What's FUD Gotta Do With It?

For some reason, I've found myself having a really hard time creating my next post. It's not like I don't have ideas for posts. Far from it, I have an overwhelmingly long list of potential posts that for one reason or another I simply haven't gotten around to writing. And I've still been posting comments as well, albeit to a lesser degree, so there's that. Oddly enough, this wasn't even the post I had expected to write, but it was the one I felt "inspired" to write in the moment.

Perhaps, the problem is partly related to feeling the need to keep "outdoing" my previous posts. But there are other factors at play as well. For example, in discord or the mumble after-party hangouts (now on Saturdays, btw), I've had no trouble telling people what I thought of the "bubbly" crypto markets. And as John Maynard Keynes so astutely stated, "the market can remain irrational longer than you can remain solvent", and people will often believe what they want to believe, regardless of how "compelling" your opposing view may be. Yet, I've felt less than willing to share these perspectives in the context of a STEEMIT post.

but I can't seem to stick my head that far up my ass!

I am vexed...

In the back of my head, I am vexed by the thought that some whale might suddenly show up and feel that my "FUDish" perspective may be a threat to their various speculations "investments". If the solution to a disagreement is calling FUD and completely demonetizing / censoring a post (with hundreds of upvotes by other high-reputation voters) in a single click without recourse... well, at that point perhaps we should just all go back to posting on YouTube!

And while so far I may have escaped relatively unscathed, others such as @officialfuzzy have not fared nearly as well, giving way to a true modicum of "Fear, Uncertainty, and Doubt". Furthermore, when cycles turn, sometimes it's better to take a step back, as returning to the table too early can be brutal.

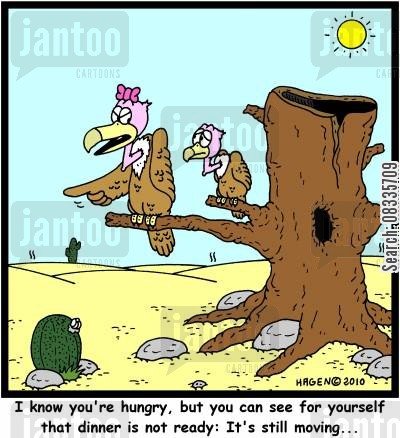

In fact, it's one of the reasons, especially as a trader, that I posted this image above my trading monitors:

image source

I know you're hungry...

Moves don't tend to capitulate until the majority of players either become excessively greedy and complacent on the upside (the extreme pump), or have all but given up, lost interest, and forgotten about it on the downside (the extreme dump). To complicate matters further, this fractal dynamic repeats itself over multiple timeframes. The "bigger picture" trigger often tends to be some "event" that wakes people up from their deep sleep and nudges them a bit closer back to reality.

From my perspective, the real "FUD" emanates from outright propaganda, fake reports, and weak attempts at making trading "predictions". For example, I laugh to myself when I see some bozo claiming EOS tokens will shoot straight to 100 once "the testnet is released". As I discussed in the mumble after-party last weekend, I tend to see things a bit differently. I view most pricing as rather arbitrary and mostly based on people's confidence, needs/desires, and various other illusory perceptions.

Regardless of how captivating the underlying tech may be, finding the correct "value proposition" as an investor (and having the patience to wait for a price that justifies that view) is another matter entirely. If you miss it, so be it. FOMO (Fear Of Missing Out) is a fool's game. There's always another opportunity lurking just around the corner for those astute enough to identify them.

From a trading perspective, when the EOS team releases a post indicating additional game-changing features and dramatic progress way ahead of schedule, and the price of EOS tokens shows little or no reaction to the news update, well, that tells you something too. The news is often not nearly as important as the market's reaction to the news. And if everyone expects a testnet to be released on schedule, that's a "buy the rumor, sell the news" event. If suddenly a delay crops up, that's a double "sell the news" event.

