Business banking for blockchain organisations

tl;dr: Getting a business bank account for a blockchain organisation anywhere in the world is particularly hard, even in Switzerland. For now, the only possibility is to bank in Liechtenstein, but there is hope that the Swiss government will pressure its banks to start accepting again.

I shall outline the problems as I understand them in this blog and I will elucidate on potential options.

What I say in this blog is fairly common knowledge for those already working in the industry. For those of you who are not working in the industry, this blog may be surprising. Some of what I say here relies on anecdotes, i.e. private conversations, so I can’t give attribution to the people I’ve spoken with, but I will try my best to provide links to sources.

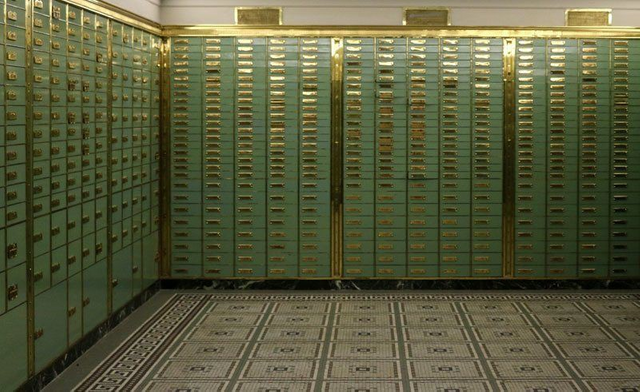

Business banking is a problem

Getting a bank account for a blockchain business is particularly hard in the current climate. As soon as you mention that your business has anything to do with cryptocurrencies, Bitcoin, or blockchain, the banks are refusing to open accounts. Moreover, they may even close your account. Unfortunately, Switzerland is no exception.

Obtaining a personal bank account in Switzerland is very easy, and you probably shouldn’t be faced with account closer provided there is no reason to suspect the source of your funds (i.e. from employment). I mentioned this in a previous blog: Moving to Crypto Valley.

If you aren’t working in blockchain then you might assume that getting a business bank account in Switzerland is easy. Well, it used to be easy. Unfortunately, that is no longer the case. Despite Switzerland’s apparent desire to become the leading blockchain nation, and also despite Katon Zug’s desire to attract more blockchain organisations, it is essentially impossible to get a business bank account for blockchain projects.

From what I hear, it is also very hard to get a business bank account anywhere in the world for a blockchain project. I hear mixed messages on places like Singapore, Hong Kong, Gibraltar and Malta. The latter two have been keen to attract projects, and politically it is a hot topic. The one country that I know for sure that banks are accepting new projects is Liechtenstein.

This is making some in the Swiss government nervous, especially those in Crypto Valley, that they are losing ground to Liechtenstein. They are natural choices where the level of professional support is also high. Even if the challenger countries could offer banking, I’m not sure if it necessarily makes sense to incorporate in those jurisdictions. While a bank account is absolutely essential, it is my understanding the rest of the business infrastructure is lacking. If you want to find an account or lawyer in the challenger countries with experience of blockchain I think you are going to struggle.

Switzerland is still one of the best places to be set up a blockchain project because of the wealth of experience that already exists. Their maturity is far ahead of any other country.

Why are the Swiss banks being difficult?

This is the question that most of us are wondering about. We suspect we know why, but we can’t quite say with absolute certainty. Most people suspect that the Swiss banks fear future pressure from other countries, particularly from the US. Given the fallout from 2008, where we know that the US bullied Switzerland, then it isn’t really a stretch of the imagination to consider that the US (or even the EU) could put pressure on Switzerland into taking action. That may already be happening and could be the underlying reason that the Swiss banks are being extra cautious.

Part of the worry of blockchain organisations is knowing where the funds have come from. Given the possibility of receiving funds from anonymous sources, there is a fear that anti-money laundering checks can be performed correctly. Naturally, you can consider why this can make banks cautious.

What can you do right now?

Given that getting a business bank account is tough, what are the possibilities?

I’ve heard of teams having mixed success for getting a business banking account in other countries across the world. It might be possible to get an account if you stretch the truth. For example, I’ve heard that it can be possible to get a bank account if you state that your business is a ‘software company’ and don’t mention blockchain or cryptocurrencies. Not necessarily a lie, but rather it is being economical with the truth. I have heard that this can even work in the US and it may even work in Switzerland, but it isn’t really the best solution in the long run. Sooner or later I expect the banks will catch up with this ‘trick’.

The other possibilities are to consider banking in another nation that claims to be “blockchain friendly”. For example, Malta has been making a lot of noise about supporting blockchain. Binance supposedly opened an office there, and there has been an indication to legalise DAOs as a new type of legal entity under Maltese law. Before you rush into setting up a business bank account there, I will urge some caution after what I learned from someone else working in blockchain:

“banking in Malta is not so advanced. I have to send a fax every time I want to put money in or take money out of my business account there”.

That sounds like a PITA.

Do your own research on that Malta and the other supposedly friendly blockchain jurisdictions. I have to say that I’d be inclined to look elsewhere.

Liechtenstein is not only a viable alternative to banking in Switzerland but possibly the best choice of any. The local government and the banks are both supportive of blockchains organisations.

Liechtenstein leading the way?

There are a number of factors coming together to make Liechtenstein a key player in the growing blockchain industry.

One, there has been a proposed blockchain act, although currently on-hold, could be set to give legal definitions to security tokens and all sorts of token events. This could give a solid basis for many blockchain based assets and activities.

Two, the banks in the country are actively trying to attract blockchain projects to the country. You can see this by checking the Twitter account of Bank Frick. They show a keenness for blockchain technology and seem to be welcoming new sign-ups.

