Why DeFi (Decentralized finance) is important? And How Algorand Can Give The Best Solution Among Other Blockchain?

Before I tell you about the importance of the DeFi (Decentralized finance) first, understand the importance of decentralization because there is a huge possibility of a system can be fail if it centralized because all of its data stored or depended on a single server or node so a hacker has to hack a single server or node and the owner of that server or node has all the power of decision making and his decision can be wrong and because of his wrong decision every person will suffer who connected to that server or node.

The 2008 global financial crisis has happened because of the centralization of our banking system and this kind of crisis can be again and again until we decentralize our banking system. In our traditional banking system, mostly the government owns the banks even if public money is there but the public has no power to decide and the government mostly regulates and deregulates rules all the time, Banks are making huge money by lending and circulating public money but the account holder gets a 4-6% ROI (Return of the investment) which cannot fight with the increasing inflation rate.

In the year 2019, there is a bank crisis in India and because of this crisis Punjab and Maharashtra Cooperative Bank (PMC Bank) could not repay the money of the depositors and after investigation, it found that the bank has irregularities in certain loan accounts. This bank has given huge loans to the financially stressed real estate company;

Reference:Article

Do you know? According to FBI data in 2018, there were 2707 commercial bank robberies and attempted robberies happened in the united state and in 2003 Over $920 million robbed from the central bank of Iraq with a handwritten note.

Reference:Article-1, Article-2

Banks are making billions of money from the transaction fees is around 34.6B and in the US enormous banks are making 6B from ATM and overdraft fees and these fees are not stable and always fluctuate with time.

Reference:Article-1, Article-2

So what is your opinion? Why did this kind of crisis and robberies happen? and why the bank has an exorbitant fee structure which is fluctuating always?

Please comment on your opinion but I can say to you why these kinds of problems in the bank are happening.

In short, the cause of these problems is the centralization of the banking system and the absence of the blockchain and smart contract.

How decentralization, Blockchain, and smart contract can solve above problems?

With an example let me explain how blockchain and decentralization is the important key for a financial system; After 2008 bank crisis, Satoshi Nakamoto has invented Bitcoin using blockchain technology and that time Bitcoin was the best solution as an alternative of the financial system, the main purpose of blockchain and bitcoin is to save our financial system from the further collapse proven in 2020 where all the stocks and banking system are struggling because of corona crisis bitcoin market is showing the most stability and growth.

And this stability in bitcoin is because of decentralization where there are so many miners are creating the network of the bitcoin's blockchain, And there is no one's own the blockchain hence no dominance of a single entity.

So now a hacker can't hack the system only by hacking a single node, hacking of all nodes is technically impossible, and money will remain under your control no need to give your money to a third-party.

A smart contract is a digital form or computer protocol of a contract so by implementing a smart contract in the financial system not only put automation but also eliminate corruption in the financial system so no one can easily get a loan or can't fraud with the system.

How Algorand Can Give The Best Solution For DeFi Among Other Blockchain?

As I told you in the year 2009 when bitcoin launched and it was the best solution for the DeFi but with the time, there are some limitations with the bitcoin blockchain we found like the issue of scalability, low transaction speed with high transaction fees, security, and decentralization.

So a question may come to your mind that bitcoin's motto is to give decentralization and security, but why I'm saying there is an issue of decentralization and security in bitcoin?

There are many blind lovers of bitcoin in the world and maybe we are among them but my friend the fact I will tell you which may force you to think again.

As bitcoin is a PoW(Proof of Work) coin so they're always hash war going on the blockchain that clear means the person has the huge computing power only get rewards and do you know there are 6 pools in the bitcoin network who possess most of the mining power and in short, control of the bitcoin blockchain. If these pools combine can rearrange blocks, Double spent of coins, can control transactions, etc.

Because of the hash war, the mining pool named BTCC has closed its mining pool business and with time many mining pools will get closed because bitcoin mining gets harder with each halving, and hence the mining pool numbers are decreasing so bitcoin is losing its decentralization and security.

