the time of the fall and ask yourself: when will it stop? You are trying to catch the bottom, that is, to enter the position at the lowest point of the downtrend.

It is extremely difficult, so difficult, that in English it is spoken of as an attempt to "catch a falling knife". If you constantly try to catch the bottom exactly, you will probably lose. I many times waited for this moment, and waited only for a trend reversal - because of my perfectionism I lost much more than I received.

Sometimes, when planning to enter the market, it's better to buy near the bottom, rather than wait for the asset to fall to the very minimum. If you are a true master of technical analysis, perhaps you have more chances - then this text is not for you. I'm writing this for ordinary retail investors, who have a majority in this market.

You are not a wolf from Wall Street, and an error in this regard can be costly to you.

2. Do not sell your coins to buy other, growing coins.

Everyone does that, and there's nothing to be ashamed of - we are just people. With everyone, it happened to sell at the bottom, only to find out that the trend turned around and the coin soared in price.

It seems that every time I sell a coin for fear of missing the growth of some other crypto currency, the sold asset goes to the top. This fear is very hampered in the trade. Let's look at an example. You buy a $ XYZ coin at $ 0.25, having prepared properly and having studied all the necessary charts. You did not even try to catch the bottom, you know that you have invested for a long time, and you are cold-blooded, like a corpse.

Two weeks passed, and $ XYZ still costs $ 0.25. And you, of course, begin to doubt yourself and your decisions. You catch yourself on that in a cafe you argue about what is generally money with an unfamiliar elderly person, and the longer this continues, the harder you are to live. Two weeks pass by. $ XYZ is already $ 0.2.

And then your friend John, who last week invested for the first time in crypto currency, tells there about a coin called, say, $ ABC. You make fun of it, because you obviously have the only promising coin, it's $ XYZ, but the trouble is, just 6 hours after John buys $ ABC, it rises sharply in value.

It rises by 70%, John considers himself a crypto-currency tycoon, and knowing that your coin does not feel well, he begins to give you advice. It is at this fateful moment that you lose sight of the most important thing: your strategy. You exclaim: "Well, to hell with him!" You think: "If idiots like this John win, it means that all this does not give in to any logic." In the end, he trades only 12 hours, and has already earned 80%.

How is this even possible? The next day, John's stupid coin goes up another 150%. You look out the window, but not at the beautiful sunset in the sky, but on the pavement below - oddly enough, it seems to you that it's easier to jump out of the window than to listen tomorrow at the office as John will mock anyone who prefers to keep assets. You return home, open the exchanger's site and say goodbye to $ XYZ.

You sell everything, fix losses and buy for all money $ ABC. The next day, $ XYZ grows by 800%. John anxiously calls to you: "Congratulations! I saw how $ XYZ shot up today. Eh, how I would like to leave $ ABC on time, but now it has fallen to almost the same price I was on.

It was necessary to listen to you and buy $ XYZ ". Try not to prove yourself in the place of the hero of my story. And then I was at this place, and it's very unpleasant.

3. Do not look at the charts all day long via GIPHY You're not a Jedi, and you can not force the thought to make the chart move in the right direction, right? Believe me, I tried.

When I first started, I spent countless hours glancing at the charts, and now I understand that most of this time was wasted.

Of course, in part I studied and applied the knowledge, but for long, long hours, I just foolishly looked at the screen. And now I know that most of the mistakes I made at these moments, when, without doing anything useful, I watched the price of my investments - it made me worry and make unnecessary deals, and this is exactly what you do not have to do in any way the case.