How to 'Hodl' Your Gains

First, I'd like to thank @sashadaygame for his article, "How To Avoid FOMO and keep your crypto profits ;)". Sound advice is hard to come by these days.

Fear of missing out is a huge thing. Any seasoned frequent-trader, whether ForEx, Securities or Cryptocoins knows that learning to control your reactions may mean the difference between gains and loss. Emotions, whether fear, excitement or any other whether valid from experience or a response to a bit of news, a convincing salesperson, a need to be accepted -- human psychology is understood in many frameworks, but in my opinion we haven't seen more than the tip of the iceberg. fMRI studies, evidence-based objective cognitive models, logos, archetypes and spitting on Freud's grave should be saved for a book or two in the future, though.

One of the cryptocurrency groups on Facebook that I follow and participate in has had more than a few people questioning why people suggest you hold. It's nothing new. People often ask if you're trading or investing for profit, why people don't talk about exit strategies and taking advantage of markets. The truth is that it's about resources. I've been following Bitcoin since shortly after BitcoinTalk came into being. I even mined a bit back in 2011, and joined BitcoinTalk.org.

I was an early adopter who lost interest due to priorities. This isn't the tale of my regrets, I have far bigger regrets than not investing in Bitcoin that aren't relevant here, too, and priorities like a spouse and children are trades and investments of their own. However, the decision-making processes that made my choices are relevant.

Many of you are where I was in the past ten years. Some of you are where I was further back than that, which is to say without many options but with a desire to participate. The question, regardless of what Mark Cuban has to say about Stocks and Investments being stupid to buy and hold (though he holds his companies, his basketball team and now a share of Unikoin so a lack of congruency there), is driven by scarcity.

Let me explain. Scarcity and popularity drive up price, the good ol' Supply and Demand chain that we're taught even before economics. However, that same scarcity is what has people asking "When do I get out?". You need to decide when to get out even before you get in. It's really simple. If you just toss cash at an altcoin and see it go up and down you question "But can't I sell high and buy more low, and sell more high?" Sure you can, but it's worse than House Odds at a Las Vegas casino without a great deal of foresight and control. Some people think when we say "Hold" and "Don't make emotional decisions." we're saying not to get out, ever. We're saying to get out when you planned on getting out in the first place. If you haven't calculated trade costs before you get into a coin, or any security you're missing the point and practices. Best-practice-wise, are you okay with 10% gains? Do you want to hold for 30% gains? Are you in the black already?

Buy Orders and Sell Orders can be set when you make your purchase. Do you want 10% gains? Set it to at that. Do you want to hedge your bets? Set it to sell at 5% below what you bought it at, but be prepared for dips wiping you out. Or sell half at below 5% and half at above 15% so you gain 5% overall even with a dip. Developing your strategies takes thought. Personally I don't like selling with automation at a loss, so I never set my sell orders for anything but on gains. That's just me.

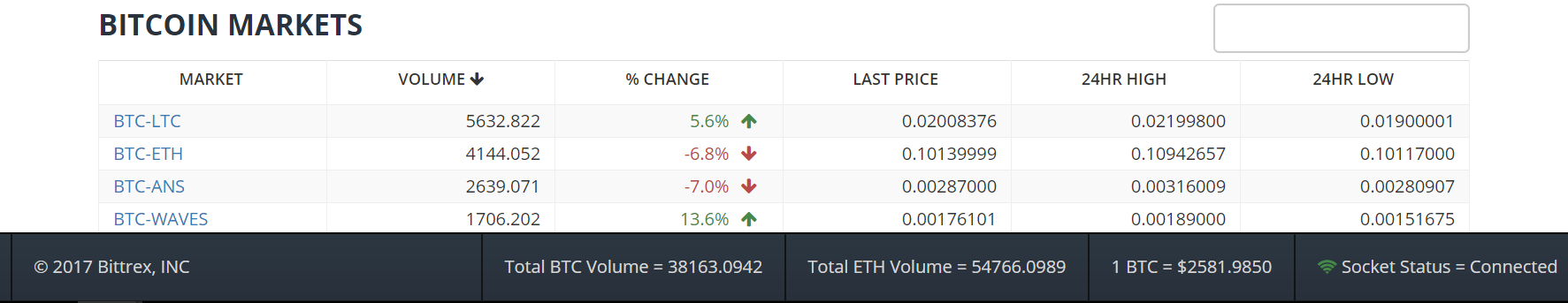

Taking from securities exchanges, cryptocurrency exchanges should be looked at the same way, just like securities versus cryptocurrencies. Think of the new cryptocurrencies as Pink Sheet / Penny Stocks where many will rise, and market capitalization in the millions mean one wealthy person can manipulate the market. For now, the best advice is to read anything but Warren Buffet and Benjamin Graham, figure out where you are financially and go from there. I'm an investor and a trader, personally. I've bought and will continue to hold SiaCoin and a few others in paper wallets. And I'll continue putting in sell orders with the majority of my buy orders, ensuring that I can gain as well as possibly double what I leave in by setting a few tiered sell orders in along with my purchase.

My go-to strategy is to sell half at a 10% gain, a quarter at a 30% gain and the rest at a 100% gain. It's very simple, and made far less risky if you investigate who you're buying coins from and use sound, proven securities-buying principles to buy. I hear so many people saying buy whatever's new on CoinMarketCap that has a lower amount of coins and a higher market capitalization. Sensation-buying and selling as a trading method isn't new. You'll no doubt here "Buy at Rumor, Sell at News" more than once in your lifetime.

Be careful out there. Start reading. Stop basing your investments on what will go up. Trade based on what will go up. Invest on what's sound that will last. If you haven't read a book on trading, you need to start now. If you haven't seen what bots do to every market, you need to research it now. Otherwise when others use strategies to take your gains there's no one to blame but yourself.