Why are banks so profitable?

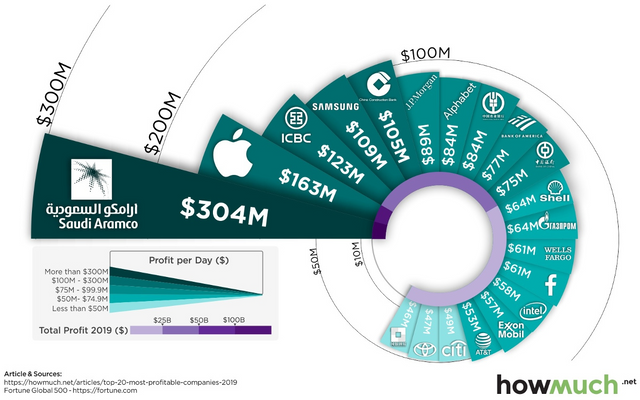

Banks are among the most profitable businesses in the world. According to the data on this Forbes page where they ranked the top 20 members of the Global 2000 list of the world's largest public companies by their profit margins. Unsurprisingly, 10 out of the top 20 are banks and the top 4 companies with the highest profit margins are all banks.

The information from Forbes might seem somewhat dated and I am unable to trace when was the article published. However, a more recent article showing the top 20 companies by profits is also giving similar statistics. Of the 20 companies, 9 are banks. So why are banks so profitable?

Income from loan interest

Banks these days offer a multitude of financial services. However, their main bread and butter is still interest income from loans. But where do banks get the money to provide those loans? The simple answer is, largely from our deposits.

Most of us save some money in banks because it is not that safe to put too much money at home and putting money at home doesn't yield any interest. As a result of that, the banks are able to amass huge amount of money from savers like us. Of course, banks being banks will not allow the money to just lay there and do nothing. That is why they will loan out those money and earn themselves some interest.

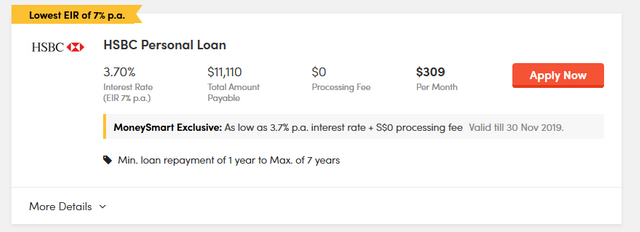

If you have not realized, if you take a personal loan from a bank, the interest is usually much higher than the interest you get from depositing money to the bank. Based on my research, the personal loan with the lowest interest rate I can find in Singapore is from HSBC, at 3.7% per annum.

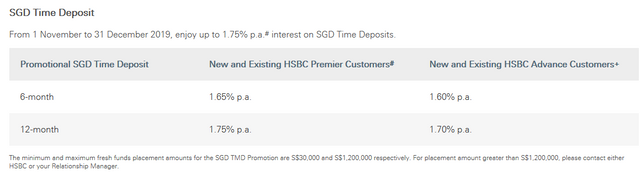

On the other hand, HSBC is offering up to 1.7% interest on a time deposit. Instantly, you can see that the profit margin is astonishing. It is essentially (3.7% - 1.7%) / 1.7%, which is a staggering 117% profit. But that is not all... Enter fractional reserve!

Fractional reserve banking

Fractional reserve banking is a system in which only a fraction of bank deposits are backed by actual cash on hand and available for withdrawal. This is done to theoretically expand the economy by freeing capital for lending.

The fractional reserve banking system allows bank to hold only a fraction of the deposits that they have in the bank and loan out the rest. In the US, the fractional reserve requirement is 10% of total deposit while in Singapore the Monetary Authority of Singapore mandates a minimum cash balance of 3%.

