"Decoding the Trading Game: Beyond Charts and Formulas"

There is a mania in the trading space, especially after the revolution that digitalism brings to the arena with increased accessibility. Everyone now thinks that making money is easy, and they want to become rich quick. Here, the first obvious way that most people start with probably is cryptocurrencies, especially for younger generations. When they start their journey and fail many times, they shift to learning about trading and markets, and by following the basic logic about fast and easy ways, they again fall into the trap of endless indicators and chart patterns. Also, engaging in future trades and using high leverages sets the stage for final broke out.

But why do people think they can beat the market without knowledge of the economic and trading as a profession? Why do many believe it's easy to win the hardest and most complicated game in the world? I believe this is not a coincidence. The amount of knowledge, methods, and strategies about markets and trading is vast, but the number of people who choose to dig deep enough to reach reasonable and practical method is few.

Another sad reality about today's markets is the saturated field of education about the market. Of course, it has its advantages for better and more options for learning, but the downside is that almost everybody, from retail traders to professionals, gets confused after a while because of this mixture of theories. Interestingly, this problem is not new at all; on the contrary, it dates back to the first decades of the markets' appearance and the subsequent methods to deal with them. Although, I don’t know any golden formula for success in the market either. What I believe is that the underlying principles of all markets are practically the same, and we can explore a critical understanding of market mechanics over reliance on external advice or simplistic trading formulas.

Speculation

It costs money to raise money, and Wall Street finance corporations create a broad market by risking money. Through speculation, buyers and sellers meet in an established marketplace. Speculation is a business, and all business involves speculation; in fact, it’s the mother of investment and inevitably precedes it. Speculation is "a risky investment," and like merchandising, the purpose is to derive profit from price changes. However, unlike the investor which focuses on the core value or the essentials, the trader looks at the functional value or the outcomes.

Bid-Ask

The method of operating in all markets and theories is the study of supply and demand forces and their power to lift or depress prices. The market is like a slowly revolving wheel. Will the wheel continue to revolve, standstill, or reverse? Here, the bid-ask spread is more than a reflection of supply and demand; it's a microcosm of market psychology and efficiency. Each bid and ask represents a moment of decision, a story of where traders believe value lies. These forces might be natural or artificial, resulting from public sentiment or manipulative operations like algorithmic trading. Also, the spread can signal market health or stress. A widening spread might indicate fear, uncertainty, or liquidity issues.

Uncertainty

The only unchangeable thing about the market is its tendency to change and its incalculability. Unforeseen circumstances are part of trading and life, and where certainty ends, speculation begins. Prices point farther ahead than any individual can see, representing the composite opinion of millions of people. As a trader, we should remember that the market has its own way, and disregarding others. Even the largest interests do not know what obstacles they will encounter or will be obliged to change their plans. But also, the more uncertain conditions are, the more often does the market afford opportunities. This fluidity requires traders to be not just reactive but proactive, constantly updating their understanding of the market's pulse, understanding that what's unknown today might be the key to tomorrow's profit.

Science

We should treat trading like experimental science, where each trade is a hypothesis tested in real-time, learning from every transaction (strategies, outcomes, and reflections), whether successful or not. Traders should use scientific methods not only to analyze data but to manage their own biases, emotions, and cognitive errors.

Chance: Trading is an art; don’t undertake or expect to make precise calculations since prices are made by the minds of men, and thus, calculation must measure the incalculable. Although speculation is different from gambling, in using intelligent foresight, but there is a doctrine of chances allowed for accidents. the belief that chance is such a large part of speculation that it is subject to no rules is a serious error. Anyone who figures that his success is dependent upon merely chance may as well stay out of the market. No one can be invariably right all the time, but it’s possible to be right in the majority of instances. Accurate and profitable forecasting and trading have been done, are being done, and will be done.

Study: 95% of those who fail do so because they are ignorant of the market and its techniques. They are incompetent. “The market is dynamite if you do not know how to deal with it.” To breed success in the market, it is not capital you need but knowledge, study, and self-training. It is essential that you lay a sound foundation by serving an apprenticeship. Trading is a science that can be learned and followed as a profession. Thus, only the facts indicated which the future would be, not the surface or present conditions. Studying historical market reactions to events similar to current ones could provide a contextual understanding, helping predict how markets might react to new, similar stimuli.

Formula: Markets are complex adaptive systems, not mechanical devices; thus, they resist simple formulas. Strategies should be uniquely tailored to an individual's trading style, risk tolerance, and market understanding, and also evolving as one learns. Moreover, the factors influencing the market are infinite in number, character, and effect. Therefore, the attempt to construct a formula for market success would seem futile, and the person who thinks he knows the market is usually his own worst enemy because something new can always occur.

Factors: In addition to the intrinsic value of an asset, we should consider manipulation, technical conditions, and market trends. Understanding these interactions could help in anticipating market moves where one factor might amplify or mitigate the effects of another.

Business: Trading is an ideal business when you know how to operate scientifically. Beethoven’s Sonatas are in any piano, just if you know how to play. But the question is, how does a person learn this profession? The answer is simple: he should begin by gathering all available information about it. People do trade in the market without any experience, with little capital, and no knowledge of the business, and they always complain about their failures.

Judgment

Each trade decision could be seen as a judicial 'case' where traders gather 'evidence' (market data, news, trends) and argue both for and against the trade. This method would encourage traders to consider all angles, reducing bias and enhancing decision quality. Moreover, just as judges sometimes reserve judgment pending further evidence, traders could adopt a similar approach, waiting for additional market confirmations before acting. Therefore, judgment in trading is about exercising and refining one's decision-making capabilities. It's a skill that evolves through constant interaction with the market's ever-changing nature, involving not only reading the chart but interpreting the broader narrative behind price movements.

Exercise: Some people are born musicians, others seemingly void of musical taste, and must develop themselves into virtuosos. Also, in this matter, perfection is the key; thus, by constant practice and study, putting more time and thought, traders should exercise their 'judgment muscles', constantly cultivate more accuracy, and strive to make it perfect. The rule is simple as it looks; practically use the principles, and gradually develop your intuition to judge a situation even without conscious reasoning. Constant repetition makes the mind able to function instinctively as routine reasoning fixes its principles. A trader gathers experience from transactions, summarizes the basic factors, and gradually evolves a character.

Factors: Do not permit prejudice in politics or personal commitments to bias your judgment. Apply yourself to judging and forecasting the market by its own action, not just the fundamental factors. Be familiar with the mechanics of the market, and give weight to every little incident affecting price. Judge the Price Movement by Time and Comparative Lifting Power or Pressure of supply and demand forces. And finally, judge the psychological reactions of the players by weighing their motives through observation of the volume.

Anticipating: Money is made by anticipating what is coming, not by waiting until it happens and going with the crowd. In spot trading, the whole game is in anticipating future business conditions—say, six months or a year from now. Also, day trading is "The science of determining from the tape the immediate trend of prices." All because the best protection against losses is judgment that approaches 100% accuracy in knowing "when."

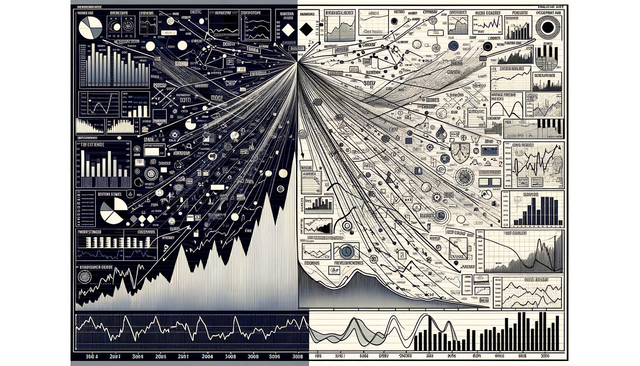

Technical

Fundamentalist: Do not try to mix economics with technique. These two factors too often contradict each other. Commercial training (economist or financial) unfits traders for dealing actively in the market. One should disregard fundamental and corporate statistics and study the action of the market itself. The position of large operators is more important than the so-called basic factors. Statistics are often lies; they are poor guides of the market. The more statistics, the more confusion. Statistics must be kept subordinate to a comprehensive view of the whole situation. Just know the history of earnings and the financial condition of the companies, and that’s enough for an active trader.

Mechanical: There is no shortcut or simple set of rules for practical market operations. The habit of using mechanical methods defeats the purpose of developing judgment. Stand free of mechanical forecasters or mathematical lines. Rigid methods, sooner or later, will break the operator who blindly follows them. They would all make money only when the market suits the method. When you are losing money, electric quotation boards always seem to snicker.

Chart patterns: There is nothing so fallacious as facts, except figures. Do not reduce the behavior of the market to rules of fanciful patterns which the charts may accidentally form. They pretend to forecast without giving logical reasons. No two pictures on the chart ever get duplicates and are comparable only with the previous same location of structure. Figures require merely blind following of definite rules. Such methods lead only to errors, losses, and discouragement. Also, simpler patterns often generate more false signals because they are so common.

Behavior

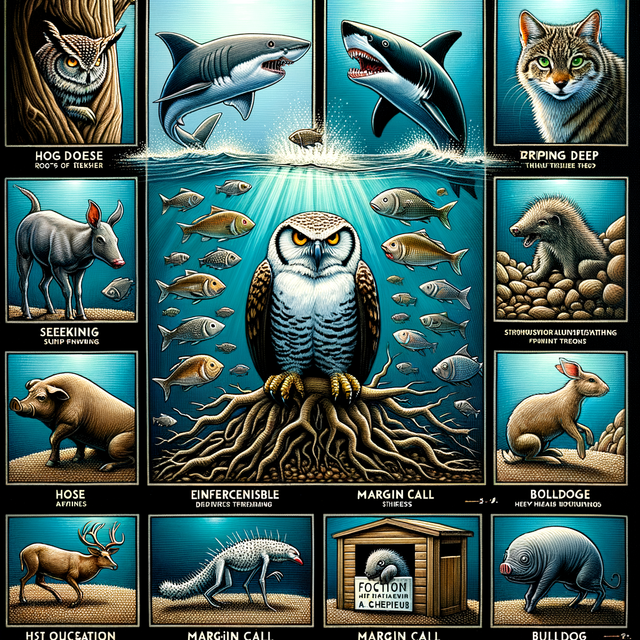

Understanding how groups form opinions, spread information, and react to crises could provide a deeper understanding of market movements beyond individual psychology. One could metaphor the market participants as animals or mythological creatures to explore how these behaviors manifest in group dynamics, leading to phenomena like herd behavior, market bubbles, or crashes.

Professionals:

Builder: A builder type is not always a good trader. He visions enterprises and sees them through in the physical aspect.

Banker: The banker, acquires money by possession and its adroit use.

Speculator: He’s the real Wall Street man, the manipulator, the gambler, the people who really stay in the business. This type must be a good trader. They believed in advertising and worked by suggestion.

Sociating with them;

There is the Owl, wise looking but silent, very rare.

The Mole that gets at the root of things.

The Shark that feeds on the poor fish.

The Hog, never satisfied with his profit.

The Wolf that preys upon the weak.

Adventurers:

They look upon the market as a sport or an adventure in which they hope to prove that their guessing was right. They are almost totally ignorant and incompetent in the business and mentally lazy. They have outside sources of income and bring money to Wall Street. All they ask is to be told tips or information.

Sociating with them:

there is the Flea, who always hopping in and out.

The Porcupine, forever sticking someone.

The Parrot: he repeats the tips.

The fright-paralyzed Horse that refuses to leave the burning stable.

The Rabbit, so easily scared.

The Bulldog that hangs on too long.

The Ostrich that buries his head when he expects a margin call.

Public:

The public rarely sees values and acts until they are pointed out; they do not lead but are led in speculation. They are leaners, wanting someone else to go and get things for them. The market, predominantly by the public, represents a sort of speculative “jag” indulged in, producing violent fluctuations. People operate almost constantly and are really the largest and most powerful of all. The problem is that in most cases, they are untrained and, as a body, unorganized. The attitude of the public chiefly affects the price and is a valuable guide to the technical position.

Sociating with them: there is Sheep, so easily led, and the Lambs so frequently sheared, also the Jackass and the Poor Fish.

Conclusion:

In this article, all content is inspired by or directly taken from Richard Wyckoff's books and teachings, and I'm proudly his student. My aim was to show you why trading requires deep understanding and discipline. In short, the point is that trading is not a game of luck or quick wins but a profession like any other. You should avoid simplistic approaches and not rely on oversimplified strategies like chart patterns or mechanical methods. Understanding the psychological and behavioral elements of trading affects market outcomes, and these can provide an edge in trading. Look beyond the superficial tools and delve into the deeper, more nuanced aspects of market interaction and personal judgment.

If Wyckoff's wisdom resonated with you, share your thoughts or trading stories below. Let's connect and grow together!