Binance Multi-Assets Mode: Exchange the World

I welcome you again to another concept to trading on Binance Futures. We already know that the future of cryptocurrency allows us, traders, to expose ourselves to the world of digital currencies without possessing the actual cryptocurrency.

Now, let me introduce to you what is likely to be your new addiction, which is the Binance Multi-Assets Mode.

Lots of traders may not know what this means. But worry not, as that's why I'm here.

The Multi-Assets mode was recently launched by Binance Futures, another mode that allows its traders to expand their steady coin openness among USDT and BUSD. Furthermore, this model permits investors who attempt to profit from market inefficiencies to deal with their profit and loss margin effectively. With this, it becomes an ideal item for arbitrageurs, hedgers, and traders who would prefer to perform a long-term trade.

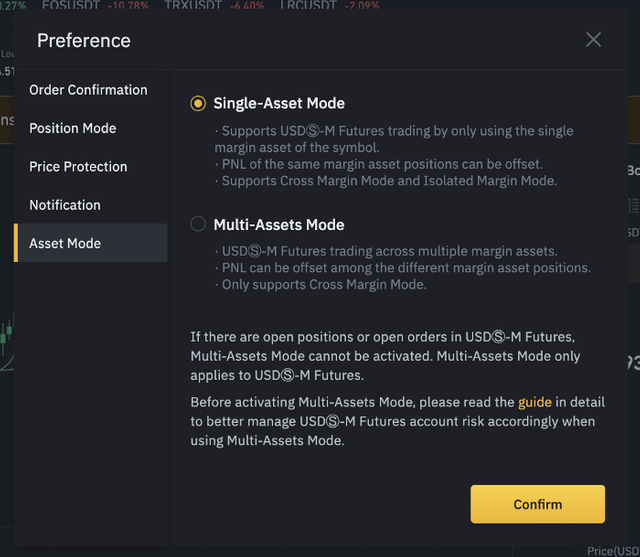

Going further, Multi-Assets Mode also makes it possible for traders to exchange USDⓈ-M Futures across different marginal assets. As we speak, Binance Futures offers USDT, and BUSD margined contracts based on the USDⓈ-M Futures product line, which is definitely one of the incredibly great features of Binance Future Trading. Any benefits made on both the USDT contracts and BUSD contracts can be used as margin, specifically depicting that one position's benefits can counterbalance many losses in another losing position. In this way, the margin balance mirrors the net profit and loss between positions in both markets. However, one thing we should note as regards this new feature is that it only supports the Cross Margin Mode.

In the meantime, clients who need to exchange with just a solitary margin asset, using BUSD only, can choose the Single-Asset Mode. For this situation, the margin is shared across positions in the equivalent margined asset, which is the BUSD-margined contracts. However, like I previously stated, the position's profits and losses of the same margin may affect each other. In this view, you should also note that the Single-Asset Mode does support both Isolated Margin Mode and Cross Margin Mode.

DIFFERENCES BETWEEN MULTI-ASSETS MODE AND CROSS COLLATERAL

We already explained that Multi-Assets Mode allows its traders to expand their steady coin openness among USDT and BUSD. We also need to understand that Cross Collateral is another innovative feature of Binance Futures that allows traders to collateralize their crypto assets to borrow against another cryptocurrency resource.

Cross Collateral feature makes the traders use their crypto assets to borrow USDT, i.e., Tether, without any interest rate on Binance Futures. In this way, the acquired assets can be utilized to exchange suture contracts on Binance Futures.

In Multi-Assets Mode, all traders will have Single-Asset Mode, which will be activated on default. Also, they will have to enable Multi-Assets Mode manually. However, Cross Collateral permits traders to borrow funds, as already explained, to trade futures contracts.

The exciting part of the Cross Collateral feature is that these loans are secured by the particular cryptocurrency assets that you own. Interestingly, this feature also enables users to collateralize against BUSD and BTC on the Binance Futures platform.

