Steem Total Value Powered Up - $62 million - May 8, 2022

This is next in my series of posts reviewing the amount and value of powered up STEEM on the Steem blockchain. For previous posts, see the end of this entry.

Noteworthy in the last week,

- Week over week, the number of powered up STEEM decreased by 150K, or just about 1/10%.

- The week saw 4 daily increases and 1 new high in number of STEEM powered up.

- At 41.61%, the series-long high as a percentage of market cap was recorded on April 26. All subsequent observations have been in the 39% range, so this was probably a fluke of timing in the way that CoinGecko updates their market cap and price fields.

- The modeled value of powered-up STEEM lost ground against all comparison tokens except BTC and ETH. Changes ranged from -30% against TRX to +3% against BTC.

- The modeled value of powered-up STEEM lost ground against the USD by about 9%.

- Total power-downs this week totaled 690K STEEM, up by about 5% from last week's 653K.

- In terms of all comparison tokens except for TRX, today's locked value is markedly higher than the January 1, 2022 baseline.

Here are the numbers as-of a few minutes ago:

Total value locked in powered-up STEEM (USD): $61,814,187.42

STEEM market cap $156,723,944.24

Locked value in terms of other tokens:

| token | price | locked value equivalent | Jan 1, 2022 | pct of Jan 1 baseline |

|---|---|---|---|---|

| tron | $0.09 | 706,730,548 | 809,173,538 | 87.34% |

| steem-dollars | $3.65 | 16,935,393 | 11,284,131 | 150.08% |

| bitcoin | $34,585.00 | 1,787 | 1,300 | 137.50% |

| ethereum | $2,569.59 | 24,056 | 16,501 | 145.79% |

| litecoin | $94.72 | 652,599 | 411,561 | 158.57% |

| steem | $0.40 | 156,462,698 | 142,930,214 | 109.47% |

| USD | $1.00 | 61,814,187 | 61,837,042 | 99.96% |

And here are the charts, based on data collected daily since April 10, 2021.

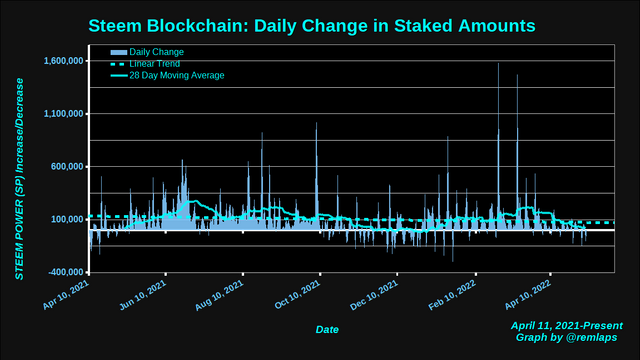

Daily Changes

Here is a chart of daily changes in powered-up STEEM from April 11, 2021 to present. The graph also includes a linear trend line and a 28 day moving average.

Here are some descriptive statistics, for numbers geeks.

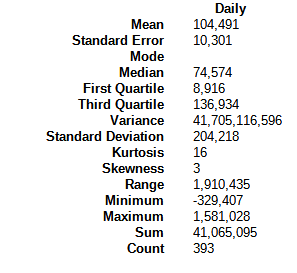

VESTED STEEM

With a decline of about 150k, this was the first weekly decline in quite some time.

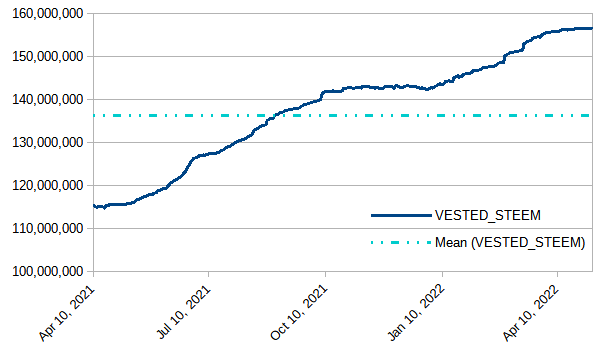

Modeled value of powered-up STEEM in terms of USD

In terms of USD, we saw a weekly decrease of about 6 million dollars, or 9%. Despite the downturn, this was slightly better than the market at large for the week. The value is slightly below its series-long average value.

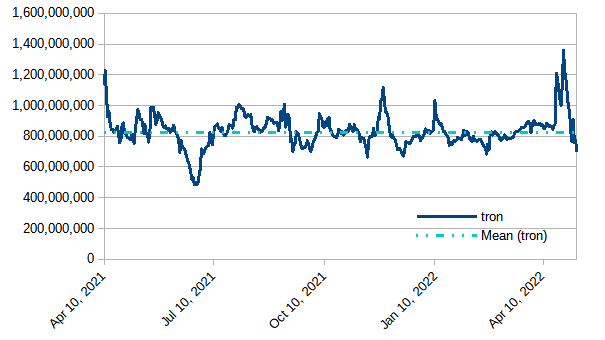

Modeled value of powered-up STEEM in terms of Tron (TRX)

Despite an overall market downturn, TRX has had some good days, gaining strength against powered-up STEEM by 300 million tokens or 30%.

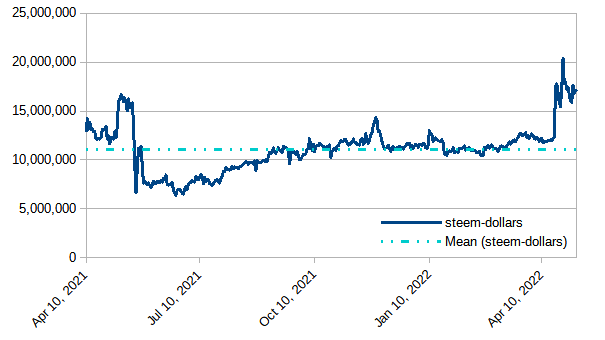

Modeled value of powered-up STEEM in terms of Steem Dollars

Down by about 400K or just shy of 2 1/2%

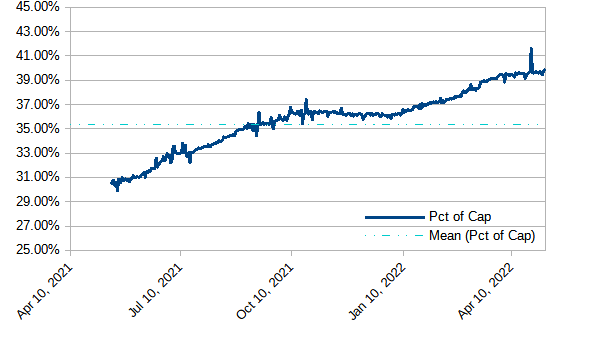

Modeled value of powered-up STEEM as a percentage of Steem's market cap

Running just slightly above flat for the last four weeks, with an anomalous jump up on April 27. With today's observed value of 39.74%, we have now seen 34 consecutive days above 39%; 67 consecutive days above 38%; 98 consecutive days above 37%; 225 consecutive days above 35%; and 288 straight days above 1/3. After three months of upslope, the graph is now leveling off. Will it hold above 39%? Will it go above 40%?

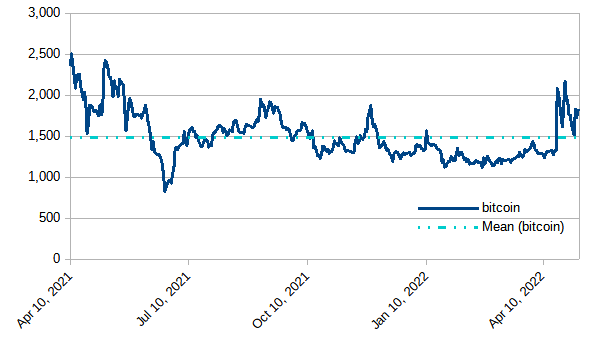

Modeled value of powered-up STEEM in terms of bitcoin (BTC)

Up by about 52 BTC, or 3% during the week.

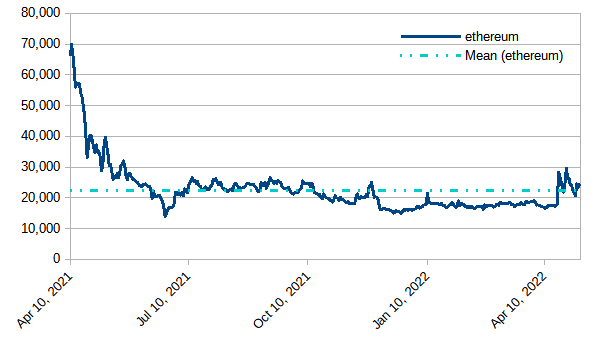

Modeled value of powered-up STEEM in terms of Ethereum

Up by about 350 ETH, or 1 1/2%.

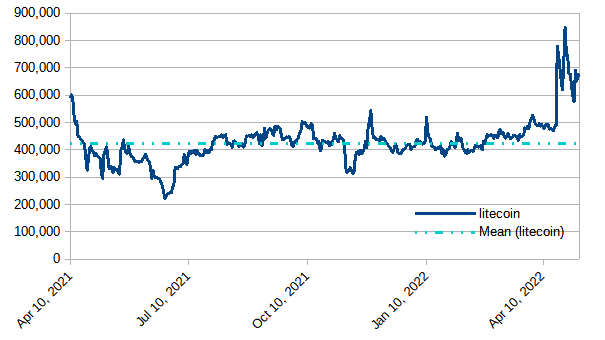

Modeled value of powered-up STEEM in terms of Litecoin

Powered-up STEEM lost ground by about 10,000 LTC, or 1 1/2%. Still running well above the historical average.

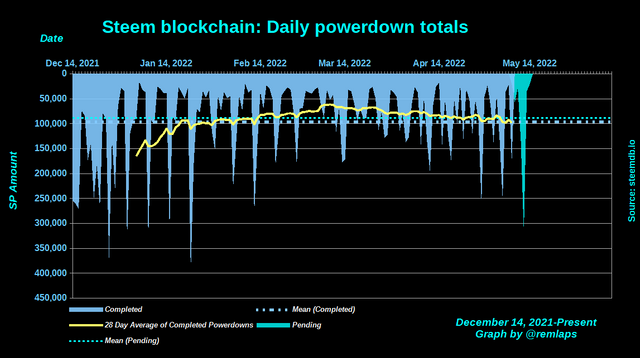

Daily Powerdown Activity

Here is graph with data from steemdb.io to show daily completed and pending powerdown activity. Overall, with about 690K powered down last week and 800K pending, we can expect weekly powerdowns to increase by about 15%. The big spike in pending powerdowns is exactly three weeks after the April 21 price pump. That spike represents more than 1/3 of this week's pending powerdowns.

The horizontal lines are the average values for completed (blue) and pending (cyan) powerdowns, and the yellow line is a 28 day moving average of completed powerdowns.

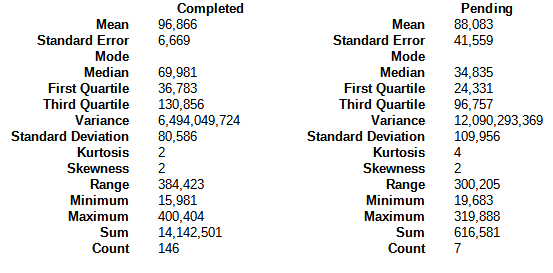

Here are some descriptive statistics for the numbers geeks:

And here are the times, dates, and amounts of the top-10 pending powerdowns:

