Digital Currency Headlines you should acknowledged today 06/07

Bithumb and Bithumb PRO welcome Aeternity [AE] and NEM [XEM] to its platform

BLOCKCHAIN IT Giant Fujitsu Launches Blockchain Based Rewards System

Bitcoin Mining Giant Bitmain Could Go Public in Record-Breaking IPO: Report

Fidelity Flexes Muscles in Possible Crypto Exchange Move

Ripple Exec Launches Smart Contract Platform to Rival Ethereum

Coinbase awaits SEC approval

After making its entry into Japan, Coinbase is now on track to become a US-regulated blockchain securities trading venue. They announced early on May 7th about their progress on the path to operate a regulated broker-dealer, pending approval by federal authorities.

They tweeted about listing SEC-regulated crypto securities:

“Today we’re excited to announce that we’re on track to become a US-regulated blockchain securities trading venue. We believe this is an important moment not only for Coinbase, but the entire crypto ecosystem.”

Once they get the approval, Coinbase will soon be able to offer securities based on blockchain under the oversight of the US Securities and Exchange Commission [SEC] along with the Financial Industry Regulatory Authority [FINRA]. This step ahead is accredited to their acquisition of a broker-deal license [B-D], an alternative trading system license [ATS], and a registered investment advisor [RIA] license. Their acquisition of Keystone Capital Corp., Venovate Marketplace, Inc., and Digital Wealth is the key point that has enabled all of this for them.

Vietnam Proposes Import Ban on Cryptocurrency Mining Hardware

NEM (XEM) Gears up for an Upswing with Exciting Partnerships

- Multiversum Announces Partnership NEM and ProximaX

- NEM Ties up With BitPrime

Ethereum [ETH] has a condemnatory bug, Parity Technologies detect!

A condemnatory bug has been detected in a testing domain utilized by one of the two vital virtual products pivotal to the task of the world’s second-biggest blockchain; Ethereum.

As covered, by the UK-based Parity Technologies in a blog entry, the issue was found to cause those running the software to fall out of synchronizing, which means others utilizing distinctive programming would not perceive their exchanges. While the bug was found on a TestNet, the stress is that it could be misused on the MainNet too.

All things considered, Parity Technologies is currently encouraging all clients to refresh their product to a recently fixed rendition.

more:Parity Issues a Mandatory Update Due to a Critical Vulnerability

Bitcoin [BTC] and other altcoins’ hardware wallet partners with ShapeShift

The XEEDA alliance with ShapeShift was announced on June 5th, 2018, with the hope of integrating ShapeShift onto XEEDA’s hardware wallet. The alliance will allow XEEDA users to instantly exchange between leading digital assets from their smartphone, without ever having to expose their private keys to the internet.

Latin American NGOs Embark Upon Tour to Promote Bitcoin in Argentina

“Bitcoineta”, a cryptocurrency awareness program conceived by non-profit organizations, Bitcoin Argentina, and Bitcoin Americana has commenced. The campaign will comprise a minivan boldly donning the bitcoin logo embarking on a road trip across Argentina and Latin America with the goal of spreading knowledge and fostering bitcoin adoption.

Bitfinex is back with a bang in the game after the DDoS attack

“Security is paramount to any crytocurrency exchange. Very glad that users were unaffected and everything is back under control”

Zilliqa [ZIL] on another platform! India’s mobile wallet opens trading

Trading Giant Susquehanna to Help Clients Buy and Sell Cryptocurrencies

Bitcoin Price Rebound to $7,800 Could Confirm Short-Term Rally

Mid-Term Optimism

This week, Nathaniel Popper from The New York Times reported that Susquehanna International Group, one of the biggest investment firms in the world, has already started to facilitate bitcoin trades.

“We believe that this technology and this asset class is going to change some facet of financial services, and we think it is going to exist forever,” Bart Smith, the head of digital assets at Susquehanna, said.

The firm, which first experimented with BTC in 2014, has started to process the settlement of bitcoin, Ethereum, and Bitcoin Cash futures, enabling institutional investors and large-scale traders to invest in the cryptocurrency market.

Goldman Sachs-backed Crypto Giant Circle Seeks a US Banking License

Litecoin [LTC] Foundation brings #PayWithLitecoin to your door step

Finance Industry Slams Google’s Crypto Ban As ‘Unethical’ and ‘Unfair’

Swift Continues to Struggle With Ripple’s Growing Success in Banking Sector

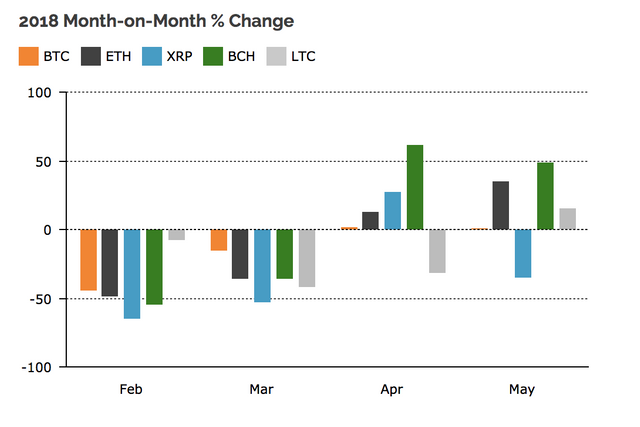

Bitcoin Cash and Ethereum Trading Volume Soars But Ripple Keeps Falling

The entrance of firms like Susquehanna into the cryptocurrency sector could lead to a domino effect in Wall Street and the global financial sector. While investors are uncertain about the short-term future of the market, the majority of traders are bullish on the long-term growth of bitcoin and the rest of the cryptocurrency market.