BTC hits $1,000 in India. How is this possible?

Cryptocurrency has always commanded a premium in India, though usually it was an insignificant one, in the ~5% range. However, since the demonetisation of INR 500 and INR 1,000 notes (bills for American steemians), both BTC and ETH have soared.

Let's step back a bit - about that demonetisation. There have been a few articles on Steemit too, but in general there seems to be a lot of misinformation outside of India. Firstly, this is not a brute force attempt to go cashless or a war against cash. The old INR 500 and INR 1,000 notes were immediately replaced by new INR 500 and INR 2,000 notes. The stated goal of this substitution was to curb corruption, laundering and terrorist financing. NOT a "war on cash". Of course, this doesn't address the offshore accounts where the vast majority of the above nefarious activities happens.

In India, this has been a complete mess. The ex-Prime Minister - Manmohan Singh - also the man behind the radical free market economic reforms in the early 90s, sums up the situation well, calling it "monumental mismanagement" and "organised loot and plunder". It's a relatively impassioned speech from the calmest politician in the country.

As for the ground realities - in some major cities, withdrawing cash from ATMs has become an experience of drudgery not much different to that of an Apple fanboy lining up for the new iPhone. After standing in queue for an hour, cash runs out for the next half a day. Banks were overwhelmed with queues running well outside of the branches. New INR 500 and INR 2,000 notes are in such ridiculous short supply that exchange for older notes have been stopped now - we can only deposit them. There's much more to it, but in short, it's a complete mess in some cities.

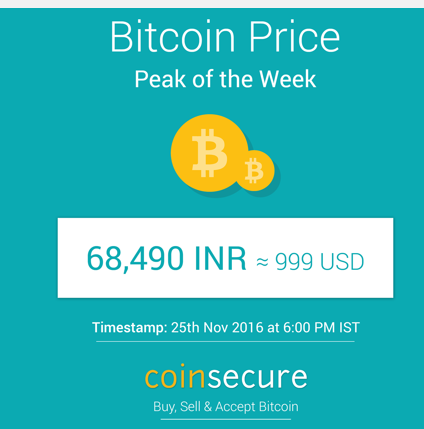

Anyway, back to cryptocurrency. This has led to a huge surge in demand for both BTC and ETH. (As far as I'm aware, these are the only two currencies currently on Indian exchanges.) Yesterday, BTC hit $999.

Meanwhile, ETH is up to $12.5.

In short, this is an astounding 35% over the prices at US exchanges.

So, here's my question, and the reason for the tag. How is this possible? I understand these markets are separate, and there's always different prices for regions. But nothing this extreme.

Surely arbitrage opportunities would have balanced them out? A trader who has accounts at both Indian and US exchanges can keep converting BTCs in an endless loop, essentially doubling their money ever couple of hours. Buy BTCs in US$, sell them for INR, send that to US$ etc. Accounting for all fees etc, it's an easy 25% profit each round. Now, I know not everyone has accounts at exchanges in both countries, but I would have expected the markets to respond - like any fiat currency market would in such a scenario. It's been over two weeks now, the BTC-INR market keeps surging, with zero response from the US markets.

So what's happening next? When will the US markets respond?

As an aside, here's an excerpt from the (now quite obsolete) Whitepaper.

Consider this post, using #asksteem, an attempt to engage #2 on that list.

surely something has to give one way or another. very interesting to see where this price goes in the coming weeks. thanks for the info.

Yes, that's what I thought a couple of weeks ago! It's just continued going up. Let's see how it goes - $1k is an important mark, maybe there'll be a response now.

The simplest answer to this question is that BTC did not hit $1000/btc in india. It hit 68490 INR. But that probably needs some explanation.

When you say BTC costs $1000USD in india, what you are really saying is that some exchange told you that the most recent transaction they did was at an exchange rate of 68.490 INR/USD.

What it isnt telling you is that that it would actually cost much more that 68490 INR for 1000 USD. Because there would be significant transactional costs involved in using INR to buy USD, then getting the USD onto a conventional bitcoin exchange.

You are correct that under normal circumstances, this disequilibrium would be quickly normalized by arbitrageurs. However, in order to complete the arbitrage, they would have to do the following.

In this particular case, theyll get bolloxed either by 4 or 5, depending on where they are at, because its quite expensive at the moment to move cash out of india (thats basically why indian business use companies like mine when they want to sell stuff in the USA)

Of course. The point here is - surely it wouldn't cost 35%. For example, I can right now send USDs for INR 71 via PayPal to a US account holder with a click of a button.

