The Bid Ask Spread (Part II)- Steemit Crypto Academy- S4W3- Homework Post for @awesononso

Hello guys welcome to my assignment by Prof. @awesononso. Feel free to go through.

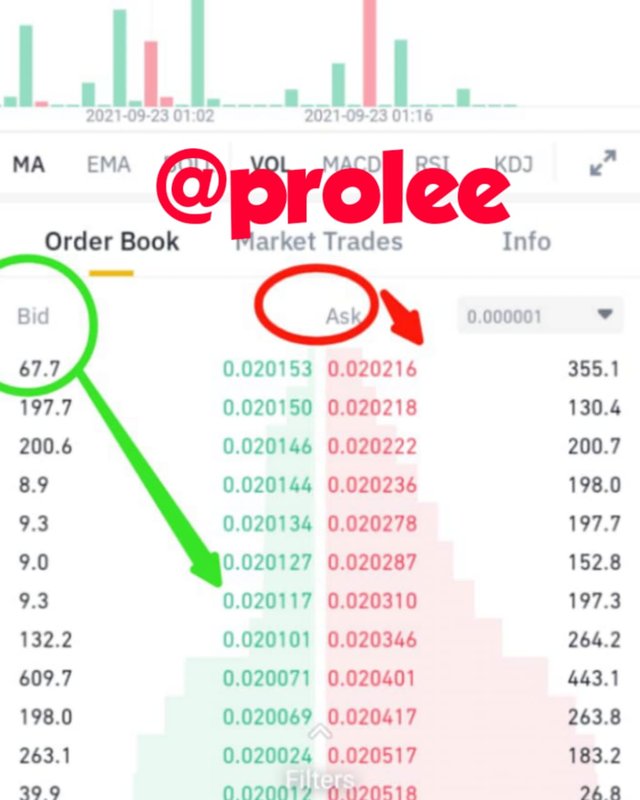

1.) Define the Order Book and explain its components with Screenshots from Binance.

ORDER BOOK

An Order Book is an electronic list of buy and sell orders for a security by price level. It can also be said to be a book use for various exchange such as Stock, Cryptocurrencies, e.t.c.

The Order Book has various components such as;

• Ask side- is the two last Columns on the right side of the order book containing the sell order.

• Ask price - this is the price a seller or market maker is willing to accept for a particular security ask price.

• Ask size - is the quantity of security a market maker is willing to sell.

• Bid price - is the price a buyer is willing to pay for a particular security.

• Bid side - is the first two columns by the left side of the order book.

• Bid size - refers to the quantity of security that an investor is willing to buy or purchase from order book.

2.) Who are Market Makers and Market Takers?

Market Makers and market takers

The crypto exchange order book is an electronic list of buy and sell orders use in facilitating trading in the Crypto space. A trade is executed if buy order matches the sell order of a particular market maker.

There are two kinds of people that enhances trading or exchange in the order book. They are the;

- Market Makers

- Market Takers

• Market Makers

The market makers are those who provides who provides liquidity for the Order Book. They usually place the buy order above the market price and the sell order below the market price. The fees for market makers are usually low.

The market makers are also service providers and at times they also act as middle men the the market.

• Market Takers

They are the group that consumes liquidity from the order book

3.) What is a Market Order and a Limit Order?

MARKET ORDER AND LIMIT ORDER

Talking about limit and marks order,both orders are very important to the market makers and takers like I made mention before,so let's look at what this two orders are.

Limit Order

As the name implies limit order, we know this are orders associated with specific price,this kind of order are outstanding orders that are executed at a specific price or even better.

Market Orders

The market order as the name implies is associated to the market,the price are not filled unlike the limit order,the market order is a kind of order that excute trade immediately at the best price,unlike in limits order where it need s to get to a certain price.

4. Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

The forex market is the biggest market in the word and as such anyone can be a market maker,the forex market is populated by market makers,thats because anyone can be a market maker.

Like I said before market makers are service providers or some times they act as middle men between the buyers and sellers in the market,market makers buys at bid price and sells at the offer that we give them profit thats if the price is not affected.

In the order hand the market takers like I said before they are the once that places an order in the forex market, thats when an order has been open by the market makers.

In other words market makers provides liquidity to the market while the takers consumes the liquidity.

5.) Place an order of at lease 1 SBD for Steem on the Steemit Market place by;

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

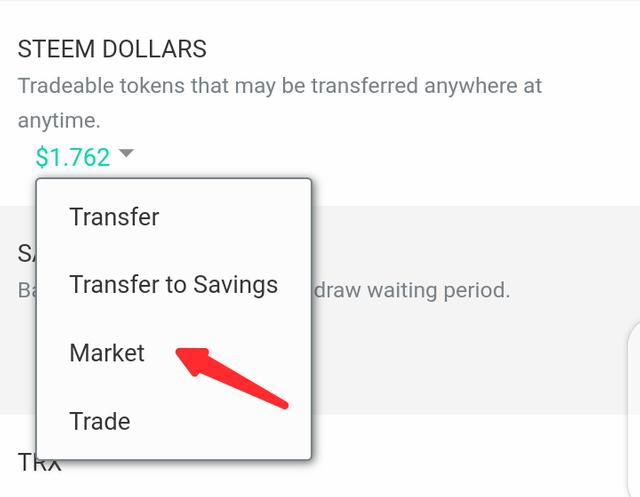

a.) Accepting the Lowest ask. Was it instant? Why?

For me to make this possible I need to login my steemit wallet, which is done by entering my steemit wallet and clicking on the highlighted SBD value, which then I'll click "market" in the option that rolls down.

clicked on Market option

As that the time of my transaction the lowest ask price was 0.080750 and when I placed 1 SBD order, it gave me 12.384 Steem and I clicked the "BUY STEEM". The transaction was successful after putting my active keys for confirmation.

The order was immediately rounded up. The reason is because it was the existing market price. I did not specify my own price.

Later on I placed another order. This time around I specified I want to buy at 0.080002, which is lower than the current market price, That is, I placed a limit order. This time I SBD is giving me 12.492 Steem

I confirmed the Limit order and followed the usual process

I placed my price below the current market price, my order delayed to be summarized. This means that the order has to wait until a market taker accepts to sell at that my limit price.

That's all.

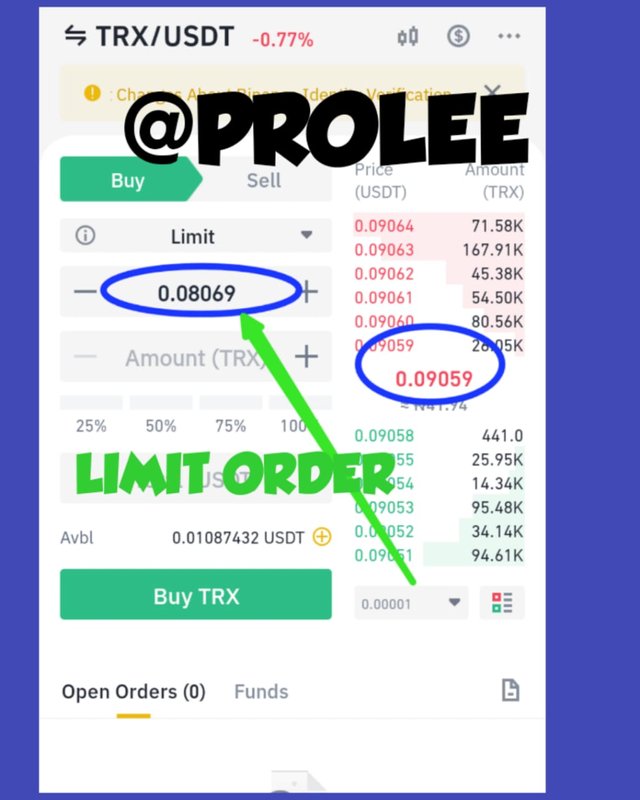

6.) Place a TRX/USDT. Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

LIMIT ORDER ON BINANCE

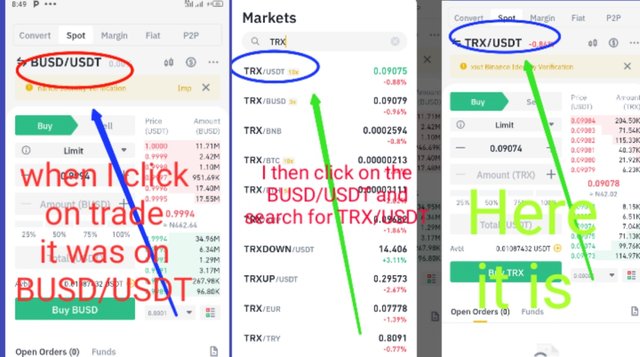

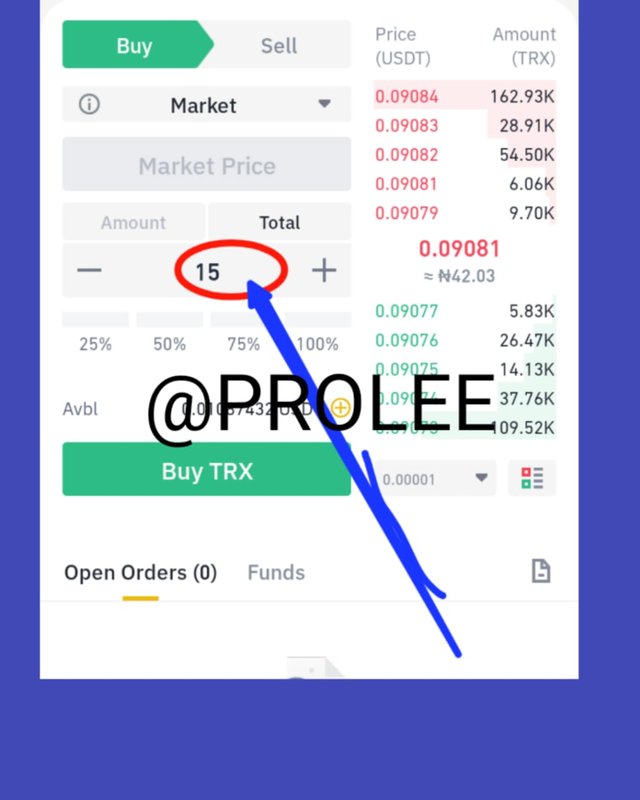

In order for me to place limit order of $15 TRX/USDT, I took the following steps;

The first thing I did was to log into my binance app.

The next step I took after logging into my binance app was to click on trade .

After that I click on the market and search for TRX/USDT

4 I then selected it,and place my order.

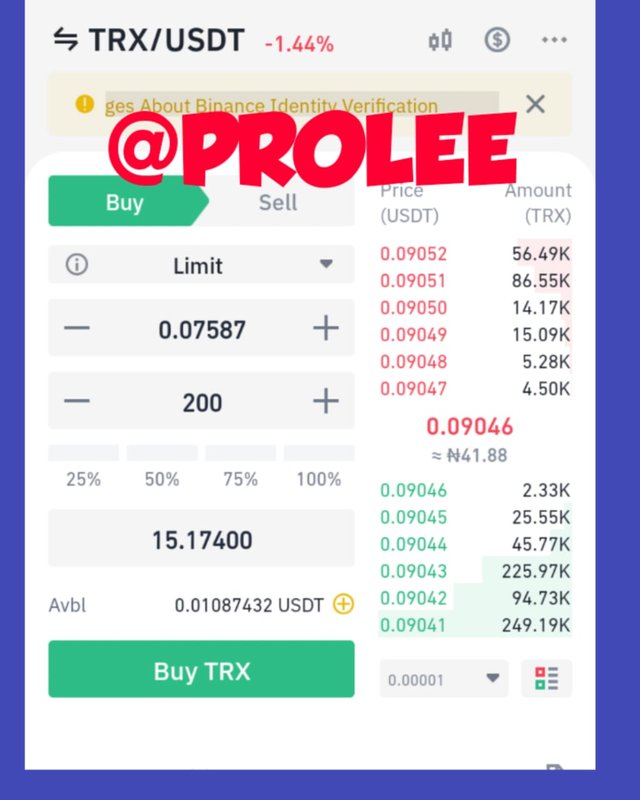

Impact of my Order

From what I said previously about market makers, that they are service providers, here I am to illustrate it fully with me providing my own liquidity into the market as 0.07587 usdt, any taker who want to place an order at 0.075 has less than 2 limit order open to match.

My order would be excuted once there is a decrease in the market since it is lower than the market price.

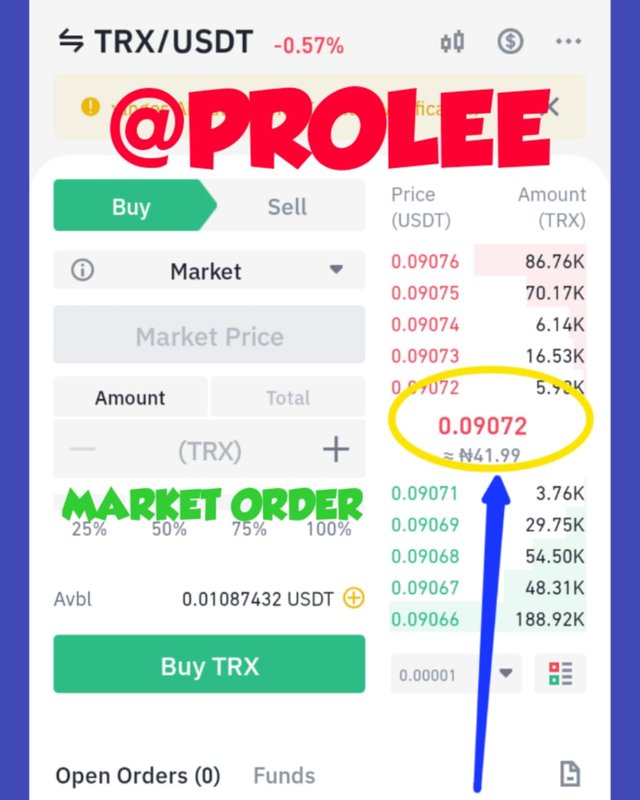

7.) Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

MARKET ORDER ON BINANCE

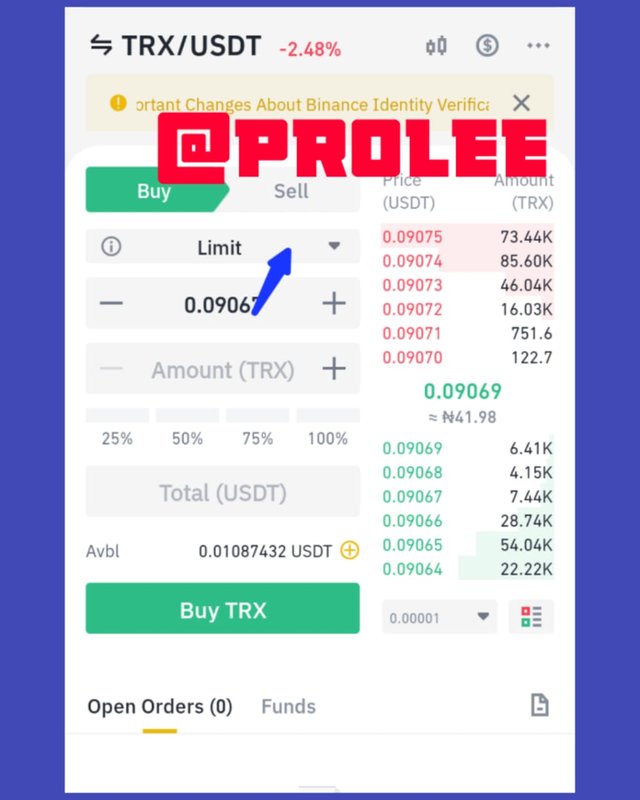

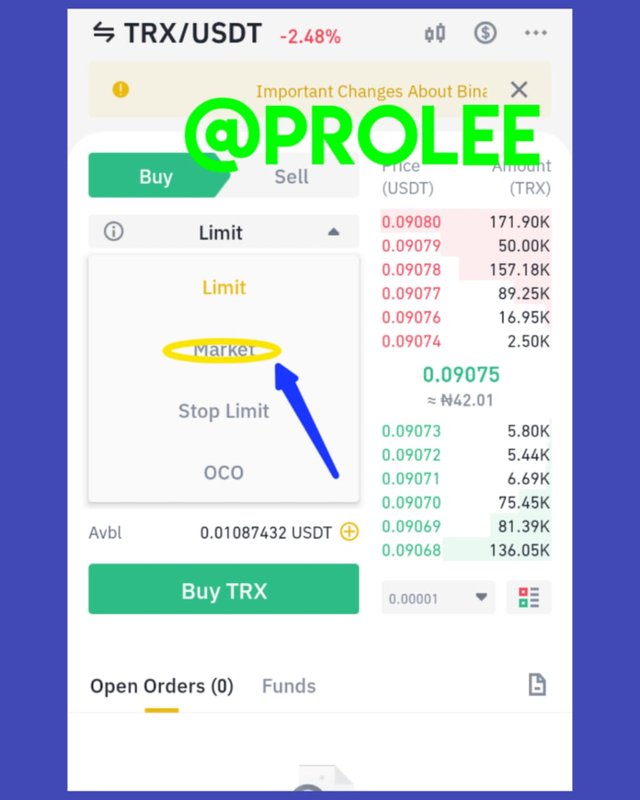

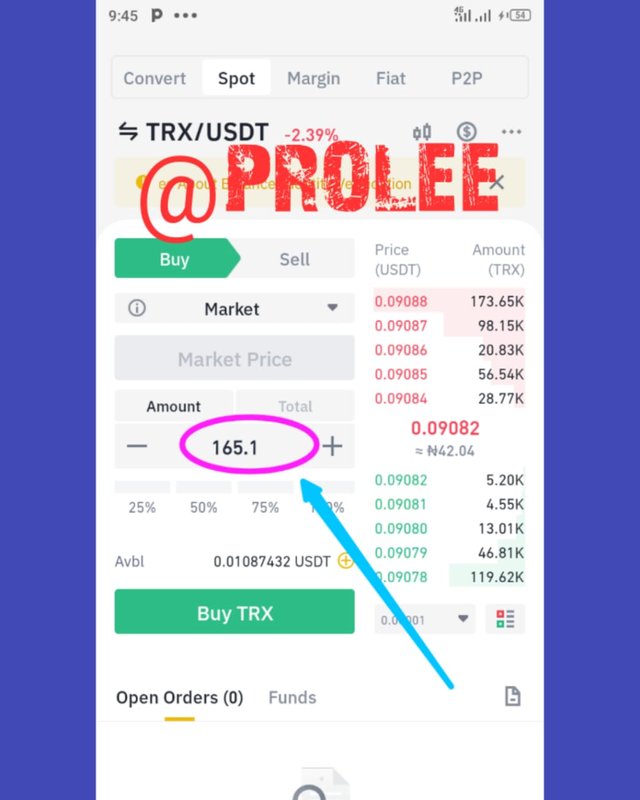

I also place a market order on binance on TRX/USDT. Like I stated before in market order,it is excuted immediately unike in limit order.

1.So the first thing I did was to select market order so as to enable me place market order automatically.

- Then after that I selected the amount of usdt in percent out of the total usdt remaining in my wallet that I am willing to spend.

3 when I was done I placed the order it was excuted immediately.

Check out the screenshots.:

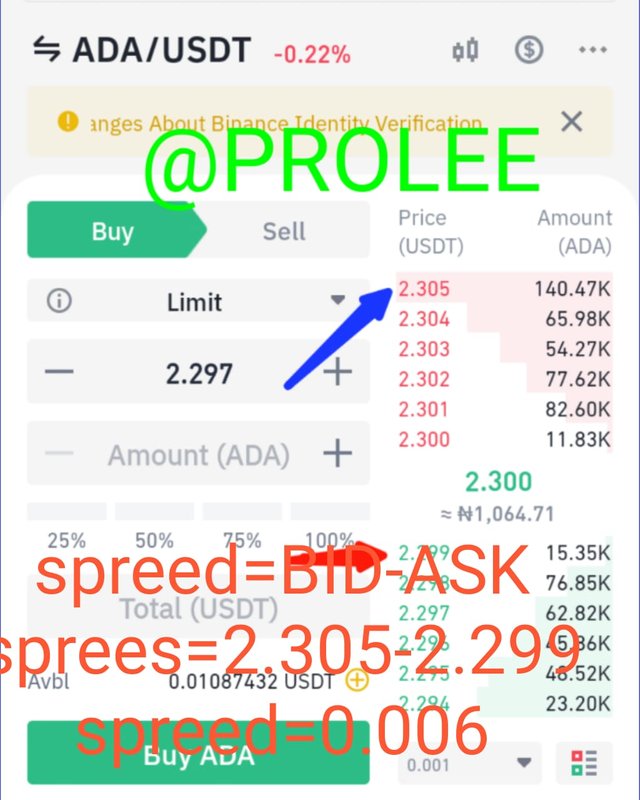

8.) Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

Spreed=bid-ask

Spreed=2.305-2.299

Spreed=0.006

Cc:

@awesononso

Hello @prolee,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Thanks again as we anticipate your participation in the next class.

Okay.. thanks for the feedback

Will do better next time