Negative Income Tax (NIT) and Unconditional Basic Income (UBI): What makes them the same and what makes them different?

NIT and UBI are two ways of achieving a basic income guarantee (BIG). One gives a varying amount of money according to income, and the other gives the same amount to all and taxes different amounts back. However, among basic income supporters, some of us prefer UBI and some of us prefer NIT even despite the potential for their outcomes to be identical as described by Milton Friedman himself.

“A basic or citizen’s income is not an alternative to a negative income tax. It is simply another way to introduce a negative income tax if it is accompanied with a positive income tax with no exemption. A basic income of a thousand units with a 20 percent rate on earned income is equivalent to a negative income tax with an exemption of five thousand units and a 20 percent rate below and above five thousand units.” — Milton Friedman, 1976 Nobel Memorial Prize in Economic Sciences

So why then might we prefer one over the other?

Well, a NIT is like giving someone $50 and asking for nothing back, and a UBI is like giving someone $100 and asking for $50 from their next paycheck. Both result in the person getting an extra $50. The question of which is better depends on the details involved and how someone feels about them.

Here's a less simplified and more accurate description:

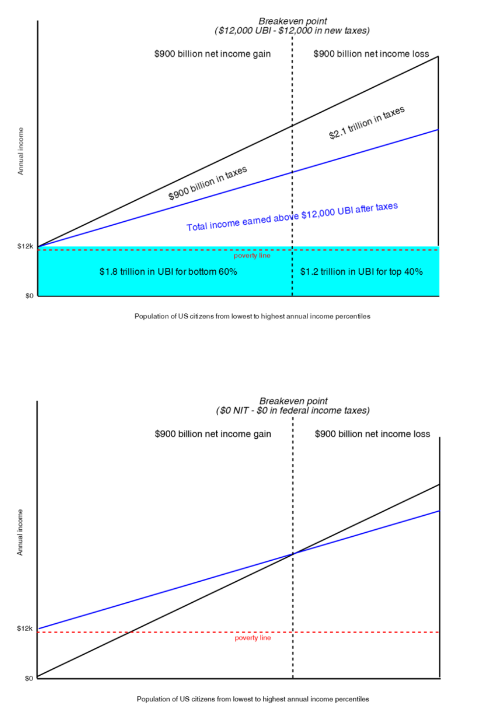

A basic income of $12,000 per year achieved using a NIT is basically the top quintile (the top 20% of income earners) providing an additional $1,000 per month to the bottom quintile, $666 to the next quintile, $334 to the middle quintile, and $0 to the 2nd richest quintile. Now, these numbers can be different according to what the amount is set at, and the tax rates used, but that's basically the kind of outcome we'd see. It's a transfer of $900 billion per year.

Meanwhile, a $12,000 per year UBI provides $1,000 per month to every quintile, and then taxes everyone sufficiently to accomplish that. And this can be accomplished in a variety of ways that don't even necessarily include income taxation. It too is a transfer of $900 billion per year.

To go a bit further into this comparison here's a hypothetical scenario based on your earning $36,000 right now, with a NIT, and with a UBI.

Scenario ($36,000 salary):

Example 1 (Control): You are currently drawing a salary of $3,000 per month, for a total of $36,000 per year. After taxes you net $31,000. Your taxes are automatically deducted from each paycheck, leaving you with $2,583 of disposable income each month and you owe nothing and get nothing at the end of the year.

Example 2 (NIT): You are currently drawing a salary of $3,000 per month, for a total of $36,000 per year. With a NIT threshold set at $40,000 and a tax rate of 30%, you get a NIT refund of $1,200 ($40,000 - $36,000 = $4,000 and 30% of $4,000 is $1,200). However, this isn't just a check at the end of the year. Because your salary was known, this refund was expected. So you actually received an additional check for $100 per month over the course of the year and lost nothing from your paychecks to taxes. The result is that you had $3,100 of disposable income per month ($517 more in your pocket each month), for a new NIT enhanced annual salary of $37,200 (effectively a $6,200 raise)

Example 3 (UBI): You are currently drawing a salary of $3,000 per month, for a total of $36,000 per year. With a UBI set at $12,000 and a tax rate of 30%, you pay $10,800 in taxes. Because of UBI, this leaves you with a net bonus of $1,200. However, because a UBI is paid every month, you actually received an additional $1,000 per month. In addition, because your salary was known, and because it was expected that you would be paying $10,800 in taxes (about twice the $5,000 you would have paid without UBI) about twice what would have been withheld from your paycheck is withheld for you each month. The result of this is that each month, your paycheck is $2,100 and your basic income check is $1,000. So each month you earn $3,100 ($517 more in your pocket each month), for a new UBI enhanced annual salary of $37,200 (effectively a $6,200 raise).