All these mean that banks can leverage savers' money and make even more profit. Assuming there is a deposit of $1million. The bank can theoretically issue a loan of $10million with it earning an interest of $370k per year. On the other hand, the bank just needs to pay $17k of interest to the depositor. That is 10 times the profitability! Easy peasy lemon squeezy :)

Conclusion

Banks are extremely profitable because they are able to perform an instant arbitrage on the money that are deposited with them. In a certain sense, they are making money out of thin air. No wonder there is a saying,

"Give a man a gun and he can rob a bank, but give a man a bank and he can rob the world"

Source

With all these said, I just want to end by saying that I am actually presenting a very simplistic analysis in this article. Running a bank is extremely complex and much of the costs go to making sure they are compliant with regulations. Moreover, there may not be that much demand for loans such that all banks will be able to earn that level of interest. Therefore, in reality, banks are not that profitable as what I described in this article. But, they are still sure to be profitable enough to dominate the list of top 20 most profitable companies.

10% of post rewards goes to @ph-fund and 5% goes to @leo.voter to support these amazing projects.

The "Raise to 50" Initiative

Under 50 SP and finding it hard to do much on this platform? I might just be able to raise your SP to 50. Check this post to find out more!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

Thank you for your thoughts, I think you are right with it.

As Andreas M. Antonopoulos is calling this "banking cartel", I encourage everyone to play this video (at least 5 times) Escaping the Global Banking Cartel.

Thanks for recommending the video!

Simple analysis, yes but a very good one @culgin.

Banks are very profitable and the fractional reserve banking is key to their model. Also, many of the big banks are market makers so they are basically establishing the spread in many markets.

Using just the first part, that is why it is vital for us to get more of our holdings in cryptocurrency. Every dollar held in crypto removes $10 from the established banking system. If we just focused upon this aspect of the banks business, we would see a major impact.

Over time, I have a feeling this will be the trend. As there is more to do with crypto i.e. places to spend it, we will not see people converting it back to fiat.

This will eventually take a toll on the banks.

Indeed. People need to learn to take charge of their own money. Though the problem I see is that the vast majority are still too use to the existing system.

Cryptocurrencies still have some way to go to make it seamless for less technical users to start using them. However, as millennials and future generations come to age, that will be less of an issue. In addition, crypto usage experience is also improving by the day which is really encouraging :)

Hopefully... And to be honest... I think tha banks will either have to transact eventually on blockchain or be removed from the "very big transaction game". And this will be something that either the "regulation" can prohibit... or allow criminals to coexist. Maybe there is a third or fourth term/state in this, but mostly it will be hard nails on your feet.

I would love for little students to start making thesis of Financial markets evolution... and how crypto transformed them in terms of dept liquidity... which is something crypto does not really still have.

Anyway, enjoying this amazing revolution is going to just make my life more interesting. I am on it since 2013/14... but I never though it would be like this in 2019...

Was going to comment on this very thing as soon as I read your title.

Recently heard a news segment where someone described banks as having first mover advantage when quantitative easing takes effect. Hopefully crypto will be able to mitigate how much they escape with this time

That is very true. QE benefits the banks the most

Resteemed already @culgin

Upvote on the way (once VP will be fully recharged).

Thank you very much!

Let me rephrase something for people to REALLY understand this statement...

BANKS can issue dept... by asking it to central banks!

This is basically the same role of a "SHIT COIN" creating crypto... and then saying... its worth money! The difference thought... is that shit coins... DIE!...

BUT BANKS DON'T!

Yup! Banks have an unfair advantage over other industries

@culgin, Definitely Banks hold the all Control and in my opinion most of the people fall for the Dept Trap. I am not sure but hope that Blockchain Technology and Cryptocurrency Space is here to change that picture. Stay blessed.

Posted using Partiko Android

The world is indeed in a debt trap. Global debt is estimated to be over $244 trillion and counting

Yes and it's unfortunate aspect because in my opinion people are not fully aware about the issues and at the end of the day common people suffers the most. Let's hope for the best and stay blessed.

Yes, we can only hope for the best. But at the same time, we should also prepare for the worst

Wow! very good analysis @culgin.

Thanks for reading!

Congratulations @culgin! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP