[Beginner Course] Steemit Crypto Academy Season 3 Week 1 | Home Work Post for @wahyunahrul, Whales - The Driver Of Cryptocurrency Value

Little facts about whales and how it relates to cryptocurrency

Whales are said to be the biggest in the ocean especially the deep blue whales not that they perform special features like being fast of having sharp teeth’s but they are respected and also feared by the little fishes because when it moves it consumes a large amount of small fishes at a go without struggle.

So when relating it to the crypto world the whales would be specified to be the rich business men or companies who ventured into cryptocurrency they are said to be the one behind the increasingly flow decrease flow rate of cryptocurrency. For example when a new token is out in the market the small income earners try to purchase the little amount that they can purchase and it won’t shift the demand for the token cause the amount invested isn’t really worthy of it but when billionaires try to invest in the market once the coin generates a very rapid increase the in the rate price and helps the small investor to get huge profit but if it becomes otherwise like when the billionaire sells his coin the coin then tends to start reducing its value to a very lower point that it would not even be favorable to the small investors. These makes the billionaires to be dignified as the factors responsible for the shift in price which could be seen as the whales of cryptocurrency

The whales is said to move in accordance to the factors of demand and supply.

Why small investors fear whales?

The small investors are not really scared of the whales the only reason they fidget is because they hope whenever there is a downtrend they should at least be able to withdraw a little bit more than the amount they invested. Before they when into investing they already knew about the risk of it increasing and decreasing.

The small investors make vigorous researches on other small currencies and invest in them with the hope that a business man or there would be an uptrend later in the future.

The investors fear whales because when the partners with higher stakes in the platform start to sell their currencies the value would start to reduce drastically and the small investors are the one to suffer the loss in investment at a greater rate.

In taking over advantages to reduce the fear of small investors to whale

Reducing the fear of whale by small investors has to do with the ability to actuate from the risk of loosing all the investment invested. Risk can be seen as the the ability of an individual to be able to adapt to either situation he or she may find himself either challenging or highly grave situation.

Risk aversion could then be defined as the ability of people to prefer results from low uncertainty to those results with high uncertainty even if the mediocre outcome is at a balanced level higher in monetary value than the more expected outcome. An averse investor is said to avoid high risk investment they prefer short run investment with immediate return on investment those types of investors like to invest in bonds and debentures.

Investors also set a contingency plan based on risk availability circumstances which can not be predicted or excaped from, every investor must know before going into the business that its rate or risk is high in terms of the rate of competition between other blockchains like bitcoin

Proper checking of rate before investing is therefore advisable that when going into any cryptocurrency or blockchain business either mining or investment proper scale of preference should be taken to differentiate between different investment schemes to select which is best suitable and gives desirable returns on capital and at a quick rate

What is fixed savings?

Fixed savings can be seen as a particular fixed amount that is being sent to a particular piggy bank or an account where the money is to be used on a later basics

While flexible savings can be seen as an amount of token or coin that is being saved but can be deducted on a gradual basis for important reasons applicable to the investor. There are different types of risk products in terms of cryptocurrency the ones at an high rate alcohol be simply the bitcoin, etherum or binance Bnb among so many others.

The binance Bnb blockchain which was actually created in the year 2017 has been having many. Multiple cases but the system used by the Bnb blockchain is that is used as a satisfactory token that allows his investors allowable discounts when paying for their trading fees . I find the binance as a risk bacause it’s not yet as matured like the bitcoin blockchain in the market and it is an ico and no one knows when it will be likely to wrap up.

Litecoin is also a decentralized cryptocurrency.It had a very long line of successful increase during the years till now that it had become no 14th on the chart.

The above diagram explains the detailed analysis of phases a cryptocurrency goes through

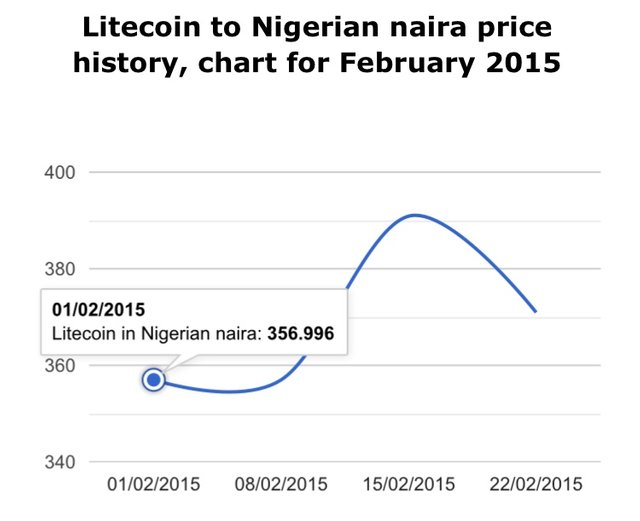

Accumulation phase

Well, the accumulation stage might be said to be the beginning stage where the price is relatively low. In the above diagram it shows when the coin as at February 01 2015, the price of lite coin was relatively 356.996 per naira.

