Steemit Crypto Academy [Beginners' Level] | Season 4 Week 3 | The Bid-Ask Spread (Part II)

Hello family,

Here is my presentation for this week.

Made with iMarkup

1 Define the Order Book and explain its components with Screenshots from Binance.

The order book

Components of the Order Book

The Order Book is categorized into two sections which are red and green (red on top of the green in the Binance app).

The green section is the Bid side whiles the red section is the Ask side.

The green section displays all the Buy Orders and other relevant informations associated with them. There are columns for the bid prices and amount and the highest Bid price is usually located at the top.

Whiles the red section is the Ask side which is made up of Sell orders. Just like the bid side, there are columns for prices and amount.

The highest Ask price is also located at the top of the order book.

2 Who are Market Makers and Market Takers?

Market Makers are the people who place their orders based on their preferred price and interest. Market Makers are known for placing Limit Orders. These people do not have their orders filled at the current market price because they specify their preferred price level to the exchange. They are the people that usually buy at the Bid price and Sell at the Ask price.

Market Takers are the people who initiate Market Orders instead of Limit Orders. Their orders are filled instantly based on the current market price or trend.

3 What is a Market Order and a Limit order?

Market Order

A Market Order in an order that is placed and filled instantly based on the current market price without any price adjustment by the trader or investor. Normally this type of orders are placed by Market Takers.

Limit Order

A Limit Order is an order that is placed for a particular amount of an asset to be bought or sold at a specified price. Once placed, they are arranged on the order book until they are filled.

This form of order is noted as the preferred order method for the Market Makers.

4 Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

The Limit orders initiated by the market makers provide liquidity for an asset. A lot of Limit orders would mean a lot of standby orders at any price level. This would mean that there would be a ready market for the Market Takers and Market orders can be filled easier and more efficiently. Now, market takers come in with their market orders and are matched to the limit orders. Once matched, these market takers accept the price of the market makers and both orders are filled.

In a simple terms market makers provide the liquidity while market takers take the liquidity.

5 Place an order of at lease 1 SBD for Steem on the Steemit Market place by

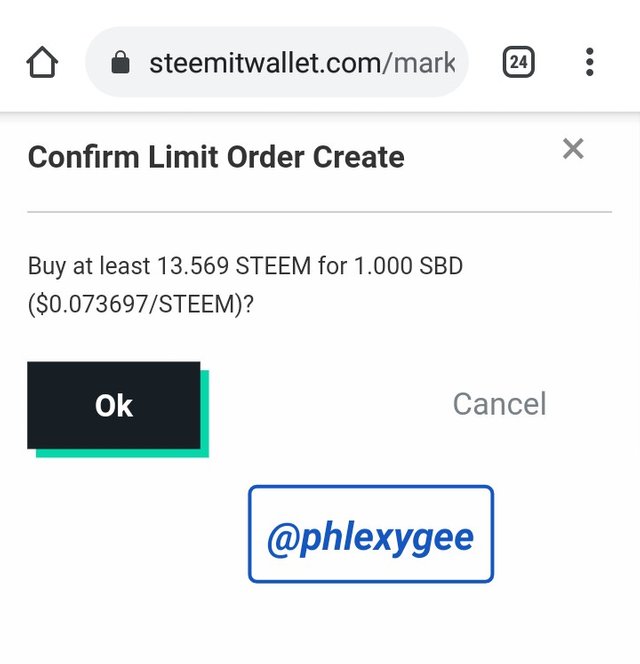

a) accepting the Lowest ask. Was it instant? Why?

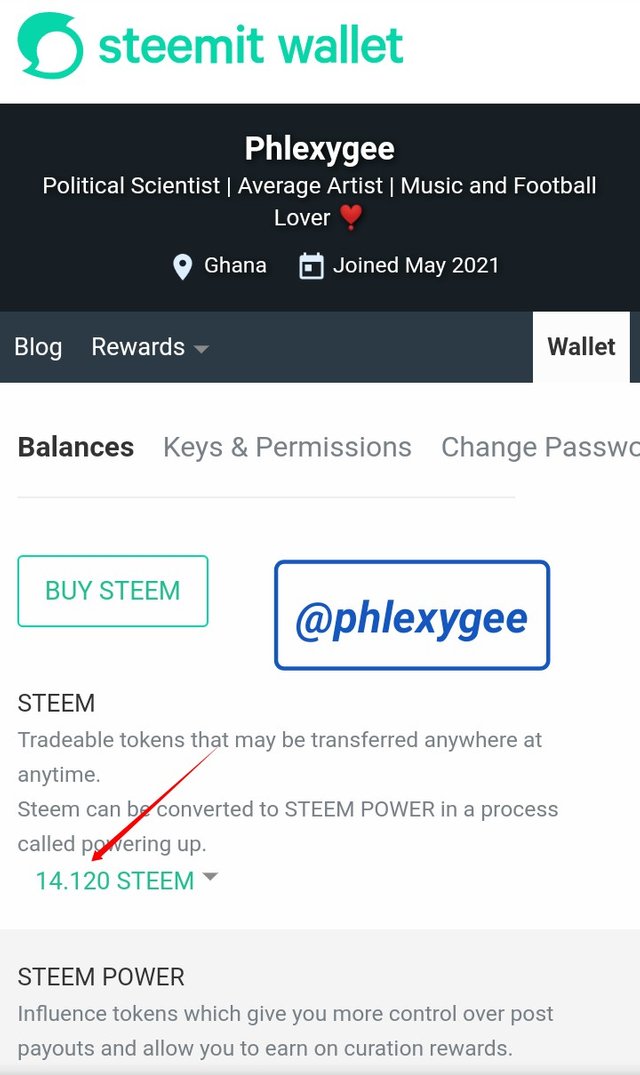

I accepted the Lowest Ask and proceeded with the transaction.

During the time of the screenshots I alread had about 0.5 Steem in my wallet.

Was it instant?

Yes the order was executed instantly.

Why?

I think the order was instant because it was not a Limit Order and the price I offered went in line with the highest Ask price.

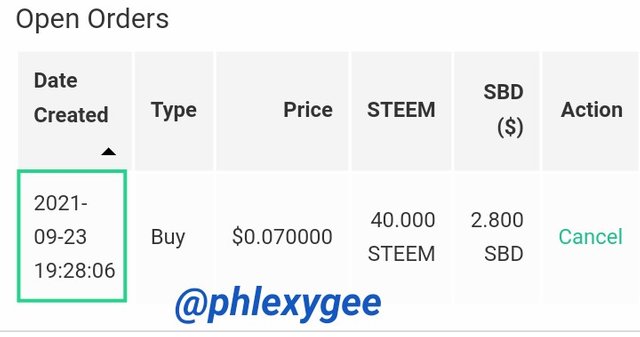

b) changing the lowest ask. Explain what happens.

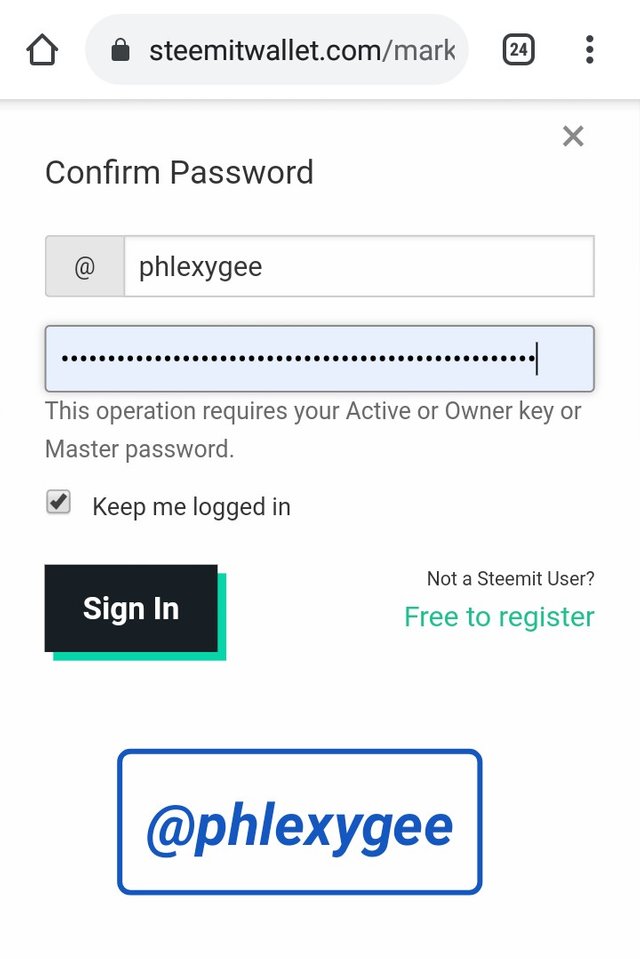

(Make sure you are logged in to your wallet).

