Crypto Analysis Series - Part 3: Augur and the Future of Decentralized Predictions Markets

Intro

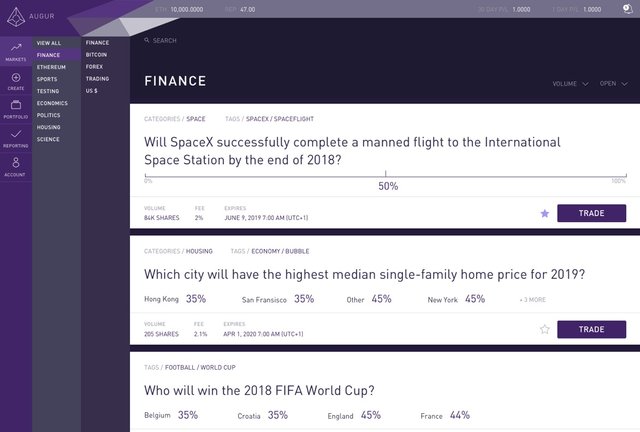

Augur is a decentralized, Oracle-based prediction platform that allows users to create mini-markets asking for predictions, which the users of the market can back by the native cryptocurrency REP to show confidence in their individual predictions. It is built on the Ethereum platform, which makes the application of prediction based Smart Contracts easier. Smart contracts help in the timely execution of predictions, payouts to victorious predictors and real-time tracking of data linked to the contract using an oracle.

“Augur is a trustless, decentralized oracle and platform for prediction markets. The outcomes of Augur’s prediction markets are chosen by users that hold Augur’s native Reputation token, who stake their tokens on the actual observed outcome and, in return, receive settlement fees from the markets. Augur’s incentive structure is designed to ensure that honest, accurate reporting of outcomes is always the most profitable option for Reputation token holders.” > - Jack Peterson, Joseph Krug, Micah Zoltu, Austin K. Williams, and Stephanie Alexander Augur whitepaper

Breakdown

Augur is closely linked to the economic philosophy of “The wisdom of the Crowd”, meaning that for any given scenario, the outcome can be predicted with the help of the individual predictions of as many informative market participants as possible, rather than relying on the probable intellectual knowledge of the few. Augur presents itself as an update to the failed business model of centralized prediction markets that constantly faced criticisms in the past. There was an article by Barry Ritholtz, the CIO of Ritholtz Wealth management back in 2008 where he explained all the possible economic and regulatory reason why predictions market will always fail. The article contains valid propositions, but all of the criticisms are with respect to the outdated business model of centralized prediction markets. Barry couldn’t possibly have foreseen the advent of a decentralized mechanism that Augur was implemented on. The curators of Augur markets are volunteers that revive “oracle fees” as compensation for their responsible work.

Use cases

Tens, if not hundreds of possible use cases have been screened out and implemented since the main net roll out in July 2018. Hundreds of markets within Augur have sprung up, ranging from sports to politics to even memes allowing users to make decentralized predictions and even profit for the successful ones. It allows market makers to successfully implement their vision or an idle user to profit off of simple short-term predictions, or even large entities to get a general view of the market.

- Investing in any asset or security or cryptocurrency for that matter can sometimes be painstaking, involve huge amounts of liquidity and requires absolute knowledge of the market conditions. Regular, non-periodical investors who cannot always stay updated with the market conditions can make use of the Augur platform. Staking on predictions markets on Augur does not require the need for physically holding the asset, which reduces risk. Also, any amount can be used to stake, thus reducing the liquidity problem for small-time investors.

- Corporation and large entities can make use of Augur to get a general or specific view of any questions they want to be answered. For instance, a technology-based company can put up a prediction market for the next technological revolution, for which the community can make sound bets. The category with the maximum stake can be perceived to be the right step to take, as it overwhelmingly carries the communities vision.

- In an interesting discussion on the team’s Slack, one user described how Augur could be used to incentivize weight loss by opening a market based on a target weight and date. Similar time-based incentives on a much larger scale can be put up to encourage fast and timed growth.