So here Algorand comes into work which not only breaks the limitations of existing blockchains but also keeps the Blockchain Trilemma (Security, Scalability & Decentralization) for a lifetime.

Algorand uses the Pure Proof-of-Stake consensus protocol because of which it gives a chance to everybody to be part of the network even if you are holding a single coin and there is no penalty for anyone in the network. Like PoS(Proof-of-Stake) here a single committee can't produce, propagate and attach a single block to the blockchain here in Algorand the block production, propagation, and attachment of a block done with two-phase.

In the first phase, a single holder get selected randomly and his public key gets revealed to all users then this person produces the block and proposed to the blockchain and from now the second phase gets started where a 1000 holders get selected randomly to form a committee who will verify the block whether the block is legit or fake and if the committee verifies that block it legit then the block get propagate and then get attached to the blockchain but if the block found to be wrong then the phase 1&2 repeat with other random holders.

And the important thing do you know? The fund never goes to the third party for hold or lockup so you control your fund and you can do anything with your fund at any point in time so this is safer than the traditional financial system.

So Algorand will never ever lose its decentralization and if more people will join the network more decentralized, it becomes.

So now we understand how Algorand will never lose its decentralization and how to remain decentralized will help DeFi but now will deeply understand how Algorand will give the best solution for DeFi?

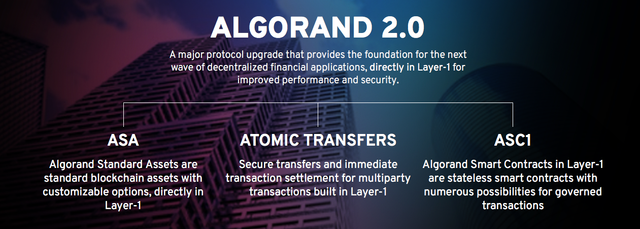

All the best tools for a DeFi we will get from the Algorand 2.0 and we can implement any DeFi application directly on the layer one of the Algorand blockchain.

Algorand 2.0 has three key features 1. Algorand Standard Assets, 2. Smart Contracts in Layer-1, 3. Atomic Transfers.

Algorand Standard Assets:- This feature will help you create and issue of assets in the layer one of Algorand blockchain here you can create fungible assets (currencies, utility tokens or stable coins), non-fungible assets (tickets, real estate, in-game items), restricted fungible assets (securities), restricted non-fungible assets (certifications and licenses). As these assets created on the first layer of the Algorand blockchain so these poses all ability like Fast and Secure, Compatibility to all Algorand application, and Ease of use.

Algorand Smart Contracts on Layer 1:- By using Non-Turing complete TEAL language by Algorand you can build your own smart contracts and the Algorand team provides many smart contract templates using which ASC1 development becomes easy.

You can create and deploy a smart contract in Escrow accounts, Crowdfunding, Collateralized debt, Interfacing with Oracles and off-chain data, Decentralized Exchanges, etc.

Atomic transfers:- Using this feature you can do multiple transactions in a single time even if the transaction signed by multiple people it group into a file and submitted to the network and if one transaction gets failed, then all transactions get failed so this feature can be very helpful for transactions like Circular trades: (A pays to B, if B pays to C, if C pays to A), Group payments: Either everyone pays or no one does, Trades without trusted intermediaries, Payments to multiple recipients, and so on.

Conclusion:- So we understand bitcoin created to be the alternate of the traditional financial system but how with time bitcoin is going towards centralization so we need a revolution like mobile after the telephone so if bitcoin is the old generation then Algorand is the new generation and with all of its features Algorand can not only be an alternative to the traditional financial system but also can give the best solution for decentralized finance (DeFi).

For more information must visit these links below.

Website-1, Website-2, Join Algorand community, Twitter, LinkedIn, Telegram, Facebook, Medium, Youtube, Community, Reddit,

Risk warning!!: All the information above are not financial advice and neither legal nor illegal advice all are my opinion and this article is of your knowledge Before. investment do your own research because nobody will responsible for your profit or loss

About the Author:-

Name: Jitendra naik

Email: [email protected]

Great, Algorand seems to be such a great for DeFi! Excited already! 👍😮😎

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!