Bitbond: Germany’s First STO(preview)

Introduction:

Lending on the blockchain has never been so Interesting as what it is appearing to be now. BITBOND is introducing its new approach to the activity and is ready to release infrastructures to that end such that people can have a dependable body or structure that is able to give them loans without all of those struggles in the existing system when they seek loans. This platform will make them follow some basic patterns and the plans made by the STO with all the criteria made available. Also, funds will be made available for all establishment and bodies with moderate charges and full transparency or support will be given to the users. This is how this platform chooses to introduce the new loaning strategy with lesser charges without the ICO but the STO.

about Bitbond

Bitbond is the first decentralized business lending platform operating worldwide in more than 80 countries. The project is owned by Bitbond GmbH, which is officially registered in Berlin. The founding company has one of the country's most serious financial licenses from the state financial regulator. For the founders of Bitbond, it is a great honor and responsibility to customers and government agencies, considering, moreover, that this is the first blockchain platform in the country to receive this license.

What should be noted from the history of the project is that in its entire history of existence since 2013, Bitbond GmbH has successfully established itself as a reliable partner in many countries in Europe and Africa. The company has opened credit lines to over 3,000 small and medium-sized enterprises worldwide, totaling more than 13 million euros.

Currently, the founders of Bitbond can provide monthly loans in the amount of about 1 million euros, which is a worthy result, the achievement of which, as the developers assure, they do not intend to stop.

PROBLEM

An unsettling problem in the startup ecosystem is the incessant problem investors and business founders are faced with regarding capital and investing respectively. The existent ICO approach to investing has been since as no longer working. The absence of gains for the small investor is incredibly discouraging. Consequently, this tells on the access to capital for entrepreneurs and a solution to this will be hugely advantageous to both players; a new pattern of investing is needed.

SOLUTION

A way to mitigate these problems, Bit bond comes to play, with its solution introduces a new method displacing the conventional ICO with an STO (security token offering). As an encompassing solution, Bit bond holds consumer interest to esteem hence its introduction of a more efficient blockchain, the stellar blockchain. Furthermore, a bit bond has introduced a EURT coin, which the investors crypto will be converted to. Afterward, this is loaned SMEs and small investors.

Bit bond since 2013 has been a once stop the call to small businesses for loans, providing small businesses with capitals to float their businesses. Furthermore, the platform boasts of a peer to peer loaning system, with its unique token BB1.

ADVANTAGES OF BITBOND

There are so many advantages derived by the users, they are enabled to perform so many activities without paying so much, the leverage on the type of advantage they can get with the relationship with money. Bankers are able to relate well with the setup with lessers fees. The transfer of money might seem difficult and communication as well. Using SWIFT will make that possible and will establish the best communication means for the users or borrowers and lenders. This feature will help process International trades and there would be codes to guide them through. It would provide a faster and more dependable means of connecting with the stakeholders. The loaning concept will, therefore, follow the dictates of the Swift codes and the BICs and that alone will make the entire activities faster and more dependable. The DLT also plays a part as it fulfills its part of the entire operation and makes the loaning services very effective that processing becomes very easy.

Bitbond token (BB1)

Bitbond token (BB1) is the first security token in Germany and makes the global lending business accessible.

The target profit is 8% (see computer). This results from a fixed interest rate coupon of 4% per year and a high-profit participation of 60%.

Token BB1 is a preeminent investment because:

Profits are significantly higher than for other fixed-income investments.

BB1 token is safer and more stable than other electronic-based investments because the prospectus complies with legal regulations that govern your rights.

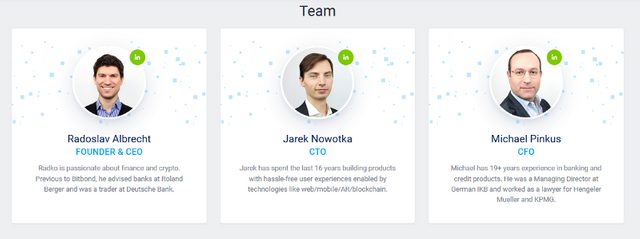

TEAM

ADVISORS:

Links

WEBSITE: https://www.bitbondsto.com

TELEGRAM: https://t.me/BitbondSTOen

LIGHT PAPER: https://www.bitbondsto.com/files/bitbond-sto-lightpaper.pdf

ANN THREAD: https://bitcointalk.org/index.php?topic=5130337.0

FACEBOOK: https://www.facebook.com/Bitbond/

TWITTER: https://twitter.com/bitbond

MEDIUM: https://medium.com/bitbond

REDDIT: https://www.reddit.com/r/BitbondSTO/

STO AFFILIATE LINK :

https://www.bitbondsto.com/?a=EMSVAD

Personal info:

ETH adress : 0x0B448c913cC7b8f1072215AbA22f79233036654e

BTT username: steem01

BTT profile : https://bitcointalk.org/index.php?action=profile;u=2251815