Ripple Price Soars amid Asian Expansion

The Ripple price soared on Wednesday following the FinTech startup’s announcement that it had opened an office in Singapore as part of its continuing plan to penetrate the Asian markets

Ripple Expands Asian Footprint

As CCN has reported, blockchain payments firm Ripple has been making a concerted effort to establish a significant footprint in the Asian banking sector. Several weeks ago, Ripple opened an office in India–the world’s largest receiver of remittances. This week, the company upped the ante by establishing a base in Singapore, a country which handles more than $550 billion in trading volume annually.

Interestingly, Ripple’s new office opened just days before Singaporean banks began denying banking services to bitcoin and other blockchain-based startups operating within the country, a move contrary to the country’s reputation as a FinTech-friendly region.

Ripple Price Soars amid Market Recovery

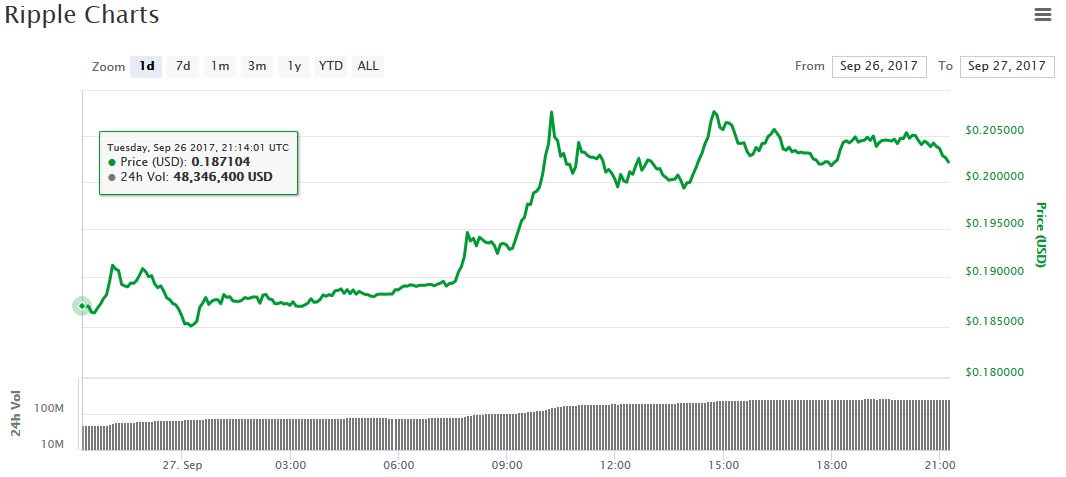

In the days following this announcement, the Ripple price has begun a marked advance. While some of this movement is the result of the general market uptrend–the bitcoin price broke past $4,100 on Wednesday and the combined value of all cryptocurrencies has swelled by $20 billion in the past four days–Ripple has been among the week’s biggest movers.

As recently as September 23, Ripple was trading at a global average of $0.171. Following Wednesday’s 9% rally, the Ripple price has climbed to $0.204–a combined ascent of 20%. Ripple now has a market cap of $7.8 billion which has enabled XRP to fight back into the 3rd-place position in the market cap rankings and put more than $250 million of distance between it and 4th-place bitcoin cash.

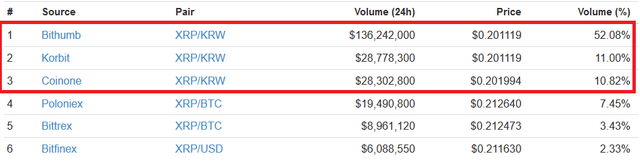

The vast majority of Ripple trading is concentrated on the three Korean exchanges that list XRP pairs. Bithumb’s XRP/KRW pair accounts for more than half of Ripple’s daily volume, and traders on Korbit and Coinone added another $57 million of liquidity to that currency pair.

(+) ICO Analysis: Dentacoin

Explore Menu

Altcoin NewsAltcoin PricesNews

Ripple Price Soars amid Asian Expansion

Josiah Wilmoth on 28/09/2017

Twitter

Linkedin

Facebook

Reddit

Weibo

Get Trading Recommendations and Read Analysis on Hacked.com for just $39 per month.

The Ripple price soared on Wednesday following the FinTech startup’s announcement that it had opened an office in Singapore as part of its continuing plan to penetrate the Asian markets.

Ripple Expands Asian Footprint

As CCN has reported, blockchain payments firm Ripple has been making a concerted effort to establish a significant footprint in the Asian banking sector. Several weeks ago, Ripple opened an office in India–the world’s largest receiver of remittances. This week, the company upped the ante by establishing a base in Singapore, a country which handles more than $550 billion in trading volume annually.

Interestingly, Ripple’s new office opened just days before Singaporean banks began denying banking services to bitcoin and other blockchain-based startups operating within the country, a move contrary to the country’s reputation as a FinTech-friendly region.

Ripple Price Soars amid Market Recovery

In the days following this announcement, the Ripple price has begun a marked advance. While some of this movement is the result of the general market uptrend–the bitcoin price broke past $4,100 on Wednesday and the combined value of all cryptocurrencies has swelled by $20 billion in the past four days–Ripple has been among the week’s biggest movers.

As recently as September 23, Ripple was trading at a global average of $0.171. Following Wednesday’s 9% rally, the Ripple price has climbed to $0.204–a combined ascent of 20%. Ripple now has a market cap of $7.8 billion which has enabled XRP to fight back into the 3rd-place position in the market cap rankings and put more than $250 million of distance between it and 4th-place bitcoin cash.

ripple price

XRP Price Chart from CoinMarketCap

The vast majority of Ripple trading is concentrated on the three Korean exchanges that list XRP pairs. Bithumb’s XRP/KRW pair accounts for more than half of Ripple’s daily volume, and traders on Korbit and Coinone added another $57 million of liquidity to that currency pair.

ripple price

XRP Trading Volume Chart from CoinMarketCap

It is unclear why Korean traders in particular have developed a craving for XRP, but the country’s cryptocurrency industry is celebrating two major announcements that are expected to make South Korea even more central to the global bitcoin ecosystem. First Korea’s most popular messaging application announced it will launch a cryptocurrency exchange that will support more than 100 cryptocurrencies. Then, Japanese gaming giant Nexon purchased a majority stake in Korbit–the country’s second-largest bitcoin exchange–through a holding company based in Korea. Analysts expect this will lead to further partnerships between Korean and Japanese crypto firms in the future.