AI and Machine Learning in Cryptocurrency Trading: A Steem/USDT Perspective

Assalam o Alaikum Everyone I hope all of you are fine and happy in your life. Here is my participation in the steemit contest. This is week 2 participation. This contest was organized by @crypto-academy. The contest is about using Artificial Intelligence and Machine Learning in Cryptocurrency Trading. It is the best thing for participants to apply their understanding of AI and ML and implement it.

AI & ML in Cryptocurrency.

The combination of Artificial Intelligence (AI) and Machine Learning (ML) technologies in the domain of trading in cryptocurrency for assets has changed the game of traders when it comes to analyzing the market and formulating strategies. These technologies make it possible to handle extensive datasets, detect complex relations, and make well-educated trading points with higher accuracy. In this respect, I will focus on cryptocurrency trade using AI and ML technologies, for the pair of Steem/USDT.

Question 1: Exploring AI and ML in Cryptocurrency Trading.

AI & ML are more advanced now. AI Provide us with tools where we can do analysis and they surpass traditional methods in speed, accuracy, and adaptability.Here are some of following below.

- Predictive Analysis:

Predictive analysis mean our ML model will analyze the historic data set and then do some forecasting on behalf of historic data. We can do this on simple excel and any BI tool like power bi. But we make ML model for better output. For example, ML algorithms can detect patterns indicating potential price increases or decreases in the Steem/USDT pair in last their history. One of the major Advantages is these models can process complex and larger datasets more efficiently than human analysis, It provide more accurate results.

- Automated Trading:

Automated system mean it works auto without any interference. AI systems do trades automatically based on predefined permissions and real-time data, It is basically rule base system. It eliminates human error and kills emotional decision-making.

The main advantage is ehese systems can works 24/7, They always active in trading market and taking advantage of market opportunities even when the trader is not actively monitoring the market.

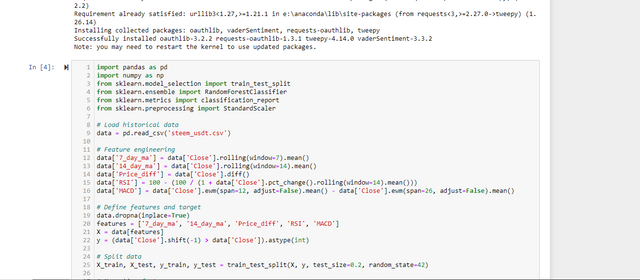

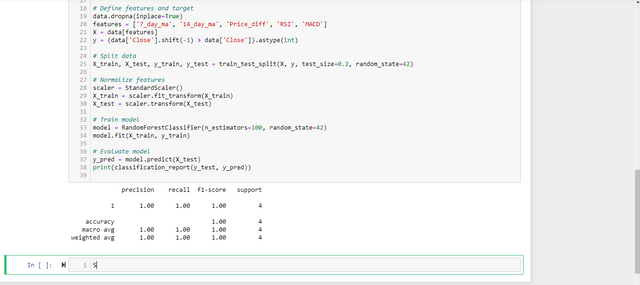

Question 2: Building a Predictive Trading Model.

Making of predictive trading model, I make a simple machine learning model using Python's Scikit-learn library.

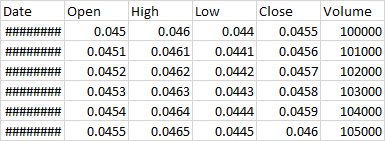

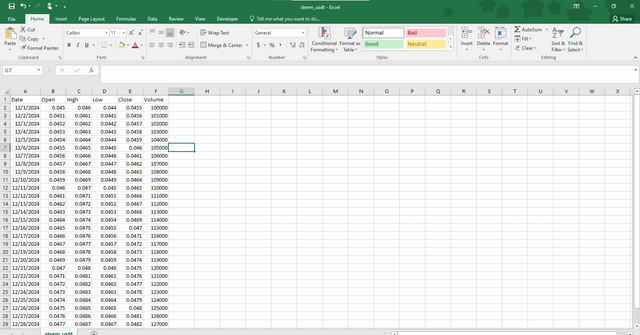

Data Collection: I make a dummy dataset. here are some data.