Mainstream Market FUD

And as for "FUD" in a blue chip stock, some of you may recall back in 2013 when Boeing (NYSE:BA) dropped nearly 7% "amid fears its electric 'car batteries' can trigger fires":

- Boeing's flagship 787 craft banned from flying in Europe, U.S. and Asia

- All 50 of the world's Dreamliners owned by eight airlines now grounded

- Fears over new lithium battery system that can catch fire onboard

- Technology used in electric cars and laptops has history of problems

- First time FAA has grounded an aircraft model since the DC-10 in 1979

- Shares plunge 6.3 per wiping $2.7billion from Boeing's stock market value

- But British Airways said it will press ahead with its order for 24 787s

- Boeing hoped to increase production of the $207million jet to 10 a month

At the time BA was trading in the 70's and quickly recovered. It now stands at nearly $250/share. Fundamental problems are one thing. But when management steps up to the plate, objectively addresses the problems head-on, and fixes what needs fixing, the long-term prospects improve, sometimes dramatically so, and "FUD" can sometimes end up being one of your best catalysts as the stock begins to climb (and short-squeeze) a "wall of worry" back to new highs and then some. This is also the example I tried to set by spending dozens of precious hours of my time tackling various bitshares issues that we discovered, some of which potentially effect other graphene-related chains as well:

- Rounding issue when matching orders hardfork

- added new asset permission flags pay_fees_core_only and exchange_restricted hardfork

Getting back to BA, to be clear... I'm not recommending anyone run out and buy Boeing up here, although I would admittedly be more comfortable holding it over most of the dramatically more speculative crypto assets that many choose to call "investments" (even after this recent "price adjustment"). Of course, in the meantime that doesn't mean there aren't trades to be had in the more liquid crypto assets, especially when there's "blood in the streets" (just remember to keep your risk management in check)!

Finally...

Whatever your "poison of choice", regardless of the terrific "game changing" prospects, there's a right time to consider buying (when few are likely paying attention), and a not-so-right time (when everyone's still talking about it). Beyond that, I'll leave it up to all of you to decide...

remember to feed the ducks while they're quacking!

You just had to wrap this up with some cute chicks ; )

I hear you @alexpmorris... sometimes it feels like we simply live in times where the "signal to noise ratio" is in an all-time low. The world runs on rumors and fake news... and I suppose it's no surprise that elements of that circus would bleed over into the crypto markets.

Meaning (at least from where I'm sitting) that any kind of "sane" approach to these markets is... well... difficult, at best. Plus... anything with a heavy FOMO component tends to be dangerous, at best, since it's often driven by neophyte "investors" who'll fly left, right, left at the slightest sign the lead bird is taking some direction.

But the ducklings are cute...

Haha, posting your real thoughts and especially which is against the interests of some whales, is so difficult and harmful on Steemit. Steemit has a long way to become real decentralized. Right now it is a battlefield. Between you are also right about the trading. It's mostly based on illusions than reality.

Just sit-down and take cigarette, calming down myself. Grateful for life even we lost in trading. When price go down , I will keep the stuff and do not let speculation trader get profit from my losing.

By the way EOS is interesting project but it is a little complicated for common people to understand the purpose of EOS. So it is need a simple explanation for commoners to understand it. Nice :)

Everything is so strange and volatile... I dont know what to think... :( Iam a NY trader and this new world is so strange!

is it though? to me it's more like "same 'ole same 'ole, plus ca change, plus c'est la meme chose"... though if anything, many of the exchanges seem to operate much in the same way as most forex bucket shops (or the bucket shops of yesteryear Livermore talked about in "Reminiscences of a Stock Market Operator").

If I was a nimble investor I would have bought some Steem last night, but as I'm a dope with no exchange account I sat watching Netflix. It hurts to be a troglodyte at times !!! But yeah, FUD is def the acronym of the week !!!

'I have an overwhelmingly long list of potential posts that for one reason or another I simply haven't gotten around to writing.' Oh, I know that one!!! Thanks for writing this one - I appreciated it!

I'm glad others can relate! :) lol

Drafting a potential post right now. Might take me a while to finish and post it though. Ah, the joys of procrastination...

very easy for you guys in the US to buy and sell, here in Africa Nigeria-we live in the Shadows, we can't even buy eos if we have the money to do so...😔

you do realize that EOS and ICOs in generally "off-limits" to U.S. citizens, at least "officially". However, that hasn't stopped people from finding ways to circumvent those rules by using VPNs and other "tricks" to bypass IP blocks and such.

Link: Are Most Cryptocurrencies Doomed to Collapse — because they’re “ICO-issued”?

Well, from a non'techy person like me; using VPNs and bypassing could be like magic to us

Ya sometimes I'm sure a crypto is going to go up so I invest, then china news slams me. Followed and I'm going to look into these discord/mumble discussions.

I missed the buy opportunity today.