Three, the Liechtenstein royal family is hot on blockchain too. I want to believe that this will help to make the local politicians also favourable to the idea of inviting more blockchain organisations.

This begs the question of how to figure out whom to bank with, and how can you be sure to trust them. That’s a good question and not one I can fully answer. To start your research, you will need a list of all the banks in Liectenstein and then start the due diligence process. You could consider things such as their capitalisation values and the amount of profit they make. Ultimately, you will have to speak with them and figure out if you can build a relationship with them.

According to Andrew Henderson of the Nomad Capitalist blog, Liechtenstein is trying to shake the ‘tax haven’ moniker and be seen as a ‘safe haven’ instead. As alluded to in Andrew’s blog, it is almost impossible to gain residency there and only slightly easier to open a personal bank account if you are not a resident. This corroborates with an article written on the TransferWyse website. However, while residency is almost impossible and opening a personal bank account is tough for non-residents it should be relatively straightforward for blockchain projects. I dare say it helps if your project is well capitalised or, at least, soon to be.

Of course, there is a fear that Liechtenstein will be forced to reign its banks in should the shit hit the fan. Whether it is another global financial crisis, or some other political upset locally, it isn’t unforeseeable that banks in Liechtenstein may eventually stop accepting blockchain projects.

Liechtenstein Foundations — pause for thought

There is a question around whether to set up a Liechtenstein based company or foundation if you are intending to bank there. Foundations can be set up with a minimum of 30,000 CHF and supposedly offer a good level of asset protection. However, while researching some details around this blog post I came across a news article that made me pause for thought on Liechtenstein based foundations:

Liechtenstein: The mysterious tax heaven that’s losing the trust of the super-rich — from the Independent, 8th March 2018.

However, what is less well known is that this secrecy comes with a heavy price — under Liechtenstein law the beneficiaries of a discretionary offshore trust have no legal rights. If there is a dispute with the trustees, the grievances of the beneficiaries cannot be heard in legal proceedings — even if they have reasonable grounds to challenge a trustee’s actions. Under the laws of the principality, legal rights are held by the trustees. And so if there is a dispute with the trustees, the beneficiaries can be left with no access to their own assets.

That has to raise a lot of eyebrows and make people very cautious. My first thought would be to figure out if that is indeed the case, or whether the Independent is stretching the truth. The newspaper is fairly left leaning and isn’t fond of low tax territories. Unfortunately, details are fairly scant upon a quick search. Proper legal advice would be wise.

The answer may be to bank in Liechtenstein but have a business or foundation based elsewhere, such as Switzerland.

Liechtenstein is a very pleasant country. I visited last year and was impressed with the picturesque valley. It’s calm, clean, has low-crime, and great nature. There is less than 40,000 people, so the country is only a little larger than the town of Zug (not the Canton though!). By area it is the 4th smallest country in Europe. Incomes are high, so GDP per capita is one of the highest in the world.

Worth visiting even if getting residency there is next to impossible.

In case you ever wondered where my profile picture came from, now you know!

Will the situation in Switzerland be resolved?

Fortunately, it isn’t all doom and gloom. The folks in the cantonal government of Zug are aware of the problems and are not happy with the Swiss banks at present. They are keen to keep attracting more blockchain projects. Obviously, this will give them even more tax income. Often said to be the richest canton (per person at least), it is clear that they are keen to maintain their position as the world-leading jurisdiction. Blockchain projects are still keen to move to Zug for a number of reasons: the great quality of life, the attractive tax benefits, but also the wealth of experience in the local organisations.

Some of the recent news articles point to a correction of the situation and a brighter future:

Switzerland looks to liberalise cryptocurrency banking access — from the Financial Times.

“Heinz Tännler, finance director of Zug canton, said he expected Swiss politicians and regulators to remove obstacles in coming months, allowing crypto companies to operate with banks in the same way as other companies.”

And:

Switzerland seeks to regain cryptocurrency crown — from Reuters.

“Swiss regulators are stepping up efforts to halt an exodus of cryptocurrency projects from the country, after two of only a handful of banks active in the nascent sector shut their doors on it in the last year.”

One thing I should point out, is that there are some Swiss banks who are still willing to work with blockchain projects. I cautious to say much about them since I haven’t yet heard of anyone using them. For the curious, all I can say is that you could research into Hypothekarbank Lenzburg.

The coming months

I think it is worth keeping an eye out for the headlines in the coming months about Swiss banks welcoming blockchain projects back as customers. Old customers who were kicked out might not return, but new customers may be willing to take the chance. The longer they refuse to take on new projects, the more damage that’s done to their reputation.

This topic is very much “do your own research”. Consider other nations beyond Switzerland but be aware of the potential problems of banking in countries where the technology may not be so advanced. If you have plans to set up a business, or a foundation, then you need to be sure of the professional support that you can rely upon to help solve problems. Switzerland is still number one in that regard, but Liechtenstein is pulling up fast as a worthy competitor.

About me

Currently, I work at the Web3 Foundation, covering numerous responsibilities, but mainly security and communications.

One of the main projects of the foundation is the Polkadot network. A next generation blockchain platform. To read more about the innovation that Polkadot is bringing to the blockchain industry I invite you to read the following blog post: link.

Questions / Comments?

You can create a reply to me here on Medium, or reach out to me on Twitter: EAThomson

great Mr.geronimo................

Amazing piece...great content

I run my business and it's important for me that the number of my clients increase, and it would be especially good to start working with international clients. Doing business banking through traditional banks isn't very convenient. I'm not getting the level of service I need. Now I've started working with Silverbird platform experts and the difference is clear. They really try to do everything possible for comfortable and safe money transfers to international accounts.