Crypto Flipping Mania, consideration on mindsets, desperation and possible cures (part 2)

Dear fellow flipper, good afternoon.

I am here to finish what I have started, I know you are rushing but if you can, please, take 3 minutes and read part one (link below). If you have no time, skip it, it wasn’t that good after all.

Now, before EtherDelta comes back from the Caribbean with a nice tan, an hungover, and its new girlfriend; let me present you my point of view.

Among the many strategies to invest in this crypto rocket-market we are using one that is as effective as trying to kill Darth Vader by shooting at him with the super liquidator our grandmother bought us for our 6th birthday. This one.

Let’s consider for a minute the state of the crypto market as of today.

First, second, third, and fourth there is Bitcoin; and let me tell you, is a pretty shitty coin.

If you want me to motivate the claim above read this piece. If you do not want to bother, well, carry on.

https://steemit.com/bitcoin/@cryptotuna/bitcoin-was-a-great-king-we-should-now-kill-it

You haven't switched off your computer after my last sentence, great, this means you can reason with your frontal lobes of the brain which are associated to reasoning and logic (https://scitechdaily.com/role-of-the-frontal-lobes-in-reasoning-and-decision-making/) and not only with the central part dedicated to scream that you really want some nuts immediately, when you feel hungry.

Bitcoin is old, slow, expensive, not a currency, not a store value. No one wants to spend it, everyone wants to hold it. Not to mention that it uses the same amount of energy your house utilizes in a week to run hot water, lights, cooking, dishwasher, laundry, call of duty, chat roulette/pornhub, electric guitar, and drone to spy on neighbors in order to process ONE BLOODY TRANSACTION (https://motherboard.vice.com/en_us/article/ywbbpm/bitcoin-mining-electricity-consumption-ethereum-energy-climate-change).

Bitcoin won’t probably even be there in 10 years. Its principles are locked-in its code, it won’t adapt well enough to the tremendous waves of innovation the crypto world will face every month from this point on.

Bitcoins best governance practices, to decide what its future will look like can be summed up as follows, miners from all around the word schedule multiples rounds of martial arts fights (last ones held in New York), much like the ones Master Roshi used to bring Son Guku and Krillin at the beginning of their carriers.

The consensus reached after 15 days of KungFu fighting lasts on average between 6 to 8 minutes, after that, the mining community gives birth to terrific sets of forks, knives and spoons.

Bon Appétite.

But hey, you are right! Bitcoin is the king because its price goes up, goes up, goes up, goes up and looks like it will go up forever despite not having any kind of real world application, why?

Because you bought it yesterday, I bought it today, and tomorrow another dude will read the front page of his average newspaper discovering he has lost and epic ride to the top.

He will most likely FOMO and run buying it.

I am not here to deny Bitcoin’s credit for showing the world what the Blockchain is, and what it can achieve, but please guys, let’s move on.

Until the last time I have checked we do not use the steam engine anymore despite the fact it was the first engine to move a train in history.

Below bitcoin we find the Alts, I am not going to discuss what problems they are trying to solve and their value propositions, they are too many, actually, did you know that we have from 5 to 30 new Alts each day?

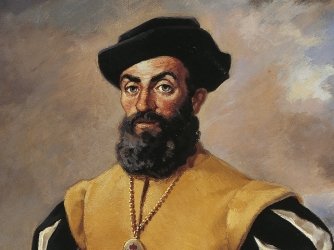

Now, despite the fact that you are thinking I am circumnavigating my key argument better than Ferdinand Magellan, and by reading this intro you are reminded of when you spent 45 minutes waiting for the appetizer at that 56-course-degustation-menu-dinner-night; Here's the surprise.

Crypto investing has two extremes, they are -> flipping and hard-core holding.

In between these strategies there are the infamous 50 shades of trading.

We will focus only on the two extremes, and now that we have finally got on topic, let’s stick to it.

Long term holding is about betting on value being generated in the long run.

97% of Altcoins that we see today listed on Coinmarketcap will not be there anymore in few years.

Besides raising enormous sums of money the ICO teams will also need, eventually, to comply with the old-fashioned rules of capitalism by going to work in the morning and create REAL VALUE.