After changing the lowest Ask price the order has not been filled or executed yet and I know this is because the order I placed is a Limit Order so therefore I have become a Market Maker over here.

Which means my offer do not tally with the current market price, not even the lowest Ask so my order is pending and I have to wait for some gracious period.

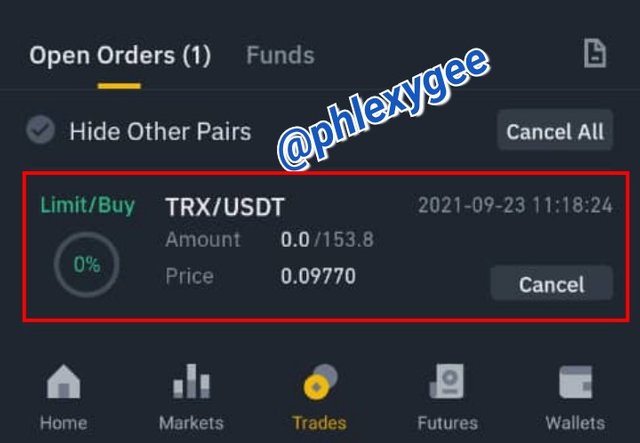

6 Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

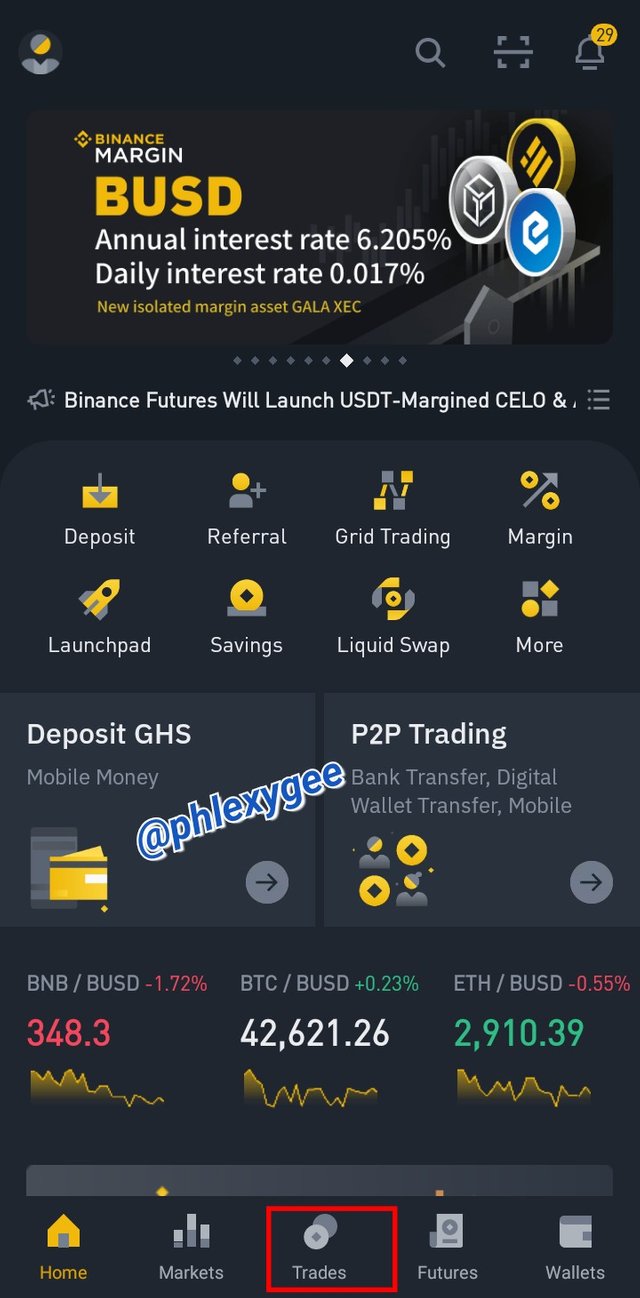

- To place a TRX/USDT buy Limit Order on the Binance exchange firstly you have to login in your Binance account and go to trades (Spot).

