BABB — Banking The Unbanked — Review and Potential ROI As An Investor

In the world of crypto currency we come across hundreds of companies that have the potential to shake up an industry. I believe I have found such a company in BABB that not only has the potential to shake up the banking industry but can on board banks and introduce them to blockchain technology by way of Central Banks Digital Currency.

What is BABB?

BABB is an acronym for — Bank Account Based Blockchain.

The whole premise of the company is that anyone in the world can become a bank by registering for the BABB App. BABB is looking to help anyone in the world apply for a bank account. The aim is to help over 2 billion adults who do not have access to banking facilities (Source: uk.businessinsider.com). This market, according to Accenture, is worth $380 billion (source: newsroom.accenture.com)

For the normal banking industry it is simply not profitable to help bank the unbanked, but the blockchain revolution can change that.

By using blockchain technology and new proprietary technology like biometrics BABB aims to bridge the gap and help anyone open up a bank account and have access to facilities like peer to peer lending, a secure payment card (Black Card) and of course a real bank account.

Technology Behind BABB

Blockchain

Blockchain makes it possible to run a decentralised peer-to-peer platform, enabling users to transact without an intermediary and benefit from faster and cheaper transactions. Smart contracts create tamper-resistant transactions for greater security.

Biometrics

Biometrics, including voice print, face scan and geolocation, make it possible to create secure digital identities for all account holders. This enables everyone — even those without an address or ID documents — to open a bank account, and retain ownership of their digital identity data.

Artificial intelligence

AI will be used for ‘dynamic KYC’, enabling us to build up an ever-evolving profile of BABB users and spot fraudulent or uncreditworthy behaviour. Trust is a crucial element of a peer-to-peer network, and AI is pivotal in ensuring everyone on the network is trustworthy.

The BAX Token

BABB uses the BAX token which is implemented on the public Ethereum blockchain as an ERC20 token.

BAX is a utility token which will be used under the hood in the BABB platform, powering the network across all jurisdictions. All service fees and licensing on the platform will be collected in BAX, meaning any individual or business must hold BAX in order to use a BABB account.

As a universal currency, BAX will also have many use cases on the platform, including: ensuring liquidity of P2P currency exchange, facilitating cross-border fundraising, and international payments.

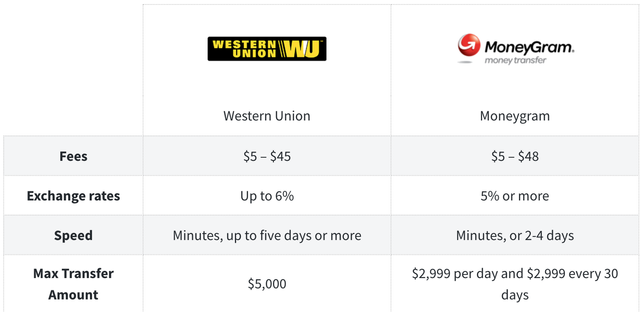

The token can be used to send money around the world much cheaper and much faster than current solutions like Western Union or Moneygram:

much faster than current solutions like Western Union or Moneygram:

Source: Finder.com

With BABB the fees would be pennies and will be sent in seconds.

So you can see the potential of BABB and who it’s current traditional competitors are. However as an investor why would you want to invest in BABB as a company?

Investing in BABB

Lets looks at the fundamentals first before going onto the potential for BABB as an investor.

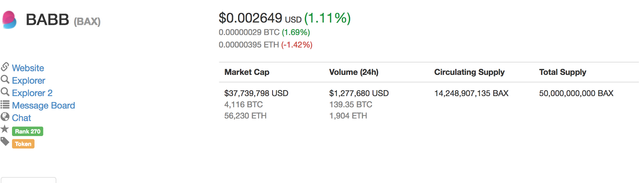

Lets take a look at where things stand as of the 28th April 2018:

Source (Coinmarketcap.com)

Current Market Capitalisation: $37 Million

Circulating Supply: 21 Billion Bax Tokens (Coinmarketcap have the wrong figure)

Total Supply: 50 Billion BAX tokens

Current Price: $0.002649

Right now BABB is on two exchanges: Idex and Bancor. These are decentralised exchanges which are fairly easy to use, but don’t quite provide the liquidity needed for the company to grow bigger, however this is not a bad thing at this stage of the companies growth.

If you look at the volume on the current exchanges there is currently $1.2 million BAX traded every day, as of 28th April 2018, which is amazing for a crypto company of this size, but there is so much more room for growth it’s almost like stealing money for an investor to get in now.

Room To Grow

Okay so what is going to make BABB grow as a company and why is it such a good investment just now?

For investors, there are two key drivers of growth for the immediate future of BABB:

Banking Licenses

Listed on other exchanges

Lets looks at each of these areas and find out where BABB stands just now:

Banking Licenses

At the moment BABB as a company really need to have one of the three banking licenses they are working toward. They can of course still thrive as a company without the banking licenses but most current investors feel we need the banking licenses to grow (After all, the whole premise of BABB is to be a bank on the blockchain)

Bank of England License

Currently BABB are at the Pre-Application stage of getting a license with the Bank of England and talks are ongoing at the moment. I feel the BoE license would have a huge impact in, not only the price of BABB, but for gaining more partnerships with other banks and for getting more more banking licenses around the world.

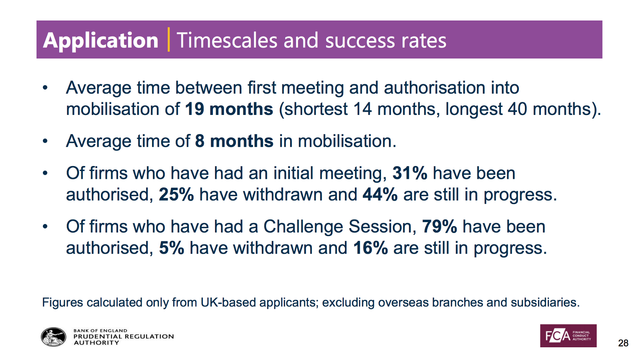

Having looked at the BoE banking application process I wrote to the BoE to get detailed statistics on the success rates of companies who apply for a banking license. Here is what i found out:

Source: Bank of England

You can see from the above that the success rates for companies to be granted a license who have had the initial meeting (BABB have already had the initial meeting) is around 31%. BABB are still in this stage so would fall under the 44% who are still in progress.

The next stage for BABB will be the challenge session and of those companies who have a challenge session 79% of them have been authorised.

With the BoE license there may be a possibility of ‘Mobilisation’ which is a restricted version of the full banking license and would possibly mean that BABB get this mobilisation version quicker than the 14 months spoken about above.

In a recent telegram chat message Paul Johnson (CIO) advised they would NOT withdraw their application at any stage of the talks. We can see from the above that 25% of companies withdrew their application after the initial meeting. This is great to hear from Paul and further strengthens my belief in the company.

Bank of Lithunia

Paul Johnson (CIO) and Adam Haeems (COO) recently had opening discussions with the Bank of Lithuania to begin the process of getting a banking license in Lithuania which would mean getting a Pan European License.

The process and timescales for gaining a banking license here is quicker than the BoE license, although similar in nature to the process of gaining a license from the BoE.

In a recent update Paul and Adam talk about their trip to Lithuania:

My feeling is that they will get their banking license from Lithuania sooner than the BoE, although the BoE license would give them more credibility around the world, it would still be an amazing achievement for BABB to get the Lithuania Banking license.

Central Bank of Bahrain

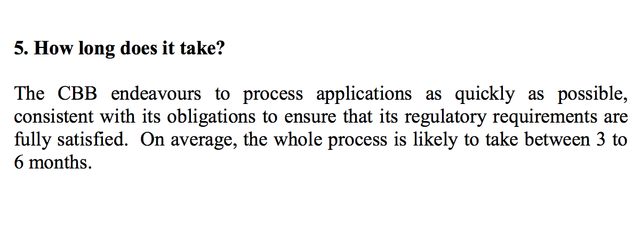

A CBB license application is a little different from obtaining a banking license from the Bank of England or Bank of Lithuania, although still as rigorous.

A great thing about obtaining the CBB license is that the whole process is a lot quicker from submitting the application to getting the license:

Source (Central Bank of Bahrain Application Process)

To further strengthen support of their CBB application BABB have already met with the Economic Development Board of Bahrain and by all accounts the meeting was very positive. BABB also have Middle East investors in the company, so this all looks great for them achieving the CBB license.

See recent updates: Progress Update 03.04.18

All in all getting one of the three banking licenses looks extramely likely and is a case of ‘when’ and not ‘if’.

If and when BABB do get one or all of their banking licenses then we can expect the price of the BAX token to shoot up, which is great for current investors, but also great for BABB as a company to realise their potential as a Bank on The Blockchain.

Getting on More Exchanges

I feel this is also a key driver for increasing awareness of BABB as a company but also for investors.

Being on more exchanges provides more liquidity which makes for a better trading environment for traders and investors alike.

BABB are not too concerned, at the moment, of getting on more exchanges and in a recent update, Rushd Averroes explained why this was the case:

Our approach is to take our time, put the work in, and get it right.

“We take this view because:

BAX trading volume is increasing all the time. Our chances of getting listed are better if we give the volume more time to keep increasing. Higher volume gives us a better leverage and a higher likelihood of being listed.

Our community is one of our main priorities and we always seek to act in the interests of our token holders. This means our instinct is to adopt a cautious approach as the landscape takes shape.

Centralised exchanges are getting hit hard by regulators at the moment and the future is uncertain. As a result of this volatile regulatory environment, the policies of different exchanges are unpredictable and liable to change. We want to see how this pans out.

We are still in the groundwork phase of our project and this time-consuming, behind-the-scenes work doesn’t always lend itself to flashy announcements. We would rather enlist once our progress is more visible.

If we go for a listing and miss it, it’s bad for our reputation and the token. It also reduces our chances of getting listed in the future. You only get one shot at most of the big exchanges so it’s better to take your time and get it right.”

I think this is a sensible approach to getting listed on the bigger exchanges. However that does not mean they are not working toward getting listed on more exchanges. In a recent Youtube update Ricardo Abreu (CPO) introduced us to a lot of the team at BABB including Dean Refaat who advised:

I’m trying to partner with exchanges to get BAX on the exchanges and increase it’s liquidity

You can see the update here:

So this tells me that they are currently working with exchanges and they are working with them, which is great news for current BABB investors.

So all in all if and when BABB get their banking licenses and when they get listed on more exchanges the price of BABB could skyrocket from it’s current $0.0026 price.

What May Be Even More Exciting

This may have been overlooked for many when talking about BABB but one of the most exciting things for me about BABB is Central Bank Digital Currencies (CBDB)

BABB currently have the infrastructure to onboard banks who would like to create their own digital currency i.e. tokenise fiat money.

What is CBDB?

Central Bank Digital Currency — CBDC, also called “Digital Fiat Currency” or “digital base money” is the digital form of fiat money which is a currency established as money by government regulation or law.

Central bank digital currency is different from “digital currency” (or virtual currency and cryptocurrency), which are not issued by the state and lack the legal tender status declared by the government. As such, public digital currencies could compete with commercial bank deposits and challenge the status quo of the current fractional reserve banking system. (Source: Wikipedia)

Central banks looking to launch their own digital currency can leverage BABB’s technology, and host and operate domestically a portion of the federated network. This takes into consideration local jurisdictions and the complexity of the existing fiscal and monetary policies. This sub-network essentially becomes a part of BABB’s global platform, allowing central banks to ensure security, regulations and economic control, while at the same time providing their citizens with the opportunity to transact not just locally on the central bank’s local system, but also internationally on any currency supported by BABB.

This to me is what could fuel the massive growth of BABB in the future and I believe we will hear a lot more stories about CBDBs over the coming months as banks look to the blockchain to update it’s current antiquated system.

What About The Future for BABB as an Investor?

You can see from the above that there’s a lot of exciting times ahead for BABB and I feel we’re only just at the beginning.

Currently BABB have a market capitalisation of $37 Million which is relatively small when compared with the likes of Ripple (XRP), another banking sector crypto currency, with a market cap of $32 Billion (1000x larger than the market cap of BABB).

