Is This the Alt-Coin Apocalypse?!

Back in the late '90s the NASDAQ was going wild. Stocks like Cisco had been rocketing upward, splitting, rocketing back up, splitting and so on for much of the decade. The ".com" stocks were also blasting into the stratosphere. I remember telling my boss at the DSL startup that eBay had gone up $85 one day. "Oh, it's up to $85, huh?" I'm like, "No. It went up $85 per share today." That was a lot back then. And it was a sign of the irrational exuberance of the times.

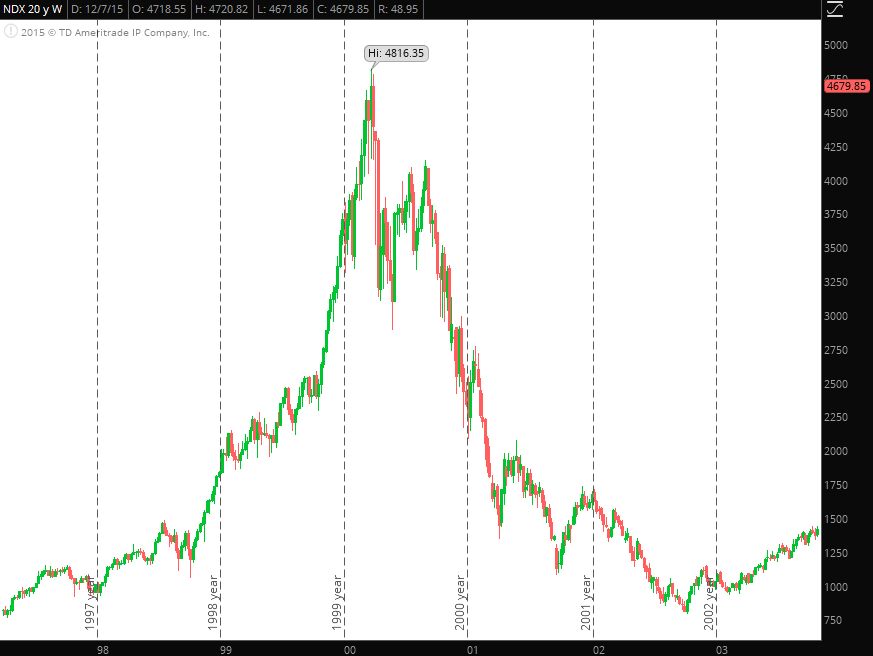

I had a friend who ran a short fund back then, and he and I used to cheerfully ridicule each other's perspective on the .com boom. Obviously, he was all gloom and doom, "get out while you can", etc. I was insistent on the reality of the new economy. "This is just the beginning." Long term, for at least a few of those stocks back then, I was right. But, relatively short term, for many of those stocks, he was right. Including, unfortunately, the stock of the DSL company I worked for. On March 2000, the NASDAQ hit 5000 for the first time, and the last time in that decade. It would take 15 years to get back to that not-so-magic number.

So, of course you can guess where I'm going with this. This isn't just FUD. There are some very good reasons to be concerned about the cryptocurrency market right now, but there are also some excellent opportunities. Fact is, the market is now flooded with coins -- there's over 1500 of them listed on coinmarketcap.com. Considering how few of them actually do anything other than offering another coin "community", 1500 (and still rising aggressively) aren't going to be supported, even if cryptocurrencies take another jump in popularity in 2018.

But there are at least a few gems out there, and right now they're at bargain prices. The key is putting in the work needed to sort them out. Several recent ICOs which are now on the market are taking a beating along with everything else. Among those ICOs that recently hit the market, there are some real finds. Do your due diligence, your homework, whatever you want to call it.

While there were a lot of investors who got out of .com stocks several years ago, and some did it before the crash, some held on through the bad times to a select few investments like AMZN. I won't insult your intelligence by asking if you think they're glad they held on.