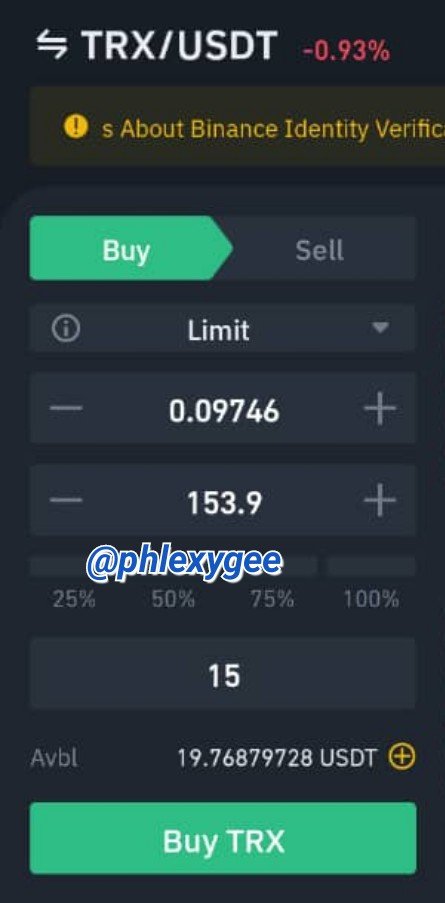

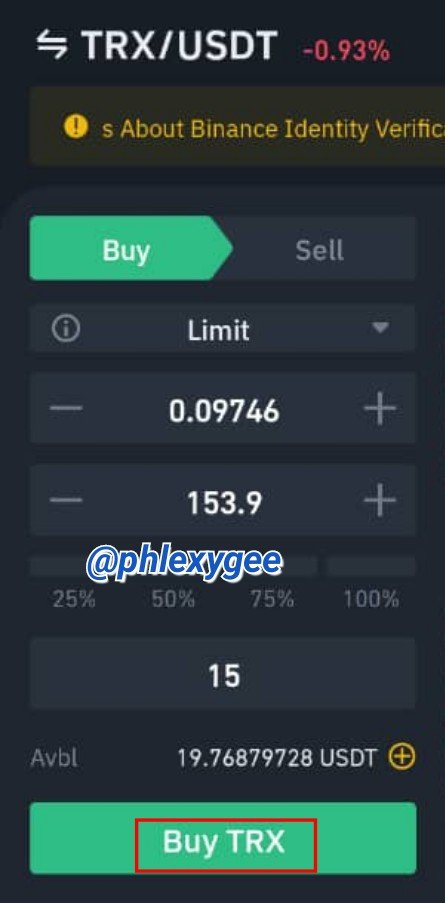

- Tap on the top left corner to search or select your preferred crypto pair in the market. We must choose TRX/USDT because that is what our homework demands.

- Fortunately the default Binance exchange trade order is a Limit Order so you just have to input the amount of TRX you want to buy with your preferred amount of USDT.

- Then finally you confirm the order.

Since it is a Limit Order it will take some period of time before the execution of the order and this depends on the market demand or liquidity.

The Order has made an impact in the market by serving as liquidity to the Market Takers.

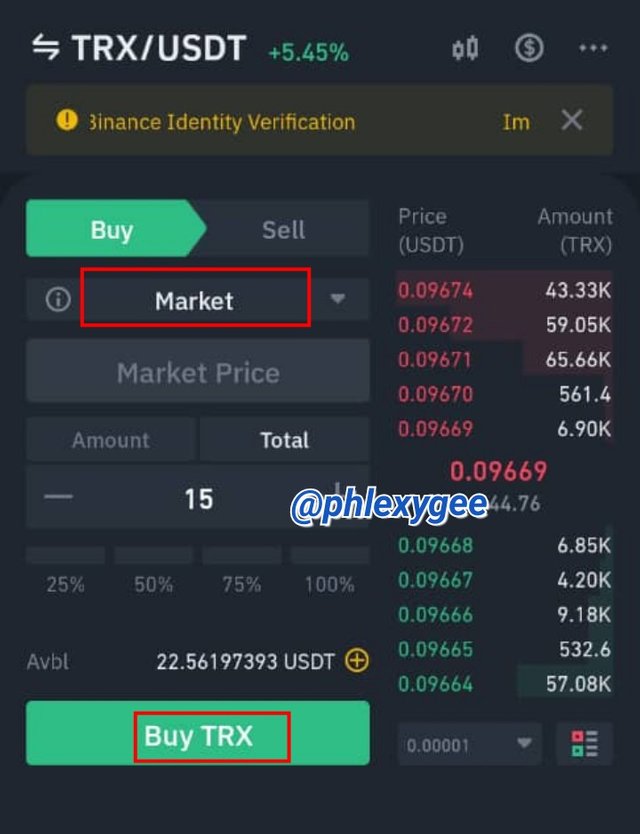

7 Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

The steps to place a TRX/USDT Buy Market Order on the Binance exchange are similar to that of the Buy Limit Order but with this one you have to switch or select Market from the trade options in order to proceed.

