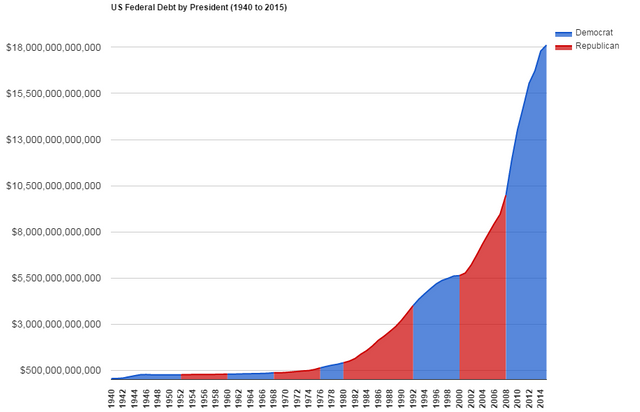

[Nervous about the upcoming financial crisis?] Why You Should Consider Purchasing Gold.

Why invest in gold bullion?

There are numerous reasons why you should purchase gold. You can secure your savings, combat the effects of inflation and dangerous monetary policy, and protect yourself against coming banking collapse. Ride the current gold bull market all the way to the top, before it is too late. There are various reasons to put money into gold. One of the most notable reasons is gold bullion is a hedge against inflation. The primary factor behind the rising inflation rates is the large amounts of currency created out of thin air. Gold bullion is a means to protect yourself from inflation's devastating effects. Each time more money is added to the economy, the buying power of all of the money in circulation decreases. This occurs because there is more currency with the same amount of goods and services.

Inflation hurts everyone

Inflation seems to hit supermarkets more than other areas of the economy. This makes food and necessities less affordable as each year passes. Unfortunately, lower income people are affected the most. According to official sources, inflation is around the 4.2% mark annually. The truth is that inflation is greater than this amount. Since the average person is spending more of their money on things which are inflating in cost, like food, fuel, housing and education, the true inflation rate is around the 10-20% mark. When you invest in gold bullion, it is implied that the money you've put in that gold is protected from inflation.

Gold is rare

Since gold is in limited supply, its value can't be inflated by increasing its supply. When the amount of fiat currency like the US dollar or British pound increases, the value of gold goes up as well. Throughout history, Gold has always maintained value. Having gold investments, particularly physical gold coins, protects you from inflation and allows you to keep your buying power. For me, that's reason enough to invest in gold bullion.

Rising price.

Gold is set to increase with a growing interest from nations like China, India, and Russia. After the subprime mortgage crisis and a lack of confidence in paper money, gold seems like a safe bet. As of today, gold is hovering around $1300 US dollars an ounce. The current gold bull market is young, and a lot of trusted analysts are predicting that $2000+ per ounce isn't unlikely. Some have even said that $5000 per ounce could be possible.

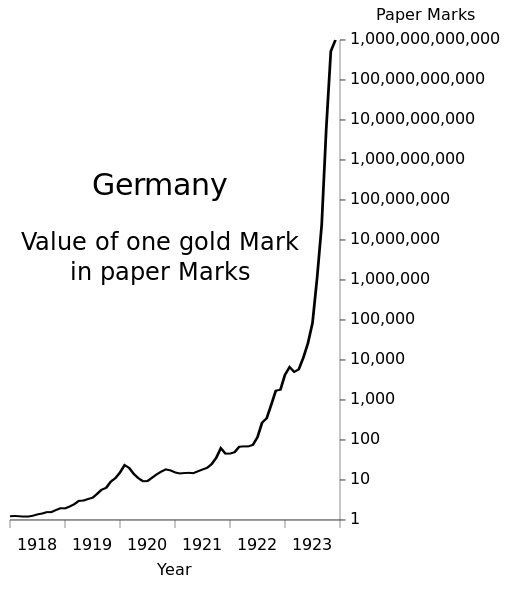

Germany

Throughout history, fiat currencies have collapsed and as a result, the price of gold reaches astronomical highs. One example occurred in Germany when the German marks collapsed and went into hyperinflation. Over a five-year period, the price of gold in German Marks went from 1 German Mark to 1,000,000,000,000 German Marks.

Disclaimer

I am not a professional investor and you should not risk any money you can not afford to lose. Gold shouldn't be seen as an investment that is going to make you rich. It should be seen as an investment that is a protection of your wealth.

If you have enjoyed please upvote, comment, and follow me.

Sincerely Yours,

@johnnyyash

Guys, I like the post and agree with the majority of thoughts. However, number of facts to consider :

since 2008 US government printed a lot of money, same for ECB, yet we see deflation fears. Even more remarkable example here is Japan. This is to your comment that more money means inflation.

German exampel here is irrelevant as their currency depreciated not just against gold but against other currencies as well. Over the same period price of Gold was unchanged for example in USD.

And finally, just a reminder, that following the start of Reagonomics (early 80's) - gold became commodity and is now very volatility because of headge funds. It should be considered as a long term investment rather then quick buy / sell. In short term it may very well go down.

Silver is more useful and more undervalued. Look at the ratio being mined gold vs silver compared to the price disparity.

Good point. I own silver as well and it's way cheaper than gold.

I sold my gold and bought silver when the ratio was in the 80s. Will switch 50% back when it is in the high 20s. Good ol arbitrage

Want proof gold is a true measure of value added currency, in Star Trek they use GOLD pressed LATINUM as the only currency that cannot be cloned, replicated or mass produced like fiat currency...

Now STAR TREK is something you can take to the bank and bank on ! ! !

I like both, however if you need to move 50k of silver is not as easy to bring with you as 50k in gold. And let's face it people, they both feel good in hand.

PS I travel a lot and always carry small gold and silver coin, so whatever happens I may find a way home... and it hides nicely like small change in a jacket pocket (zippered).

Love the way the coins feels. Even silver quarters are way cooler than copper quarters.

I have them in a small bag (I do not care about wear as they would be more low key beat up), but man do they make a sweet ring when they move around. That sound alone screams MONEY.

Lol, I know exactly what you are talking about. :D

Nice post... I nominated you for Project Curie :)

Thank you.

I like interesting content like this on Steemit. I've never put much thought into gold/silver, but now I may.

It took me a long time to get myself to buy some even though I had a huge interest in it. The first step is getting one coin either silver or gold. Silver is cheaper so it may be good to start here, or buy less than an ounce of gold. There is something really excited about holding these coins in your hand. I was hooked after that.

Due to income I invest in silver, but agree that precious metals are sound investments as a hedge against inflation.

I started with silver as well. It's a good starting point.

The bigger question is taxes. How do you go about them? Or how you don't..... ?

Buy with cash...

Nice article.

I am interested in purchasing gold & silver to hedge against inflation. I'm a first time buyer. What are the cheapest and safest ways to go about buying?

Try and find a local gold and silver bullion dealer. Don't purchase old gold coins that used to be in circulation. Just buy ounces that say .999 fine silver or gold. The coin dealer will add a fee to the market price of the coin. For me a silver coin would be $1.50 - $3 over market price.

Thank you for your post. Gold is assurance of course. Silver, for example, is more volatile so you have to be more nimble. I think you encounter the same deaf ears when you speak about gold to friends/relatives. All the best.