$285 Billion: Cryptocurrencies Are Now More Valuable Than Visa

------------------Advertisement------------------

------------------Advertisement------------------

------------------Advertisement------------------

Get Trading Recommendations and Read Analysis on Hacked.com for just $39 per month.

The market valuation of all of the cryptocurrencies combined has surpassed the market cap of leading financial service provider Visa, by $30 billion.

At the time of reporting, the market cap of Visa remains just above $254 billion, while the market valuation of the entire cryptocurrency market is $285.9 billion.

Visa vs Cryptocurrency Market by Numbers

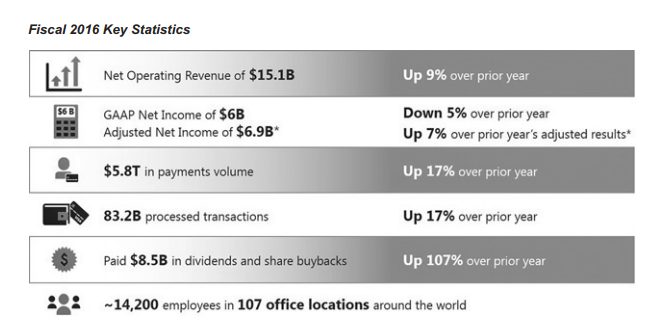

According to the Visa 2016 annual report, the Visa network processes around $5.8 trillion worth of transactions per year, mostly from the 3.1 billion visa debit and credit card issued globally. More than 83.2 billion transactions were settled on the Visa network in 2016.

In contrast, the cryptocurrency market settles significantly less transactions on a daily basis. The Ethereum network settles more transactions than all of the cryptocurrencies in the market combined, and the entire cryptocurrency market processes around 1 million transactions per day. That is, 30 million transactions per month and approximately 360 million transactions per year.

However, core developers of most public blockchain networks such as bitcoin and Ethereum are working on the development and deployment of second-layer payment networks. The utilization of second-layer payment channels like Lightning and Plasma will enable cryptocurrencies like bitcoin and Ethereum to remain as secure store of values, while payment channels operate like the Visa network and are launched on top of the cryptocurrencies.

A recent research paper from the Blockstream research team entitled “Scalable Funding of Bitcoin Micropayment Channel Networks” revealed that with necessary solutions in place such as micropayment channels can support at least 800 million users with the current infrastructure.

“Micropayment channel networks create new problems, which have not been solved in the original papers [8,18]. We identify two main challenges – the blockchain capacity and locked-in funds. Even with increases in block size it was estimated that the blockchain capacity could only support about 800 million users with micropayment channels due to the number of on-chain transactions required to open and close channels,” read the paper.

With micropayment channel optimization through the elimination of channels and unnecessary information, the Blockstream research paper noted that nearly 96 percent of the blockchain space, significantly increasing the capacity of transactions and number of users payment channels can handle.

“By hiding the channels from the blockchain, a reduction in blockchain space usage and thus the cost of channels is achieved. For a group of 20 nodes with 100 channels in between them, this can save up to 96% of the blockchain space,” the paper added.

Already, in terms of daily trading volume, the cryptocurrency market is processing over $10 billion worth of trades on a daily basis, from cryptocurrency to fiat and vice versa. The global cryptocurrency exchange market processes $3.6 trillion in trades on a yearly basis, which is closer to the volume of the Visa network. It is fair to compare the trading volume of cryptocurrencies to the Visa network as both markets handle trades amongst hundreds of digital and government-issued fiat currencies.

In the long-term, the transaction volume of cryptocurrencies will be able to surpass that of Visa, if on-chain and off-chain scaling solutions are implemented onto leading public blockchains.