Why AXL Is Getting Popular

Some Trending Features Of AXL

Interoperability: Interoperability is the strong point of the AXL DEX. We will fully support multi chain smart contract protocol through poly network. Currently, we support the Ethereum chain and Binance smart chain. Users with crypto assets on these platforms can carry out their trades without needing to switch from one chain to the other hence reducing costs of operations drastically. An added advantage is that if the user feels a particular Blockchain is not efficient enough, cross chain support makes it easy for the individual to switch to a different Blockchain that may be faster or may have lower transaction fees. After the staking concludes and the minting of our NFT characters are done, development of the decentralized exchange will begin in earnest.

Buybacks, Burning, and Burn Mechanisms:Burning AXL token would mean the destruction of an AXL token as a means of retaining valuation of the AXL token. Buyback and burn programs will help support growth and price stability of the token value and this will make it more attractive to investors. Buyback and burn methodology will also result in increased liquidity and reduces price volatility. This brings about a friendly trading ecosystem that will incentivize long term growth to the platform, token holders and help stabilize price of AXL token. DEX fees and interest accrued from the lend & borrow model will help us buyback AXL/AXLS tokens and burn them.

Secondary use cases: AXL tokens will be directly tradable on AXL DEX for other supported tokens while cross chain interoperability will allow AXL tokens to be exchanged for AXL token on another Blockchain speedily and with less costs.

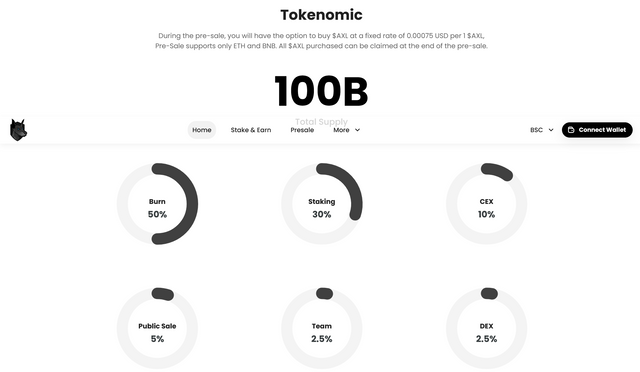

Tokenomics

- Token Name: AXL INU

- Token Ticker: AXL - Total token supply: 100.000.000.000

- Total IDO supply: 25.000.000.000

- Token pre-sale price: 0.00075/AXL

Yield Farming: The AXL platform will enable yield farming for those interested for generating high returns in the form of additional cryptocurrency. This incentivizes liquidity providers to stake or lock up their crypto assets in a liquidity pool based on smart contract These can include a percentage of transaction fees, interest from lenders or from a governance token. The yield from it, will then be paid out to those who have made deposits and shared accordingly.

Staking: The AXL ecosystem will allow staking as a way to earn rewards for holding certain cryptocurrencies. If the token allows staking, part of an individual’s holdings can be staked and the individual will earn a reward over time. The stakes are held in a staking pool and each portion of an individual’s holding will be put to work through a consensus mechanism for ensuring that all transactions processed are duly verified and are secured. Staking a crypto asset in this case will allow for it to also be a part of the ‘proof-of-stake’ process.

More Information

Web: https://www.axltoken.com/

Twitter: https://twitter.com/axltoken

Reddit: https://www.reddit.com/r/AxlToken

Discord: https://discord.gg/axltoken

Telegram: https://t.me/AxlToken

Author :

Bitcointalk Username: Vipersia

BSC address : 0xB150e75d32a36eea5c513E51b8B5b4620eFC1328