Thoughts on Trading Gold, Silver, Oil and Pot (Commodities) -Linked Cryptocurrencies (and Indicator Automation)

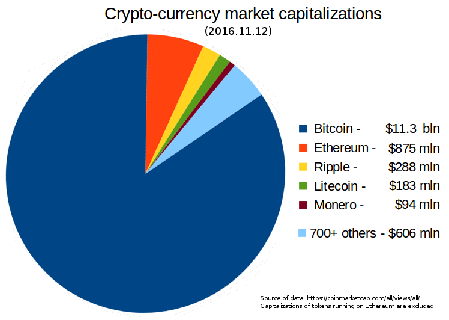

With a lack of information available to the average consumer, even the average cryptocurrency trader, sometimes investment is blind. Or a guesstimate based on how many Reddit posts and Google Search results there are for one coin versus another. If a coin is invisible, it likely won't reach a higher market. If a coin is highly visible, the gain may be better suited to long-term investment rather than trading.

In come the commodities-coins. Bilur for oil (one coin to one ton of Brent Crude Oil), Ethereum Link (LNK) for Silver. Orocoin for Gold. Onegram for Sharia-Compliant gold trading. DeClouds for Gold, Silver, Platinum and Palladium. The list goes on, with some in the ICO stage while others are trying their hand at Survival of the Fittest in the real world.

The novelty of these coins shouldn't be their fixation on precious metals and real-world items, but instead in the fact that they've been widely traded for years. This gives savvy traders the upper hand in the cryptocurrency realm across several coins that are already being traded and more that aren't yet. You see, with major markets, algorithmic trading has been available for years. The easiest focus would be those that are the most available and most visible. Research into expert advising systems and automated indicators in ForEx (which was another digital market for currencies and precious metals long before BTC came about) will yield results that may shock you.

Indicators are to stock screeners what a Citizen Eco Drive Solar Watch is to a Winding Watch -- far more convenient. One of my favorite Indicator authors is Avery T. Horton (The Rumpled One). His opinion in the past was that robots on the MetaTrader Platform (for Forex Trading) weren't good because there are factors that the robots must be able to control but are limited due to the platform. This isn't the case with Bitcoin and AltCoins.

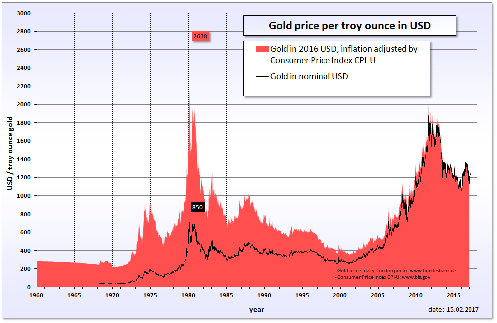

Almost every day I trade in physical gold and silver bullion coins, bars and rounds. Every morning after I get to work I receive market pricing reports via text message and indicators via e-mail. These are solely for precious metals. They make the views we get from ICO Lists and Cryptocurrency Market Capitalization Reports look like scribbling on the wall from your favorite three-year-old child. Finding something similar to a stock screener is nigh impossible. Finding expert advisor systems, automated indication systems and trading robots is even harder. Companies often pay private individuals and entities in their employ to develop systems for automated trading and hold them as closely guarded secrets, not even allowed to be used by those that invented them. That's some pretty closely held Intellectual Property.

(Electrum Alloy Coin -- Gold and Silver, Image Attribution Classical Numismatic Group, Inc. http://www.cngcoins.com )

So, are you seeking trade gains? Modeling ForEx Trading is the way to go. Seeking Long-Term Investments? Modeling Securities Trading is the way to go. Finding fundamentals with coins is even harder than with publicly traded companies and currencies. At least with companies and currencies you have historical data and a broad ocean of information to work with, while with cryptocoins, you have avalanches of nascent markets often with little differentiating them in crypto trading platforms other than the color of their Pot Leaf Logo (yes, I'm talking to you PotCoin Clones).

Stock exchanges have changed from yesteryear. From small to large wooden and brick buildings like the Amsterdam Stock Exchange shown above in an engraving to modern stock exchanges shown below.

And now on your shiny status-symbol that you carry around in your back pocket.

Doing research into the Voice of the Internet can be confusing, but is a must for investigating large-scale corporations for potential investment. This is also true for Cryptocurrencies of course alongside who's involved, what's up for grabs and simple things like availability of coins and mining difficulties.

Simplifying your choice of investment with Ethereum-backed markets, Bitcoin and AltCoins can be as simple as going with what you know, or if you're new to them, what others know very well. PotCoin may be something you know, and support, and know there will be a growth for as legalization continues through the US and other nations. However, indicator systems built for gold trading open in one window while another window has Bittrex, Coinbase or another trading platform open may serve you better depending on your level of interest, availability to trade and the time you have. Long-term I'd go with any of the coins that show a direct link to the performance of the commodities they represent. Short-term I'd go with any of the coins that show a direct link to the performance of the commodities they represent. Yes, I said it twice because it bears repeating. Don't invest blindly. Grab a historical gold price chart web page or excel spreadsheet and compare it. Whatever the commodity, compare the performance to the stock markets and commodities exchanges that have direct bearing on the cryptocoin in question.

Find growth information on the Colorado, Washington, Oregon and other state-legal marijuana industries. If they show a direct link, even with latency time and again they're viable commodities candidates both cheaper and easier to manage and invest in than opening a TD Ameritrade account and purchasing publicly traded oil, precious metals or marijuana stocks. After that, it's off to the races. Trading bots will become more commonplace. High security hardware wallets able to deal in tens of cryptocoin types are already available. Indicators are already here. Charts abound. And don't forget to buy the first Uranium-backed cryptocoin when it comes around because if nothing else, political uncertainty will drive the price up and the Federal Reserve rate changes won't drag it down as much as they do gold and silver.