"QUANTOR" Develops the Investment Algorithm Market and Traditional Cryptocurrency financial Markets

The history of automated trading in financial markets began in the 1970s and 1980s, when traders began using special algorithms to multiply their investments, which analyzed the current situation in the financial markets and automatically performed trading operations.

This method quickly proved its effectiveness and began to improve as the experience and mistakes of previous programs were taken into account.

Algorithmic trading today is an effective and automated asset management tool that does not require any knowledge in the field of investment and allows you to manage your financial resources with the help of innovative technologies. And the direct evidence of its effectiveness is the confidence of global international players.

For example, the Medallion fund, a well-known algorithmic hedge fund, generated a significant annual income of more than 35 percent over a 20-year period.

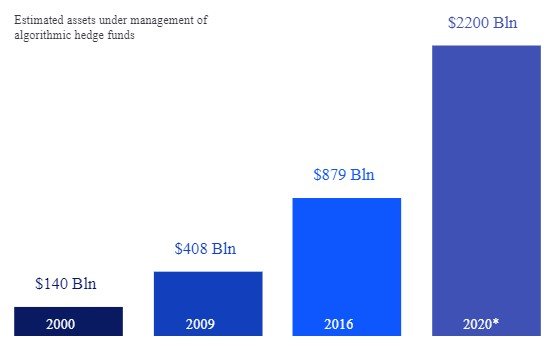

Over time, the use of algorithmic trading systems captures more and more areas of investment. In some financial markets, it has already reached more than 50% of trading volumes.

In 2014, 67% of trading volumes with futures on interest rates in the US were formed using trading algorithms, which proves one thing: algorithmic trade is the inevitable and effective future of the global investment industry.

Concept

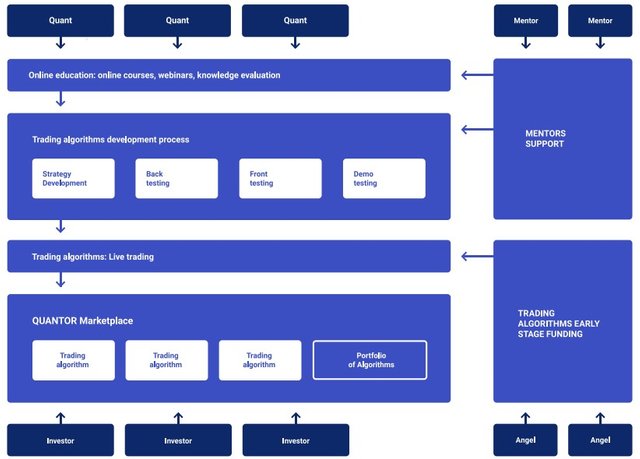

Quantor is an ecosystem that integrates the marketplace of investment solutions and an online learning platform for crypto-currency markets, knowledge and skills of investment industry experts and developers of investment algorithms.

Computer technologies increase reliability and efficiency in the investment industry, reducing the risk of a human factor in making investment decisions.

The main objective of the platform is to create a know-how conveyor for the implementation of profitable and reliable investment algorithms in a decentralized economy.

Algorithmic Hedge Funds Trading Algorithms Usage

Technology

Quantor is an ecosystem that integrates the marketplace of investment solutions and an online learning platform for crypto-currency markets, knowledge and skills of investment industry experts and developers of investment algorithms.

Ecosystem Quantor

The Role of Smart Contracts and Blockchain Technology in Trading Algorithms

Blockchain technology makes it possible to consider a trading algorithm in conjunction with smart contract, which allows you to automate the financial processes on the platform.

The Mechanism for using smart contracts

The executable algorithm file is launched in the Docker container on the platform hosting;

The algorithm analyses the data and sends control signals to the stock exchange;

The actual information is reflected in the smart contract, tied to the algorithm;

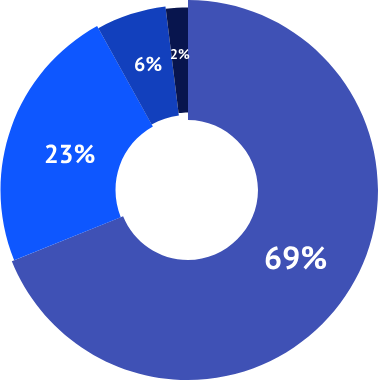

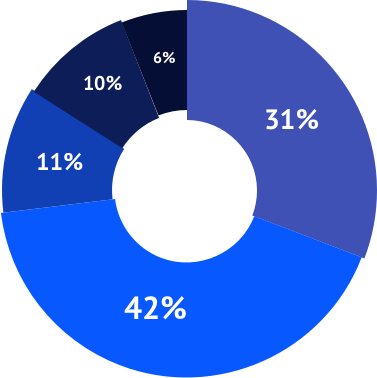

Issue and Allocation of tokens QNT

Issue of tokens

- Sale on the market

- Team and founders

- Experts, consultants and partners

- Bounty campaign

Allocation of collected funds

- Platform development

- Marketing

- Team and founders

- Payroll fund

- Unexpected expenses

To want to know more satisfying information, complete and more clearly visit the existing below.

Team

Achievements

Roadmap

WEBSITE

BitcoinTalk

MEDIUM

LINKEDIN

TELEGRAM

TWITTER

FACEBOOK

GITHUB

YOUTUBE

_____________________

Bitcointalk Link Profil: https://bitcointalk.org/index.php?action=profile;u=858487

ETH addrees: 0x2BBEEA86F155668d78FB108da0Ff5725B06f6994