The Order has made an impact in the market by fulfilling the interest of some of the Market Makers.

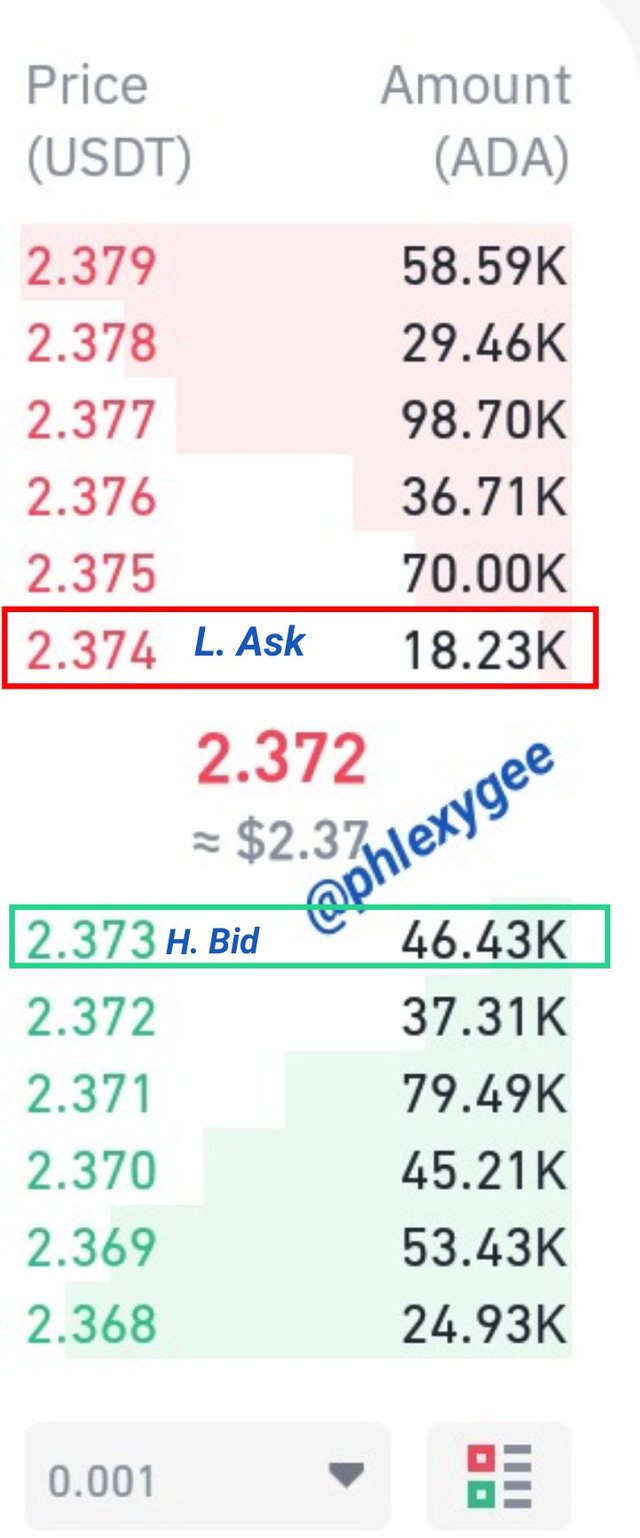

8 Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

a) Solution:

Bid-Ask Spread = Ask price - Bid price

Bid-Ask Spread = 2.374 - 2.373

Bid-Ask Spread = 0.001 USDT

b) Solution:

Mid-Market Price = (Bid Price + Ask Price)/2

Mid-Market Price = 2.373 + 2.374

Mid-Market Price = 3.56 / 2

Mid-Market Price = 1.78 USDT

All the above screenshots were taken from Binance exchange and steemit wallet

Conclusion

This part II of Bid-Ask Spread is a very interesting lesson as a compliment to the first Bid-Ask Spread lesson and I have really enjoyed it.

Hello @phlexygee,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You really should not paraphrase the lesson. Always do your own research and provide facts based on your own understanding.

You should also work on your arrangement and markdown use.

Thanks again as we anticipate your participation in the next class.