[In-depth Study of Market Maker Concept]-Steemit Crypto Academy | S4W6 | Homework Post for @reddileep

Hello everyone, this is season 4 week 2 of the steemit crypto academy. This week’s lecture was delivered by professor @reddileep and the topic was centered on the Market maker concept. After going through the lecture and understanding it I have decided to try my hands on the given task.

1- Define the concept of Market Making in your own words.

In the market making strategy, the market makers create the liquidity that carries out the buy and sell operations in the market. This is different from the traditional market system where the market is controlled by the marketing platform and the traders follow. In the market making strategy, the market makers set the price limits.

The liquidity in the market is created by the market makers. This helps traders in smooth transactions of their trades. All the trades going on in the market has an internal market created by the market maker is their center point.

There is also a Bid-ask spread between the buy price and the sell price. This Bid-ask spread serves as the profit for the market maker.

For instance when you want to sell crypto assets in the market, there must be liquidity in the market. This means that for the trade to take place successfully, there must be a buyer that is willing to buy at your price. This is where market makers function by creating liquidity in the market through the creation buy and sell orders within a reasonable price range for both buyers and sellers.

This concept is practical in even real currencies. For example a person wants to convert Euros to pounds. There are centers that are available for the conversion of Euros into pounds. At this centers, the buying price and selling price for converting of these two currencies are different at the exchange center. These prices are determined by the market centers. These market center are performing the function of market makers in the case of cryptocurrencies. The market makers open buy and sell orders in the case of cryptocurrencies as the market centers also set price ranges for the Euros and pounds conversion.

Through the buying and selling of the Euros and pounds, the exchange centers make profit from that. In the same way in the case of cryptocurrencies, the market makers make profit from the spread between the purchase price and sale price.

2- Explain the psychology behind Market Maker. (Screenshot Required)

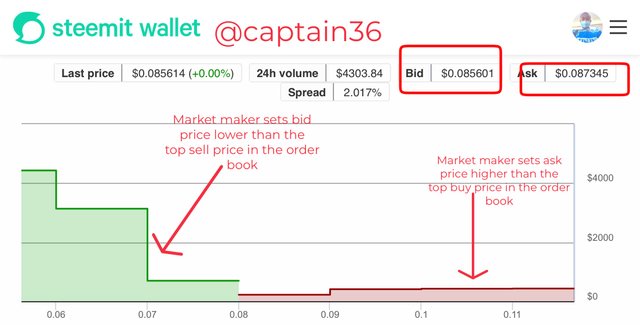

Market makers open buy and sell orders in some numbers to provide liquidity in the market so as to make trading very convenient for traders. But traders do not just invest to maintain liquidity and for this reason, the market makers work at a huge risk. The traders also invest in order to make profit but not to maintain liquidity in the market. I’ll visit https://steemitwallet.com/market to use the SBD/STEEM pair to illustrate this example. The Bid and Ask values are clearly seen below.

Screenshot from Steemitwallet

The bid price and ask price are both clearly indicated in the screenshot above. The difference between them is very small as seen in the above example. But the spread gained from each coin could amass large profit for the market maker when the are in large volumes. Let’s assume the spread is 0.08 for a certain coin. When you’re a able to record transactions worth 200,000 USD for that particular coin, the market maker will make a profit of 16,000 USD.

The discussion above clearly shows the advantages of market making strategy. Both the market makers and the inventors gain their profit through the liquidity provided by the market makers. However there are some case where large controllers of the market could set wrong signals in the market and then the small investors will follow them and run at a loss.

3- Explain the benefits of Market Maker Concept?

Market makers makes the operation of buy and sell orders move smoothly. Sometimes the liquidity in a market is too small to operate some market orders. The market makers provide liquidity and for that matter orders are executed smoothly.

New traders with minimal funds can still operate in this kind of market. The market makers make it easy for everybody to invest in the market

The number of people investing keep increasing. This is because the prices keep increasing and this will attract a lot of investors.

The slippage in the market will reduce. The reduction of the Bid-ask price in the market makes sure that the slippage in the market is also reduced

The price ranges set by the market makers ensures that the volatility of the assets doesn’t affect the prices drastically. Crypto assets are very volatile but these market makers ensures that the effects of this volatility on the prices is controlled.

There is no delay in the execution of orders. The market operating with liquidity does not need to wait for some time before the orders are executed. The orders are executed immediately.

4- Explain the disadvantages of Market Maker Concept?

The liquidity provided is not consistent. The liquidity is only provided periodically as these market makers are not very organized and consistent.

Lower prices can result in a loss for inexperienced investors. The way we discussed that market makers increase prices, it’s the same way the market makers could decrease prices in some cases and some traders with little experience could execute these orders and then run at a loss for the investors.

Prices might not be entirely in favour of investors because these prices are controlled by market makers.

There very little rules and regulations guiding these market makers. And for this reason, they are able to manipulate the market in their favour but to the disadvantage of the investors.

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

Indicators are technical analysis tools that are used with other tools to predict the movement of a market and help in the use of market trends to execute buy and sell orders. The use of these indicators can help traders predict the actions of market makers and this will help them take advantage to make profit in the market.

Here I will be discussing the moving average indicator and the Relative Strength Index (RSI) indicator.

Let’s start with the Moving average indicator.

The Moving average is mainly used to identify upward and downward trends. This indicator can be configured into different periods. These periods help us to determine the average price of the asset.

Like I said earlier the Moving average indicator identifies trends in the market. These trends are identified by crosses. These crosses are the Golden cross and the Death cross. These crosses become visible when the indicator is configured into periods. Mostly the periods used are 50 and 200 periods.

The indicator shows an uptrend if the 50-period moving average moves above the 200-period moving average. On the other hand, the indicator shows a downtrend when the 50-period moving average moves below the 200-period moving average.

Now using the Tradingview site, I will demonstrate the use of the moving average indicator. I will apply in on a ADA/USDT pair chart. I will also indicate both the Golden cross and Death Cross in the chart.

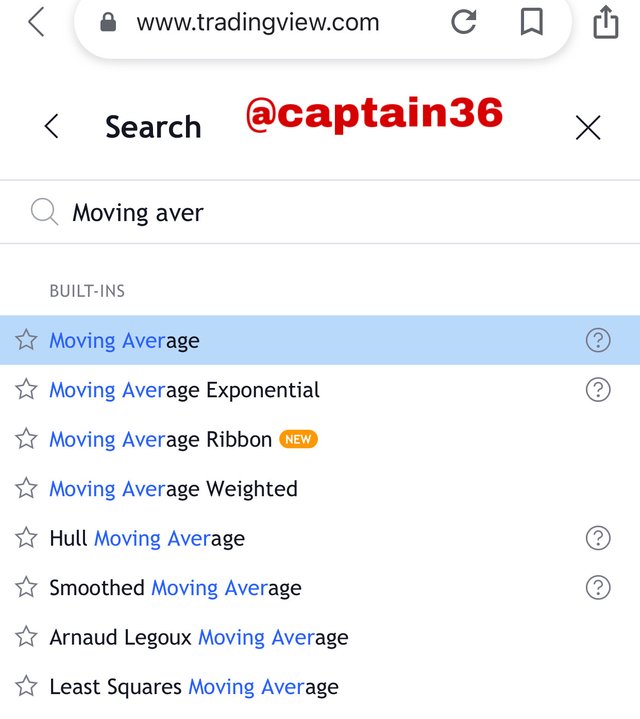

- First of all after opening the chart, we click of the FX symbol. A search box will pop up and then you enter Moving Average Indicator and click on it.