Its not just about buying USD with INR. Its about buying USD with INR IN INDIA then getting that USD to someplace where you can get it onto a non indian BTC exchange.

You need two ends to do this, the indian end and the US (or other non indian country) end. At some point, the indian end has to get cash from his titties to the US guys titties.

So yeah, you can USD's for INR. But you can't get the proceeds from selling the bitcoin on the indian exchange into your paypal account. Because theyre going to an indian bank account, and they need to withdrawal to an indian paypal account.

Which can't send international payments, because of regulations. The same regulations stop you with WU, MG and most conventional methods of getting money across borders. You could roll it into a wad, put it in your rectum and try to get it out of the country on a plane, but since they only have small bills right now that would be pretty uncomfortable.

don't call me shirley.

For the typical man on the street, if it was possible at all to get money out (which im not sure it would be for anything but relatively small amounts) that seems about right-ish. I charge between 15 and 45%, depending on the client, the country and the direction money has to move. We don't do a ton of business in india, and all of it is money moving in the wrong direction (and none of my personal clients are there) but its definitely one of the most problematic countries we would be willing to work with.

For someone like me, with access to legions of permissive merchant accounts, no moral compass, and a willingness to get creative with fincen, it might be doable. I actually wasn't aware this arbitrage opportunity existed until i saw your post. Im working on finding a way to make me some cash off of this. At the very least, our indian clients are going to get a rate hike.

So why aren't you taking this chance? Try with small amount first and if the whole cycle is successful, then increase the amount and repeat.

Would be curious to hear the result of this.

Earlier I saw this post - https://steemit.com/bitcoin/@candy49/mystery-solved-as-to-why-the-bitcoin-price-in-india-is-higher-than-the-price-on-western-exchanges

But still, I don't understand. It would be good business to be able to go around the loop and set a better price for others to buy.

I don't get it. You don't need to use the hawala system to send money. There are a gazillion different ways to send INR to USD - PayPal, Western Union, Moneygram, SWIFT etc. etc. Each time, you have to pay fees, taxes, etc, but each time you still make a handsome 25% profit.

The hawala system is mostly for black money, laundering, tax evasion etc.

I'm going to be in India in December and probably could report how it's working than ;)

So far I've checked on LocalBitcoin, if I want to sell BTC the price range is something like 800-920$ ( and about 1000$ if I want to buy )

But the only available mode of payment for BTC seller is "transfer to account in Indian Bank" ( no credit card or Western Union options provided, also you can buy BTC with Western Union ) Also as far as I know it's possible to get an account in Indian Bank even with tourists visa ( you have to provide a rental contract) but probably due to this notes shortage the money would be to hard to withdraw.

India has capital controls. You can send money to India freely, but you are limited as to how much money you can take out of India.

Also, they reckon that half of all money in circulation is black money, so sending it via official channels will get get you caught and fined. If taxes + fines are greater than the hawala fee, then it's cheaper to go hawala.

Maybe there just aren't that many people set up to take advantage of it, yet. You would need an Indian bank account, I assume, to retrieve the Indian currency from the exchange. I would guess the high % difference to reflect the lack of participants cashing in on the opportunity. Arbitrage opportunities being what they are you would think this can't last.

I suppose that's the explanation - there are very few people with accounts in both countries. However, with an opportunity this lucrative, I'd have expected traders to take the initiative and get it done. Like I said, it's been nearly three weeks now - no response.

Three weeks is a long time for such an opportunity to exist. I guess the costs involved in benefiting from it have kept it going. The other question too is - what level of volume exists in the Indian BTC market?

Excellent question. Sadly none of the exchanges here list overall volume over a period of time. However, one exchange, Coinsecure, is listing 50 BTC sell orders. That's the closest I can get to volume... It's still a fairly small market, but the price is real.

Resteemed

This post has been ranked within the top 10 most undervalued posts in the first half of Nov 26. We estimate that this post is undervalued by $11.68 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Nov 26 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Demonetization is the main reason behind it

You are right @liberosist. The old currencies of INR 500 and INR 1000 are replaced with new currencies of INR 500 and INR 1000. But, right now, the government minted only INR 500 and INR 2000. INR 1000 has to be minted soon.

It's just going to be INR 500 and 2,000 going forward. Maybe there'll be a new INR 1,000 note in the future, but there has been no official announcement as far as I know.

Whoa!! This is awesome! I am going to sell some of my coins. Thanks for the news.

So is it possible to take advantage or there are money controls? Otherwise I assume that anyone who has a buddy in India can send them a few Bitcoin, they make $350 benefit of each BTC to split between the two, just off the top of my head...