Comparison Summary $36,000 Salary:

1. $31,000 per year or $2,583 per month after tax salary

2. $37,200 per year or $3,000 after tax salary per month + $100 NIT = $3,100/mo

3. $37,200 per year or $2,100 after tax salary per month + $1,000 UBI = $3,100/mo

This example should make it more clear how NIT and UBI can have identical outcomes, but with a NIT focused on taxing and transferring less, and a UBI focused on taxing and transferring more. If we dislike taxing and transferring, we're probably going to lean more towards NIT, and if we dislike treating people differently based on income, we're probably going to lean more towards UBI.

Maybe a NIT is something more economists might prefer, because they are just looking at numbers, but everyone else would not prefer because of its inequality of distribution and the added administration is requires?

Maybe someone doesn't like the prospect that only poor people get a check that only rich people pay for and would instead prefer the idea of everyone getting a check like in Alaska and everyone paying to make that check possible in varying ways?

Maybe someone thinks rich people shouldn't get anything until they meet the definition of needing something, and that it makes no sense to tax more money than necessary, only to give it back.

So why might it make sense to tax more, when there's no need to? And what's the point of giving more only to take more back?

Well, perhaps the added taxation could be meant to affect behavior.

If this increase is added to income taxes such that top marginal tax rates are returned to 90%, maybe this would provide an incentive to not seek huge incomes at the top?

If this increase is added to the price of carbon, perhaps this would provide an incentive to reduce our use of carbon and invest in clean renewable energy resources?

If this increase is added to the cost of buying and selling stocks, perhaps this would reduce the financial instability of high frequency trading and the potential for flash crashes they introduce?

If this increase is added to the purchase of luxury items, perhaps this would provide incentive for those who can afford luxury items to pay a greater amount for them, and also provide an incentive against that 5th sports car or 3rd vacation home?

If this increase is added to the price of owning undeveloped land, perhaps this would be a more fair way of handling land ownership and development in general?

If this increase decreases the amount available at the top to buy politicians, perhaps this would result in a stronger democracy that's more responsive to ordinary people?

If this increase replaced existing tax expenditures, perhaps that could simplify the tax code, make it more fair, and remove market distortions born of picking winners and losers with subsides?

There are a lot of reasons to see taxation as a useful tool and not something to universally hate, especially when it comes to Pigovian taxes like carbon taxes and financial transaction taxes.

Also, maybe there is great value in full universality? Because a NIT requires people to file their taxes even if nothing is earned, that might leave people out, whereas an amount universally given to everyone as a new right of citizenship would be better at avoiding any holes for people to fall through.

Or perhaps it would be just far easier to simply pay everyone the same thing, and then figure out what to tax away after the fact? If 80% of the population doesn't need time-intensive calculation, then it would be far more efficient to just calculate the remaining 20% instead of the full 100%.

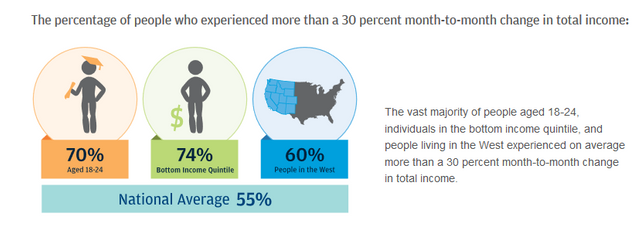

Perhaps the biggest difference between NIT and UBI is one that has grown over time and will only continue to increase, and that's in regards to monthly income variance.

At this point in time, as opposed to decades ago when incomes had far less monthly variance, for an overwhelming majority of the bottom 20%, their incomes are varying by about a third, month after month. This means one month, someone will earn $1,000 and then the next month $700, and then the next month $500. Because a NIT requires calculation based on monthly earnings, a NIT makes it far more likely that someone who requires $500 based on their income to stay above the poverty line that month, would instead receive $200 instead of $500, and thus plunge below the poverty line that month. Because a UBI is always above the poverty line, that would never happen with UBI.

There's also an interesting psychological finding that found people are more motivated to work when their earnings are taxed instead of their benefits reduced.