Date Open High Low Close Volume

12/1/2024 0.045 0.046 0.044 0.0455 100000

12/2/2024 0.0451 0.0461 0.0441 0.0456 101000

12/3/2024 0.0452 0.0462 0.0442 0.0457 102000

12/4/2024 0.0453 0.0463 0.0443 0.0458 103000

12/5/2024 0.0454 0.0464 0.0444 0.0459 104000

12/6/2024 0.0455 0.0465 0.0445 0.046 105000

- 7-day Moving Average (7_day_ma): Average price over the last 7 days.

- 14-day Moving Average (14_day_ma): Average price over the last 14 days.

- Price Difference (Price_diff): Difference between today's and yesterday's closing prices.

- Relative Strength Index (RSI): Indicates whether the market is overbought or oversold.

- Dummy dataset:

- Code:

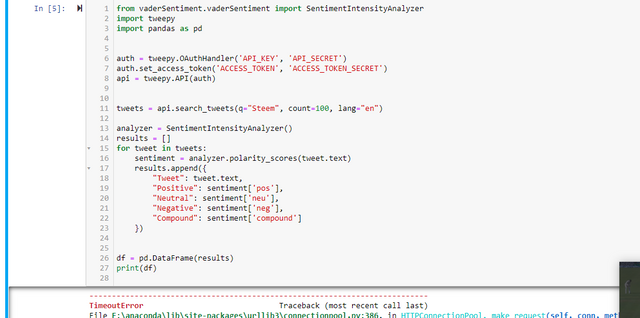

Question 3: Implementing Sentiment Analysis for Trading Decisions

Performing Sentiment Analysis

Sentiment analysis can help to measure the market's attitude toward a cryptocurrency like Steem. Here, I analyze tweets mentioning "Steem" using the VADER sentiment analysis tool. I have work on code there are some errors. I will update this post after removing error. On that time I am not able to do this.

Question 4: Designing an Automated Trading Strategy

Automated system mean it works auto without any interference. AI systems do trades automatically based on predefined permissions and real-time data, It is basically rule base system. It eliminates human error and kills emotional decision-making.

The main advantage is ehese systems can works 24/7, They always active in trading market and taking advantage of market opportunities even when the trader is not actively monitoring the market.

Buy Example:

Current Price: $0.045

15-day Moving Average: $0.043

RSI: 25 (oversold)

Sentiment Score: 0.3 (positive)

This AI agent identifies that the price has crossed above the moving average with strong positive sentiment and an oversold RSI. It generates a Buy Signal and places a buy order.

Stop-loss: $0.04275 (5% below entry price).

Take-profit: $0.0495 (10% above entry price).Sell Example:

Current Price: $0.050

15-day Moving Average: $0.051

RSI: 75 (overbought)

Sentiment Score: -0.4 (negative)

AI agent notices that the price has gone below the moving average, the sentiment is negative, and RSI shows that the market is overbought. It generates a Sell Signal and places a sell order.

Question 5: Addressing Challenges and Improving Reliability.

Here are the following Challenges and Improving Reliability.

Overfitting

Models frequently excel on training data but struggle in live trading because of overfitting, which occurs when they memorize patterns that do not apply to real-world situations. To address this, implement techniques such as cross-validation and dropout regularization during the training process. Furthermore, training models on a variety of datasets gathered from different exchanges can enhance their ability to generalize.

Data Limitations

Challenge: Cryptocurrency markets are extremely volatile, and relying solely on historical data may not accurately reflect the current market dynamics, which can lead to flawed predictions.

Solution: Enhance historical data with alternative sources, such as social media sentiment, on-chain metrics, and news feeds. For instance, combining real-time Twitter sentiment analysis with price data for Steem/USDT can offer a more comprehensive view of market trends.

Execution Speed

Challenge: The fast-moving nature of cryptocurrency markets means that delays in trade execution can lead to missed opportunities or less favorable prices.

Solution: Implement high-performance computing environments, fine-tune algorithms for minimal latency, and colocate servers close to exchange data centers to ensure quicker execution.

Example

The AI bot trading Steem/USDT addresses a significant challenge by integrating real-time sentiment analysis from Twitter with live price data. By utilizing a cloud platform equipped with GPU acceleration, the system is capable of making predictions in mere milliseconds. As a result, the bot adapts to changing market conditions in real-time, effectively minimizing the risk of overfitting. It continuously learns from incoming data and reduces execution delays, which ultimately enhances the reliability and profitability of its trading strategies.

Thank you for reading this blog.