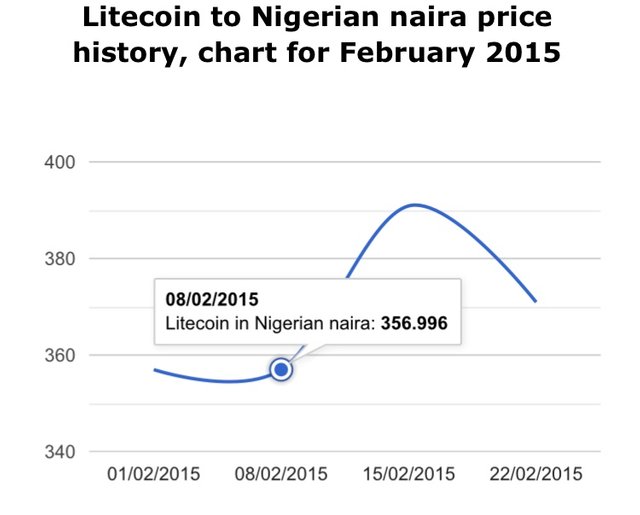

Uptrend stage

It could be said to be when the platform is trying to gain its stand in the market based on the rate that people are purchasing the cryptocurrency. In the above diagram at the break point the price started moving higher due to the rate of business men purchasing and investing in the coin as at February 08 2015 this is a bullish trend

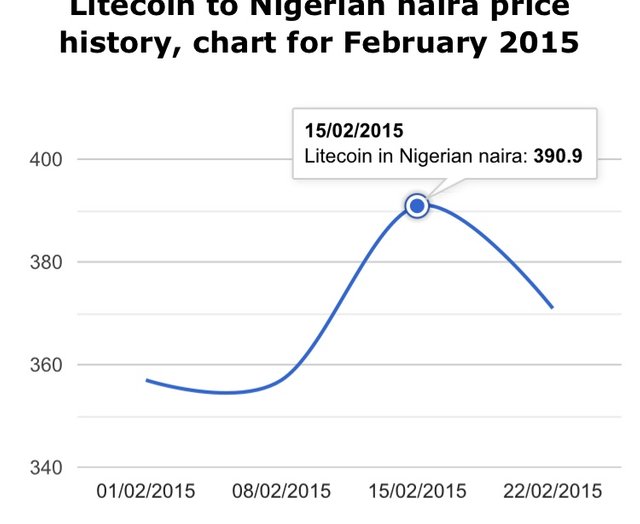

Distribution stage

The stage above shows the place when the price is high the chart shows when the price increased from 356.996 to 390.9 where profit earned can be sold

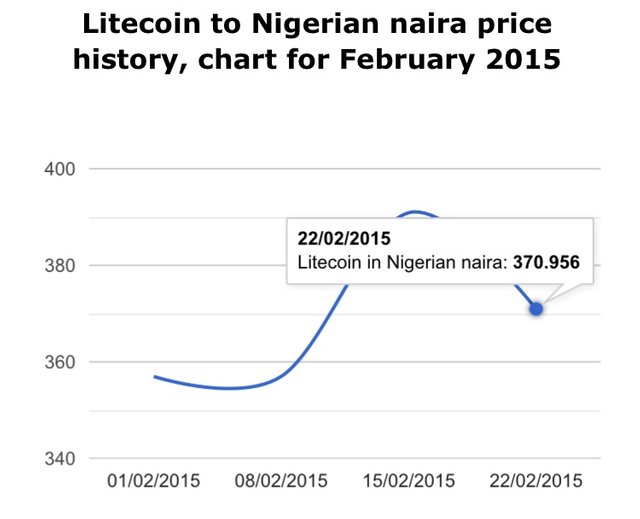

Downward trend

This is said to be the level when the coin reduced and begins to loose its value in the market the above diagram shows how the price reduced from 390.9 to 370.956 this is said to be a bearish trend

If I’m a whale, I would still prefer to use the lite coin based on the reason that the coin has already made its stake in the market through the previous years by gaining at least trust from the investors who made their profit from it. Because when they get to know there’s going to be an uptick in the value they would be motivated to invest because they have had their cut of the cake before and they know how it tastes.

As self explanatory the diagram is if I were to make investments and remove my profit as at when I find it suitable I’ll invest when the price is at 360.0 naira to allow for an uprise in the market because when an high investor invest others would want to also and it would make the price for the currency increase drastically while I wait, so when the price becomes 390.00 I’ll make my move to either sell or withdraw every of my profit earned cause waiting too much at times might lead to me falling victims of bigger whales

Conclusively, the whales are mainly the factors behind the uptrend and downward trend in the value of cryptocurrencies. the access of businessmen and companies to invest in the penny platform and inflate the price value to increase at the point of investment and reduce also at the point of selling the token or withdrawing all the profit in investment earned.

Thank you for reading my post.