Subjects were required to perform a real-effort tedious but simple task (to move sliders on the screen) in return for experimental payments. How much they earned depended on the number of correctly positioned sliders on the screen. Experimental earnings were taxed in the same way, but the way the tax was presented differed across treatments. In one treatment, the tax was paid from the earnings themselves. In a different treatment, the tax was paid from a fixed sum (benefit) every participant received at the beginning of the experiment. Because money is completely fungible, it should not matter which source of income is used to pay the tax. However, it turned out that subjects who were asked to pay the tax from their benefit rather than from their earnings were around three times more likely to quit working early.

So even though the total incomes didn't vary between conditions, the way the income was taxed did lead to different outcomes. We should acknowledge this kind of psychological finding when designing policy.

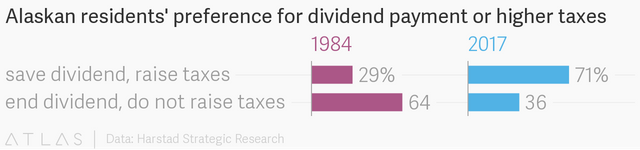

A UBI can also potentially draw more support and maintain it in the long term, whereas a NIT might be actively fought against by those not receiving it, and could lose support over time.

Alaska provides strong support for this potential. Since 1982, everyone in Alaska, rich or poor, has received the same dividend amount year after year. The dividend does not vary according to earned income. Over 30 years later, the annual dividend has become so popular that a majority of Alaskans would prefer to have their taxes increased than their dividends decreased.

Coming from a state as conservative as Alaska, that's a pretty incredible finding. Would the dividend be as popular, or even still exist, if the amount varied according to earned income? It's impossible to say for sure, but I doubt it.

It's also far easier to see UBI as a technological dividend owed to all citizens if everyone receives the same amount. Stockholders don't receive dividends based on their annual earnings. They receive a dividend because they've earned it as a stockholder. Well, citizens are the stockholders of nations, just like Alaskans are the stockholders of Alaska.

A NIT can only be considered superior to UBI if one subscribes to the idea that all taxation is evil, and therefore should always be minimized in all possible cases it can be minimized, regardless of the net cost being the same, regardless of behavioral findings, and regardless of real life examples of universal incomes like in Alaska.

The above is in no way exhaustive and is meant to only provide a better understanding. There is plenty of further studying to be done by those who wish to even better understand the similarities and differences between a UBI and a NIT.

Here are three papers for your own research. I recommend reading each of them in their entirety:

Universal Basic Income and Negative Income Tax: Two Different Ways of Thinking Redistribution

Arguing for Basic Income: Ethical Foundations for a Radical Reform

Universal Basic Income and the Cost Objection: What are We Waiting For?

If you read all of these, or even just one of them, you'll probably walk away preferring one or the other, even though both guarantee a basic income and both as a result would profoundly improve the systemic outcomes of our respective societies.

And it's that last part I think would serve us all best to keep in mind.

Cryptocurrency for the people! The way of the future !!

That is called Manna...it is already in operation.

Cryptocurrency + Blockchain = UBI

https://www.mannabase.com/?ref=fbt5zz3bfh

I'll take some of that manna, man /// ty

Glad you can join the party @clumsysilverdad.

I believe they are looking to distribute on January at some point and are shooting for weekly distribution.

By the way, it already trades under the symbol GRT.

I spoke with you briefly when you introduced yourself, and I have followed you ever since. Prior to that I always believed fervently in NIT, not having heard of UBI. After you introduced me to UBI I felt that in the main, NIT and UBI are the same thing.

By and large I was right, but I see from this article that what is important is the few differences. Most important is the psychological difference. Americans, in particular, do not like taxes but everyone likes income.

If NIT is the only option then we must take it and hope it works. If UBI is on offer it wins.

Trust me, I'm a doctor.

This post has received a 2.72 % upvote from @booster thanks to: @scottsantens.

@scottsantens payed 4.8 SBD to @minnowbooster to buy a stealth upvote.

transaction-id cf16e2e6d9bc9e5104a505d2225a1483dc0d729b

@stealthgoat

We are both so pleased to see you posting such fine essays on this subject dear to all our hearts. This really is an idea whose time is coming. In a sane world, it would have already arrived. We appreciate your presence and your contributions to Steemit.

This excellent post was included in our new curation effort The Magnificent Seven -- a collaborative work by @enchantedspirit and @catweasel. You have received a 100% upvote from each of us to show our appreciation for your post. To see your creation showcased here ... and the fine company you keep ... please visit this link.

We appreciate your support both for our work on this project and for the other creators of exceptional content who make it all possible. (Follow @catweasel to catch our future Magnificent Seven posts. He's really not as annoying as you might think. <--- He always makes me say that.)