Thus, many projects will fail for the same reasons start-ups do, namely: will not be operated successfully, will die out from competition, their products/services will never be adopted by the market, and so on.

This said we should also foresee that there will be winners, huge ones. If you can identify such winners and hold their coins without worrying about the many ups and downs their prices will surely go through, you will be a successful investor in the cryptospace.

But unfortunately for us this is not a post about long-term holds. Am I right?

We both know why we are here, repeat this after me, we are here because we like to make easy and quick bucks, at least we like to think about it this way, therefore, we flip.

Let’s begin by looking at when flipping works out well.

Flipping can work out brilliantly in the following conditions:

• When we participate in an ICO that has huge demand but a medium-size hard-cap. In this case many people willing to participate to the ico are left out and they will buy the token as soon as it hits the exchanges. This results in positive gains for the people that were able to get in the ico. The strong price push after ico is given by the difference between the low supply side at ico compared to he strong demand for the token.

• When we get spectacular discounts through pre-ico terms. If this often happens to you, good chances are that you get in super early, or that you are now reading this post under the Atlantic, lucky whale.

• When the project does not raise much attention pre ico, only after the ico the public gets to see the full potential of the project. In this scenario, the strong demand for the project will have to acquire the tokens via exchange and not via ico, pushing prices up.

When Flipping does not work:

• When Hard cap is huge, the whole world gets in. In this scenario, the demand for the project is totally absorbed by the ico and almost no investor is left behind. Who is going to beg for some coins when the project hits exchanges? Mmhhh…

• When the set price at ico makes no sense, it does not reflect the market sentiment about the project.

• When the team tries to raise way more money than needed, shooting for an absurd marketcap. Please read this fantastic post where the founder of Binance explains this point. https://steemit.com/binance/@czbinance/5mm9uo-i-don-t-like-big-icos

• When you get in late (usually better terms at the beginning).

• When you invest in a shitty project. Not sure if you ever thought about this one.

• When 1223 other reasons take place, such reasons might concern timing, missteps, poor management, founders going wild on Oysters and Champagne and so forth.

Last considerations on flipping.

This is the section where I would like to write not to hunt for flips, rather hunt for long-term value.

But I will not, because, to be bluntly honest, if done right, flipping can remunerative (forget this last sentence as soon as you can).

I will propose you to do a little experiment. Let’s open https://coinmarketcap.com/all/views/all/ and click on 10/20/30 different alts.

Look at the price graphs.

What do you notice?

If you take into consideration price highs and lows most of most Altcoins their prices have already doubled in value and went back to the original ones, in addition, many of them have done this multiple times.

During 3/4 months of on average Alt life we see at least couple of trips to the moon and back.

It is called volatility you dumb writer! Ok, fair enough, I get the concept, but let’s take a breath and appreciate our responsibility, WE are the flippers, the authors of this beautiful dance.

These projects have no operations, no revenues, no costumers and most of them not even a minimum viable product, yet they beautifully swing up and down. We see them raising millions in few minutes, increasing and decreasing their value by orders of magnitude based on speculation, FOMO, FUD, news and noise. Let’s drink to that. Most of the time flipping happens out of boredom, we look for novelty, for freshness. To create real world value teams needs to work for months if not years. We flip with just 5 clicks of a mouse.

In conclusion, if you are not following the rules of the good flipper I have presented above, do me a favor, at least get the best gear out there for impeccable flipping results.

They are well balanced, they never miss.

Ah, I was about to forget, if you miss a couple of shots you will be fine, eventually everything that goes up goes back down and vice versa.

Worst case scenario? Thank you for asking!

If you are really, really, really unlucky you will hit a project that will go to 0 $ value in a matter of 1/3 years, but do not worry about it too much, it will happen only 95% of the times.

P.S. thank you for reading. if you found that this post was difficult to read , do not worry, you are not dumb, it’s me that is not a native English speaker/writer/listener/reader/thinker/…

If you liked it please leave an up -ote below, if you did not please write me YOU SUCK in the comments.

Stay tuned on Cryptotuna for the latest wacky crypto comments, flipping strategies, grammar mistakes, and who knows… darts competitions?

Congratulations @cryptotuna! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP