Steemit Crypto Academy Contest / SLC S23W4: Steem/USDT Scalping – Mastering Short-Term Trading Strategies

Canva design

Understanding Scalping in Steem/USDT Trading

Introduction to Scalping

During their trading period traders generate numerous small profits through their implementation of scalping techniques. The time span during which scalers achieve their investments lasts for less than one minute through performing small market movements. The trading platform must present rightful prices combined with minimal fees while generating noteworthy price movements to make scalping possible.

The ability to earn profits through scalping directly correlates with selecting an accurate trading platform that includes fast response times and rapid decision capabilities. Fundamental analysis remains out of reach for scalers since their market-driven strategy seeks to capitalize on short-term profitable opportunities that arise during market uncertainties.

Scalping vs. Other Trading Strategies

Potential buyers evaluating scalping strategies need to assess them by comparing them to traditional trading techniques.

Scalping vs. Day Trading

Day trading spans between minutes and hours but scalping only works with time intervals between seconds and minutes.

The profit margin ranges which price movers attain during trades remains beyond the expected profits that day traders calculate.

The higher number of trading activities during each session arises from scalpers who trade hundreds of times during each session but day traders trade at a lower frequency.

Day traders handle their trading environment better because of their operational method that creates faster reaction time to challenging situations.Scalping vs. Swing Trading

Swinging traders hold their market positions across weeks but scalpers limit their trading duration to brief time intervals.

Swing traders use technical and fundamental strategies to develop their system but technical analysis remains their core because scalpers need only technical methods for trading management.

Scalpers implement loss control measures because this ensures a steady cash flow but swap traders accept greater risks to take advantage of significant market price changes.Scalping vs. Position Trading

The timeframe for position trading spans months to years but separate from its operation structure as short-term trading.

Position traders need market data analysis that follows long-term movements yet scalpers succeed by trading during brief timeframes.

Position traders require larger capital amounts during longer investment durations so minimum capital pools prove suitable for their scalping operations.

Several features related to Steem/USDT entail benefits but also restrictions when used as an instrument for scalping trading operations.

Low trading spreads together with high market volatility and solid market liquidity define the ideal trading pair conditions which allow effective scalping operations. The evaluation process of Steem/USDT scalping operations includes these key elements.

Advantages of Scalping Steem/USDT

Liquidity & Trading Volume

The boosted market liquidity helps scalpers acquire improved trading conditions by reducing regular exchanges slippages.

The trading market accepts Steem cryptocurrency as a solid choice because its liquidity standard reaches main cryptocurrency trading platforms.Volatility

The normal price oscillations in the market allow traders engaging in scalping to find profitable opportunities.

Market events and news-related updates together with system updates trigger fast price movements which generate varied trading possibilities for traders who operate within the Steem platform.Low Transaction Fees

USDT pair trades have minimal fees which enable traders to cut down their business expenses because they execute numerous trades every trading day.

Users achieve greater profits through their scalping activities because they join zero-fee promotion programs which grant maker rebate benefits.24/7 Market Access

Users can conduct operations completely disruptively across all times throughout the 24 hours since the crypto marketplace operates without interruptions.

The platform provides market entry and exit opportunities to its users because it maintains continuous periods of high market volatility.

Challenges of Scalping Steem/USDT

Market Depth & Spread Issues

SteemUsers executes trades based on market depth since platforms supply varying user depth levels to their users.

Price slippage arises from the profit reduction that occurs when traders must accommodate the buy and sell price spread that hinders scalper position closure efforts.Exchange Reliability & Latency

Timely trade execution becomes necessary for scalping businesses since quick execution speeds determine success.

Profit-seeking operations face two main challenges which combine exchange order execution speed and systemic delays.Unexpected Price Manipulation

The major price manipulation incidents take place among the trading platform of cryptos with low market recognition.

Steem suffers from price volatility which exposes scalpers to new risks because of activities made by the community combined with big whale transaction movements.Leverage Limitations

Specific exchanges reject Steem/USDT leveraged trading options despite the potential profit benefits to scalpers through leverage.

Trading operations are made unprofitable by the absence of leverage in the price spread.

Effective Scalping Strategies for Steem/USDT

Market-Making Scalping

Successful scalpers execute multiple orders by placing buy positions at support points but their selling orders must stay at resistance levels.

The profit margin of scalping occurs when buying price is subtracted from selling price.Momentum Scalping

Scalpers should identify substantial price movements in front of their trading period to generate profitable trend-based orders.

Trading signals become straightforward when Traders stretch the RSI with MACD indicator.Breakout Scalping

Scalping trading operations rely on price transactions that happen after bars cross through both upper resistance barriers and lower support boundaries.

Market participants find upcoming breakouts through Bollinger Bands as they examine volatility growth intervals.Volume-Based Scalping

The elevated trading volume makes it possible for traders to execute their trades because of increased market trader activity.

To achieve their analysis maximum effectiveness traders should depend on Volume Weighted Average Price (VWAP).

Risk Management in Scalping

Strict Stop-Loss & Take-Profit Rules

Every trade during scalping operations should use automatic stop-loss protection as the standard practice for securing positions from losses.

Each scalp trading operation must have risk parameters that match reward values at minimum 1:1 level.Avoiding Overtrading

A trader becomes successful in trading through using setups that present high probability ratios while maintaining control of emotions which drive their trading decisions.

Due to market stability all scalping operations should be immediately put on hold.Using Reliable Exchanges

The selection of an exchange for successful trading depends on high trading activities which come with low costs along with efficient speed of order execution.

The process of quick order execution stops slippage from appearing.Leveraging Trading Bots (Optional)

The combination of automated trading control systems that monitor all operations reduces the amount of time needed for automatic order execution.

The decision-making process for trades operates better since it eliminates emotion-based factors throughout the administrative period.

The analysis of market behavior patterns and proper trading method implementation enables traders to make profits when handling Steem/USDT market operations. The Steem/USDT trading pair provides fast trade possibilities because it demonstrates stable price movement combined with sufficient trading volume. Market managers need to understand which risks primarily affect their operations when exchange delays occur and market rates change and price manipulations happen incidentally. Success in scalping requires disciplined performance together with analytical skills and a well-structured plan to handle possible risks within the strategy.

All investors who want to scalp Steem/USDT need to examine markets carefully before selecting their trading platform and developing their strategy.

Best Indicators for Scalping Steem/USDT

Scalping serves as a trading approach that requires numerous small trades at different times to seize small price changes. Scalp traders dealing with the volatile Steem/USDT cryptocurrency pair require dependable swift indicators to assist them in their quick trades. For efficient scalping of Steem/USDT traders should use moving averages (MA), Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) and Bollinger Bands. This essay will thoroughly examine the RSI and three additional indicators together with their applications during Steem/USDT scalping operations.

1. Relative Strength Index (RSI)

What is RSI?

Momentum indicator RSI provides evaluation of price movement strength together with its rate of change. The index operates between 0 to 100 to reveal external conditions of overbought or oversold states.

Above 70 → Overbought (Possible price reversal or pullback)

The market currently shows oversold conditions when RSI falls below 30 but this could result in either a reverse movement or a price rebound.

How RSI Helps in Scalping Steem/USDT

When RSI falls below 30 it indicates Steem has become oversold thus indicating a temporary purchase opportunity.

Steem reaches overbought status when RSI exceeds 70 which signals traders to conduct quick sales for profit extraction.

A bearish divergence appears when the price forms higher highs and RSI creates lower highs thus indicating potential market reversal. RSI shows bullish divergence by creating higher lows at times when price forms lower lows which suggests an upcoming price rise.

Example:

At its current price level of $0.25 in Steem/USDT the recent RSI reading reached 25.

A professional can establish long contracts based on beliefs that the market will quickly increase in value.

A proper exit point exists for the scalper to secure profits when the price reaches $0.27 while RSI shows 60.

2. Moving Average Convergence Divergence (MACD)

What is MACD?

The trend-following momentum indicator MACD consists of three main elements including the MACD Line and Signal Line and their relationship through the Histogram.

- MACD Line (12-day EMA – 26-day EMA)

- Signal Line (9-day EMA)

- Histogram (Difference between MACD Line and Signal Line)

How MACD Helps in Scalping Steem/USDT

The MACD confirms an upcoming uptrend when its line successfully breaks above the signal line thus indicating buying opportunities.

A downswing comes from two lines crossing each other when the MACD line drops beneath the signal line to indicate vendors should make trades.

A widening histogram shows traders that the crossover determines strong directional momentum which allows them to initiate quick trading moves.

Example:

Once the MACD line surpasses the signal line at $0.28, a scalper would potentially start acquiring Steem as they predict brief market expansion.

The trading strategy dictates scalpers to sell Steem after the histogram begins its contraction when momentum weakens past $0.30.

3. Bollinger Bands

What are Bollinger Bands?

Bollinger Bands consist of:

Middle Band → 20-day Simple Moving Average (SMA)

Upper Band → 2 standard deviations above the middle band

Lower Band → 2 standard deviations below the middle band

How Bollinger Bands Help in Scalping Steem/USDT

The Breakout Strategy reveals powerful upward market trends as price exceeds the upper band thus generating potential buying conditions.

Should the price reach the upper band it shows price overextension thus possibly triggering a market pullback suitable for selling opportunities.

The tightening band serves as a warning for low volatility although a breakout is expected soon.

The red lines here are looking for buy and the green lines that are looking are to sell.

Example:

A long trade entry for Steem/USDT scalpers becomes possible when price meets the $0.26 mark on the lower Bollinger Band while an exit should happen near the $0.28 level on the middle band.

A short position at $0.30 will be taken by a trader since a pullback toward the mid-Bollinger Band appears likely when price touches the upper boundary.

4. Moving Averages (MA)

What are Moving Averages?

Moving averages function as data smoothing tools while they detect market trends. The main MAs which work effectively for scalping are:

Exponential Moving Average (EMA) reacts swiftly to changes in price through its calculation method.

Simple Moving Average (SMA) (Slower but reliable for trends)

How Moving Averages Help in Scalping Steem/USDT

Scalpers implement the 5-period and 10-period EMAs for their system to identify brief market movements.

When the 5-EMA crosses above the 10-EMA the indicator signals purchasing opportunities because it indicates bullish momentum.

Market trends reveal bearish pressure when short-term Moving Average crosses below long-term Moving Average thus signaling trade opportunities for selling.

Example:

A scalper should buy and exit at $0.29 after 5-EMA crosses above 10-EMA when the price reaches $0.27.

When the 5-EMA falls beneath the 10-EMA at $0.30 a scalper starts selling Steem and exits at $0.28.

Best Scalping Strategy for Steem/USDT

Multiple indicators can be utilized by scalpers to elevate their profitability.

Example Strategy (RSI + MACD + Bollinger Bands)

- RSI Below 30 → Look for an entry.

- MACD Bullish Crossover → Confirms momentum.

- Market conditions that bring the price level near to the lower Bollinger Band confirm that the time is right to buy.

- Scalpers should choose to exit their position at the middle or upper Bollinger Band when RSI approaches 70.

Example Strategy (Moving Averages + Bollinger Bands)

- The 5-EMA and 10-EMA cross above price position confirms price movement is point upward.

- A price rise above the average level of the Bollinger Band creates a buy signal.

- The price starts slowing down so exit near the upper boundary of the Bollinger Band area.

The best indicators to use for Steem/USDT scalping operations are RSI, MACD, Bollinger Bands with Moving Averages. Through the analysis of RSI traders identify market conditions both when prices become too high and too low while MACD signals momentum changes and Bollinger Bands indicate potential entry points and average shifts produce trending indications.

Scalppers should boost their accuracy by using several trading indicators while implementing stop-losses as risk mitigation tools and trading when trading volume is high. Trading expertise in Steem/USDT enables traders to execute successful quick trades for profits.

The Step-by-Step Guide to Conduct Scalping Strategy for Steem/USDT Trading

Rejoicing within brief durations with numerous transactions allows traders to profit from minimal price alterations through their scalping methodology. Any trader who wants to scalp Steem/USDT needs to create a solid trading methodology that allows both increased earning potential and reduced exposure to risks. The approach outlines systemized scalping steps for traders which includes both entry and exit tactics and position management strategies and they learn about stop-loss placement rules and execution plan details.

1. Understanding Scalping in Steem/USDT

Trim is an approach which operates on brief market price shifts throughout highly liquid trading environments. Steem/USDT functions well as a scalp instrument because the market exhibits high trading activity coupled with deep market liquidity. This investment strategy pursues short-term trading opportunities which differ from the average long-term strategy.

Why Choose Scalping?

Significant returns happen quickly since traders be exposed to minimal market risks.

Works well in both bullish and bearish markets.

The method depends less on fundamental analysis which makes it suitable for users who focus on technical approaches.

2. Essential Tools and Indicators for Scalping

A trader needs essential tools alongside effective indicators to analyze price movements successfully before starting trade execution.

Recommended Trading Platform

Binance, KuCoin, or another exchange with low fees and fast execution.

Key Indicators

The combination of Exponential Moving Average with nine and twenty-one time periods works as an indicator to detect rapid trends.

When using Relative Strength Index (RSI) with a 14-period calculation traders can identify market conditions that become both overbought and oversold.

Volume Indicator: Confirms the strength of a price move.

Bollinger Bands: Measures volatility and potential breakout points.

3. Step-by-Step Scalping Strategy for Steem/USDT

Step 1: Identify Market Conditions

The optimal time to trade Steem/USDT exists during high volatility periods especially when the market demonstrates increased trading volume like the US and European market hours.

Scalping should be avoided during steady or low-volume market periods since price fluctuations will likely be inadequate to generate profits.

Step 2: Define Entry Points

Scalpers need to accomplish precise trade entry points to generate profits. The following entry conditions apply:

Bullish Entry (Long Position)

The crossing of the 9-EMA above the 21-EMA indicates that an upward price movement is currently active.

The trading momentum can be evaluated through the RSI indicator which shows values between 40 and 60 to designate sufficient trading power.

Scalping should occur when the price approaches the lower boundary of the Bollinger Band because it signals an upcoming price climb.

Buyers demonstrate intense buying intent because trading volume raises steadily.

Bearish Entry (Short Position)

A decline in market trend shows when the 9-EMA drops beneath the 21-EMA.

The RSI reading within the 40 to 60 range demonstrates there is enough selling pressure.

The current value location at the upper border of the Bollinger Band points to a possible market decrease.

The rising volume demonstrates investors strongly selling the assets.

One must determine their position size and establish risk management strategies during Step 3.

Individuals who want to prevent large losses and boost their benefits must master position sizing techniques. Follow these rules:

Your total trading capital should define the maximum amount at risk per trade which should fall between 1-2%.

Set your position amount according to the location of your stop-loss.

A position sized for a 2:1 reward-to-risk ratio must have stop-loss set at 0.5% below entry point.

The available $1,000 capital lets you risk $10 but your risk should be distributed across a trade size that matches up with $10 losses when prices move by 0.5 percent.

For Step 4 establish both stop-loss parameters along with take-profit triggers.

Stop-Loss Placement

Set your stop-loss point to the lowest swing point from the market and maintain it at 1% below entry price.

For short trades put your stop-loss either 1% above entry point or at the most recent swing high.

Take-Profit Strategy

The ideal risk-to-reward ratio stands at 2:1 with a stop-loss set at 0.5% so the take-profit should reach 1%.

A different option for the trade is scaling out through the following process:

The trader should extract fifty percent of their trading stakes upon generating half a percent of investment profit.

The remaining 50% of capital should continue running until it reaches 1% profit.

4. Executing Multiple Trades Efficiently

For successful scalping you need swift trading choices and perfect market entry skills. Follow these best practices:

Fast trade execution can be achieved through using Market Orders.

With market orders users achieve swift entry during rapid market movement.

Setting your orders as limits at essential position levels helps you maintain better entry price control.

Monitor Volume and Order Flow

The trading volume of an asset tends to rise sharply before major price fluctuations take place.

The depth of order books provides essential information about feasible resistance and support levels.

Keeping trades below a specified duration should be avoided by scalpers.

Arrival-close trading is vital for honing market reversals because extended position duration exposes traders to adverse price motions.

5. Managing Emotions and Staying Disciplined

Maintaining discipline along with emotional control stands necessary for achieving successful scalping outcomes. Follow these guidelines:

Follow your trading strategy exactly: Ignore strategic changes that come from emotional impulses.

Each day continues after reaching your trading profit goal or hitting your predefined loss threshold.

A trading journal serves to document all transactions which will help you recognize patterns to advance with time.

6. Scalping strategies must be readjusted according to the current conditions found in the market.

Worsening market stability allows traders to expand their parameters for stop-loss as well as take-profit levels.

When market spreads reach unacceptable levels you should decrease how many trades you execute to prevent paying more fees.

When market unpredictability becomes elevated it might be suitable to switch to a range trading system.

When you apply exactness and self-discipline in your Steem/USDT trading activities you will encounter profits. Proper risk management combined with systematic trading steps for identifying opportunities and establishing risk zones and trading patterns can lead to better profit potential. Achievement stems from fast decisions and continuous monitoring and market-based strategy adjustments.

The implementation of this strategy helps scalpers to improve their trading behaviors and take advantage of brief Steem/USDT market price shifts.

Risk Management in Scalping Steem/USDT

The trading model called scalping performs many quick small trades during short periods to extract small price swings. Numerous marketplaces allow cryptocurrency traders to deploy this trading method for Steem/USDT exchanges. The rapid execution of scalping trades creates multiple dangers for traders because it leads to both excessive market price fluctuations and margin-related problems that trigger margin calls. Business financial operations achieve their success while lowering their losses through appropriate risk management techniques. The piece discusses the threats linked to scalping as it demonstrates structured techniques to lower losses by using appropriate leverage methods alongside safeguards against market liquidations.

Prior to conducting Steem/USDT scalping operations you must understand all potential risks which may occur.

1. Market Volatility Risk

The cryptocurrency Steem belongs to a vast group of market volatile digital currencies existing in the present era. Scalping relies on minor price shifts although unexpected market movements tend to nullify profits by causing major financial losses.

2. Spread and Slippage

The price accuracy in scalping deals depends on how tightly spread and slippage levels affect the exchange of offers for bids. Multiple ongoing trades in scalping operations lead to diminished earnings because small spreads produce negative effects on overall revenue. When an order executes at different prices from the planned price the result is increased costs through slippage.

3. High Transaction Costs

A scalper must execute multiple transactions promptly within a restricted timeframe. The calculation of numerous transaction fees from repeated trading activities results in quick reductions of total profits.

4. Leverage Risks

Using leverage has become a typical tool among scalpers to boost their profits. Leverage delivers two advantages by stretching positive returns as well as negative results. Financial institutions have the power to force trades and market orders because too much borrowing occurs through leverage.

5. Psychological Pressure

Scalpers must execute their anticipated fast market reactions during pressured conditions for their system to operate effectively. The combination of stress and FOMO alongside emotions motivates traders into making spontaneous decisions leading to increased risks of financial losses.

6. Liquidity Risks

The market liquidity stands determined by how Steem/USDT conditions perform in the market. Low-liquidity trading markets create hurdles for position entry and exit that causes lost money in selected prices.

How to Mitigate Losses in Scalping Steem/USDT

1. Use Stop-Loss Orders

A stop-loss order serves as an essential tool within scalping because it prevents traders from sustaining intolerable trading losses. Clients implementing stop-loss orders must use technical indicators and price evaluation data to determine their specific price levels.

A stop-loss order placed at $0.24 will safeguard the investments of traders who acquired Steem at $0.25 when they conducted their trade operation.

2. Set Realistic Profit Targets

Profit targets remain small and consistent in scalping because the strategy avoids prolonged trading movements with unpredictable outcomes. The establishment of realistic profit targets enables traders to generate profits from their investments through protection against unneeded market volatility.

The asset buyer setting their take-profit target at $0.255 will define this limit when purchasing the asset at $0.25.

3. Use Risk-Reward Ratio

The investment risks should be balanced with reward potential to establish maximum profitability. Traders who speculate aim to earn $2 from their initial $1 risk as per typical 1:2 risk-reward ratio rules.

The trader should set their profit target at $20 since they will take individual positions worth $10.

4. Avoid Overtrading

Scalpers incur higher fees along with mental exhaustion from trading excessive times since their trading frequency remains high. High entry probabilities should be the only setups accepted by traders because new trades bring more risks than benefits to the table.

5. Trade During High Liquidity Periods

Steem/USDT market demonstrates its most liquid state during peak market operating times. The execution quality together with reduced slippage becomes better when traders execute trades at market peak hours.

How to Manage Leverage in Scalping

1. Use Low to Moderate Leverage

Using leverage opens new profit potential but fast market termination occurs from utilizing excessive leverage amounts. Scalpers who are new to trading should commence with leverage ratios between 2x to 5x and gradually increase their vulnerability with experience.

The trader adopts a 5x leverage ratio rather than going with excessive 20x leverage in order to protect themselves from market risks.

2. Adjust Position Sizing

A trader should understand their risk tolerance before choosing specific trading quantities since leverage positions must not surpass these limits.

Trading position risk levels need to match between 1% and 2% of active trading funds.

3. Monitor Margin Levels

Traders need to keep watch on their account margins and enough available funds to stop brokers from stopping their trades.

4. Hedge Positions

A second trade with opposite properties opened by traders provides them protection against high market risks. Steem long position holders can reduce market risks by creating opposing short trades with minimized asset amounts.

How to Avoid Liquidation Risks in Scalping

1. Avoid Using Maximum Leverage

Using leverage factors at 50x or 100x level produces an excessive risk that could lead to account liquidation. Complete account losses occur whenever a trade against the capital moves even slightly in the wrong direction.

2. The trading account should always contain physical capital

An account holding a higher volume of money than trade positions ensures market safety by protecting funds from necessary forced market withdrawals.

Traders can defend against forced liquidations because they maintain at least $100 above their $500 trading capital.

3. Monitor Market Conditions

The practice of scalping becomes risky for traders whenever volatile information events like news releases and economic data announcements take place.

4. Use a Trailing Stop-Loss

The trailing stop-loss mechanism tracks price changes for the purpose of protecting profits through distance positioning that avoids forced assetselling.

The 2% trailing stop-loss at the entry point of $0.25 becomes more profitable as the price climbs higher due to rising stop-loss settings.

5. Diversify Trading Strategies

A Lorder operating with one trading approach should build swing trading strategies into their existing system for better investment security.

The profitable aspect of USDT and Steem trading occurs during scalping although traders must navigate serious risks. Success in the long run requires the implementation of well-designed risk management procedures. Trading success depends on traders who set proper loss-stop levels along with proper risk-to-reward ratios and moderate leverage usage so they can avoid liquidation risks that result in maximum profitability. Success in scalping requires disciplined execution and patient conduct along with an enthusiastic trading strategy. Risk-oriented traders demonstrate superior performance than profit-oriented traders in the volatile crypto market environment.

Real-World Scalping Case Study: Steem/USDT

Introduction to Scalping in Crypto Markets

A scalping strategy requires traders to perform many rapid transactions for trading success even though its main focus relies on speedy and accurate operations. For accurate execution of fast trades in dynamic markets one requires precise market knowledge. The current study examines authentic trade scalping operations as the Steem/USDT trading pairs execute on Binance platform. This research examines the developer's trading technique while analyzing complex market fluctuations and their effects on the trader's greatest results.

Scalping Scenario: Steem/USDT on Binance

Market Context and Setup

During the time of market volatility over Binance the operator chose to trade Steem/USDT pair exchanges. The following conditions were present:

- Steem's high volatility level boosted all market trading because the Steemit community released an announcement.

- Several active orders with narrow spreads appeared on the order book to make successful scalping possible.

3. Technical Indicators Used:

Technical analysis required implementation of moving average detection strategies based on 9- and 21-period exponential averages for brief market trend recognition.

Through the RSI indicator traders can detect markets when they are either at overbought or oversold conditions.

Large volume spikes helped identify future breakout conditions within the market through volume analysis.

Bollinger Bands function as a detection system which reveals price movements disrupt or reverse particular levels.

Trade Execution

- Identifying Entry Points

The method of sudden price breakouts called breakout scalping served as the trader's entry point for their deals.

Spotting Momentum:

The Steem prices maintained a stable position at $0.195 with RSI indicators showing low numbers of 40. Volume indicators suggested that an important breakthrough was about to happen as reading became more noticeable.

First Trade:

The trader made their initial purchase at $0.195 during an RSI increase beyond 50 and rising market volume pattern.

Target: $0.198

Stop-Loss: $0.194

Position Size: 5,000 Steem

Profit Target: 1.5% ($15 per $1,000 capital)

Outcome:

The price which reached the target of $0.198 in just five minutes enabled the trader to realize their profit goals. The trader earned $75 through the transaction by multiplying 5,000 Steem with its price of $0.003.

2. Adjusting to Market Conditions

After the breakout phase market volatility increased at the same time spreading between different market participants started to appear. Under changing market circumstances the trader made this strategic move:

Reducing Position Size:

The traders established a new trading parameter which restricted them to work with 2,500 Steem in each transaction to minimize their risk exposure.

Shifting to Range Scalping:

The price stayed unchanged at $0.197 to $0.200 because there was no significant breakthrough point during this phase.

The trader implemented range scalping which involved making various trades between $0.197 support and $0.200 resistance.

Example Trade:

Buy: $0.197

Sell: $0.199

Profit: $50 per trade

Number of Trades: 5 times within 30 minutes

Total Profit: $250

3. Avoiding False Breakouts

The brief surge of price to $0.202 lasted several seconds and wound up causing various traders to endure losses from their trades.

How the Trader Avoided the Trap:

The trading volume remained low because this price movement proved to be a false breakout.

Placed Stop-Loss at $0.198, limiting losses.

The trader obtained a quick profit by entering at $0.196 to sell at $0.199.

The Main Learning Points Derived from This Exchange Handling Session

1. Liquidity Matters

The high trading volume in Steem/USDT allowed the investor to finish his orders in a timely manner. Liquidity selection represents the primary core principle for scalpers because it allows them to avoid financial losses from slippage.

2. Quick Decision-Making is Essential

During scalping operations your profits depend heavily on quick reaction times because they can benefit from small price movements. Free trade execution became possible through a fast connection system that synchronized with pre-established keys.