2022-05-12T10:23:45 - 236482207773807 VESTS, 129942 STEEM

2022-05-12T10:28:48 - 135473453158428 VESTS, 74439.9 STEEM

2022-05-11T00:51:33 - 121315538772036 VESTS, 66660.4 STEEM

2022-05-12T03:17:24 - 91022194131026 VESTS, 50014.8 STEEM

2022-05-15T16:02:57 - 60370117013076 VESTS, 33172.2 STEEM

2022-05-11T11:21:09 - 32121262388259 VESTS, 17650 STEEM

2022-05-12T11:08:00 - 27672066227889 VESTS, 15205.2 STEEM

2022-05-09T03:39:36 - 27418822710312 VESTS, 15066.1 STEEM

2022-05-12T12:01:09 - 18849430329488 VESTS, 10357.4 STEEM

2022-05-15T15:34:33 - 18134861822825 VESTS, 9964.74 STEEM

Notes

- Reference prices for STEEM and other tokens are downloaded from coingecko.com

Previous posts

- Steem Total Value Powered Up - $67 million - January 2,

20212022 - Steem Total Value Powered Up - $57 million - January 9, 2022

- Steem Total Value Powered Up - $60 million - January 16, 2022

- Steem Total Value Powered Up - $43 million - January 23, 2022

- Steem Total Value Powered Up - $46 million - January 30, 2022

- Steem Total Value Powered Up - $54 million - February 6, 2022

- Steem Total Value Powered Up - $50 million - February 13, 2022

- Steem Total Value Powered Up - $46 million - February 20, 2022

- Steem Total Value Powered Up - $48 million - February 27, 2022

- Steem Total Value Powered Up - $47 million - March 6, 2022

- Steem Total Value Powered Up - $47 million - March 13, 2022

- Steem Total Value Powered Up - $51 million - March 20, 2022

- Steem Total Value Powered Up - $60 million - March 27, 2022

- Steem Total Value Powered Up - $65 million - April 3, 2022

- Steem Total Value Powered Up - $55 million - April 10, 2022

- Steem Total Value Powered Up - $68 million - April 24, 2022

- Steem Total Value Powered Up - $67 million - May 1, 2022

- Steem Total Value Powered Up - $62 million - May 8, 2022

Hello, in all the time I have been on steem, I never understood how VESTS is measured to calculate our steempower.

I haven't seen much that really does a good job explaining it, so even my understanding is mostly intuitive.

Basically, as I understand it, SteemPower doesn't really exist. The blockchain tracks staked tokens in terms of VESTS and SteemPower is just an accounting trick to make it easier for people to think about.

As an example, it's conceptually similar to a mapping of centimeters to kilometers, with the difference that the blockchain is constantly changing the conversion factor when it produces new VESTS and SBDs, so any time you want to do the conversion, you have to find out what the current ratio is.

FWIW, here's a description of how to convert from VESTS to SP: Converting VESTS to STEEM.

Yes, what you say makes sense.

Lately the market is crazy and it affected the steem and sbd currency a bit, I hope the currency recovers. I have seen many accounts being turned off, I imagine, for fear of losing everything.

The high powerdown this week seems to be influenced by the desire of many investors to take temporary profits because there are hopes for an increase in the steem exchange rate in the span of two weeks ago. Hopefully they will continue to hold their steem until they are able to stem the decline in the exchange rate.

I think this price drop, can also affect the psychology of other investors to buy and influence the price to go up.

Let's enjoy the movement of steem prices, and we will be the winners at the end of this year.

When this post was published, crypto market was ready to go through a big dump. I am seeing such red market after a long time. Almost all stable coin is now red in graph. Bitcoin is under 30k. I am happy to see steem with how much price it holds yet. I hope steem will so the best as usual to prevent this shock. Thanks a lot for this valuable post dear.

Can you tell me about terra? What is the main reason behind terra falling? I am mostly shocked to see Luna and UST.

It was a big surprise to me, too. Unfortunately, I am not very familiar with it either.

Thank you for the information. It is very sad that the number of Empowered Steems has decreased by 150 thousand. Of course, it is an industry that is open to everything. New power-ups can begin

Unfortunately market is going down again and again after listing Steem/USDT on Binance. Otherwise Steem could hit $0.70 now. However Steem will reach over $1 this year and very soon. Thank you.

I think the data is worse than last week. April 26 was the period when the data were the best. The number of locked Steems is decreasing. Steem price is dropping. Bad week for us. Whenever I can, I buy Steem and build reinforcements. I also use my earnings for power-ups.

The high power down activity this week, making STEEM prices fall, in my opinion, this power down activity, is due to price increases and the big pumping late last month. What we need to know, this is not significant. Even if the price drops again from now, so be it. That's the market, and let's get ready to buy STEEM, and we'll win together later.

Some people feel a bit panicked when they see these figures , what is more , some colleagues have decided to sell some cryptocurrencies , it is sad since this market moves in this way , but in reality we do not know if it is panic or necessity , I think they may be both

BTC price went down from $39k to $33k in last 7 days and it may fall a little more but then it will pump again. It's perfect time to buy some BTC or other crypto like APE. Thanks for your deep analysis.

A very bad liquidation took place tonight. UST is playing on LUNA. All cryptocurrencies and Steem are also affected by this. When the price is low, it is necessary to do a steem powerup. The records you keep are invaluable.