Predictable Volatility in altcoins, how economics can prove it.

Everyone who trades is looking for an edge. Sometimes the answer to predictable volatility is right under your nose. My economics professor told me that economics is common sense math. I agree and I feel as if economic law is a good reference point when making short and long term decisions in the crypto-trade world. A video by long time bitcoin investor, Roger Ver briefly goes over such concepts.

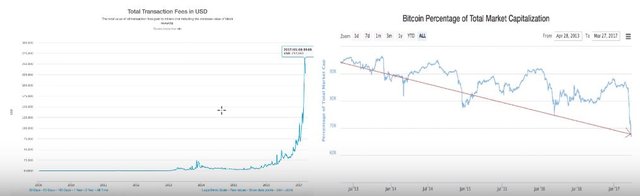

In this video Roger Ver clearly points out the faults in bitcoin and how alternative currencies are bridging the gap between user-ability, feasibility, and anonymity. He names a few alt-coins that have done very well over the past months. Zcash, monero, Dash and Ether all show a lot of promise as well as shorter wait times and lower fees. Roger shows several different examples of the relationship between bitcoin’s rising transaction fees and the declining coin market cap of bitcoin. There is certainly a correlation. To say it is a direct or indirect cause of one another is subjective.

There are patterns that can be observed by using a law of economics as Roger states. The value of a substitute good will rise when the value of a the main goods rise. The value of a substitute good will rise even more so when the other options loose it’s perception of value. In bitcoins case, alt-coins seem to rise as bitcoin falls which makes sense naturally. This is a form of macro predictable volatility. To be on the safe side, when investing, you should always diversify your portfolio. If you are deciding to experiment outside of bitcoin try to spread your money throughout the popular alternative currencies that provide a good user experience. We are still on the ground floor of the crypto-currency revolution. We choose, as a community, what we want and how we want it by majority preference.

Nice short and to the point post.

Thank you!