3. Proper Risk Management is Key

Limit orders and automated stop loss systems served traders in their attempts to control their trading losses.

A volatility spike would have the effect of making the trader reduce their active trading positions.

The setups were the only platforms used to trade since they provided reliable performance results.

4. Adaptability Improves Performance

Market conditions shifted sending the trader toward adopting range scalping after leaving breakout scalping. Through this adaptable business model the trader could sustain profitable trading results.

5. Beware of False Breakouts

Checking market volume levels helped the trader detect and stop potential fake price spikes. A quick rising market price that lacks enough suitable trading volume development creates a trading risk.

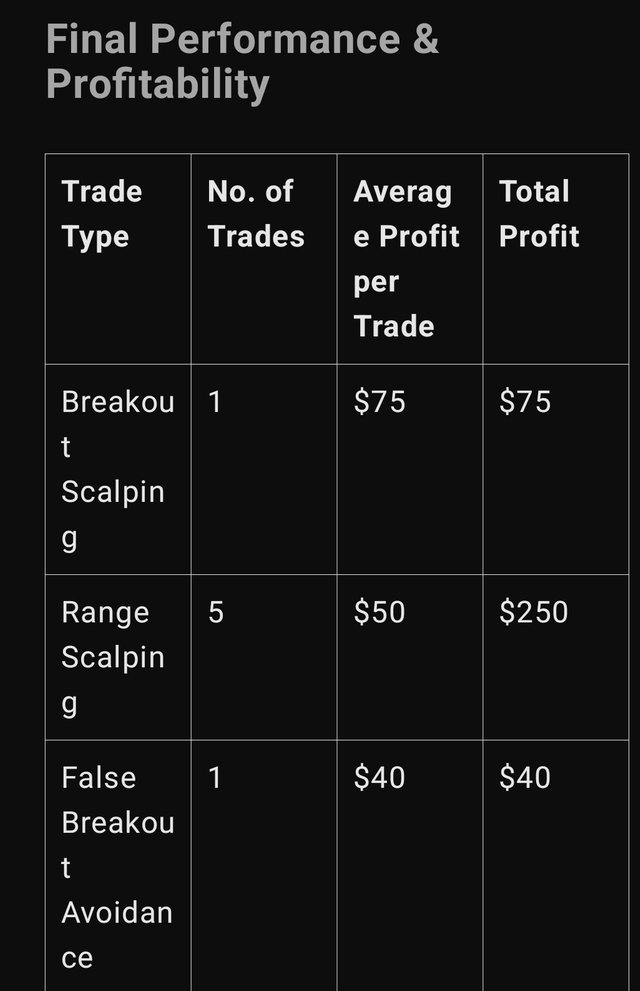

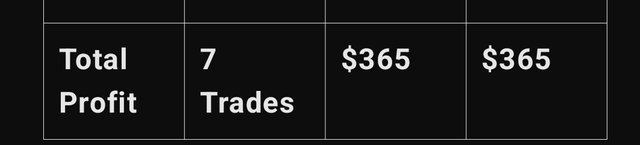

Final Performance & Profitability

By putting $5,000 into the trading session the trader obtained $365 as profits at a rate of 7.3% throughout the one hour time frame.

The Steem/USDT scalping analysis identifies crucial elements which highlight their importance in the process.

Choosing high-volume markets for liquidity.

Traders utilize technical indicators to detect when it is appropriate to both enter and exit their trading positions.

These strategies must have the capability to react to what current market conditions show.

Hi-risk management allows traders to stop massive financial losses during their operations.

Market volume pattern verification allows the trader to avoid false trading signals.

Reaching success in scalping requires experience together with disciplined thinking and quick reactions under stressful conditions. Transforming trading patterns to execute trades successfully produces stable profits for traders during volatile Steem/USDT pair conditions.

I would like to invite @wilmer1988 @pelon53 @josepha to take part in this contest

Thanks for reading my blog