The Rise of Cryptocurrencies

Cryptocurrencies, predominantly spearheaded by the Bitcoin, have taken the financial world by storm. To my disdain however, the majority of mainstream articles trying to conceptualize this new instrument are ruptured with falsities and endless bias that retract from the actual effectiveness of cryptocurrencies. It is time we holistically address cryptocurrencies and their future potential rather than drip feed and softly educate readers.

The Basics

Cryptocurrencies (or “cryptos,” “coins,” “altcoins”) are an umbrella term used for all digital mediums of exchange that implement a cryptographic framework and security features. In layman’s terms, cryptos are protected by technology that makes it impossible to expand the money supply by more than a predetermined algorithmic rate that is already known to the public. Like actual precious metals, each cryptocurrency algorithm has a roof limit beyond which no more of that specific cryptocurrency can be produced (or “mined”).

Furthermore, cryptos are completely in the “cloud,” meaning that they have no physical form but only a digital/virtual value. The first crypto ever created was, as expected, the Bitcoin. Anyone who purchases a Bitcoin has a virtual Bitcoin wallet that automatically synchronizes all Bitcoin transactions with the Bitcoin database. Users are constantly hosting this transaction log much like torrents are peer hosted, making it near impossible for authorities to crack down upon. Due to this synchronization, all transactions that take place through one’s Bitcoin wallet portal are automatically logged on the hosted transaction log and protected through cryptography. Money can instantly be sent between wallets and more importantly, each transaction comes with a private key — a secret code allowing users to prove ownership of Bitcoins.

A few take-home points are to be made here;

— The roof limit of a crypto can’t be modified after its source code is made public.

— Wallet to wallet crypto transfers are almost instantaneous.

— The source code is foolproof, crypto theft usually occurs when hackers gain access to private keys stored on users’ computers. This is just like an actual bank robbery and not an inherent problem with the cryptography.

— Noting one’s private key on a physical piece of paper or simply memorizing it is all that’s needed to claim one’s cryptos. This eliminates the risk of crypto theft via computer hacks.

Contemporary Appeal

Today, though there are over a thousand cryptocurrencies— taking Bitcoin’s original source code and tweaking it — only a handful are accepted by retailers as a method of payment. The top three on the list are Bitcoins, Litecoins, and Peercoins — considered the more “stable” of the cryptocurrencies due to their scripts fast approaching its mine limit.

Unsurprisingly, fluctuations in the price of the Bitcoin generally drive faith in all the other cryptos. Since it’s launch in 2009, the price of the Bitcoin has climbed from less than a $1 to over $1000. Recently, holding crypto currencies as a speculative asset rather than an actual currency per se has become far more attractive to the financially savvy. With no government or “anchor” backing up cryptocurrencies, the only foundation that cryptocurrencies have is people’s faith in their value. In other words, solely the market mechanism determines the price of cryptocurrencies. At my time of writing, that faith is worth $780 per Bitcoin and this doesn’t spur from the Bitcoin’s intrinsic value, but from what it allow users to do.

The value of Bitcoins. — bitstampUSD

The relative nascency of cryptocurrencies along with their unprecedented rise in popularity has caused applicable legislation to lag, and people have reaped the numerous benefits. Whether it is trading cryptos on an exchange, performing arbitrage, buying drugs online, or even something as simple as moving money across borders and avoiding the many administrative and transactional costs involved. Indeed, some percent of all Bitcoin activity happens on the gambling site Satoshi Dicer. People want to use their own currencies, but they also want a quick, effective, and anonymous way to make payments and profits internationally.

Critics & Future

Critics of the Bitcoin often cite the liquidity problem involved with Bitcoins, their qualms arousing from the fact that there is an upper cap to the number of Bitcoins that will ever be present in the market at one time. Much like gold, the only true negative to this is the inconvenience of making transactions in extremely small increments if the price of Bitcoins is driven extremely high by demand (from speculation and expectation).

Online crypto exchanges act just like currency exchanges, allowing users to convert between and/or within fiat currencies and cryptocurrencies. However, these exchanges are also frequently criticized for lags when liquidating into money, while advocates blame unaccommodating commercial banks and not the actual efficiency of the Bitcoin system. There is also the constant threat to traders that miners (advanced users processing wallet to wallet transactions in return for crypto-coins) are hoarding a share of coins that they mine. This leads to significant crashes when colluding miners liquidate their cryptos en masse and repurchase once the price has fallen enough due to panic. Unlike the real foreign exchange, there is little to no government regulation for such speculation and hawkish trade tactics.

Cryptocurrencies’ more humble uses sparks a relatively convoluted debate, as poor folk find haven in the Bitcoin as a medium for sending remittances without having to cope with heavy fees. This is a significant part of the backdrop that has fuelled Bitcoin’s popularity in developing countries such as India and China. Realizing this ripe new market, South Africa’s Standard Bank is in the process of implementing a new online Bitcoin exchange. This revolutionary move shifts users’ dependence away from patchy third-party exchanges to a commercial bank backed by investment, liquidity, and a government. Though this is bad news for the currently deeply entrenched third-party exchanges, it is excellent for users who can now reap the benefits of enhanced confidence in the Bitcoin system.

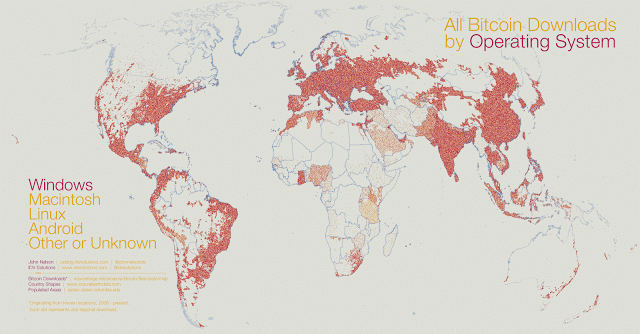

Bitcoin downloads by Operating System.

The greatest boon that Bitcoin has slipped into the current financial infrastructure is its source code. The source code is now a low-hanging fruit that can be easily plucked, reproduced and manipulated to create countless cryptos. Whether the government and financial sector like it or not, there will be cryptos as long as the internet is up and running. Unfortunately for crypto junkies, authorities are well aware of this shortcoming and have instead taken substantive domestic action to regulate crypto transactions. Just this past December, China with its bulwarking capital controls was quick to drop the hammer and ban all crypto transactions within the mainland. Similarly, Canada is moving towards restricting crypto transactions due to the plethora of laws it allows users to circumvent. What remains in question is how authorities will implement legislation that effectively restraints crypto transactions.

Regardless, optimists and internet warriors are not disheartened — just this week Montreal opened its first Bitcoin ATM to ease purchases of Bitcoins and Bitcoin ATMs are now popping up all over the United States. Satoshi Square serves as a local cryprtocurrency liquidity outlet only a block away from the New York Stock Exchange. Call the Bitcoin a speculative asset, a black market currency, a currency exchange medium, or whatever creative name serves one’s purpose — its high price can attest to its high demand and abundance of uses.

For those interested in purchasing Bitcoins or any other cryptos, a few useful links have been provided below.

Crypto Purchase/Exchange;

https://www.vaultofsatoshi.com

http://btc-e.com

https://www.mtgox.com

https://quickbt.com/ca/?

Price Trackers;

http://bitcoinwisdom.com

http://coinmarketcap.com

Bitcoin Wallets;

https://bitcoin.org/en/choose-your-wallet

Bitcoin FAQ;

https://bitcoin.org/en/faq#hasnt-bitcoin-been-hacked-in-the-past