Screenshot from Tradingview

Screenshot from Tradingview

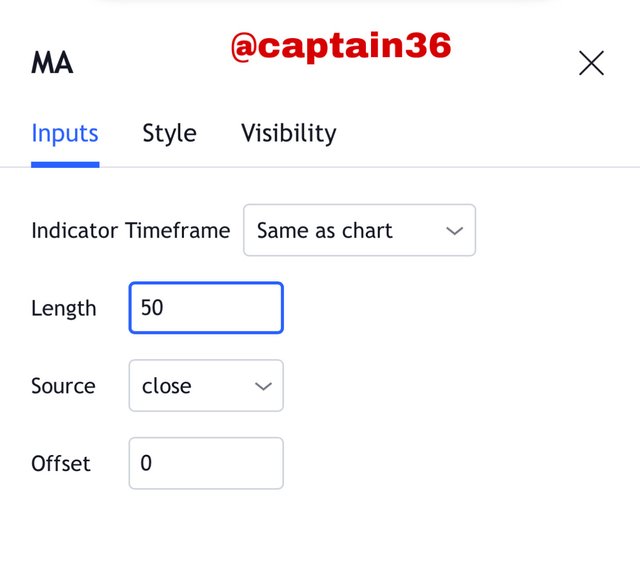

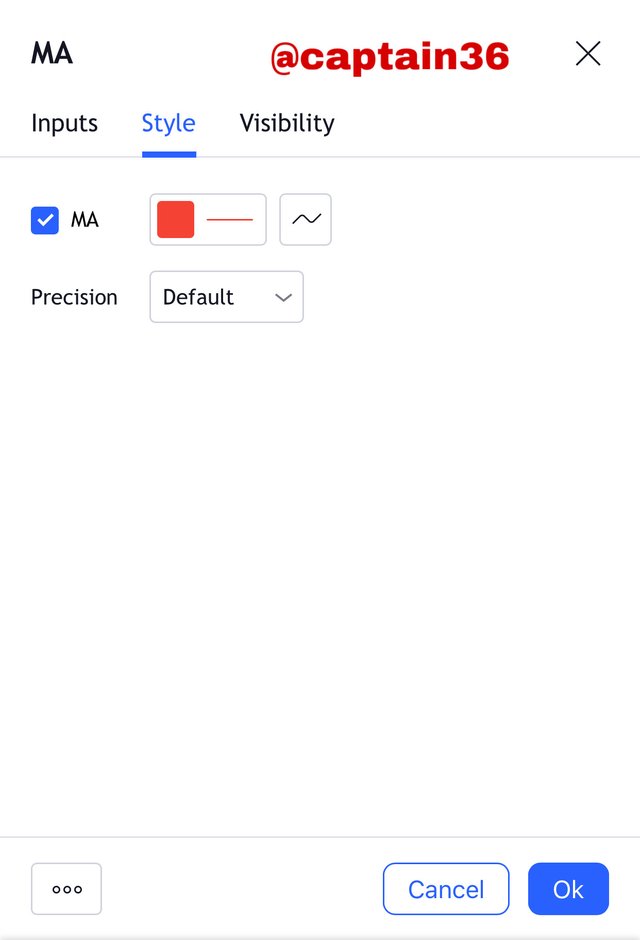

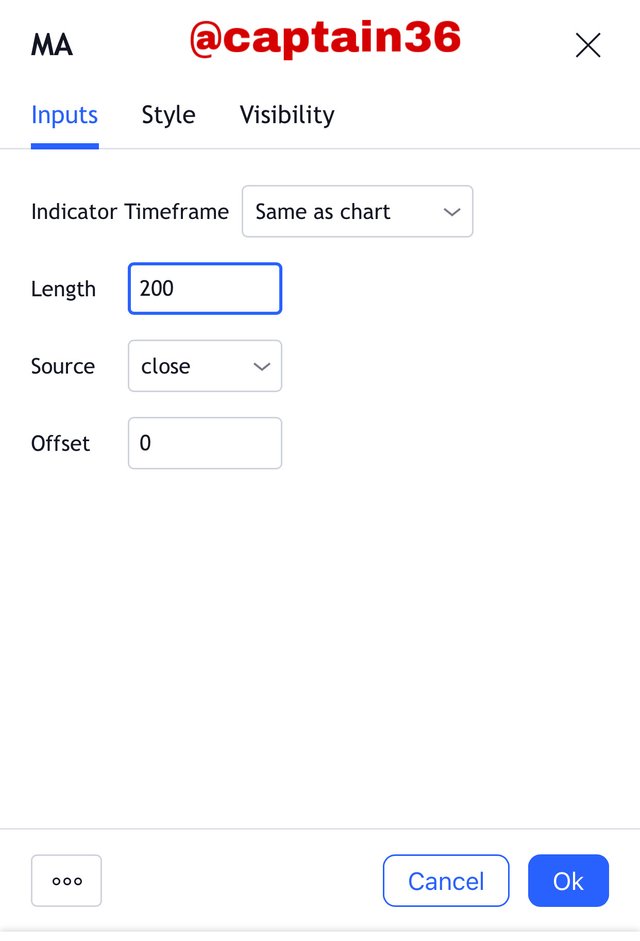

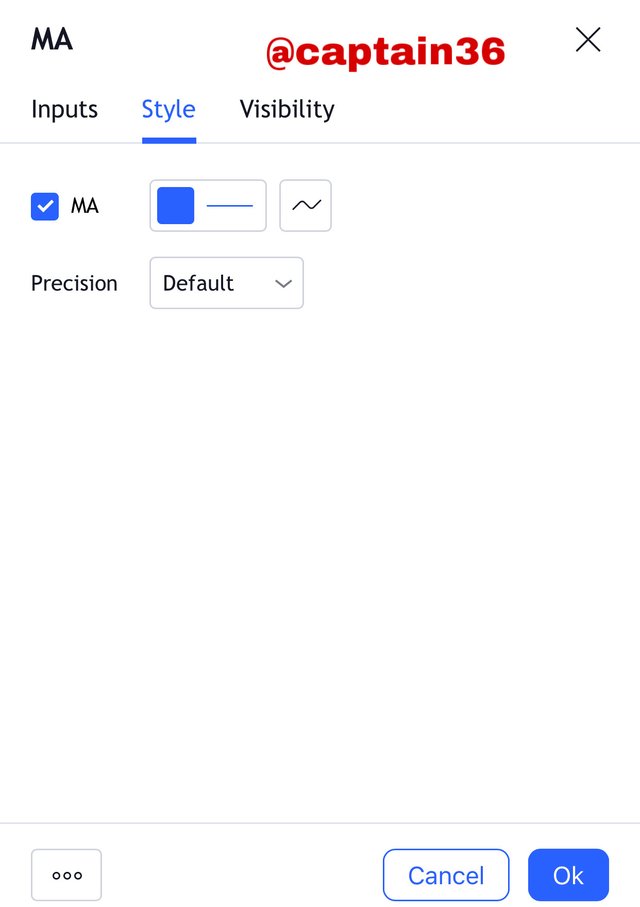

- Now we can see the moving average indicator has been added. They appear as two different lines. So we can configure them by using the settings icon showed below. One is set to 200 period moving average whilst the other is set to 50 period moving average. In this case I will set them to different colours so we can differentiate them. I will set the 50 period moving average to red and then the 200 period moving average to blue.

Screenshot from Tradingview

- 50- Period moving average

Screenshot from Tradingview

Screenshot from Tradingview

200-period moving average

Screenshot from Tradingview

Screenshot from Tradingview

After these configuration both the 50-period and 200-period moving average can be seen in the chart. Both the Death cross and Golden cross can also be seen on the chart.

Screenshot from Tradingview

Screenshot from Tradingview

The moving average indicator can be used by investors to predict whether the market makers will form an upward trend or a downtrend. This will help them to maximise profit and then reduce loss.

Now let’s move to the Relative Strength Index (RSI) indicator.

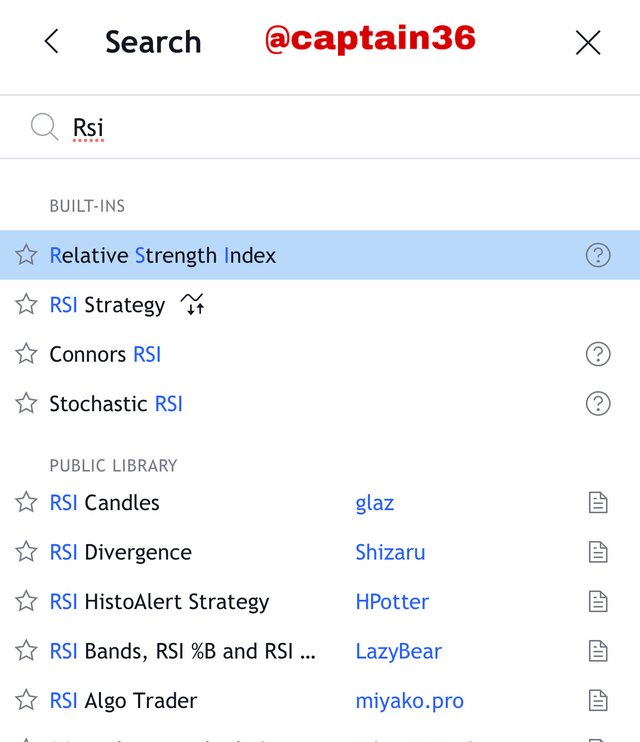

- The process of adding the RSI is the same as discussed above.

Screenshot from Tradingview

The RSI indicator is mainly used to determine the strength of trends.

- We can add the RSI indicator to the chart and it will appear as seen below.

Screenshot from Tradingview

The RSI indicator is able to identify whether an asset is overbought or oversold. Whether the asset is overbought or oversold is captured in the indicator. This price might vary as well. These market makers can use this strategy to manipulate the market in their favour. They can point out the exact overbought period and make profit out of that.

The price of the asset will rise when there is an overbought. This makes market makers to manipulate the market to overbought so the can make profit out of that.

Screenshot from Tradingview

Conclusion

The importance of market makers in crypto trading cannot by underestimated. Despite this they have both advantages and Disadvantages in the trading of cryptocurrencies. They provide liquidity for the market that makes trade move smoothly and on the bad side, they can manipulate the market in their own advantage thereby making small investors to run at a loss. Small investors must beware of this and then make the right decisions in the market.

Thank you once again professor @reddileep for this detailed lecture