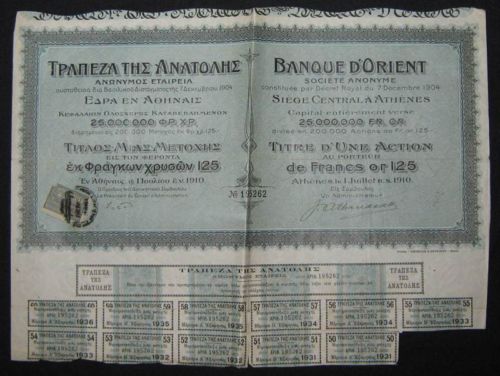

BANQUE D'ORIENT *ΤΡΑΠΕΖΑ ΤΗΣ ΑΝΑΤΟΛΗΣ Chapter No1

At the beginning of the last century, in 1904, the National Bank of Greece established the "Bank of the East", better known as the "Banque d 'Orient". This bank is then developed in three main areas. Thessaloniki, Smyrna and Alexandria. In 1932 the Bank of the East was acquired and merged with its parent National Bank of Greece.

Under current law, a clearing is required. Three liquidators take charge of the case following a decision by the General Bank of the Bank of the East. Clearance never ends. Under the laws in force and after many years of exodus, the National Bank claims that the value of the shares of the Bank of the East has been eased. He may be right about the shares even if they were in drachmas, helping the Greek state's bankruptcy.

But those shares that we are talking about were in ... gold. The petition is clear and guarantor of every such share was and ... is the Bank of France. The refugees from Ionia, Cappadocia, the Caucasus, who at some point demanded the liquidation of their shares, listened to bank employees, especially after 1940, responding to them that their securities had no more value. The subject was forgotten. Some grandmothers and some grandparents from Asia Minor had kept some of these shares on the chests. Some others in mailboxes, until forty of them suddenly appeared. The family owned by Patras of Artemis Sora.

What's more natural after this revelation is that the Sora family will come to the National Bank of Greece. In turn, the Bank officially informed the heirs in September 2010 and then in February 2011 how, based on Law 18/1944, the value of the shares has been eroded. No mention is made by the legal department of the National Bank for the fact that the value of the shares is in gold (18/1944 is the first monetary law after the liberation by the Germans.) The responsibility of the National Bank of Greece during the period of the occupation was taken over by Deutsche Bank). The Shorra family does not put it down. He comes in contact with banking, legal and economic experts. It was natural for the valuation of the current value of 40 shares to take place at some point.

The big surprise

Mr. Theodoros Karyoti is Professor of Economics at the University of Maryland in the USA and teaches Macroeconomics, International Economic Relations and Microeconomics. He has undertaken to proceed with the valuation of the shares. His finding is bullshit. Each gold bank of the "Bank of the East" is now valued at 670 billion euros each. That's one and a half of Greece's current debt, which is approximately 450 billion euros. The total value of 40 shares is close to 30 trillion.

Χωρίς καπνό δεν υπάρχει φωτιά

In April 2010 the beneficiaries had contacted the Bank of Greece. The governor of Mrs. Provopoulos is fully aware of this. After talks, the Central Bank proposed a compromise of € 1.5bn for 10 Bank of the East shares. The beneficiaries were surprised to hear the legal advisers propose a "strange route" to pay 1.5 billion through a British company. It has now become clear how the two banks, the Central and the National Banks, wanted to avoid being directly involved in a banking transaction so as not to be exposed to other stakeholders in the same case. The beneficiaries refused to adopt this "Strange route". They went to another place and founded a non-profit corporation, the "END", headquartered in Greece, where Emmanuel Lambrakis is the well-known cardiologist in New York and Professor Theodoros Kariotis is the vice president. The Sorra family is also moving forward. It donates 4 shares to "END" and submits the donation tax declaration to CYD Patron. The goal is clear. The Greek state is obliged to issue a duplicate collection of the relevant donation tax for NGOs. is in the order of 0.5% and to receive a tax of 13.5 billion. The Tax Office refers the issue to the Finance Ministry.

This money is sufficient to clear public and private debt

The rationale of the members of the END and of the Shorra family is clear. The value of 4 shares is sufficient for the repayment of Greek debt and accumulated debt to Greek citizens' banks, but also for the existence of a large reserve for the country's economic development. It is obvious how the banking system of the country and the European one in the the whole of which is unable to repay in full this amount resulting in the value of the shares. So what's left? The compromise or otherwise an agreement or more simply a common understanding of all parties (debt write-off). Mr. Papandreou, Mr. Ant. Samaras, Mr. Ev. Venizelos and Mr. G. Provopoulos are fully informed. However, no reaction has been detected yet. All he knows is the "Bank of the East" and its reserves in gold, then in 1932 and Mrs. Christine Lagarde of the International Monetary Fund. In order to laugh at the lips of every bitterness.

Source: zougla.gr (Monday, 19 September 2011