Aptos grew fivefold in a month. Traders bet on the cryptocurrency to fall

Aptos is an ambitious project from the developers of the failed Libra cryptocurrency, whose release was opposed by the European Central Bank in 2019. After separating from Facebook, the development team attracted hundreds of millions in investments to launch a new Tier 1 blockchain. The project was supported by Andreessen Horowitz's fund, Coinbase Ventures, FTX Ventures, Circle Ventures, Jump Crypto and other major market players.

Image source: StormGain.com

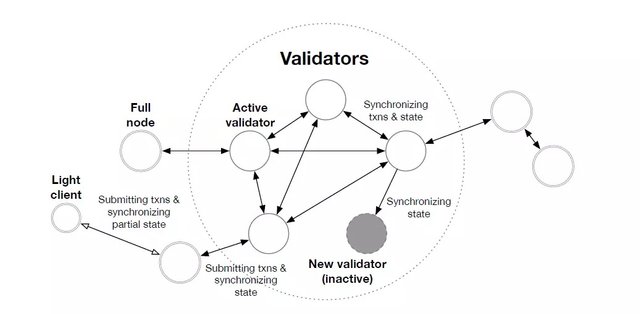

Aptos is marketed as a 'Solana killer' due to its super-fast transactions. The test network managed to achieve a speed of over 130,000 transactions per second. This and other technical features are described on the official blog.

Image source: habr.com

On 17 October 2022, the network was launched, and on 19 October, APT was listed by major cryptocurrency exchanges. Because of the high speculative demand on some exchanges, the peak price at the opening of trading exceeded $50.

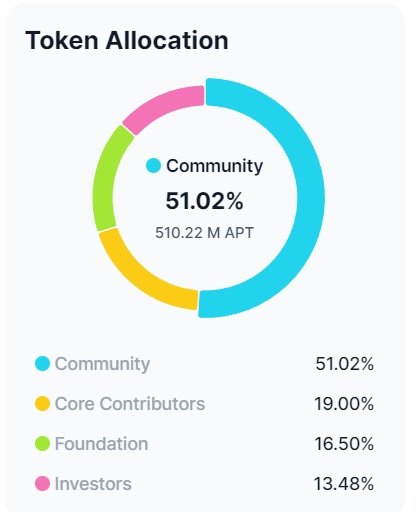

But long-term investors should be cautious. The risk lies in the pre-listing financing rounds, where investors received a significant share of APT. A lot of coins were kept by the developers, as well. According to users' calculations, about 80% of the supply remains in the hands of large participants, while no more than 2% was distributed during airdrops. The official breakdown is as follows:

Image source: dropstab.com

49% of the funds are owned by the main investors, the fund and the developers. 51% belonging to the community is still controlled by the Aptos team. These funds will be distributed over 10 years for grants and other network development initiatives.

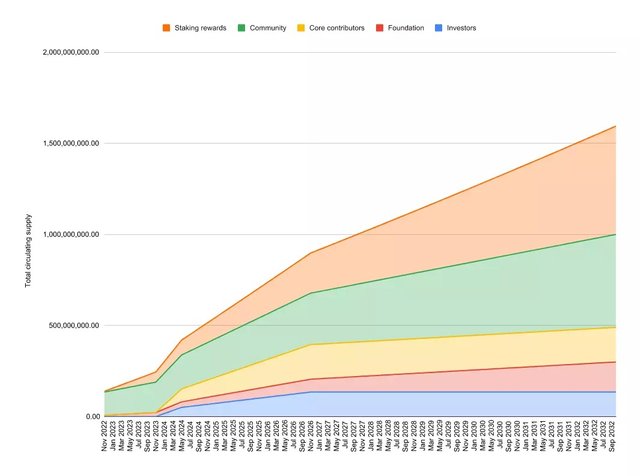

Another warning factor is the large volume of staked funds. The price is now rising on hype and an ongoing promotional campaign. According to Coinstats, only 16% of the 1 billion minted coins are in circulation. The rest will be unlocked according to this schedule:

Image source: habr.com

Currently, 4.5 million coins, or 0.45% of the total supply, are unlocked every month. Starting 12 November, the pace will be increased to 24.8 million coins (2.48%).

APT isn't the first coin to follow this path. If blockchain fails to surprise the community with impressive growth rates, the released supply will lead to a significant price drop. Foreseeing such an outcome and anticipating profits from APT's drop, traders of perpetual futures contracts are actively opening short positions. Because of the significant dominance of the bears, the funding rate broke the 2023 low, dropping below -0.1%.

Image source: coinalyze.net

It's possible that the increase in the price this year to $20 is due mainly to the creation of artificial demand, as expressed in the emergence of new addresses network activity is far from the October highs. With the vast majority of coins remaining staked. In private presales, investors bought APT for $1 or lower, which creates the temptation to sell the reserves after unlocking.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Yet, long-haul financial backers ought to be careful. The gamble lies in the pre-posting supporting rounds, where financial backers got a share of Able.