Criticisms

Even though Augur has been a welcome update to the previous outdated model of prediction markets, it faces criticism that is relevant to its time. There have been many ongoing discussions in and around the community that talk about possible drawbacks and scrupulous outcomes the market could lead to.

- The most relevant criticism is thatcher Augur is a decentralized market on the blockchain, it can be accessed by anyone. This increases the number of market freeloaders, people who benefit out of the predictions resolved by Augur, without having any part in leading towards the outcome. Users like these follow the market closely, and as soon as they find a profitable prediction that Augur participants have predicted, they jump in markets outside Augur to take away profits without much risk or stake.

- Some criticisms of Augur are the ethical concerns that it could bring along because of its decentralized nature. For example, right after the rollout of the main net, a market sprung up that asked for a prediction that required users to stake about the probate assassination of Russian President Vladimir Putin before 2019. The decentralized and anonymous nature of Augur disallows it to interfere with the market, which leads to different ways.

- Certain insider information held by a particular user can allow the user to profit immensely out of a rigged prediction that the market has no idea about. Unaware users would probably bet for the most logical outcome, while the insider knows that the outcome is otherwise and snatch value without others knowing about it.

Take away

- Untapped markets that contain no incentives to upgrade, or contain high barriers of entry can spring up to show their value on the Augur markets. If a user can think up an event, it can be made into a market.

- Augur is a definite upgrade to the existing prediction mechanism that allows the entire community to profit out of there wisdom of the entire community

- Some people say that “prediction market” is just another euphemism for Gambling. Thus the question about the legality of Augur in certain jurisdictions still remains a question.

- Users can risk whatever funds they feel comfortable with. This allows them to be involved in this expensive market, without having to fork up large amounts of funds to purchase a property. The Augur platform even provides the ability to short real estate prices, by creating a prediction market.

- Certain ethical concerns still remain around the decentralized and unrestricted usage of the platform. We have to wait and see how the market can rectify this problem.

- It is important to note that even with all the opportunities that Augur brings in, it is still susceptible to various unethical outcomes that have no reverse or censorship mechanism. As like everything in the crypto ecosystem, it is a two-edged sword.

Sources

- More Prediction Market Criticism

- Why Prediction markets fail

- Augur (software) - Wikipedia

- Augur: a Decentralized Oracle and Prediction Market Platform

- Augur’s big problem is not the assassination markets — it’s being a bucket shop

- Augur: The World’s Most Undervalued Crypto Project

- Crypviz Cryptocurrency visualization

- Reasons To Be Excited About Augur

- Augur – a mysterious start-up for predictors

- The Hype, the Horror, and the Letdown of Prediction Market Augur

- The Case Against Augur

- SB

Crypto Analysis Series

- Part 1 - Basic Attention Token and How It's Revolutionizing the Internet

- Part 2 - Golem Network Token as a Potential Giant Killer

Previous posts:

- Bitcoin Technicals: In Depth Breakdown of the Current Move

- The Scalability Trilemma

- Online Retailer’s Incentives for using cryptocurrencies as a medium of exchange

- Bearish Sentiment is Almost Gone: Bitcoin Technical Breakdown - 21 November 2018

About Reverse Acid

)

Be a part of our Discord community to engage in related topic conversation.

I just hope it doesn’t give in and turn into more of a betting platform than a prediction platform it strives to be, could have interesting use applications if it sticks to those principles

Posted using Partiko iOS

There’s a thin line separating the two. The team behind Augur, under the guidance of Vitalik, is trying hard to let the community realize all the potential the platform carries. But inconsiderate users just see the it as another vehicle to pick up undue profit out of petty and unnecessary markets.

Posted using Partiko iOS

Hi rever

@hobo.media upvoted you for $0.01 and resteemed your post, because I'm wicked cool like that. If you want future random upvotes/resteems just follow.

Upvoted and resteemed by @hobo.media. Join the exciting new upvote subscription service waiting list. Be one of the early subscribers for better ROI!

Check out info here:

Profit from the Hobo Delegation Group!

Thank you for using Resteem & Voting Bot @allaz Your post will be min. 10+ resteemed with over 13000+ followers & min. 25+ Upvote Different account (5000+ Steem Power).