If we get the banking licenses and get on more exchanges then we can expect the price to rise by at least 10x as this will help to realise their goal of becoming a bank on the blockchain.

BABB also have to get more partnerships to let banks around the world know about their company and their proposition with their banking App. And for the banks to know more about blockchain and what BABB can do for them to integrate them fully onto the blockchain with their own CBDB. I see a lot of partnerships and more institutional investors coming into BABB in the near future.

What will also drive it forward from there is onboarding users to actually use the app and sign up for bank accounts and start using the BAX token as it is intended.

I see this being a process and will take place over months and not days or weeks so the price of BABB will slowly increase month on month and spike as more and more good news is realeased.

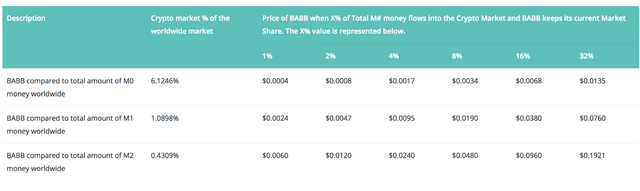

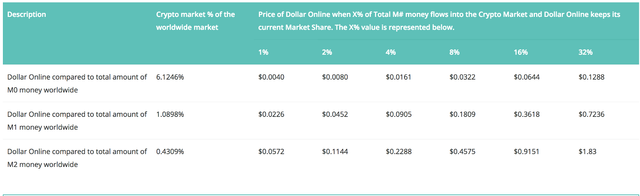

My price prediction for BABB

I hate doing price predictions as nobody can really tell what the price will be, not only of an individucal company like BABB but in the crypto market as a whole.

However, if we assume that BABB get their banking licenses, get more

investors, get the App up and running, and are on a lot more exchanges then I can see the price rising by 10x on that alone which would give it a price of $0.026

However if the crypto market as a whole is buoyant (overall crypto market is $1 -2 trillion market cap) then my price prediction for BABB by the end of 2019 is a very conservative:

$0.78

This would mean a price increase of 300x the current price or an increase of 30,000%

This would mean a market capitalisation of $16.3 Billion, however all of the above criteria would have to be met for that to happen.

Effectively this would mean if you were to invest $3,333 into BABB just now you could potentially be a millionaire in two years time..

And yes I did say this was a conservative figure. This is taking figures from coincheckup and adjusting them to add in banking licenses and more exchanges.

Coincheckup predicts prices based on cryptocurrency as a whole growing and more investors coming into the crypto market. As it stands just BABB would be have a price of $0.19.

Source (Coincheckup.com)

But if we adjust a 10x increase in current price for Banking licenses, more exchanges and more partnerships then the figure I have reached is based on a coin just now being priced at $0.026 which would look like this:

Source Coinmarketcheckup based on Dollar Online Price of $0.026

Conclusion

Please see my full review on BABB, My interview with Paul Johnson, CIO and how to buy BABB on Bancor here:

This is my totally biased opinion as I have invested in BABB, however I have done hours and hours of research and honestly believe we can reach the figures above.

If you want to find out more about BABB as a company please see the links below:

Links to Find out more about BABB the company

BABB - Everyone is a bank

_We are Building the New World Bank for the Micro-Economy_getbabb.com

BABB (@getbabb) | Twitter

_The latest Tweets from BABB (@getbabb). We are building a decentralised banking platform which will provide anyone…_twitter.com

BABB - Medium

_Read writing from BABB on Medium. We're building a decentralised bank providing anyone in the world with a bank account…_medium.com

BABB Community

_Edit description_t.me

BABB

_BABB (Bank Account Based on Blockchain) is building the first world bank for the micro-economy. BABB brings together…_www.youtube.com

Comprehensive review mate. Well done. In regard to what is next for Babb amongst bank licences and exchanges we also have an application release in Q4. Looking forward to the future of BABB. Keep up the good work.

You've put a lot of effort analyzing BABB. Great read, the potential of this project is immense

Coins mentioned in post:

Congratulations @stevenaitchison! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last announcement from @steemitboard!