THE ADVANTAGES OF USING MULTI-ASSETS MODE

It is apparent that using the Multi-Assets mode has a lot of merits, and these advantages are what we'll be discussing in this phase.

One of the advantages of using Multi-Assets Mode is that users can easily differentiate across different stable coins and increment their capital effectiveness while utilizing the Multi-Assets Mode. This means traders can share their margin across USD-margined products available on Binance Futures, which are the Tether USD and the Binance USD. We should note that this is of great importance when opening positions in the two markets.

Also, we should understand that the shared margin feature permits traders on the Binance platform to exchange between the two markets without the need to keep up with various records or margin assets. Simply put, traders would need to deposit margin in two ways: they can deposit in either BUSD or USDT in their wallets. Also, traders can utilize a similar margin edge for open situations in the two sectors.

SWITCHING BETWEEN THE SINGLE AND MULTI-ASSETS MODES

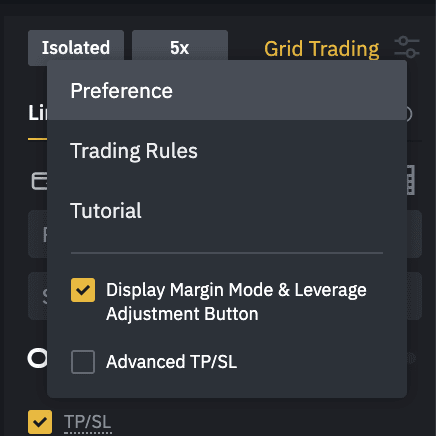

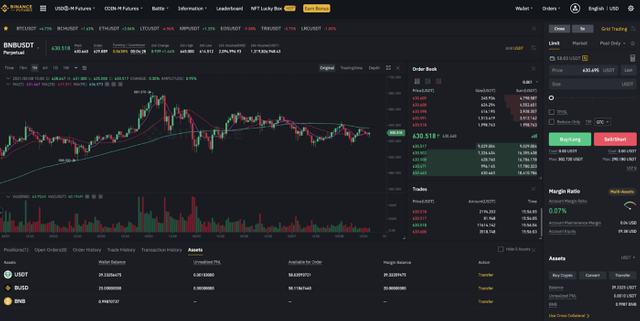

It's good you've been following all about the Binance Multi-Assets Mode. Now, you should be aware that the Multi-Assets Mode just applies to USDⓈ-M Futures. Firstly, you need to go to the upper right corner of the USDⓈ-M Futures trading interface, select Preference, and select Asset Mode.

When you get to the Asset Mode tab, select between Single-Asset Mode or Multi-Assets Mode. Understand that Single-Assets Mode is always enabled by default.

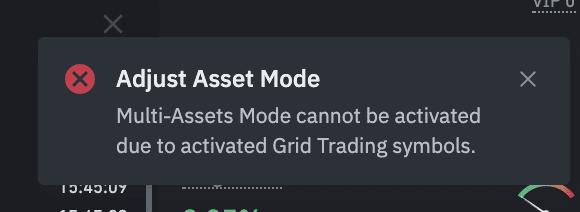

One major thing you should also note is, should there be open orders in USDⓈ-M Futures, it's practically impossible for Multi-Assets Mode to be activated. This means before it is activated, there shouldn't be any open orders at that point of switching. Below is an image sample of my point:

Also, Multi-Asset Mode can't be initiated if there are active positions in grid exchanging.

Okay, let me give you an illustration…

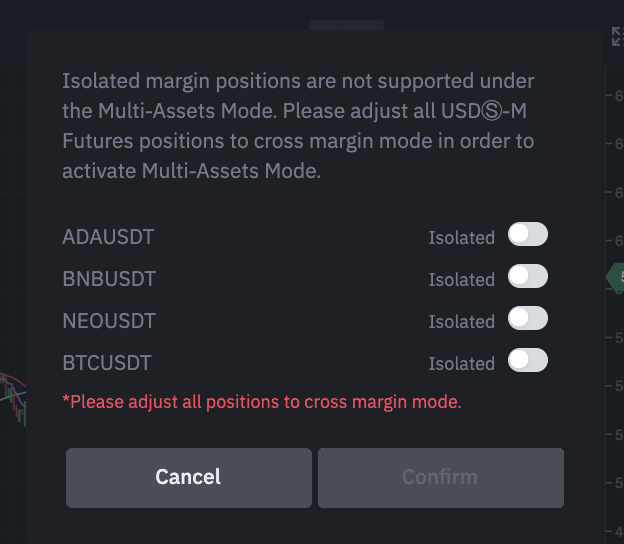

Let's assume you are holding a position in Isolated mode. All things considered, you will be approached to switched all open positions to Cross Mode prior to enabling the Multi-Assets to work.

When the contract margin assets fail to meet the prerequisites or requirements of the framework, they will be naturally converted into other different assets under the U-standard contract account as margin assets.

HOW TO CHECK MARGIN RATIO AND ASSET BALANCE UNDER MULTI-ASSETS MODE

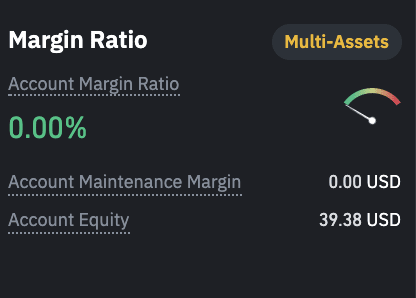

Now that we've understood how easy it is switching between the Single and Multi-Assets Mode, checking the Margin Ration and Asset Balance is much easier. If you have selected the Multi-Assets Mode, there will be an indication of the "Multi-Assets" tag at the top-right corner of the Margin Ratio widget.

Going further, since your margin balance is shared across multiple positions in the Multi-Assets Mode, one thing you must do is monitor your margin ratio closely. Once the Margin Ratio reaches 100%, it is expected that all positions will be liquidated.

I would like to show you the Margin Ratio Widget under the Multi-Assets Mode, which can be seen below:

Having seen the image above, here is the equation you'll need to calculate your margin ratio in Multi-Assets Mode:

Account Margin Ratio = Account Maintenance Margin / Account Equity

Account Maintenance Margin: The sum of maintenance margin of all cross positions in USD.

Account Equity: The sum of margin balances of all cross positions in USD.

In conclusion, we've thoroughly discussed the concept of the Binance Multi-Assets Modes, Differences Between Multi-Assets Mode and Cross Collateral, its advantages, how to switch between the Single and Multi-Assets Modes, and how to check the Margin Ratio. Note that all these simple processes are what bring out the uniqueness of the Binance Multi-Assets Mode.

If you've not registered on Binance, kindly register here, and get started to take your crypto experience to the greatest level you could ever think of.

For more information about Binance generally, kidly visit their:

BINANCE FUTURES WEBLINK to start trading on Futures

FACEBOOK

BINANCE COMMUNITY

YOUTUBE

INSTAGRAM

TWITTER

REDDIT

My Binance Referral Link: https://accounts.binance.com/en/register?ref=35918256

My Binance ID: 35918256

Thanks for reading.

This is great, thanks. Well, I know about Binance, though. I even have an account with them, but I didn't know Binance still has these great features. Checking it out soon, but I still haven't traded on futures before. I may see to it one of these days. Thanks again.

Binance is just super. One thing I like about this exchange website is that one can even use p2p to sell crypto in other markets worldwide where people are more than willing to pay even much more. You should try transferring to p2p too. You'd definitely love it.

Smiles.

I actually know about that too, and I've been using that feature as well. Thanks for this.

Thank you. Check them out. You'll be glad you did.

Binance always! Simply the best exchange platform I can think of.

Surely. Thank you.