Bitcoin value Analysis: Post-Fork Markets look sanctionative of BCH Deposits

As expected, the events leading up to the BTC hardfork were dramatic. Before cacophonous off with its hardfork counterpart (Bitcoin Cash), BTC-USD saw forceful swings in value with wildly completely different market values, looking on the exchange. whereas some exchanges saw new uncomparable highs being achieved (Kraken BTC-USD), others began to ascertain discounts in their BTC-USD values. At points, there have been even $100+ premiums between Kraken and Bitfinex.

At time of this text, Bitcoin money (BCH) markets on most major exchanges have existed during a bubble as BCH deposits and withdrawals are halted. There square measure several theories relating to the isolation of exchanges and their corresponding BCH-USD markets effects on the BTC-USD markets. Given this little bit of info, one will assume that the dramatic rise in BCH market cap is unreliable at the instant. there's an outsized portion of the Bitcoin community that's unable to sell its forked BCH and is presently sidelined. As such, this analysis can solely take a glance at BTC-USD value trend and what we will expect there.

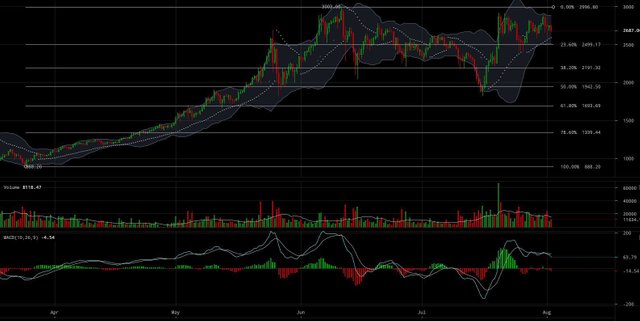

Looking at the macro trend of the BTC-USD market, we will see that a previous check of the twenty third Fibonacci Retracement values was powerfully tested and afterward rejected within the days leading up to the hardfork:

The $2500 values have evidenced to be a formidable foe for those wanting to the short the market, and last week was no exception. To date, $2500 values have engineered a powerful level of support over the past couple months and can still be a powerfully oppose value vary.

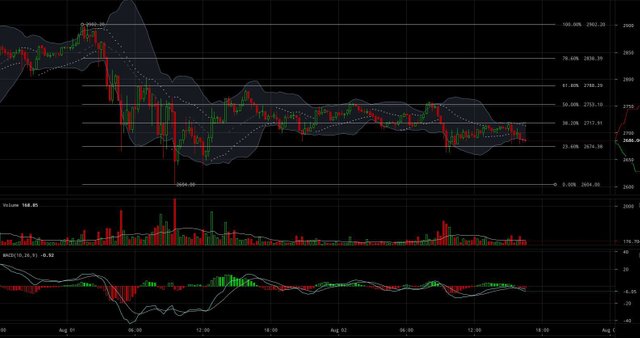

The activity following the hardfork was fully expected by several. while not going into an excessive amount of detail, the hardfork of BTC-USD may be thought of as a fracturing of its market cap basically, a second reduction of BTC-USD value:

At the instant, since BCH-USD has nevertheless to be opened to those while not coins on the most important exchanges, the particular effects of the hardfork have nevertheless to be felt (as mentioned before, the majority of the BCH holders square measure presently sidelined while not major shops to sell their coins). the present costs square measure reflective of speculators anticipating a come by price upon the gap of the BCH deposits and withdrawals. To date, the value activity has followed the Fibonacci Retracement values terribly closely. Multiple tests of the five hundred retracement values were tried before ultimately dropping all the way down to the lower values. At the time of this text, the BTC-USD markets try to check the twenty third Fibonacci Retracement values.

Given the very fact that BCH has nevertheless to essentially sink its fingers into the BTC-USD markets, one would expect to ascertain a check of recent lows among this current bear run. With every check of the Fibonacci lines there's a swell in volume. A check of the lower boundaries of the bear run are no exception.

Its ne'er straightforward to with confidence write value projections with most uncertainty within the markets. In an effort to stay objective in my writing, i'll simply say this: Volatility is to be expected as BCH and BTC decide to set their place within the market.

In general, once longing for reliable trends, it's nearly always suggested to look at the quantity trend because it correlates to cost movement. once the value is erratic and seems to operational without reasoning, check the quantity. If there's no volume to substantiate a move, additional typically than not the move are short lived. Volume establishes support and it reaffirms resistance lines. Volume is also an excellent indicator of market momentum and direction. once mercantilism BTC within the coming back days, volume are your relief.

Summary:

BTC-USD showed sturdy support at the $2500 values within the days leading up to the hardfork.

To date, the consequences of the hardfork have nevertheless to be realised as a result of BCH deposits and withdrawals from most major exchanges havent be enabled.

Once BCH deposits square measure enabled, expect high volatility on the BTC-USD markets as each coins (BTC and BCH) vie for his or her market cap share.

Trading and investment in digital assets like bitcoin, bitcoin money and ether is very speculative and comes with several risks. This analysis is for informational functions and will not be thought-about investment recommendation. Statements Associate in Nursingd money info on Bitcoin Magazine and BTC Media connected sites don't essentially replicate the opinion of BTC Media and will not be construed as an endorsement or recommendation to shop for, sell or hold. Past performance isn't essentially indicative of future results.

I am Groot! :D

Nice information

bch comming up up up

Congratulations @nasima! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP