ASICs and the price drops are killing GPU mining

The profitability of crypto mining falls, which translates into a decline in demand for equipment, for example, top-end video cards. Our sources confirm that prices for GPUs may fall by 20% within the next month.

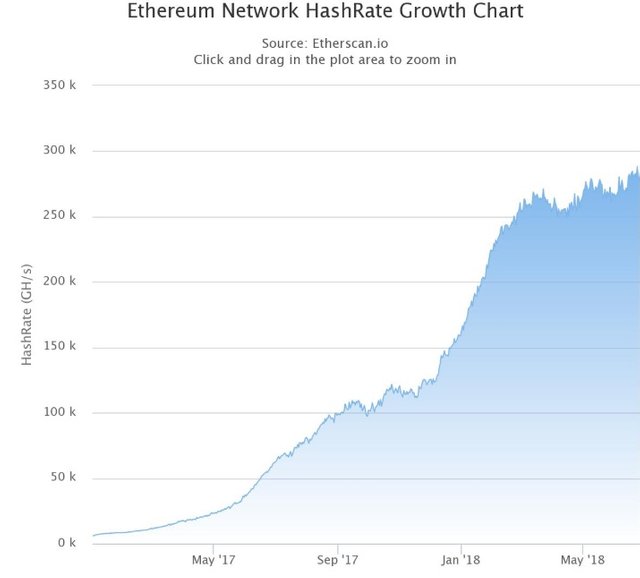

In the Asian news source, DigiTimes noted a sharp decline in demand for mining equipment. Cryptocurrency mining was one of the main trends of the year, so the hashes of networks grew at a tremendous rate. The net of the Ethereum network, the second largest cryptocurrency in the world, has grown more than 25 times over the past year. In addition, equipment prices also rose sharply to unattainable values for gamers. Nevertheless, due to a drop in prices for cryptocurrencies combined with a significant increase in the complexity of production, the growth of mining almost completely came to naught.

The growth of the Ethereum hash shows a significant correlation between the price of the asset and the demand for mining. The main manufacturers of equipment for mining - Nvidia and AMD, overestimated the future demand for video cards, which in turn led to the accumulation of equipment in warehouses. Nvidia has accumulated more than one million video cards in warehouses. It's not just the price, but also the beginning of ASIC-Miner deliveries from Bitmain for Equihash and EthHash algorithms that easily outperform the GPU chips. ASIC-devices give an exponentially higher hashed in comparison with video cards, which makes the main option for miners. Given this background, we can assume that before the end of the year shares of Nvidia and AMD companies will show a significant drawdown, and the secondary market will be filled with a huge number of unclaimed gamer video cards.

Posted from my blog with SteemPress : https://coinatory.com/2018/07/06/asics-and-the-price-drops-are-killing-gpu-mining/

I think we need to go away from highly resource intensive blockchains to coins like Steem, or even filecoin. There's so much you can do on the blockchain without wasting lots of energy. I'm not saying completely go away because that's just not feasible.

It's good idea, but this cannot be done in the nearest future. The price of electricity and of the mining equipment are the things that make cryptos more "linked to the real world" than US Dollar or Euro are. Mining dictates the price of cryptos. Miners won't sell their precious ETH of BTC cheaper than it costed for them to get those coins.

Exactly same thing happened to USD or most of the national currencies that we have today - on early stages, every bill was promised to be exchanged to gold equivalent. Governments promised that, so people believed in these pieces of paper. This made the bills valuable, nothing else.

But later on, people forgot about this and the mass adoption replaced the need in some strong promise. Same thing will happen with cryptos one day. Miners won't be needed to provide physical linkage to some real-life values.

That's an excellent analogy. I think more people would like crypto currencies if they really thought through how absurd fiat currencies are. A blockchain is fundamentally a very large piece of code that acts with some degree of consistency, and can't be controlled centrally (generally). That consistency and reliability is very very valuable. Fiat currencies operate in somewhat of a similar way, because their value is defined by the industry of their respective country, but the difference is the characteristics of fiat such as supply are defined by bureaucrats not an algorithm.

there's an article coming, called "Global Data Analyst: crypto supporters are liars. But are they?"

You would like it

I read it and I very much did like it. I'm not too worried about big shots spouting FUD. Crypto isn't a fad, it's a fundamental technological shift that will almost certainly change the entire world socially and economically.

... if they let us