Bitcoin Falls Below $800

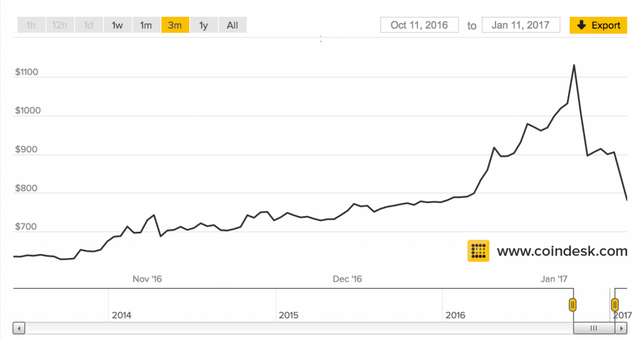

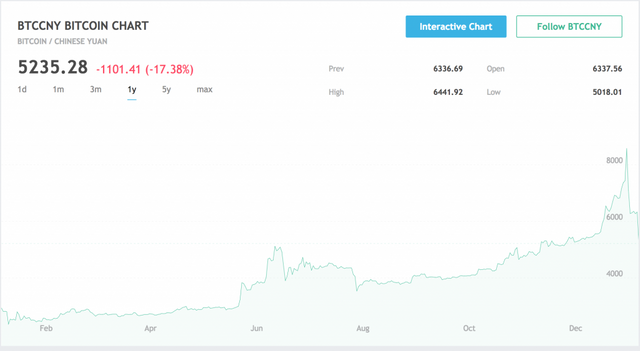

Bitcoin reached a high of around USD $1,153 in late 2016 but now for the first time in over a month has fallen below USD $800. Many articles have stated in the past the Bitcoin is closely tied to the price of the Chinese yuan. Below is a chart from tradingview.com showing the Chinese Yuan's value compared to the Bitcoin.

Despite things looking optimistic at the end of 2016 for the Bitcoin world, volatility has certainly increased for Bitcoin in 2017. On December 21st, 2016 the volatility index was at a low of 0.93% a big difference to the current volatility hovering around 4.15%. This difference in volatility might be able to be attributed to various global issues, and maybe tied to the fungibility of the currency.

If history is any indication, in terms of volatility we might be on the upward slope of another hill, and perhaps the volatility will go down in the next couple of months, but this is only speculation. Compared to the U.S. dollar the value of the Bitcoin has also had a rollercoaster of a ride over the past several weeks.

Bitcoin vs USD over the past several weeks

Bitcoin vs USD over the past several weeks

Bitcoin in Media

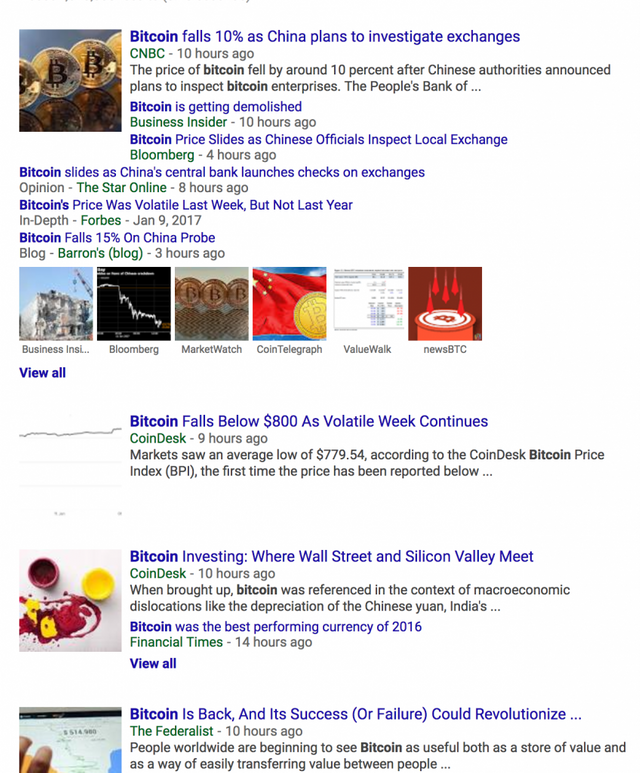

News media and media coverage can also give good insights as to where the value of Bitcoin will be going and what is affecting the thoughts of potential investors. Below is a screenshot of the Google News search for Bitcoin news.

As you can see the top portion of the feed shows primarily negative attributes to Bitcoin. Stating that Bitcoin falls or that Bitcoin is getting demolished. It is only near the bottom of the feed do we see some positivity related to Bitcoin. Another place we can probably go to get an idea of society's current sentiments regarding Bitcoin is perhaps Twitter.

Just an initial scan through of the Twitter feed for Bitcoin shows fairly a positive sentiment amongst the social media community. Though this positivity may possibly be attributed to the fact that a lot of these blogs are putting out flashy headlines in order to get more readers. Perhaps utilizing sentiment analysis and creating a Twitter script that looks for Tweets with certain keywords such as Bitcoin, cryptocurrency etc. may be a more optimal approach with doing a true social media analysis of Bitcoin.

Conclusion

As with any type of investing the thoughts and psychology of a large population of investors is affected by news media. By analyzing the maximum amount of resources and looking at things from different angles, one may be able to become a successful crypto-investor by simply applying Warren Buffett's rule:

“Be fearful when others are greedy, be greedy when others are fearful”

Nice to meet you. I first started to get into steemit. I'll follow you. Thank you for a good article.