Mathematics of Basic income. The illusionary high cost.

I love to read articles and books about basic income. But I often find myself disappointed whenever the cost of a basic income is discussed. Both proponents and opponents seems to experience a lot of cognitive dissonance by the high Gross cost. The otherwise interesting discussion usually end shortly after a calculation of the Gross cost is presented. But is gross cost a useful metric when comparing the welfare model to the basic income model?

TL;DR No.

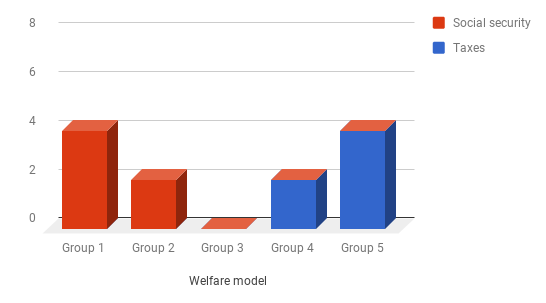

Let me start by creating a simple example. I start of by dividing the population into 5 groups based on their income.

Group 1 is the poorest group. They don't pay taxes because they don't earn anything. They collect Social security payments (social assistance, also known as welfare in American English). In this example they get 4 coins.

Group 2 earns a little. And the Social security payments are reduced with the same amount. (100% marginal effect!)

Group 3 earns above the level that make them eligible for Social security but does not yet pay taxes.

Group 4 and 5 contain the high earners. They don't get Social security payments because their income is high. They pay the taxes. This creates a Net transfer of wealth from group 4 and 5 to group 1 and 2.

| Welfare model | Group 1 | Group 2 | Group 3 | Group 4 | Group 5 | Total |

|---|---|---|---|---|---|---|

| Taxes | 0 | 0 | 0 | 2 | 4 | 6 |

| Social security | 4 | 2 | 0 | 0 | 0 | 6 |

| Net transfer | 4 | 2 | 0 | −2 | −4 | 6 |

Observe the total gross cost of 6 coins for group 4 and 5 combined.

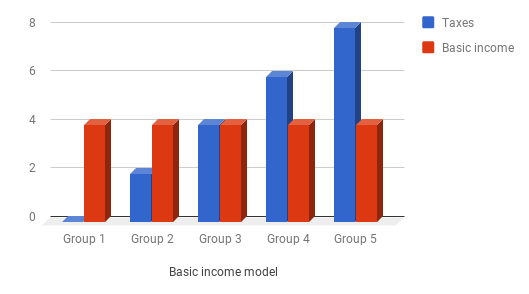

Let's do the same for the Basic income model. Notice the extremly high Gross cost, but identical Net transfer:

| Basic income | Group 1 | Group 2 | Group 3 | Group 4 | Group 5 | Total |

|---|---|---|---|---|---|---|

| Taxes | 0 | 2 | 4 | 6 | 8 | 20 |

| Basic income | 4 | 4 | 4 | 4 | 4 | 20 |

| Net transfer | 4 | 2 | 0 | −2 | −4 | 6 |

Observe the total gross cost of 20 coins for group 2, 3, 4 and 5 combined. Thats a lot more compared to the 6 coins in the previous example. The gross cost has skyrocketed! But does it really make sense to compare the gross costs for the different models when the Net cost of 6 coins is the same in both models?

The net cost is the actual cost experienced by a taxpayer.

This cost is the same in both models. With other words: The welfare model is exactly as expensive as a Basic income model, from the perspective of the taxpayer. The difference between the two models is only a number in the budget. This high gross cost does not tell us anything about the actual cost experienced by the taxpayer. The Gross cost is not a useful metric when comparing the models. Net cost is better when comparing.

What is Net cost?

Net cost is the gross cost of an object, reduced by any benefits gained.

Examples of net cost are:

- The gross cost of a machine/equipment, minus the margin on all goods and services produced with that machine/equipment.

- The gross cost of attending college, minus the incremental increase in earnings derived from obtaining a college degree.

- The gross cost of a machine/equipment, minus the salvage value that will be derived from its eventual sale.

- The gross cost of taxes paid, minus the Basic income gained.

Small poll.

Do you think that a Basic income model is more expensive than today's welfare model? (From the taxpayers perspective)

Bingo! You are absolutely correct. The net cost of UBI is the true cost for the same reason no one with $80 would ever look at something with a $100 price tag and a $50 instant rebate as being too expensive.

https://medium.com/basic-income/the-cost-of-universal-basic-income-is-the-net-transfer-amount-not-the-gross-price-tag-acb8aa5eab73

Upvoted, resteemed, followed, and shared on Reddit. Cheers!

Thanks Scott!

For everyone reading this thread in the future. Here is the reddit discussion

And another one

It'll be cheaper overall when all things are considered.

you are absolutely correct, the true cost does not change and in fact cannot change. Out of all the models for social welfare a UBI is clearly the best.

The only problem is that while it is the best way to distribute the money, it does not answer the question what is the best way to collect the money in the first place.

I'm not sure what the point of your Social Security example is. Social Security works nothing like that currently. Social Security is your money. What you take out when you retire is based on what you put in, no matter how wealthy you are. It is not a welfare program. If you never work, then you are not eligible for Social Security.

As far as UBI replacing welfare programs, I would be ok with that as long as it truly replaced all welfare and did not result in a net increase in taxes (once factoring in the UBI itself). As you say, the gross cost would be much higher because everybody would get the UBI. How that effects an individual taxpayer depends on the details. Other than possibly simplification (and again, this depends on the details), I don't see any real advantage over existing welfare programs though.

Whether or not UBI is more expensive than existing welfare programs depends entirely on how big the UBI is vs. the outlay of existing welfare programs. It could be much more expensive, much less expensive or the same depending on the implementation.

Thanks. The word is apparently used differently around the world. I did not mean insurance for retired people.

This is what I intended:

quotation source